Onboard

users with the best

conversion rates

Minimize frauds and user drop-offs while

being compliant.

1 Billion+Customers Verified

Proven at scale, our AI ensures smooth onboarding across diverse devices and demographics

![]() Works even in 2G bandwidth

Works even in 2G bandwidth

Race, age, and gender agnostic

Race, age, and gender agnostic

Compatible with 100,000+ devices

Compatible with 100,000+ devices

We onboard your customers.

You grow

your business!

![]() Convert more users

Convert more users

Launch journeys faster

Launch journeys faster

Manage fewer vendors

Manage fewer vendors

Catch more fraudsters

Catch more fraudsters

HyperVerge ONE

ONE platform for all your customer onboarding needs

Dominate customer conversion rates

Step-wise analytics with funnel insights

Discover the top 5 drop-offs points

Protection against API downtimes

See how it works -> See how it works -> See how it works ->

Build custom journeys in minutes

No-code workflow builder

Personalize for unique demographics

Launch without app releases

See how it works -> See how it works -> See how it works ->

Choose from 100+ integrations

Hassle-free vendor management

Category best integrations

Support all onboarding use-cases

See how it works -> See how it works -> See how it works ->See the average pass rate in your target country

Effortlessly expand across the Globe

Onboard new users anywhere in the world. No document type or regulation can hold you back

Tailored for every industry’s unique needs

Securing every aspect of

Customer's Journey

- Phone Number Verification

- Geolocation

- Digital CPV

- Email Verification

- Liveness

- Face Deduplication

- Face Occlusion

- Face Mask Detection

- Face Match

- Photo Illumination Check

- Face Side Turned

- Multiple Face Detection

- Driver’s License Verification

- RC Fetch

- Voter ID Verification

- Passport Verification

- OCR of Indian IDs - PAN,Aadhaar, Voter ID, Passport

- Quality Checks

- Blur Check

- Glare Check

- Partial ID

- Obscure ID

- ID Liveness

- Photo Face Quality

- Face Present

- Video KYC

- Aadhaar e-KYC

- PIVC

- KRA KYC

- KYC Record Upload

- Whatsapp KYC

- Digilocker with Analytics

- Credit Bureau Soft Poll

- EPFO Verification

- Salary Slip OCR

- Criminal & Court Case Verification

- Penny drop Bank Account Verification

- Account Aggregator for Bank Statement Fetch

- Reverse Penny Drop

- UAN Lookup

- UPI Virtual ID Validation

- Bank Statement Analysis

- Pennyless Bank Account Verification

- Signature/Thumbprint Detection

- Photo on Photo

- Video Injection Prevention

- AML Screening

- Transaction Monitoring

- Physical + Digital tampering

- Screen Capture

- Deepfake Detection

- FIR Record Check

- AML On-going Monitoring

- Shop Front Detection

- Extract shop name & details

- Nature of Business

- GSTIN Verification

- Udyam Aadhaar Verification

- Udyog Aadhaar Verification

- IEC Verification (Importer-Exporter Code)

- KYB Document OCR

- Shop & Establishment

- Udyam

- Certificate of Incorporation

- GSTIN

- Invoice OCR

Increase conversion rates in 90 days

Analyse your current funnel with our experts

Start with an optimized journey for your industry

Personalize the journey based on your users or partners

Test and optimize to improve performance

Customers love HyperVerge!

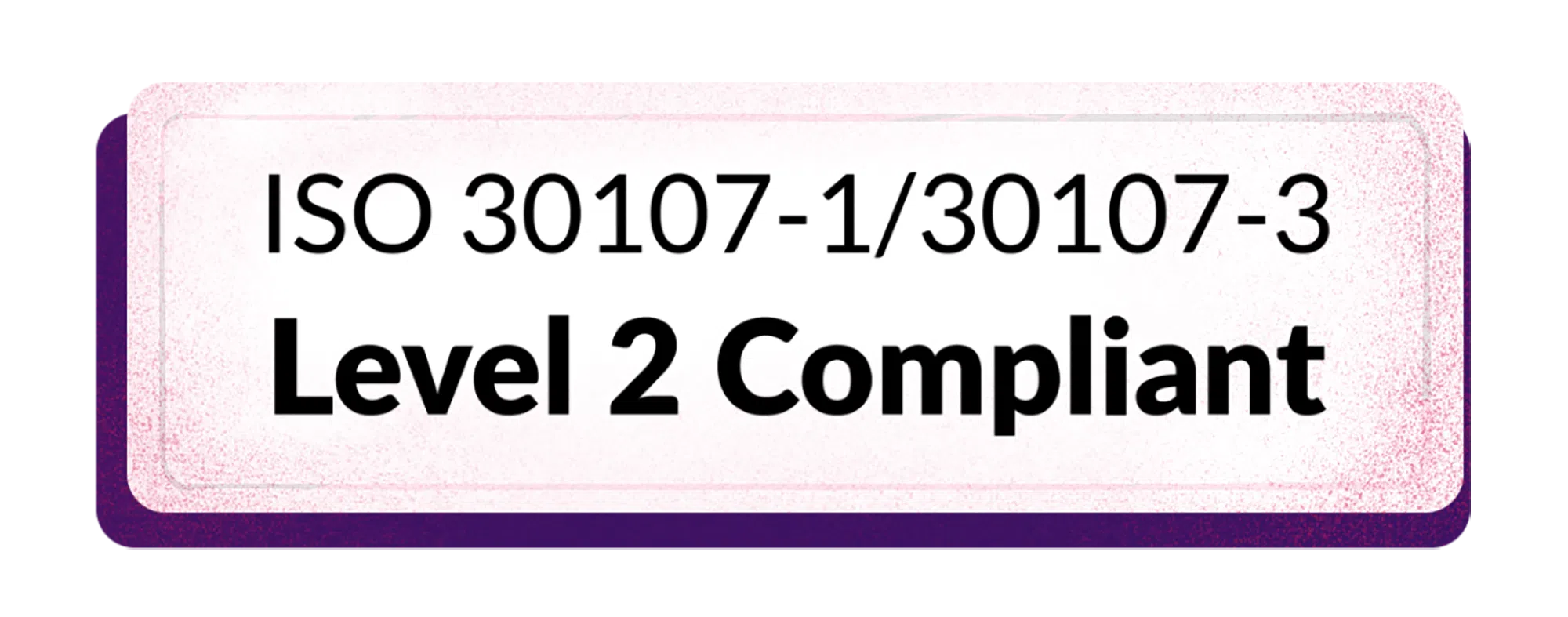

We are compliant and secure at our core

Encrypt user details to prevent data breach

Stay compliant with global regulations

Maintain audit trail of every application

#1 in Global Face

Recognition in US & APAC

AICPA | SOC2

General Data

Protection Regulation

ISO 27018

Financial Action

Task Force

Best-in-class

Regtech solution 2022 & 2024

Best in Liveness