Reduce drop offs while

onboarding customers

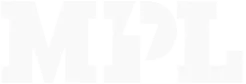

Our cutting-edge technology operates seamlessly on low

bandwidths and low-end devices, ensuring smooth customer

onboarding with high customer conversion rates.

0 %

Completion Rate

0 %

Auto Approval Rate

0 %

Reduced User Drop-off

Top 3 Challenges Product Teams Face

Multiple vendor integrations and change management take focus away

from business metric optimisation. Here are the top three challenges:

Customer Drop-offs

Identifying friction areas and integrating backup vendors are complex and time-consuming

Delayed Journey Launches

New acquisition journey launches and time-to-market are impacted by limited IT bandwidth

Inability to Experiment

Scarce IT resource hinder quick experimentation and agility to improve business metrics

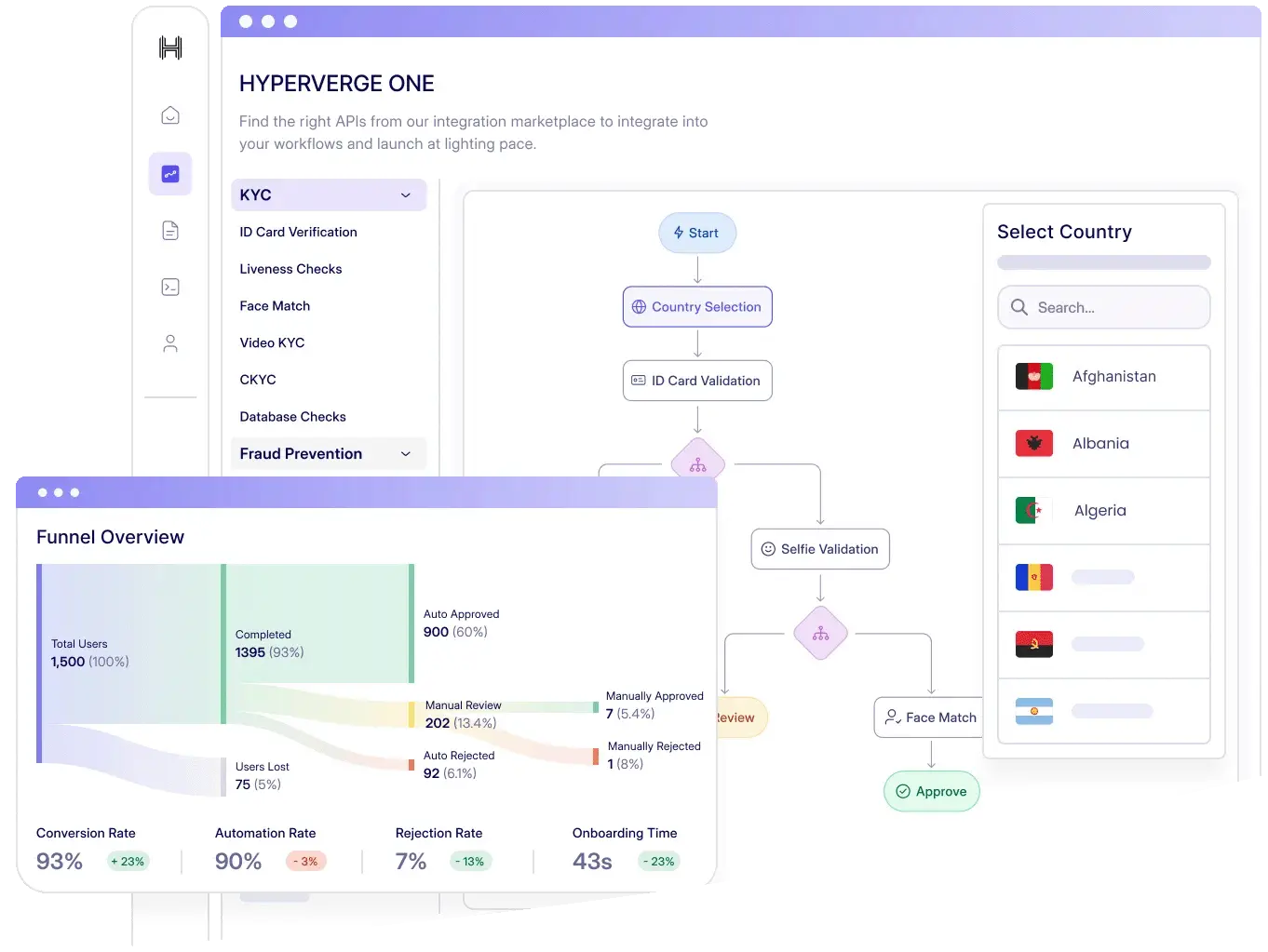

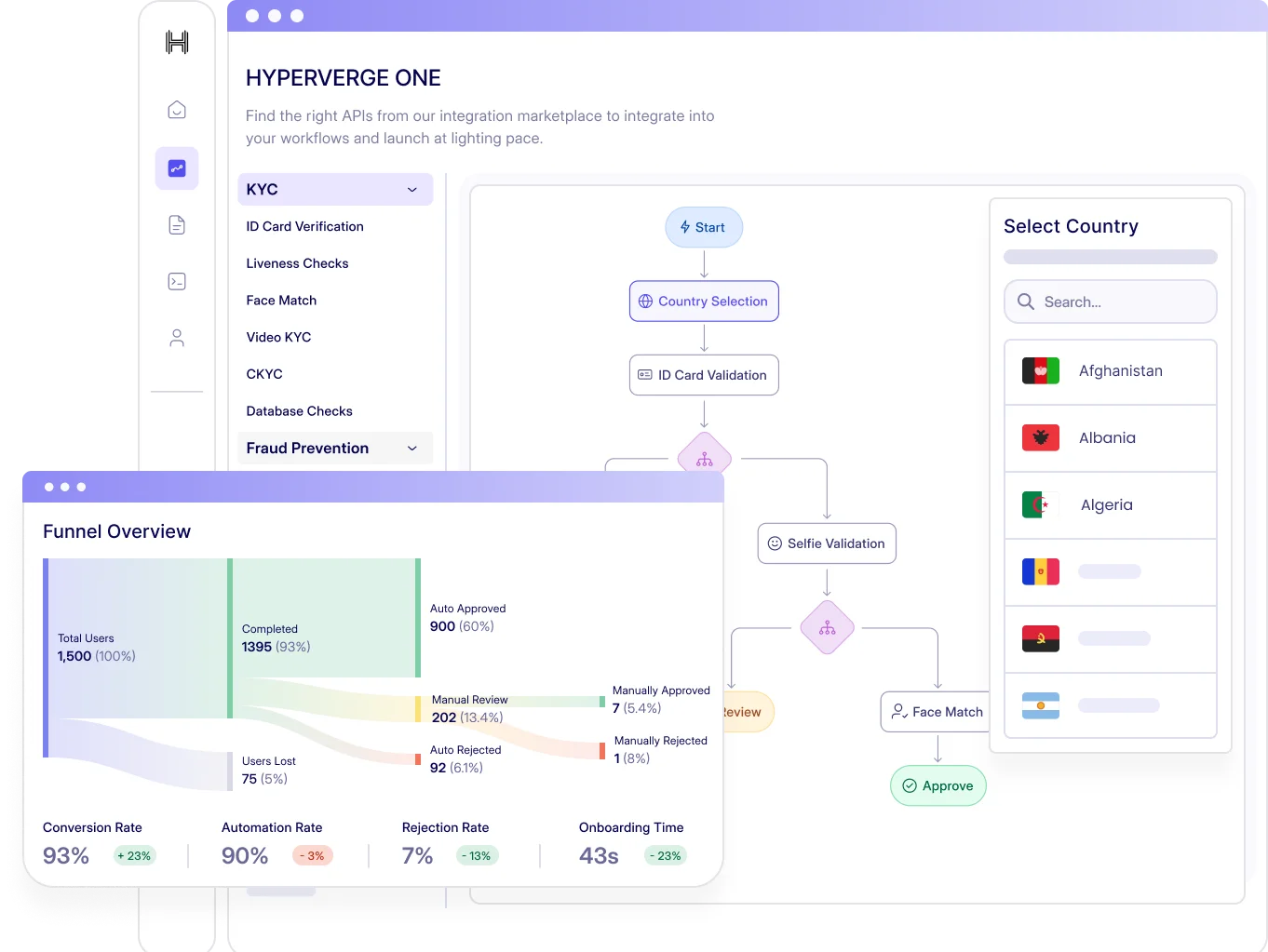

HyperVerge ONE for Efficient Onboarding

Enhance your customer onboarding process and design swift financial

acquisition journey launches to achieve industry-best conversion rates.

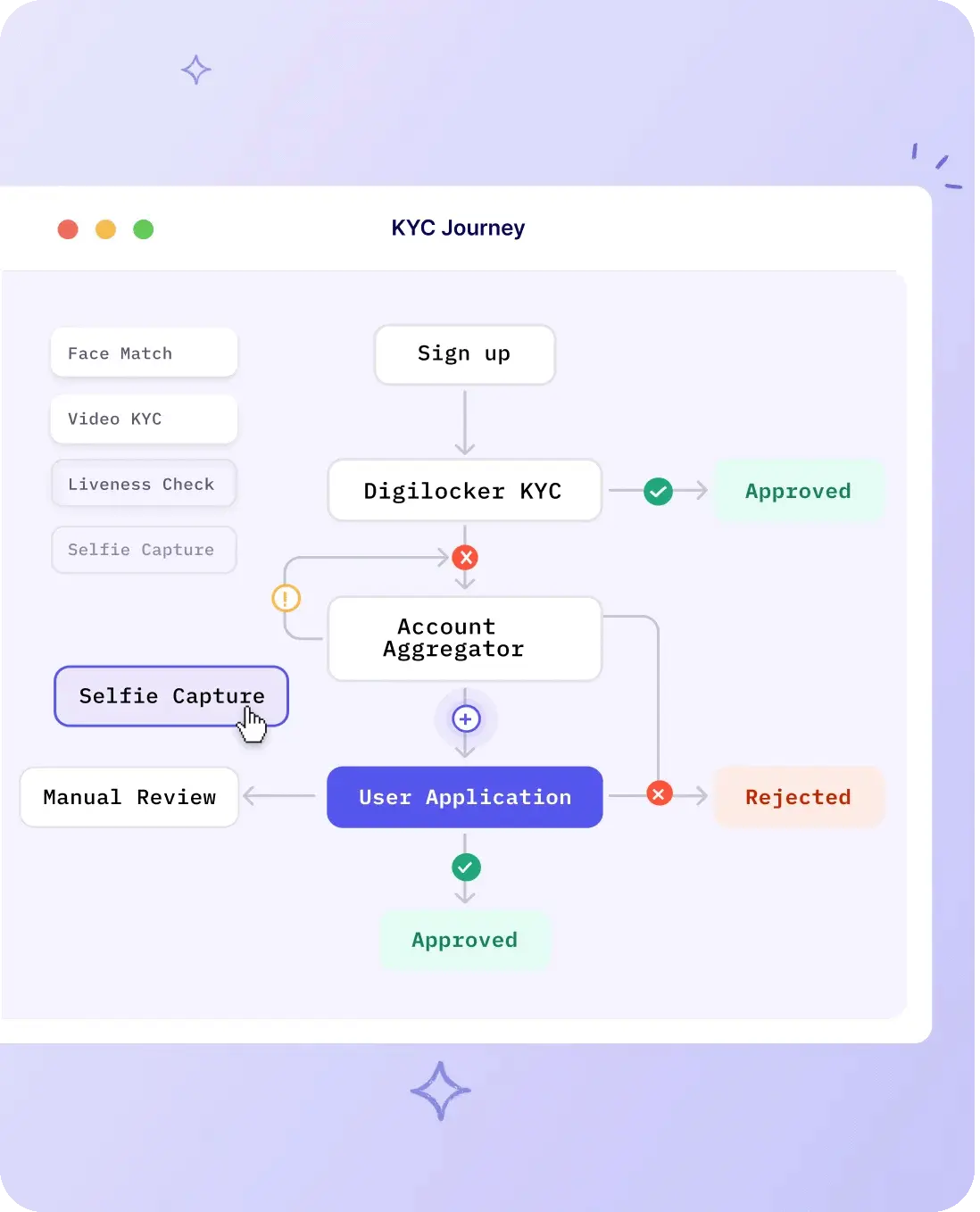

No-Code Workflow & UI Builder

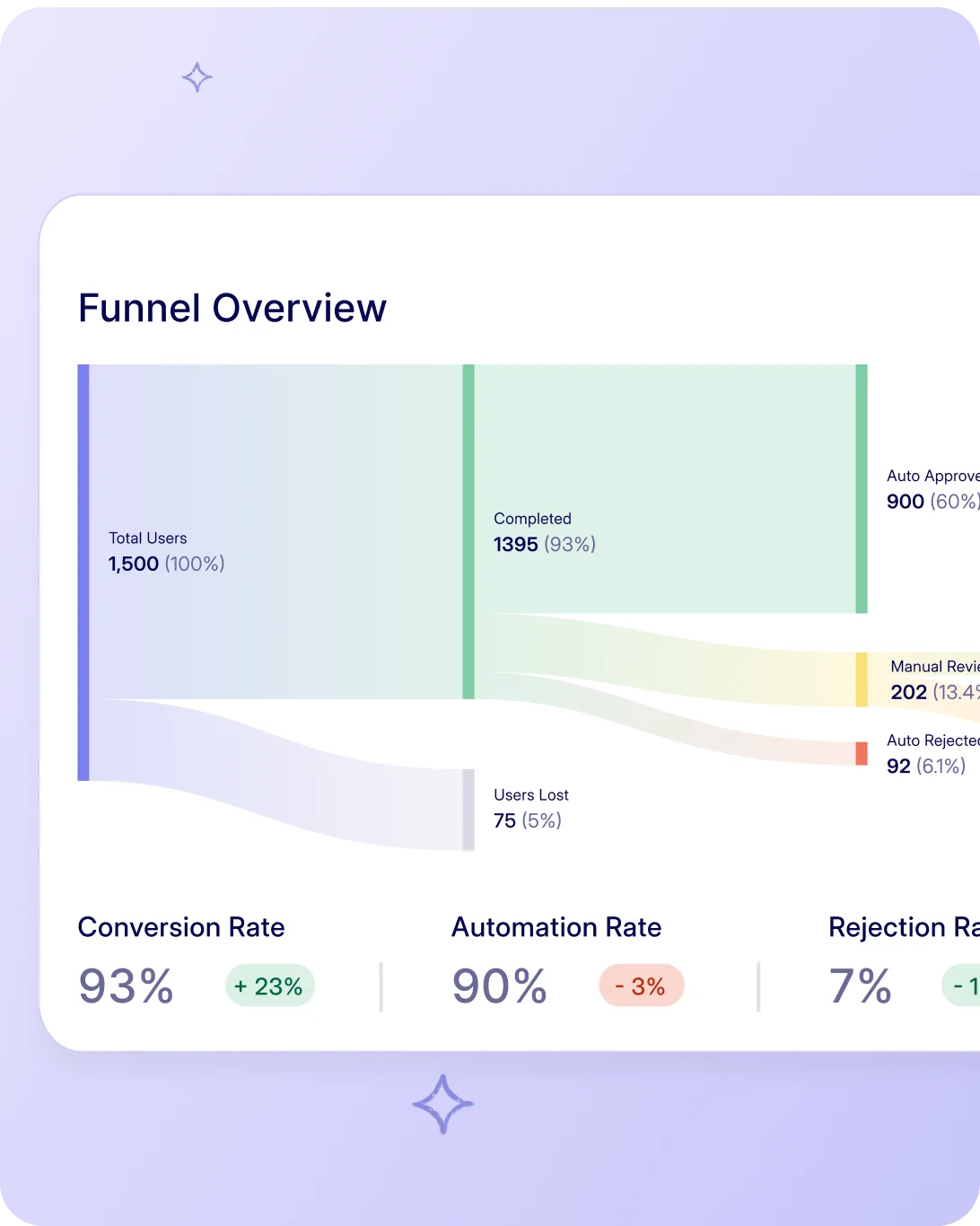

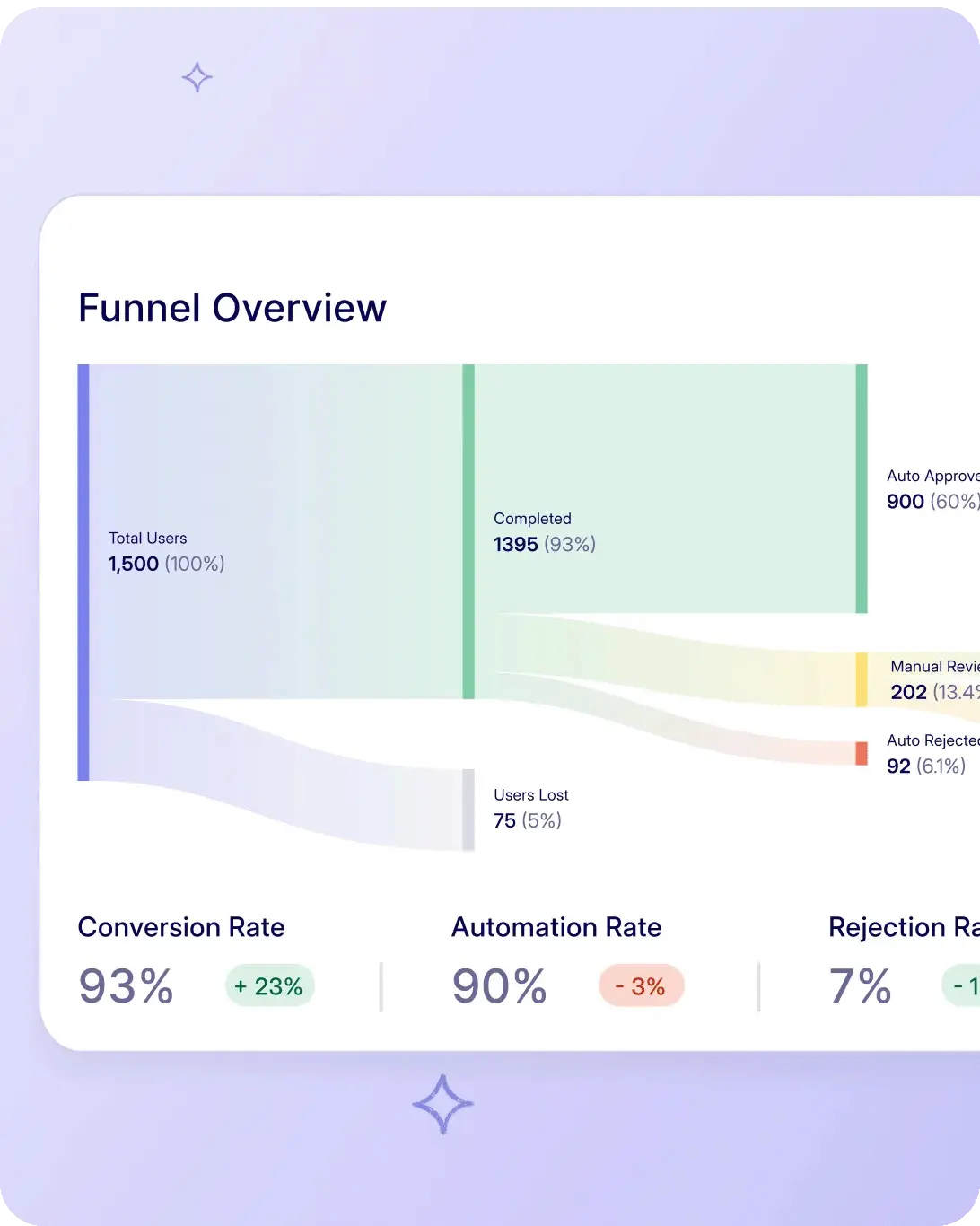

Analytics Dashboard

Integrations Supported

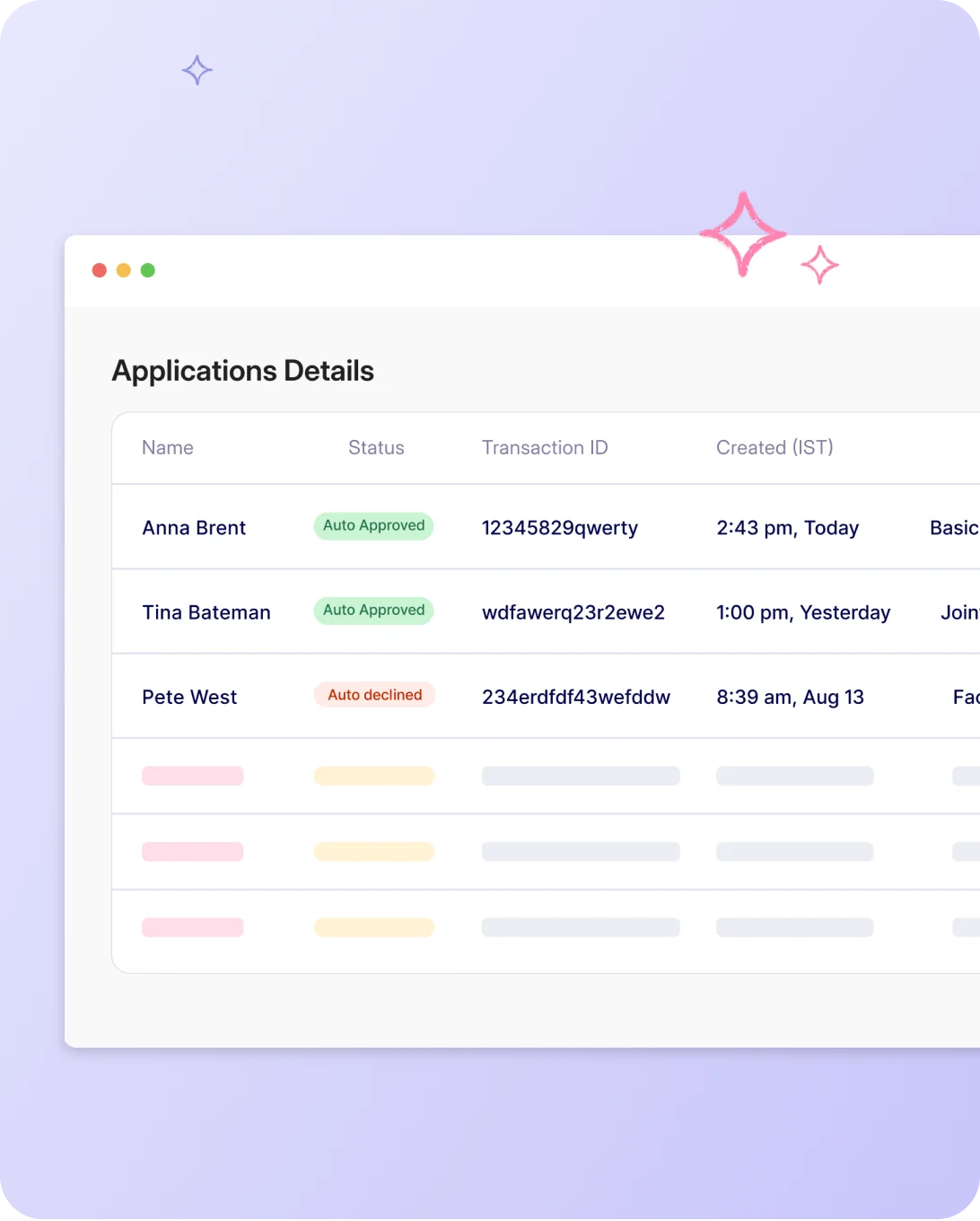

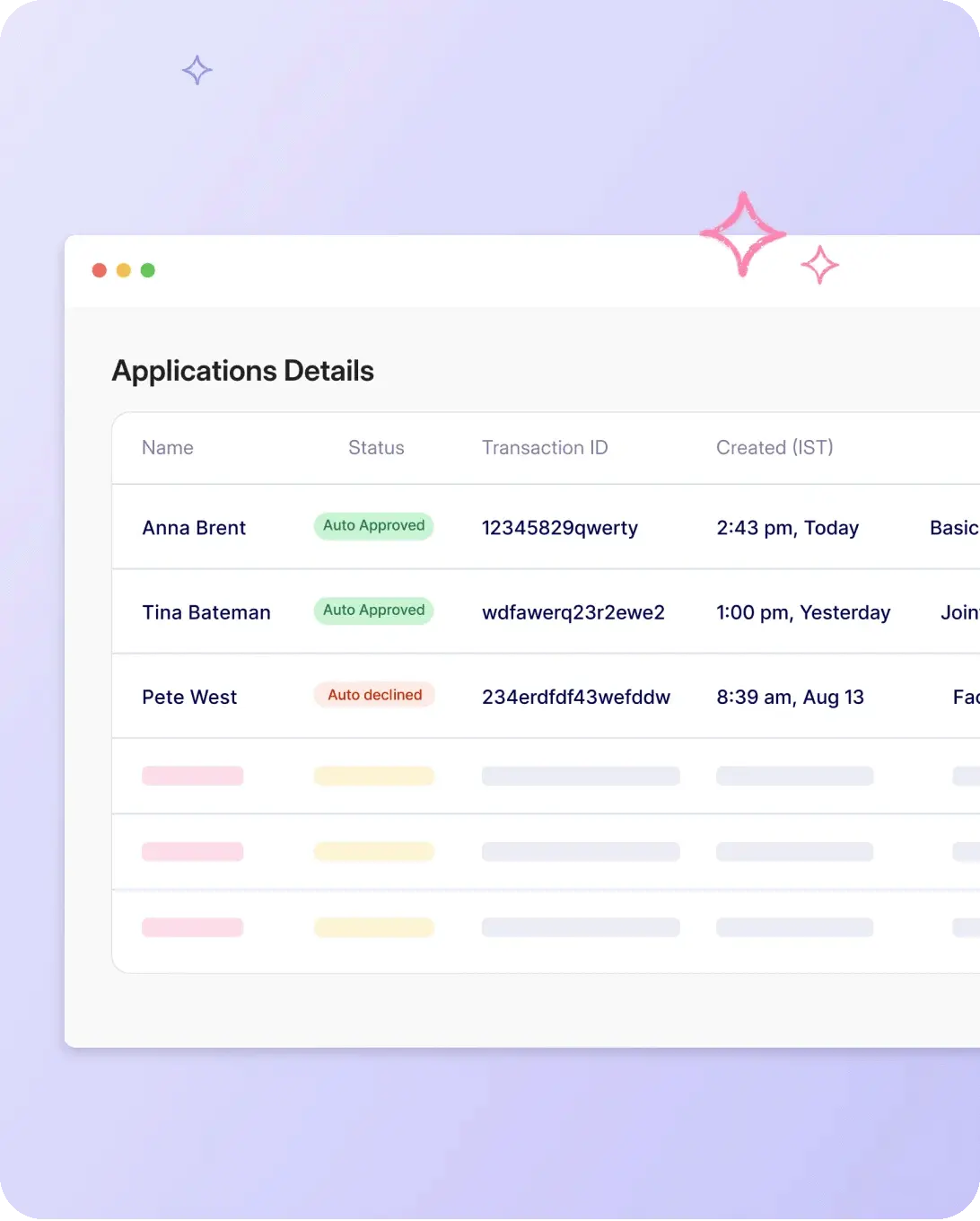

Application Review Portal

Build end-to-end journeys with

HyperVerge ONE

Customizable UI

Customise the front-end design to match your branding and UI/UX needs

Omni-channel nudges

Send nudges to users via email, whatsapp or SMS to resume journeys from the point they dropped-off

Downtime protection

Ensure smooth user experience with automated fallback options, even during API downtimes

Increase conversion rates in 90 days

Analyse your current funnel with our experts

Start with an optimized journey for your industry

Personalize the journey based on your users or partners

Test and optimize to improve performance

Customers love HyperVerge!

Frequently

asked Questions

How to ensure fraud prevention in the customer onboarding process?

What is the business impact of using an onboarding and verification platform?

How does an identity verification software facilitate user onboarding and help verify users?

Is the platform suitable for businesses of all sizes, and can it scale with our needs?

What does Case Management do, and how does it streamline the review process?

Latest Blogs

The latest news, updates and more about KYC industries & related market resources from our team.

US

US

IN

IN