Digital onboarding has become a core growth driver for Indian banks, NBFCs, and fintech platforms, but it has also expanded the surface area for identity fraud, document forgery, and compliance risk. With Karza now operating under the Perfios umbrella, many businesses are reassessing whether it still aligns with their onboarding scale, fraud profile, and regulatory needs in 2026.

Karza remains a well-known identity and data verification platform, particularly for lenders with established workflows. However, evolving requirements such as RBI V-CIP compliance, DPDP readiness, real-time onboarding, and end-to-end loan journey automation have led many teams to explore alternatives that offer greater flexibility or deeper AI-led verification.

In this guide, we compare the 10 best Karza alternatives in India, highlighting where each platform excels and where it may fall short.

Why consider alternatives to Karza?

Karza sounds like a great tool, so why look for alternatives? Here are the four reasons:

When Karza May Not Be the Right Choice

While Karza is a strong platform for identity and data verification, it may not be the best fit in the following scenarios:

High-volume, real-time onboarding

If your business handles large volumes of concurrent onboarding requests, latency across multiple verification modules can become a bottleneck. Platforms optimized for real-time, AI-first verification may offer faster end-to-end journeys.

Product-led teams needing workflow control

Karza is better suited for predefined verification flows. Product and operations teams that want no-code or low-code control over onboarding journeys may prefer alternatives that allow faster experimentation and iteration.

Advanced fraud prevention requirements

Businesses facing sophisticated identity fraud such as face reuse, synthetic identities, or mule accounts may need deeper biometric intelligence like passive liveness and face de-duplication, which are not Karza’s primary strengths.

Early-stage or cost-sensitive teams

Karza follows an enterprise-style, customized pricing model. Startups or mid-sized companies looking for predictable or usage-based pricing may find alternatives more suitable.

How did we evaluate the top alternatives?

We evaluated Karza alternatives based on factors that matter most to Indian BFSI and digital-first businesses in 2026:

- Identity verification depth: Coverage across KYC, biometric checks, liveness detection, and document verification

- Loan journey support: Ability to support more than just KYC such as income analysis, fraud checks, and decisioning inputs

- India compliance readiness: Alignment with RBI guidelines, AML norms, and data protection expectations

- Scalability & performance: Suitability for high-volume, real-time onboarding

- API maturity & integration effort: Ease of embedding into existing tech stacks

- Market adoption signals: Reviews, customer references, and visible BFSI usage

Overview of the top 10 Karza alternatives

| Platform | Core Strength | Best For | KYC Coverage | Loan Journey Support | India Compliance | API & Workflow Maturity |

|---|---|---|---|---|---|---|

| Perfios Karza | Data aggregation & checks | Large lenders with legacy flows | High | Medium | Strong | Medium |

| HyperVerge | AI-led onboarding & fraud prevention | Banks, NBFCs, high-scale fintechs | Very High | End-to-end | Strong | High |

| Signzy | Video KYC & AML | Banks & regulated fintechs | High | Medium | Strong | High |

| IDfy | Legal, BGV & AML depth | Highly regulated organizations | High | Medium | Strong | Medium |

| Bureau | Risk signals via phone intelligence | Fraud-sensitive consumer platforms | Medium | Low | Moderate | Medium |

| Cashfree | Fast OCR-based KYC | Startups & payments-led platforms | Medium | Low | Moderate | High |

| Idenfy | Biometric & 3D liveness | Global-first digital businesses | High | Low | Moderate | Medium |

| Newgensoft | Enterprise process orchestration | Banks & large FIs | High | Medium | Strong | Medium |

| Jukshio | Low-bandwidth verification | Fintechs in emerging markets | Medium | Low | Moderate | Medium |

| Digitap | Bank statement & income analysis | Banks & NBFCs | Medium | High (income layer) | Strong | Medium |

A detailed list of the 10 best Perfios Karza alternatives for automated loan journeys

This is the crux of the blog. Here we have given you a quick overview of each tool so that you know which solution is closest to your requirements.

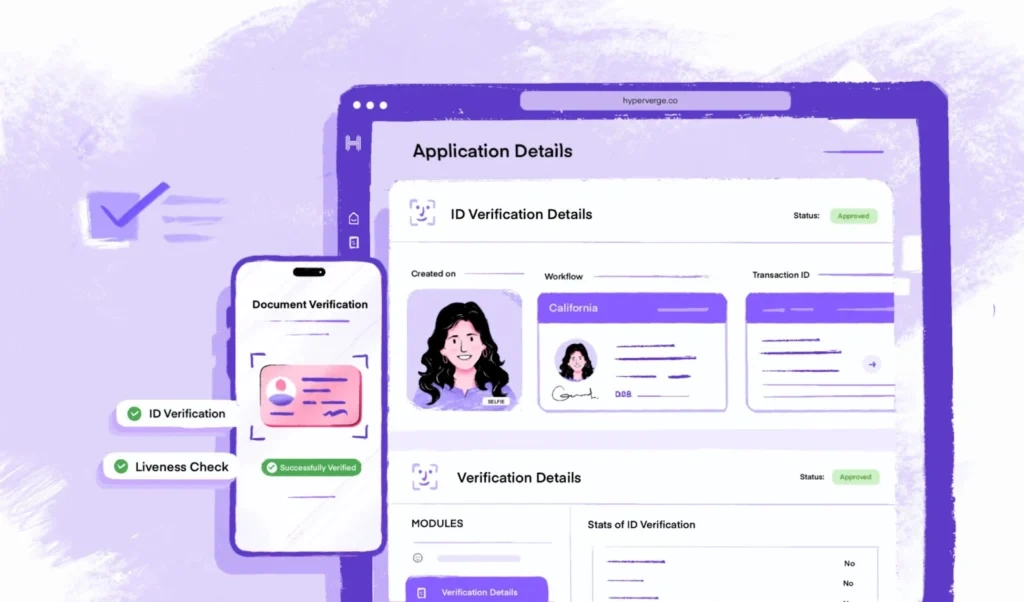

HyperVerge

HyperVerge One is a comprehensive suite of digital identity verification solutions for businesses. The AI algorithm powers the core of HyperVerge which makes the onboarding process fast and reduces drop-offs. The Machine Learning (ML) engine analyzes and verifies documents in real-time to confirm the clients’ identification.

HyperVerge scores the highest point in this list for its facial recognition technology. The passive liveness technology is one of the best in the industry and has obtained the prestigious ISO 30107-1/30107-3 Level 2 compliance certification. You can also trust HyperVerge to keep your business compliant with the latest KYC and AML norms as its ML algorithm keeps working in the background to update the platform with the latest regulations.

Look beyond identity verification and you will find HyperVerge contribute at every stage of the lending journey. After it analyzes the customer IDs and documents, it calculates the customer’s creditworthiness and helps your team pick the right profiles for the loan. It then creates scorecards and suggests loan schemes based on its analysis. The no-code workflow builder in HyperVerge is worth mentioning here because it gives your team the power to build the lending journey the way they like. This is a great tool for launching new products and building a brand-new onboarding experience from scratch without writing a single line of code. Lastly, the 100+ API integration lets you merge your existing systems with HyperVerge and achieve high operational efficiency without making drastic modifications.

In a nutshell, HyperVerge offers a wholesome platform for your business to onboard legitimate customers effortlessly, streamline the entire lending journey from start to end, and keep your business within the realm of financial norms.

Best for

Financial services, gaming, insurance, crypto, e-commerce companies, and marketplace industry

Pricing

There are three pricing plans:

Starter: Offers a free plan, great for startups. Complete integration set-up and biometric analysis are the highlight features of this plan

Grow: Ideal for mid-size companies. You have access to all the features in the Starter plan plus face liveness check and a dedicated customer success manager.

Enterprise: Perfect for large companies looking for a customized solution. The pricing is decided based on your requirements and there is a customer support team assigned to answer your queries.

What do HyperVerge users say?

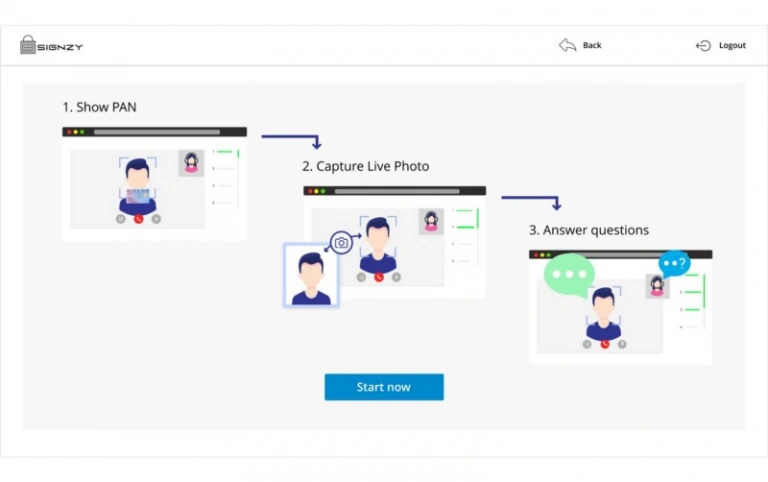

Signzy

Signzy is another AI-powered tool on the list that makes the KYC verification process a breeze for your team. The KYC engine uses machine learning to analyze customer data and verify it against government-issued IDs and biometric databases. The process is quick and reliable meaning your team can focus on more important aspects like calculating the applicant’s eligibility while Signzy takes care of the identity verification.

Facial recognition, document verification, and video KYC are the three areas where Signzy shines. It supports the coverage for regulatory requirements of 200 countries making it easier for you to expand your business in newer markets. Other than identity verification features, it offers API integration to embed identity verification into your existing workflows effortlessly.

Best for

It’s best suited for banks and fintech companies

Pricing

The pricing information is not mentioned on the Signzy website. The pricing is most likely customized as per your requirements.

What do Signzy users say?

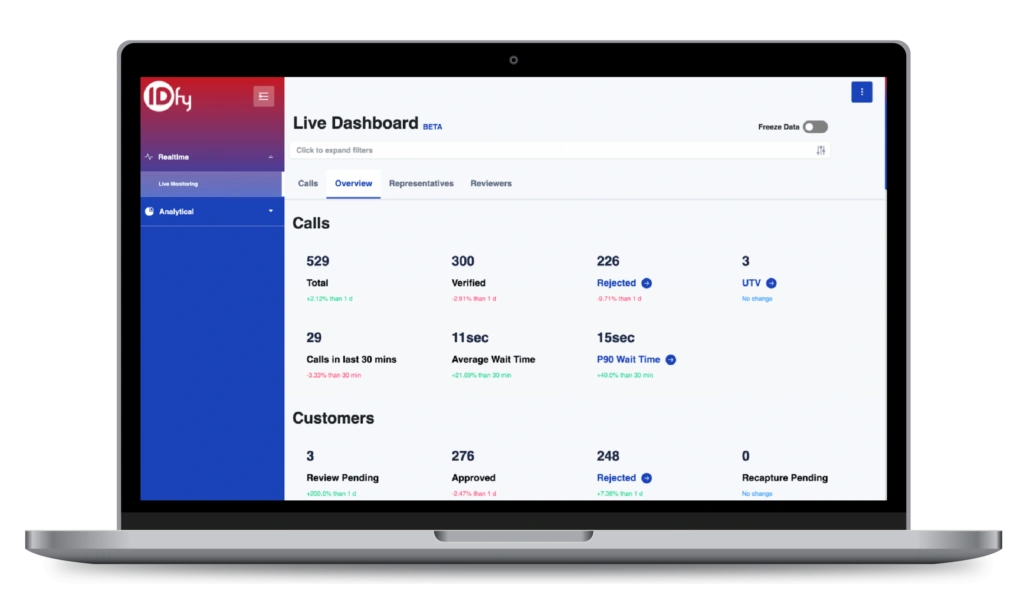

IDfy

IDfy takes care of the entire range of identity verification methods in your lending process. It has facial recognition and advanced video KYC capabilities. It also helps in AML screening with its AI-led legal history check service that analyzes over 400 million legal records in India.

IDfy also helps in employee background verification which is a great asset when you’re planning to expand an existing team or set it up from scratch. Privy is another solution from the team of IDfy that ensures compliance with data privacy regulations like the DPDP Act. The Bank Statement Analysis (BSA) feature is the major highlight as it can read quality images from different document formats and extract valuable insights from them.

Best for

IDfy is a versatile tool and best suited for organizations in the financial industry and other companies offering services within strict regulatory requirements.

Pricing

The pricing is not mentioned on the website

What do IDfy users say?

Bureau

Bureau safeguards your business from identity fraud and enhances the onboarding experience. It uses phone numbers as a key identifier to uncover risk profiles and help businesses make informed decisions. The identity verification process is solid as it aggregates customer information from different sources and checks them across an extensive list of databases.

The advanced algorithm monitors customer accounts continuously and alerts the business in the case of suspicious activities. It helps to eliminate chargeback fraud by putting companies in control to approve or decline a transaction request. This feature is highly beneficial for financial and e-commerce companies.

Best for

Banks, financial institutions, and e-commerce companies

Pricing

Pricing is not mentioned on the Bureau website

What do Bureau users say?

We couldn’t find any reviews about Bureau

Cashfree

The Cashfree Secure ID is a 360-degree identity verification tool for growing businesses. It is built on a suite of APIs that perform quick identity checks and are highly customizable. The platform claims an impressive 1-second response time for more than 90% of requests which is brilliant news for companies looking for quick onboarding solutions.

Cashfree’s KYC verification services use Optical Character Recognition (OCR) for PAN and Aadhar verification, which, according to them, reduces turnaround time by 75%. It makes it convenient for businesses to verify sensitive user information securely and reliably while enhancing user experience in the onboarding process.

Best for

All types of businesses looking for payment processing and KYC verification services in one place

Pricing

Cashfree mentions the payment gateway charges, but the price for KYC verification is not mentioned.

What do Cashfree users say?

We couldn’t find reviews mentioning Cashfree’s KYC verification, most of them are about its payment gateway

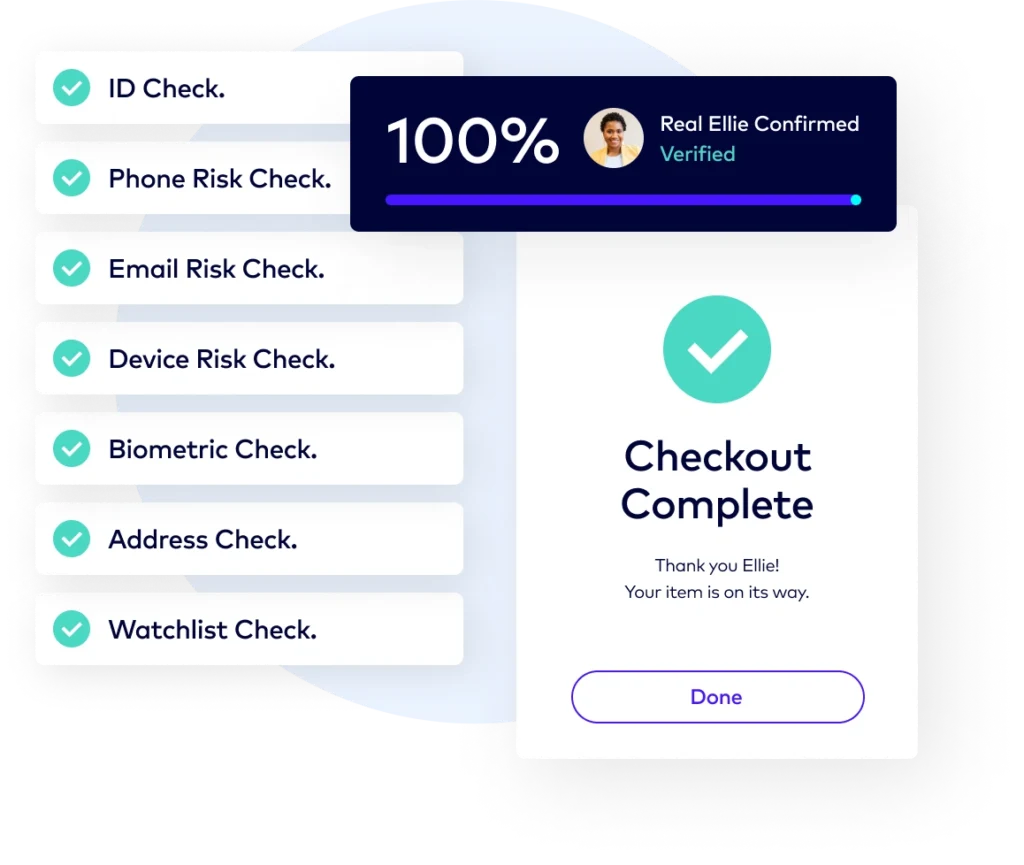

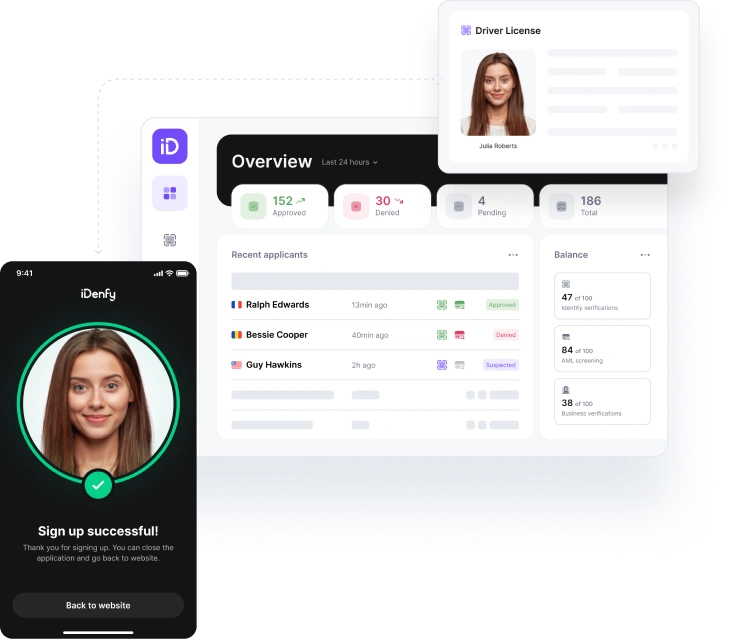

Idenfy

Idenfy is an identity verification platform that streamlines the KYC verification process for businesses while helping them stay compliant with regulatory requirements simultaneously. Its Know Your Business (KYB) and Anti Money Laundering (AML) solutions are also vouched for. The AML screening service automatically checks customers on global watchlists, sanctions lists, and PEPs (Politically Exposed Persons).

Idenfy uses biometric technologies like facial recognition and 3D liveness detection to ensure that the identities being verified are genuine. It is quick to catch fraudulent attempts when someone is trying to dupe the system by wearing a mask or using photos. It adds another layer of security with its phone verification feature to confirm the identity of an individual.

Best for

Financial institutions, online marketplace, e-commerce companies and Crypto organizations

Pricing

The pricing of Idenfy is determined based on the solutions you need and the number of monthly transactions you expect to take place

What do Idenfy users say?

Newgensoft

Newgensoft offers digital solutions to improve the onboarding experiences for financial institutions. It runs an automated KYC verification process to confirm the customer’s identity. It also integrates with government databases and third-party services to keep the information up-to-date.

Like Idendy, Newgensoft also uses an AML screening tool to automatically check customers against global watchlists and sanctions lists. Moreover, the document capture and verification feature uploads the customer identity documents and extracts the information. This minimizes errors and expedites the verification process.

Best for

Banks, insurance companies, credit unions

Pricing

The pricing information is not mentioned in the Newgen website

What do Newgensoft users say?

We couldn’t find reviews about Newgensoft

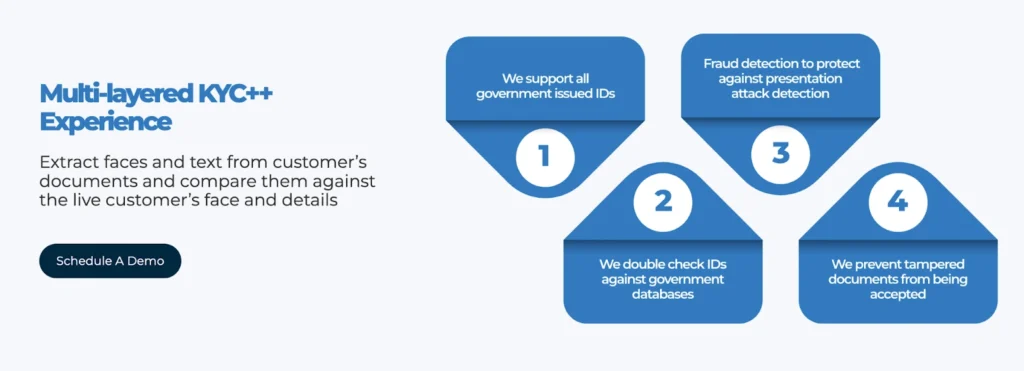

Jukshio

The Jukshio KYC++ is a cutting-edge online verification tool that extracts faces and text from customer documents and compares them against live images. It is capable of working in low-bandwidth environments making it a perfect fit for high and low-end devices both.

Jukshio emphasizes customer privacy by not storing Personally Identifiable Information (PII). The platform also features DFraud, a specialized tool designed to combat fraud proactively. It uses advanced facial ID technology enabling real-time verification with high accuracy. Jukshio also offers Know Your Business (KYB) solutions to verify the identity of your partners and clients.

Best for

It’s a great tool for fintech companies and e-commerce organizations. However, based on its application, it can be a great resource for other companies too.

Pricing

Pricing details are not mentioned on the website

What do Jukshio users say?

We couldn’t find relevant reviews about Jukshio

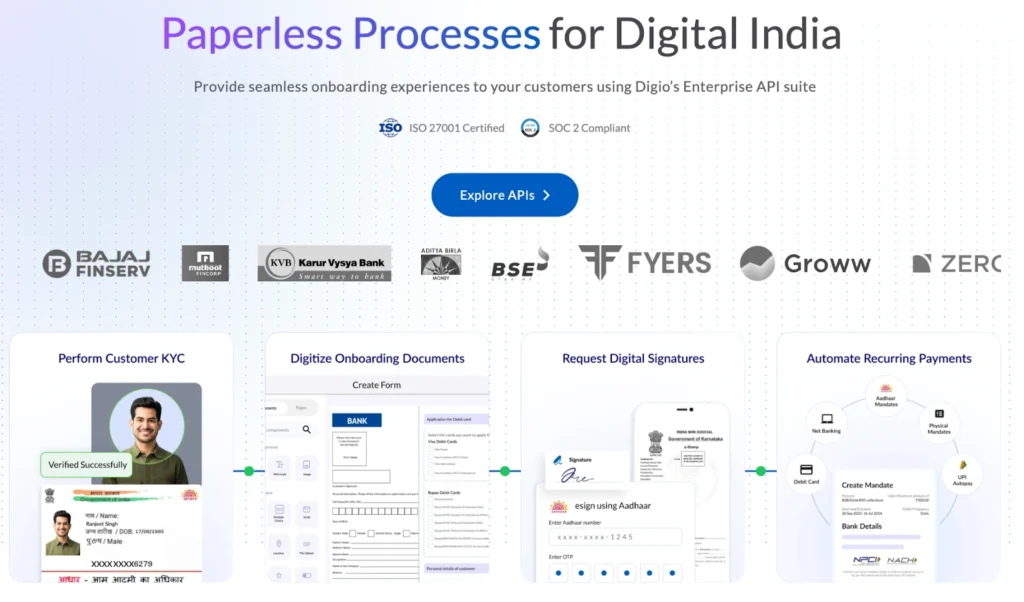

Digio

Digio is an end-to-end solution that integrates different functionalities, including KYC (Know Your Customer) verification, document management, digital signatures, and payment collections. The DigiStudio features works like the no-code builder of HyperVerge. It allows businesses to create customized workflow using a simple drag-and-drop interface.

The DigiKYC includes features such as ID OCR analysis, selfie verification, and video KYC, ensuring that businesses can accurately verify customer identities in real-time. The Aadhar-based authentication integrates with DigiLocker for secure document storage.

Digio takes special care to adhere to the regulatory requirements of SEBI, RBI and IRDAI during the onboarding process. The platform’s 360° process visibility feature allows businesses to monitor every aspect of the onboarding journey, from document signing to KYC completion and payment processing.

Best for

Banks, fintech companies, insurance agencies, and any other business looking for a digital onboarding solution

Pricing

Pricing information is not available on the website

What do Digio users say?

Digitap

Digitap offers a full-fledged solution to provide a seamless onboarding experience to customers. It can handle a high number of applications making it a perfect fit for companies scaling their operations. The Bank Statement Analyzer API is the USP of Digitap as it allows financial institutions to analyze customers’ bank statements through multiple modes, including direct extraction using net banking credentials, PDF uploads, and integration with the Account Aggregator framework.

Digitap also generates detailed reports in different formats like Excel, PDF, and XML. With identity verification and document processing, Digitap offers highly accurate results making it a perfect partner for businesses looking for a trustworthy tool to make faster decisions.

Best for

Banks and other financial institutions

Pricing

Pricing details are not mentioned on the website

What do Digitap users say?

How to choose the best verification solution for your business

We shared the list of the top 10 best Karza alternatives, but you could still be confused about how to proceed with evaluating the tools. So here’s a mini-guide to put an end to the confusion:

Functionality and features

The features of a product must always top the priority list. The alternative with the most relevant and useful features will help your team to be more productive. Focus on verification accuracy and speed, as these factors directly impact customer experience. The solutions that use AI and ML are more capable of enhancing the identity verification process. While evaluating the alternatives, ensure that it is capable of building customized journeys to comply with the industry requirements and reduce fraud risks. For example, platforms like HyperVerge offer specialized features that cater to various sectors, ensuring that businesses can efficiently meet their unique requirements.

Look for an end-to-end solution

An ideal solution will integrate all the aspects of the customer lending journey and streamline the process from start to end. This includes identity verification and document management to payment processing and compliance checks. This kind of integration reduces manual intervention and empowers you to offer a superior customer experience.

Ease of use and onboarding

Always prefer a tool that has a user-friendly interface and requires minimal training for your team to get used to. Your employees will be more productive and they will find their work more satisfying. Assess the onboarding process offered by the vendor and check for supporting onboarding materials. Are there tutorial videos available? What about a dedicated customer support team? These questions will help you get started in the right direction.

Scalability and flexibility

The best identity verification solution will fit your current business needs and will be able to match future requirements as well. The best way to evaluate that is by looking for configurable and customizable features that allow you to adapt the software to your unique workflows. This adaptability is necessary for businesses that may need to pivot or expand their services in response to market demands.

Integration and compatibility

Evaluate the platform’s capability to work with your existing systems. The API capabilities and the pre-built integrations will make the operation run smoother and avoid disruptions.

Security and compliance

Choose a tool that employs data protection measures, access controls, and complies with industry regulations such as GDPR or CCPA. Verify the software’s security certifications and data privacy measures to ensure that sensitive information is handled appropriately.

Customer support and reputation

Monitor customer reviews, case studies, and testimonials to gauge the technical support quality of the platform. Engage with existing customers on social media and other platforms to get real-life vendor support quality.

Improve your identity verification journeys with AI

AI-powered identity verification tools are the right partner for growing businesses. It automates the digital identification process while continuously protecting your business from advanced fraud attacks. HyperVerge One is a strong contender in this list and if you’re looking for a complete package with transparent pricing, you don’t have to look any further.

The no-code workflow builder is one of the best attractions of the HyperVerge One package. It’s incredibly powerful as it lets you create onboarding journeys for new products without relying on your development team making it a huge asset for scaling your business quickly. Advanced identity verification features like single-image-based liveness detection verify the customer’s identity based on a single selfie. Likewise, the face de-duplication technology ensures that each user is uniquely identified and prevents multiple accounts from being created by the same individual.

Other features like downtime protection ensure you have uninterrupted access to the digital verification features even during peak times. AI-based forgery checks detect fraudulent documents and images effectively. By analyzing various aspects of submitted identification materials, HyperVerge can identify potential forgeries before they are processed, thereby enhancing security measures.

Interested to know how HyperVerge One can improve the identity verification process in your business and streamline the lending journey? Book a demo now.

FAQs

The following FAQs summarize how Karza compares with leading alternatives based on onboarding scale, compliance readiness, and lending use cases in India.

1. What is Perfios Karza?

Perfios Karza is an identity and data verification platform used by banks and lenders to perform KYC, document checks, biometric authentication, and fraud assessment. It is commonly used in lending workflows to validate customer identity and supporting data during onboarding and credit evaluation.

2. Why do companies look for Karza alternatives?

Companies look for Karza alternatives when they need faster onboarding at scale, greater workflow flexibility, advanced fraud prevention, predictable pricing, or support beyond basic KYC. Many businesses also reassess Karza after the Perfios acquisition to better align tools with evolving RBI V-CIP and digital lending requirements.

3. Which is the best Karza alternative for NBFCs in India?

For NBFCs in India, HyperVerge and Digitap are among the most commonly evaluated Karza alternatives. HyperVerge is preferred for end-to-end onboarding and fraud prevention, while Digitap is widely used for income verification and bank statement analysis in lending workflows.

4. Is HyperVerge better than Karza?

HyperVerge and Karza serve different needs. Karza is suited for structured data and identity checks, while HyperVerge is better for AI-led onboarding, high-volume verification, and configurable workflows. Fintechs and NBFCs focused on scale and fraud prevention often prefer HyperVerge.

5. Which Karza alternative supports end-to-end loan journeys?

Platforms that support end-to-end loan journeys beyond basic KYC include: HyperVerge, Digio, and Newgensoft. These tools combine identity verification with workflow orchestration, document handling, and integration across multiple stages of the lending process.

6. Are Karza alternatives compliant with RBI V-CIP guidelines?

Most leading Karza alternatives used in India, such as HyperVerge, Signzy, IDfy, Digio, and Digitap, are designed to support RBI V-CIP requirements. Compliance depends on correct implementation, including video KYC flows, audit trails, and data protection controls.

7. What are the top Karza alternatives in India in 2025?

The top Karza alternatives in India in 2025 include HyperVerge, Signzy, IDfy, Bureau, Cashfree, Idenfy, Newgensoft, Jukshio, Digio, and Digitap. Each platform differs in focus, such as onboarding scale, compliance depth, fraud prevention, or income analysis.