Integrate quickly in an afternoon and go-live

with a fully IRDAI-compliant KYC solution!

Digital KYC

Central KYC

Aadhaar – Offline authentication

OVD with Pan/Form 60

Aadhaar – Online authentication

Video-based verification

Implementing a single mode of KYC will not help Onboard every customers!

Insurance companies need to seamlessly integrate multiple KYC methods to manage needs of all our customers.

How do you seamlessly integrate multiple KYC methods to ensure low-friction onboarding of all your customers?

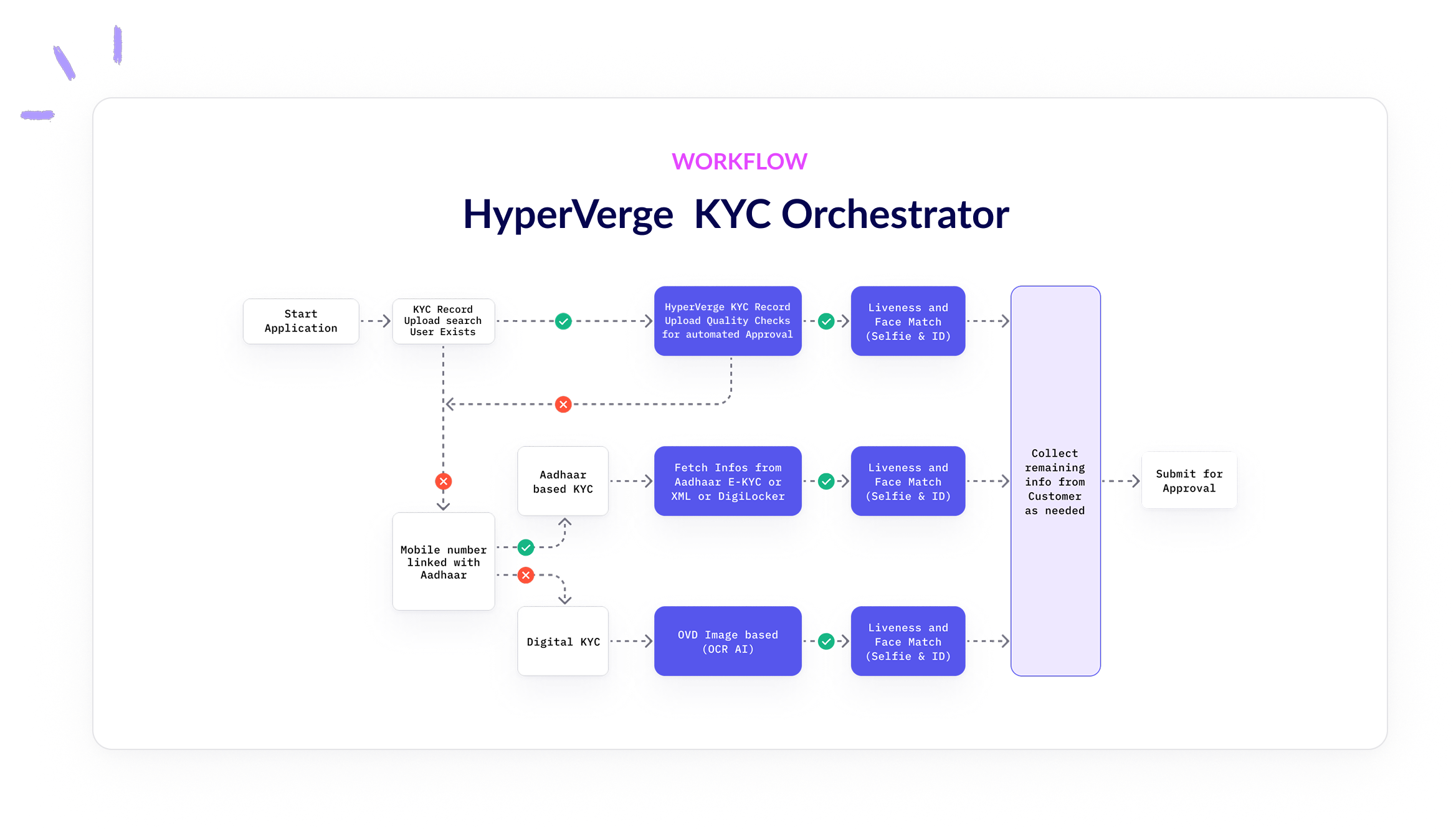

Based on factors like phone number & linkage, CKYC record’s existence, etc certain modes of KYC will fail. The HyperVerge Identity Platform has an end-to-end KYC orchestrator which can support any KYC workflow.

WORKFLOW

HyperVerge KYC Orchestrator

How do we manage a seamless KYC experience across all partners and acquisition channels?

Launch new customer journeys much faster, without writing code or requiring app releases.

Cut down on manual review efforts & resources spent using our AI to expedite your PIVC process!

Onboard customers in <30 seconds even at scale

Reduce fraud by 95% through automation.

Decrease backend verification expenses by 80%

Our end-to-end onboarding stack is a comprehensive product suite that contains global AML checks to prevent any fraud.

Global & country-specific sanctions imposed by different organisations

~100% Politically Exposed Persons Profile with Global Coverage

Adverse Media for people associated with ML/fraudulent activities

The latest news, updates and more about KYC industries & related market resources from our team.

Mistakes to avoid while selecting/orchestrating KYC methods

What are the 80-20s to get right when implementing aKYC process/ solution?