Know Your Customer (KYC) is crucial and often mandatory for onboarding. In such cases, having a versatile and effective KYC solution can make a world of difference in enhancing the customer onboarding process. According to a research paper on ResearchGate, advanced KYC solutions can significantly improve efficiency and security in banking.

These advanced solutions streamline various aspects of the KYC process by integrating technologies such as digital identity verification, automated document processing, and secure e-signatures.

Digio is at the forefront of this transformation, offering a comprehensive suite of services that includes e-Sign, Digi-docs, eKYC, document automation, and e-NACH recurring payment solutions.

However, despite its broad range of features, Digio is not without its limitations. Recent negative user ratings of its Android app, missing features, and concerns about affordability have led some businesses to explore alternatives.

This blog highlights the top KYC alternatives to Digio in India, providing insights into each competitor’s company info, pros, cons, and key features to help you choose the best fit for your business needs.

| ⭐Our top picks for the best Digio competitors include: 1. HyperVerge – Best for AI-powered identity verification and AML compliance. 2. Signzy – Best for automated onboarding. 3. Perfios KARZA – Best for versatile APIs for financial businesses. 4. Idfy – Best for accurate ID verification. 5. Bureau – Best for businesses in the financial sector. 6. Jukshio – Best for AI and ML-driven analytics. 7. Cashfree – Best for payment processing along with KYC. 8. Newgen – Best for digital transformation. 9. iDenfy – Best for AML compliance and end-to-end customer onboarding. 10. Digitap – Best for extensive ID verification platform |

Why consider alternatives to Digio?

While Digio has positive user reviews on Capterra, it is not popular or versatile enough to get any reviews on sites like G2. There may be a few reasons why that is the case, and why you can consider opting for one of its competitors. Here are 4 such reasons:

| Missing featuresEssential features such as AML checks and deepfake detection are absent from Digio’s portfolio. These features can add a lot of value to the overall KYC onboarding process. Not affordable for small businesses Digio does not disclose its pricing for businesses without contact information. Moreover, Digio offers a suite of products, out of which, only a few may be beneficial to small companies. Time consumptionKYC takes place during the initial stages of a new customer onboarding. If the KYC process takes a lot of time, it can create a negative experience for the customer, which can lead to a lower customer retention rate. Flexible integrationMany businesses have a pre-existing workflow that they do not want to change for an API integration. In such cases, effective solutions with flexible API integration are better fits. |

These limitations can hinder the KYC process of businesses to a point that forces them to consider alternatives that do not share the same issues and offer a better and more extensive overall eKYC solution.

Upgrade your business using automatic KYC today

with secure & seamless ID verification Get a free demoHow did we analyze and select the most suitable Digio alternatives?

We follow an extensive manual process that involves thorough market evaluation and detailed analysis to shortlist the most suitable Digio competitors. Here’s our process to identify and list the top alternatives.

- We evaluated more than 20 different competitors of Digio. These competitors specialize in identity verification, Know Your Customer (KYC), and fraud management.

- We compared each company’s reviews and ratings on platforms like G2, Capterra, and in some cases, Reddit.

- We shortlisted the provider based on factors such as features, efficiency, pricing models, AI capabilities, data security measures, and customer support.

Following such a process ensures that you get a comprehensive overview of the leading tools and assists you in choosing the best solution for your unique needs.

Overview of the top 10 Digio competitors

| Top alternatives | Free trial availability | Standout features |

| ☑ | • Customer conversion funnel analytics • Extensive onboarding APIs • No-code workflow automation •AI-based liveness and fraud checks | |

| ⌧ | • RM-assisted journey creation • AI-based risk/decision engine | |

| ☑ | • Automated KYC • Comprehensive skip-tracing | |

| ☑ | • NameCheck and FaceMatch APIs • Auto-scalability, | |

| ☑ | • Multiple risk checks • Account and chargeback protection | |

| ☑ | • Extensive ID support • Versatile fraud protection | |

| ⌧ | • AI-powered facial • Location authentication | |

| ☑ | • Comprehensive KYC • ID verification platform | |

| ☑ | • AI-powered identity verification • End-to-end customer onboarding | |

| ☑ | • Full-fledged customer onboarding suite • E-NACH and Physical NACH mandate |

A detailed list of the 10 best Digio competitors for ID verification

1. HyperVerge

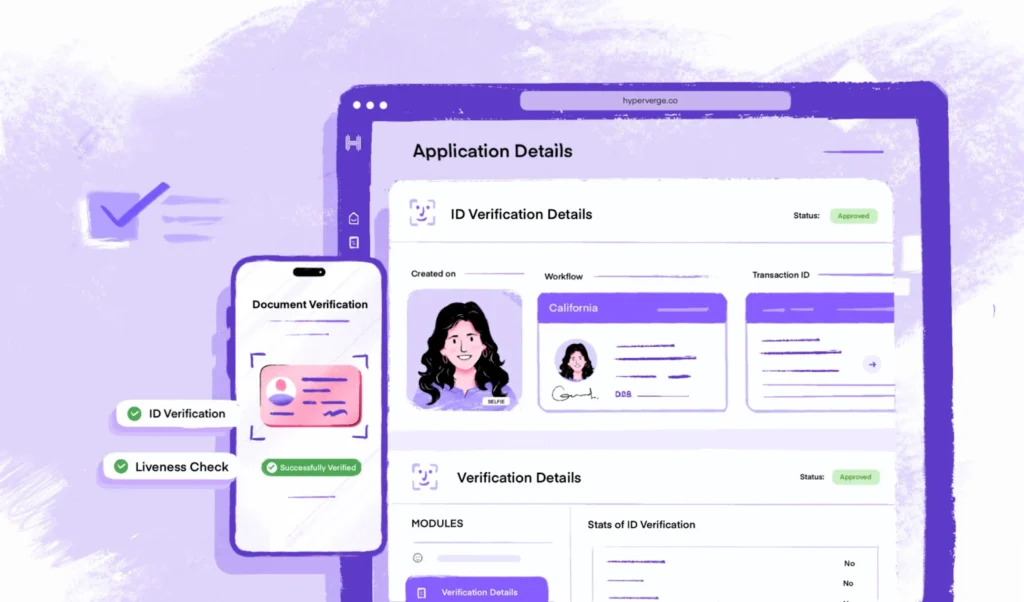

HyperVerge offers a comprehensive solution for everything regarding ID verification, including KYC– the HyperVerge ONE platform.

HyperVerge ONE is a leading AI-powered identity verification platform streamlining the end-to-end customer onboarding journey.

The HyperVerge ONE platform allows you to be up and running in just 4 hours using web and mobile Software Development Kits (SDKs) for quick KYC deployment. Additionally, HyperVerge’s identity verification solution includes numerous features, such as:

- Liveness detection

- Deepfake detection

- OCR for document verification

- Face de-duplication

- AML checks (global sanctions and watchlists, Politically Exposed Person, adverse media)

HyperVerge has you covered with a highly trained AI that is highly accurate, efficient, and shows minimal false positives.

Moreover, to ensure optimal infusion with your existing company, HyperVerge offers 100+ onboarding APIs that cover a wide array of industry use cases, such as those in the financial services, education, crypto, and gaming sectors.

Features better than Digio

Here are some significant features of HyperVerge:

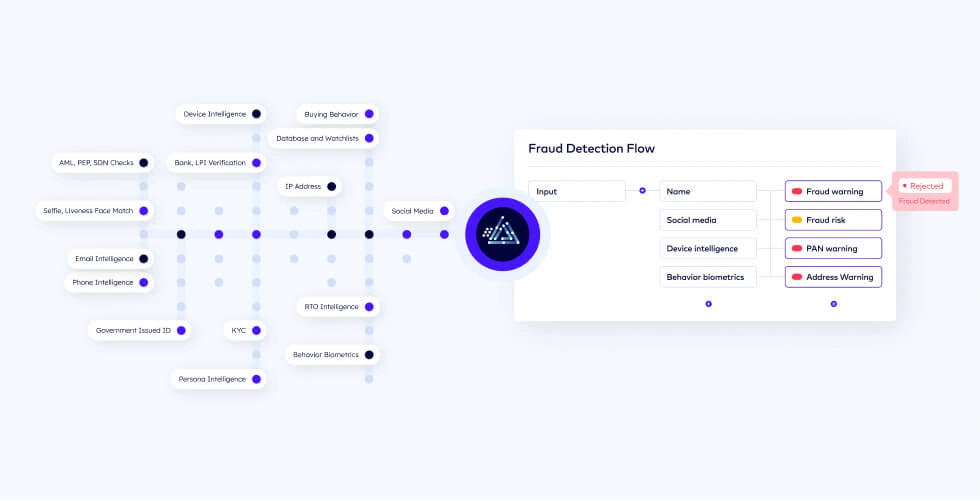

- Fraud monitoring: Integrates real-time AI-driven fraud detection to identify and prevent suspicious activities during the entire verification process.

- End-to-end journey automation: Provides comprehensive workflow automation solution to cover all grounds of consumer onboarding from day 1.

- Address validation: This process matches user-provided address information with reliable databases to ensure accuracy and detect potential fraudulent activities using fake addresses.

- Analytics Dashboard: HyperVerge ONE has a robust analytics dashboard that allows businesses to boost profits with clear business metrics and helpful insights to increase conversion rates.

HyperVerge pricing

| Start plan (Startups) | Grow plan (Mid-sized companies) | Enterprise plan (Enterprise-level organizations) |

| The Start plan includes a free trial and easy integration within 4 hours. It also offers identity verification tools to view and manage KYC and ID verification for one month. | The Grow plan involves everything the Start plan covers, including an end-to-end identity verification suite, access to AML checks, central database checks, and customized business workflows. | The Enterprise plan involves all the features and offerings from the Grow plan, along with a custom price structure and collaborative tools. |

What do HyperVerge users say?

Dinesh A.,Co-founder and CTO, Small-Business ★★★★★ (5/5)

Anand S,IT Head, Consumer Services, Mid-Market ★★★★★ (5/5)

Mayank P., Angel Investor, Small-Business★★★★ (5/5)

Utilize AI to boost your business

Reap the benefits of a 13-year-trained AI model for automated KYC and ID verification with exceptional accuracy and reliability in customer onboarding from day 1. Get a free demo2. Signzy

About Signzy

Signzy is an Indian technology company that provides solutions for the digital banking infrastructure as well as KYC. Signzy offers a no-code platform that allows businesses to create customizable onboarding journeys.

Signzy claims to have a monthly 10 million customer onboarding rate with high accuracy through their APIs. The company collaborates with giant firms such as Mastercard and Microsoft.

Signzy Pricing

The pricing for Signzy’s services is not readily available on its website.

Key features of Signzy

- Video KYC: Signzy’s vKYC solution allows users to perform video KYC on a network with as low bandwidth as 75 kbps.

- Automated onboarding: Signzy’s no-code platform supports more than 200 APIs that allow businesses to create and automate journeys however they want.

- Security and compliance: The company designs its solutions in a way that makes sure that they do not compromise data security and comply with strict regulations.

Pros and cons of Signzy

| Pros ✓ Users appreciate the streamlined onboarding process that takes care of the complete KYC process within 3 to 5 minutes. ✓ Users appreciate the consistent success rate of 99% in onboarding. This allows businesses to worry less about onboarding and focus on other things. Cons ✕ Different users can get different onboarding experiences depending on multiple factors, such as the strength of the internet connection and familiarity with technology. ✕ Some users report to have faced issues with Signzy’s customer support, causing delays in resolving any problems. |

Signzy compared with Digio

While Digio mainly focuses on e-signatures and document verification, Signzy provides a comprehensive KYC solution.

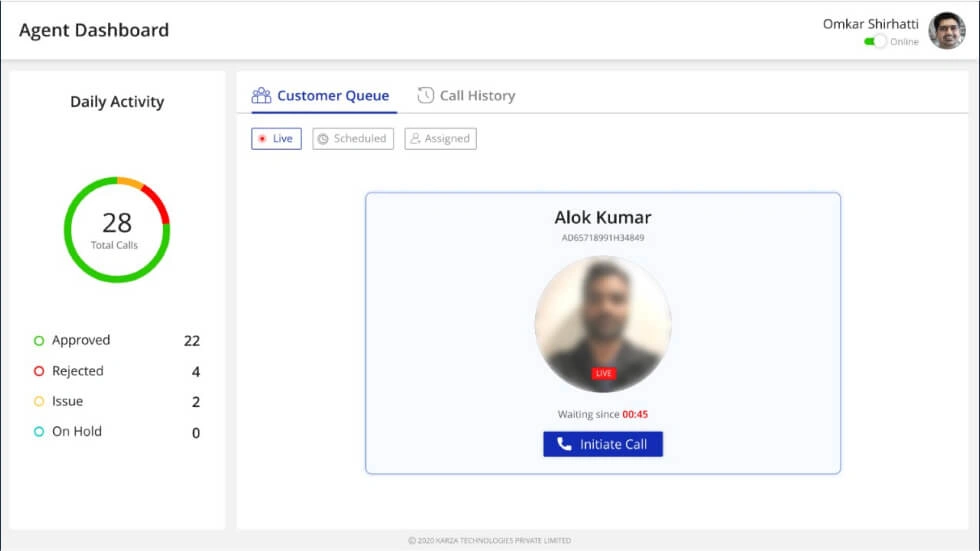

3. Perfios KARZA

About Perfios KARZA

KARZA is a comprehensive KYC and risk assessment platform from India. Software solutions company Perfios obtained KARZA in 2022, and now, the combined entity’s target is to offer a one-stop solution for businesses regardless of the industry.

However, KARZA focuses primarily on the FinTech industry where it helps lending institutions in particular. The platform also offers automation that reduces the turnaround time for KYC compliance and enables faster customer onboarding.

Perfios KARZA pricing

The pricing of KARZA by Perfios is not readily available on its website.

Key features of Perfios KARZA

- Extensive KYC: KARZA offers features such as document verification, credit scoring, and identity checks during the KYC phase to streamline the onboarding process even further.

- FinTech solutions: KARZA by Perfios provides enhanced customer identity verification as well as financial histories during the KYC process to make it easier for lending solutions to only offer their services to trustworthy customers.

- Substantial language support: KARZA offers multiple functionalities such as dynamic call allocation, live queue monitoring, and on-screen instructions in 11 regional languages

Pros and cons of Perfios KARZA

| Pros ✓ Many users admire the comprehensive risk assessment that KARZA provides during the KYC and onboarding process. ✓ Users benefit from the combined features of Perfios and KARZA into a single entity that provides a complete solution. Cons ✕ Some users operating in smaller businesses in the non-IT sector find Perfios KARZA’s solution too complex, especially if they lack the technical expertise. ✕ While KARZA offers multiple functionalities, users find its technical dependency to be worrisome as any technical issues can disrupt onboarding processes. |

Perfios KARZA compared with Digio

Compared to Digio, KARZA by Perfios puts more emphasis on advanced analytics and risk assessment to go along with KYC.

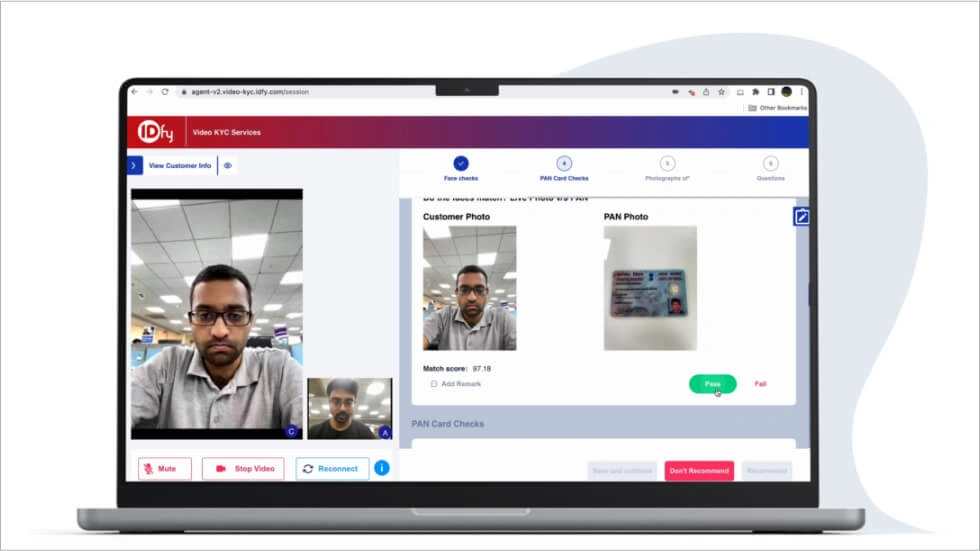

4. Idfy

About Idfy

Idfy focuses on simplifying the ID verification process for businesses. Idfy aims to enhance customer onboarding experience through services like eKYC, video KYC, and document verification.

The primary objective of Idfy is to offer seamless integration with existing workflows of businesses. This allows businesses to start offering ID verification as fast as possible.

Idfy Pricing

The pricing for Idfy’s services is not readily available on its website.

Key features of Idfy

- Real-time data verification: Idfy conducts real-time identity verification using data sources including government databases.

- Video KYC: Idfy offers a robust video KYC solution with pre-call checks such as device and network readiness.

- Comprehensive verification: Idfy supports verification through multiple methods, such as face authentication, document checks, and database checks. This ensures a thorough verification process every time.

Pros and cons of Idfy

| Pros ✓ Users appreciate the smooth and fast integration of Idfy’s KYC and verification solution. ✓ Users report positive experiences with Idfy’s customer support team thanks to a prompt response and effective solutions from Idfy’s side. Cons ✕ Some users note an issue with the uptime of the solution. An outage during critical verification can hinder the reliability of the solution as well as the business. ✕ Some users report an issue with the accuracy of Idfy’s OCR capabilities. This can lead to false positives or errors during the document verification process. |

Idfy compared with Digio

Apart from KYC, Digio offers a broader range of solutions such as e-sign, e-NACH, Digi-sign, and Digi-docs, whereas Idfy focuses primarily on the ID verification aspect of KYC.

5. Bureau

About Bureau

Bureau is a KYC and identity verification platform that focuses predominantly on the financial industry. However, Bureau’s ID verification platform is extensive enough to cater to the customer onboarding needs of businesses regardless of the industry.

Apart from identity verification, Bureau’s platform offers services such as document authentication and fraud risk assessment. In its full effect, Bureau’s platform allows a fast and secure KYC and customer onboarding while maintaining compliance with regulations.

Bureau pricing

The pricing for Bureau’s services is not readily available on its website.

Key features of Bureau

- AI-driven analytics: Bureau’s ID verification solution includes real-time data analytics that use advanced machine learning algorithms to gain insights into customer identities. This is a great way to detect fraud during the verification process.

- Customizable solution: Bureau allows businesses to customize the KYC solution according to their specific needs and regulation requirements. This allows businesses to offer a more effective KYC journey specific to their niche.

- User-friendly interface: Bureau’s user interface is intuitive and easy to use. This provides a better experience for businesses as well as customers.

Pros and cons of Bureau

| Pros ✓ Many users praise Bureau’s multi-layered approach to identity verification and KYC. ✓ Users appreciate the real-time risk assessment and analytics Bureau’s solution provides during onboarding. Cons ✕ Some users report a steep learning curve for beginners using Bureau’s solution for their businesses.✕ While Bureau offers a versatile solution, some users have found it to lack the desired amount of customization. |

Bureau compared with Digio

Apart from KYC, Digio combines document verification and e-signature APIs in its solution. On the other hand, Bureau targets risk management and ID verification, especially in the financial sector.

6. Jukshio

About Jukshio

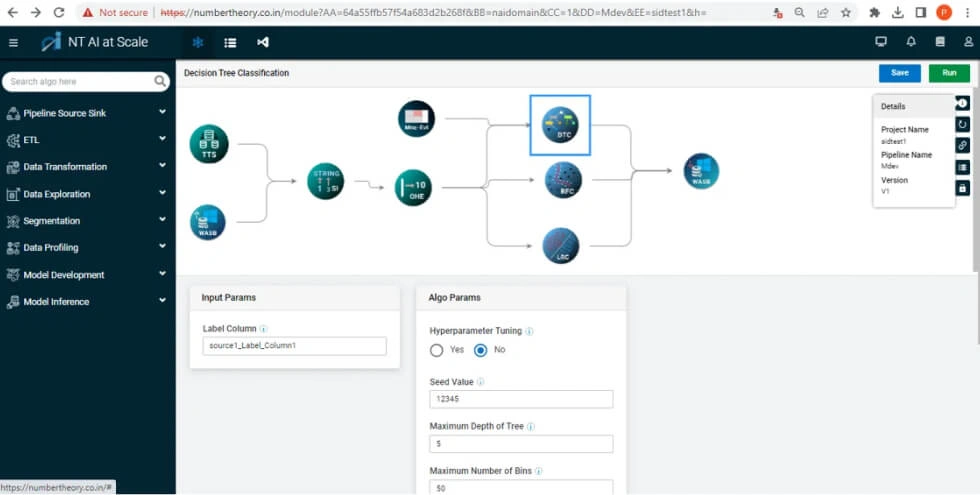

Jukshio is a tech company that aims to provide automated KYC and ID verification for businesses. The KYC++ platform from Jukshio aims to utilize advanced data analytics and deep learning networks to automate and enhance the customer journey.

Unlike Bureau’s Jukshio does not specialize in a particular industry. It rather aims to provide an equally effective solution for businesses of all industries, be it education, finance, health, or legal.

Jukshio pricing

The pricing for Jukshio’s services is not readily available on its website.

Key features of Jukshio

- Facial recognition and liveness detection: Jukshio’s KYC++ platform deploys advanced face recognition and liveness detection technologies to ensure maximum security and prevent fraud.

- Real-time analytics dashboard: Jukshio presents a versatile analytics dashboard that allows businesses to monitor fraud metrics and KYC processes in real-time for quick decision-making.

- Customizable workflows: Jukhsio offers a flexible solution that businesses can customize according to their desire.

Pros and cons of Jukshio

| Pros ✓ Users report Jukshio’s solution verifying IDs and performing KYC at very high accuracy, helping businesses reduce the time they spend on corrections and retries. ✓ Many users praise the AI machine learning-driven fraud detection capabilities from Jukshio. Cons ✕ Some users report a difficult learning curve that they must go through to use Jukshio’s capabilities to their fullest. ✕ Users from small-time businesses and startups may find Jukshio’s all-inclusive platform too overwhelming or overkill for their ID verification needs. |

Jukshio compared with Digio

Compared to Digio, Jukhsio offers a more complete package regarding automation in the KYC process.

7. Cashfree

About Cashfree

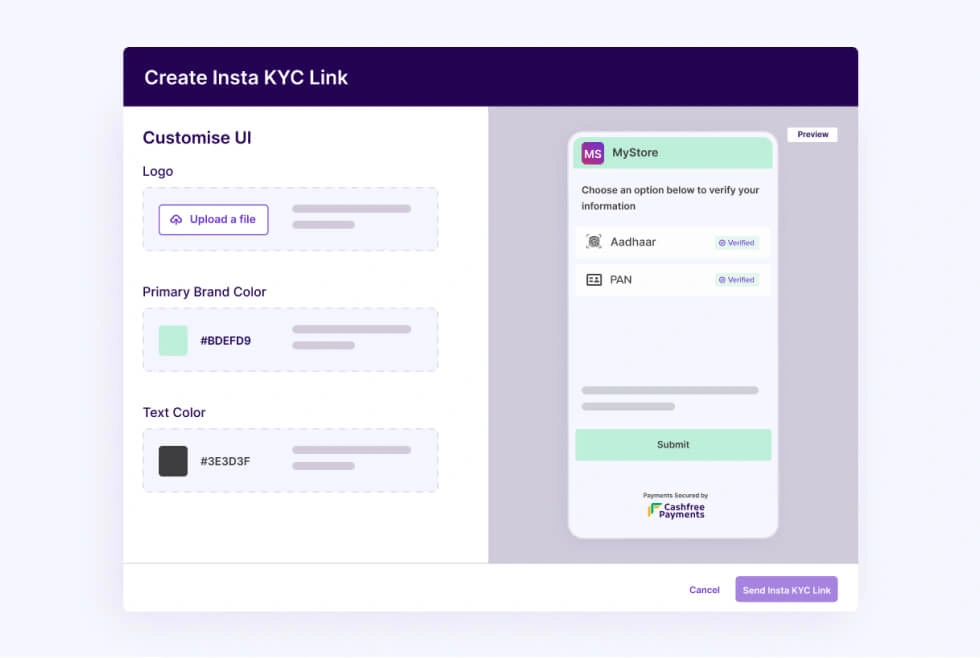

Cashfree primarily operates in the payment solutions field. However, it also offers comprehensive identity verification and KYC services now. Cashfree has designed its KYC service in such a way that it integrates seamlessly with its payment processing solutions.

As a result, Cashfree can offer an effective KYC solution for businesses but can offer a much more extensive and complete solution for financial institutions and banks. Cashfree offers an intuitive and smooth customer experience for faster and smoother onboarding.

Cashfree pricing

While Cashfree offers transparent pricing for its payment solutions, the pricing of its verification suite is not readily available online.

Key features of Cashfree

- KYC Automation: Cashfree’s solution provides automated KYC verification processes that streamline customer onboarding. This reduces manual efforts and accelerates the verification process.

- Document Verification: Cashfree’s platform supports various document verification methods to ensure the accuracy of customer identities against valid documents.

- Versatile payment processing: For businesses in the financial sector, Cashfree offers a complete solution including KYC, ID verification, payment gateway, payouts, and cross-border payments.

Pros and cons of Cashfree

| Pros ✓ Users of small-time businesses and startups appreciate the accessibility and scalability that Cashfree offers. ✓ Users admire the no-code solution not having to deploy a specialist with the required skills to operate its platform optimally. Cons ✕ While Cashfree is an effective solution provider in the financial sector, businesses in other sectors may not be able to fully take advantage of Cashfree’s portfolio of products. ✕ Since the platform comes with a no-code workflow, some users may find it difficult to customize the workflow compared to a more technical solution. |

Cashfree compared with Digio

Digio offers an extensive verification suite that takes care of KYC, e-sign, and document verification. On the other hand, Cashfree provides payment-related solutions that include KYC as a feature.

8. Newgen

About Newgen

Newgen is a digital transformation company that offers a broad suite of services. For businesses looking for a customer verification solution, Newgen’s suite also includes KYC services that incorporate advanced technology like AI and machine learning.

Therefore, the KYC solution from Newgen carries out the process with enhanced accuracy and efficiency. Moreover, the company also emphasizes regulation compliance along with efficiency for a complete package as a verification solution. This makes Newgen a versatile solution for businesses of any industry.

Newgen pricing

The pricing of Newgen’s services is not readily available on its website.

Key features of Newgen

- Customizable KYC workflows: Newgen allows businesses to tweak their KYC process to meet specific regulatory requirements and operational needs.

- Integrated compliance checks: The platform includes integrated compliance checks to ensure that businesses adhere to KYC regulations. Doing so reduces the risk of non-compliance.

- Intelligent process automation: Newgen boasts a powerful generative AI-backed automation solution that helps businesses minimize time and resources for KYC and other onboarding processes.

Pros and cons of Newgen

| Pros ✓ Users praise the advanced AI and machine learning capabilities of Newgen aiding the KYC and onboarding process. ✓ Many users also appreciate the comprehensive document management that helps businesses even after the KYC process is complete. Cons ✕ Users who only want ID verification and KYC services may find Newgen to be an excessive solution that does more than required. ✕ As a result, users who only require onboarding services may not be able to extract the most out of the money they pay for Newgen’s solution. |

Newgen compared with Digio

Compared to Digio, Newgen focuses more on digital transformation solutions. As a result, the two industries cater to businesses with slightly different requirements.

9. iDenfy

About iDenfy

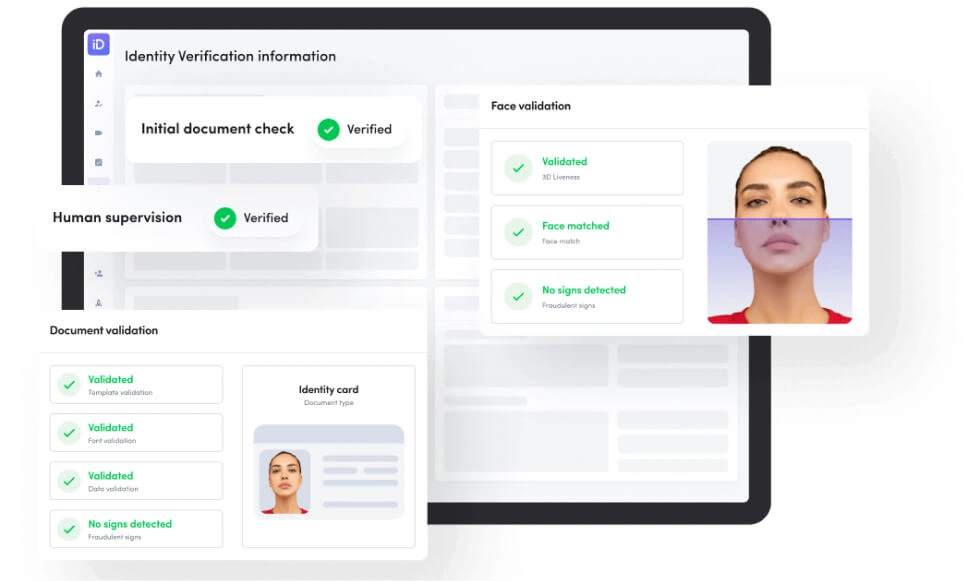

iDenfy is a Lithuania-based leading identity verification company that offers a thorough identity verification platform. Identify’s verification platform includes a vast range of services such as document verification, biometric authentication, and facial recognition.

These features come together and enhance the performance and security of the onboarding process. iDenfy emphasizes user experience and aims to provide a seamless onboarding journey on a global level. However, the platform is particularly popular among businesses in the FinTech industry that want a robust identity verification solution.

iDenfy pricing

The pricing of iDenfy’s solution is not readily available on its website.

Key features of iDenfy

- Biometric and document verification: iDenfy specializes in biometric authentication and document verification through facial recognition technology to ensure the legitimacy of the customer.

- Video KYC: iDenfy boasts a powerful video KYC feature that finishes customer journeys in minimal time, even in low bandwidth networks.

- Liveness detection: iDenfy’s verification suite comes with an accurate liveness detection tool that makes sure there are no fraudsters lurking around during the KYC and document verification process.

Pros and cons of iDenfy

| Pros ✓ Users like that iDenfy has a simple setup process for identity verification as it is easy to implement. ✓ iDenfy provides superior customer support. Users feel that their team is knowledgeable and offers instant assistance. Cons ✕ According to reviews on listing sites, users sometimes experience inaccuracy and false positives in document & identity verification. ✕ Users also feel that the AML feature lacks the desired amount of accuracy and effect. |

iDenfy compared with Digio

Digio is an Indian company that caters to KYC solutions predominantly for Indian businesses. On the other hand, iDenfy is a Lithuania-based identity verification company that operates on a global scale, including in India.

10. Digitap

About Digitap

Digitap is a digital identity verification platform that provides KYC solutions for businesses. Digitap’s ID verification platform automates the customer onboarding journey through AI and ML. Digitap’s customer onboarding suite covers multiple features such as Aadhaar KYC, Paperless XML, KYC Record Search and Download, DigiLocker, and Video KYC.

Services like document verification, facial recognition, and real-time identity verification all come with Digitap’s KYC solution. Digitap’s KYC solution is versatile enough to be a suitable pick for businesses of all sizes and industries.

Digitap pricing

The pricing details of Digitap are not readily available on its website.

Key features of Digitap

- Real-time monitoring: Digitap comes with real-time monitoring capabilities that allow businesses to gain useful insights into their KYC process and mitigate any issues before they get the time to grow.

- Aadhaar-based KYC: Digitap offers KYC through the Aadhaar card through Paperless XML, KYC Record Search and Download, and DigiLocker.

- E-NACH and physical NACH mandates: Along with KYC and identity verification, Digitap also sets up e-NACH and physical NACH mandates for customers.

Pros and cons of Digitap

| Pros ✓ Users praise the accuracy of Digitap’s digital onboarding and user verification solution. ✓ Many users report that Digitap is easy to implement for new users. Cons ✕ Some users have found that Digitap’s customer support could have been better. ✕ Non-technical users find Digitap’s solution to have limited customization options. |

Digitap compared with Digio

Digio focuses on providing seamless digital onboarding with features like Aadhar-based eKYC and OCR-based document verification. Digitap focuses on data accuracy through robust AI and ML-driven identity verification.

How to choose the best Digio alternatives for your business

Of all the options we have shown you, choosing the best fit for your business can take time and effort. Hence, this blog provides guidelines that help you choose the right service provider for your business.

Here are 5 such steps to get you started.

Step 1. Identify Digio alternatives and research options

This blog covers the best Digio competitors in the market. Yet, you must conduct detailed research to choose the most suitable option for your company. Here are a few pointers that you can keep in mind:

- Survey and inspect other leading identity verification solutions besides Digio.

- Look into the latest industry reports for any effective emerging solutions.

- Ask industry peers or members on forums for recommendations on reliable solutions.

- Analyze customer reviews and client testimonials to measure user satisfaction.

- Explore niche solutions that cater to your specific business needs better.

- Assess the pricing structure to weed out unaffordable solutions.

Step 2. Compare key features and capabilities of shortlisted solutions

After preparing a list of possible alternatives for Digio, you should analyze the features of those solutions and see how they compare with Digio. Consider the following factors during this step:

- Research and evaluate the effectiveness of the core attribute of Digio alternatives, which in this case is KYC.

- Evaluate the alternatives’ key features, such as verification accuracy and speed, integration flexibility, and AI capabilities.

- Assess how easily the service merges with your existing systems.

- Determine if the service’s scalability matches your company’s growth.

- Check each alternative’s level and quality of customer support to ensure a fruitful, long-term relationship.

Step 3. Evaluate the flexibility of the solution and its suitability for your business

Once you evaluate the objective efficiency of the alternatives to Digio, you should assess how each feature of each service provider satisfies your business requirements. Factors such as customer onboarding time, the level of security, ease of regulation compliance, and accuracy of face authentication come into play here.

You should measure how each service provider matches your current and projected business requirements to find the right fit.

Step 4. Assess pricing structures and potential ROI

Understanding each service’s financial aspects and potential Return On Investment (ROI) is important. Take the following factors into account during this step:

- Cost transparency: Ensure clarity in pricing structures like setup fees and ongoing costs.

- ROI potential: Evaluate potential savings in fraud prevention and operational efficiencies.

- Scalability costs: Understand how pricing scales with your business growth.

Step 5. Request demos, gather feedback, and decide

You should contact the service providers directly once you narrow down the suitable alternatives. Request any free demos if they offer them, ask your IT department, compliance officers, and customer service representatives for any feedback, and take usability and ease of integration into account.

Following these steps can help you choose the best customer onboarding service provider as a Digio alternative for your company.

Improve your ID verification and KYC processes with the best Digio alternative

User identity verification is integral to onboarding new users to your company. It is also one of the first processes that creates customers’ first impressions of the company. Hence, choosing the right customer onboarding platform is essential.

HyperVerge One can take care of your identity verification requirements with easy and quick implementation thanks to 100+ custom APIs.

HyperVerge comes with a 13-year-trained AI model that is highly proficient in ID verification and face authentication using tools such as:

- Single image-based liveness detection

- Face de-duplication technology

- AI-based forgery checks

- Deep image analysis

HyperVerge’s verification feats include a 95% auto-approval rate, a 50% reduction in drop-offs, and more than 800 million IDs verified.

KYC integration, AML screening, and fraud mitigation are important parts of the user onboarding journey. HyperVerge ONE considers all those unique needs and presents useful insights in a robust analytics dashboard.

The insights allow businesses to plan customer journeys accordingly, thanks to a fully customizable, no-code workflow builder that maximizes customer onboarding rates.

Frequently asked questions on Digio alternatives

1. Who are the competitors of Digio?

The competitors of Digio include solution providers such as HyperVerge, Jukshio, Idfy, Digitap, and Bureau.

2. Is Digio suitable for businesses of all sizes?

Digio is certainly suitable for large enterprises with its scalable solution. However, small businesses or startups may have better luck with solutions such as HyperVerge and Idfy which focus primarily on ID verification and KYC.

3. Can Digio’s AI accurately detect sophisticated fraud attempts?

Digio uses advanced AI to detect fraud attempts during the ID verification and KYC process. However, other solution providers such as HyperVerge can offer better fraud prevention thanks to a highly skilled AI with years of training.

4. Is Digio easy to integrate with other software and platforms?

Digio offers a flexible solution that integrates with businesses’ workflow with relative ease. However, it may not be as flexible as having hundreds of custom APIs that can go live in as little as 4 hours.