go global

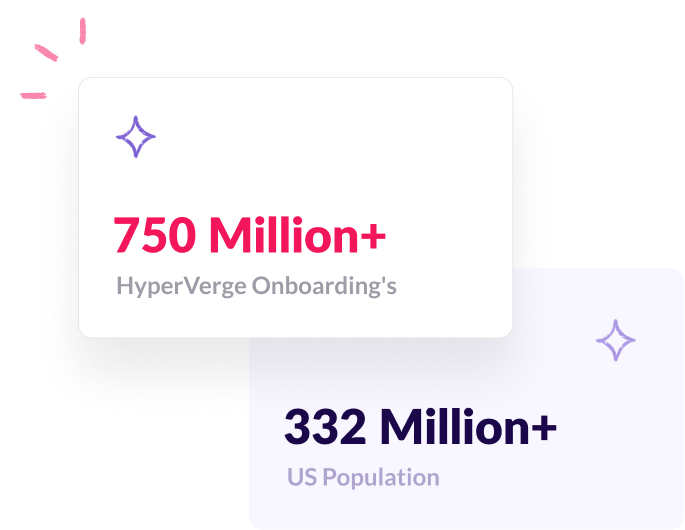

Let’s Visualize Our Scale

Trained on diverse facial variations and ID formats, our robust AI solutions have onboarded over 750 million users.

$300M+

Saved in fraud losses

~10Sec

Document Collection TAT

50%

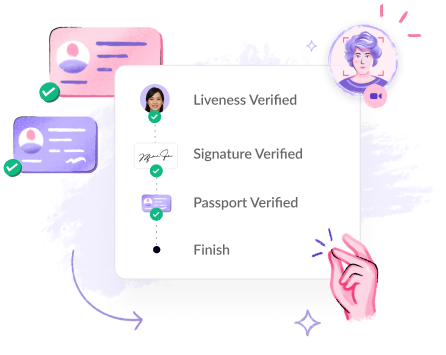

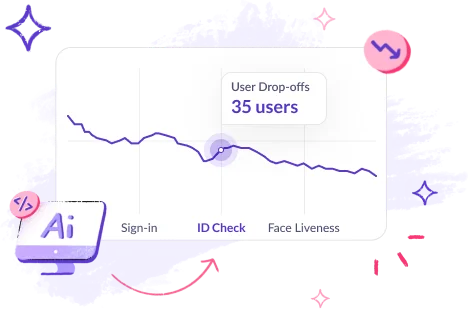

Reduced Drop-off Rates

CHALLENGEs

Financial Institutions Struggle

with Seamless User Onboarding

Time-consuming

KYC onboarding

Friction in Customer

Onboarding

Constantly changing compliance regulations

Increasing Fraud

Occurrences

TESTIMONIALS

Customers love HyperVerge !

What is digital identity verification, and why is it crucial for the fintech industry?

KYC is required by NBFCs and banks to prevent fraud, money laundering, and comply with regulatory guidelines.

How does biometric authentication contribute to a frictionless onboarding experience for new users?

Non-compliance with KYC regulations can lead to penalties, reputational damage, suspension of operations, or license revocation for NBFCs and banks.

How can fintech solutions balance the need for security and a frictionless customer experience?

Common challenges in the KYC process for NBFCs and banks include managing a large volume of applications, verifying complex business structures, and staying up to date with changing regulations.