Trusted by 200+ Global Businesses

Why trust HyperVerge?

Trained on diverse facial variations and ID formats, our robust AI solutions have onboarded over 750 million users.

0 M+

IDs verified

0 %

Auto approval rate

0 %

Reduction in drop-offs

0 Million+

Customers verified

0 Million+

US Population

0 M+

IDs verified

0 %

Auto approval rate

0 %

Reduction in drop-offs

Enhance Efficiency, Beat Fraud &

Protect Reputation with KYC Solutions

Reduce Manual Hours

Automate your KYC using best-in-class AI

technology & verify users in 3 seconds.

Maximise Conversions

Reduce drop-offs with a pass-through rate

of 95% and minimal verification steps.

Outsmart Bad Actors

Screen users against global local databases,

PEP, watchlists & adverse media.

Protect your Reputation

Safeguard your financial resources against

costly non-compliance penalties.

Personalized KYC verification software

for fast

and simple customer verification

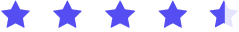

Verify the authenticity of documents using central database checks recognized by the local government.

SSN

SSN

AAMVA

AAMVA

BVN

BVN

NSDL

NSDL

Extract all relevant data with 99% precision for documents across 190+ countries.

Passport

Passport

Govt

IDs

Govt

IDs

Driver’s License

Driver’s License

Residence Permits

Residence Permits

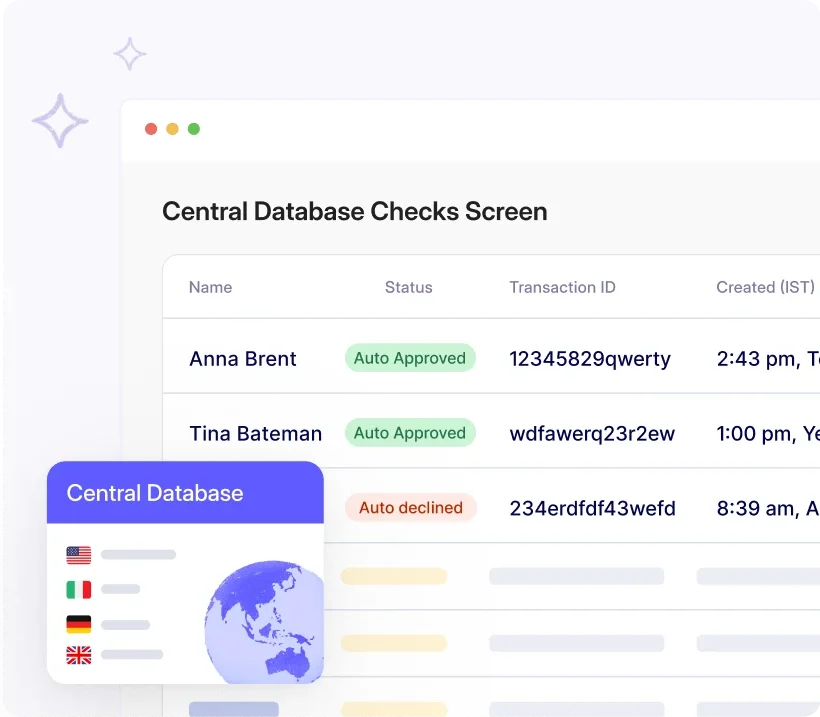

Ensure maximum conversion without compromising on security.

Single image-based liveness detection

Single image-based liveness detection

Best-in-class face recognition technology

Best-in-class face recognition technology

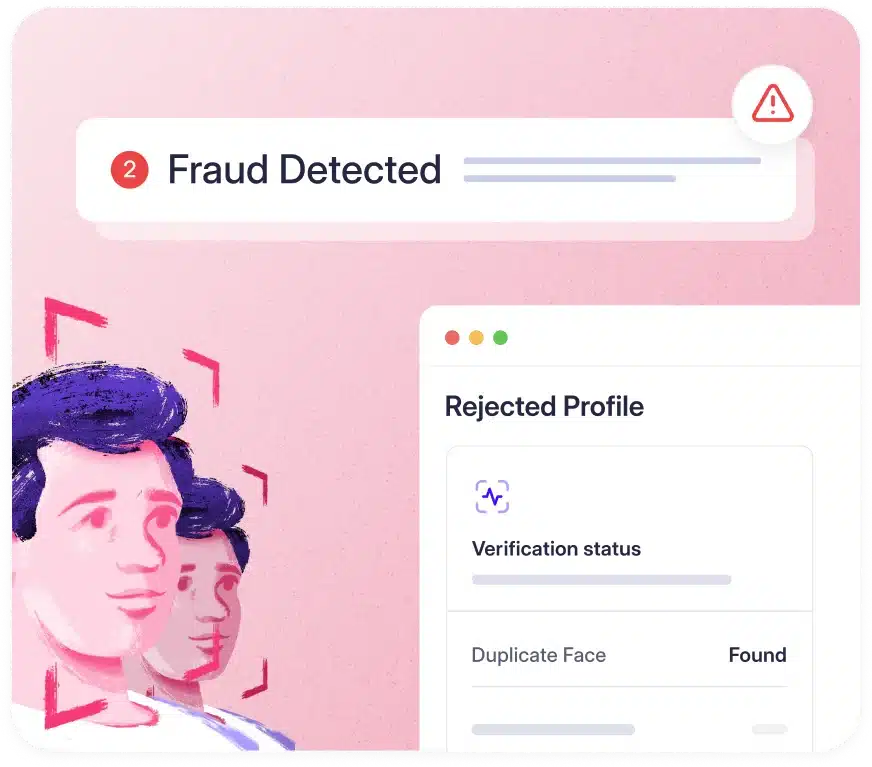

Stay ahead of fraudsters and onboard only genuine customers.

Face

de-duplication technology

Face

de-duplication technology

AI-based Checks (like forgery checks, deep image analysis, and liveness

detection)

AI-based Checks (like forgery checks, deep image analysis, and liveness

detection)

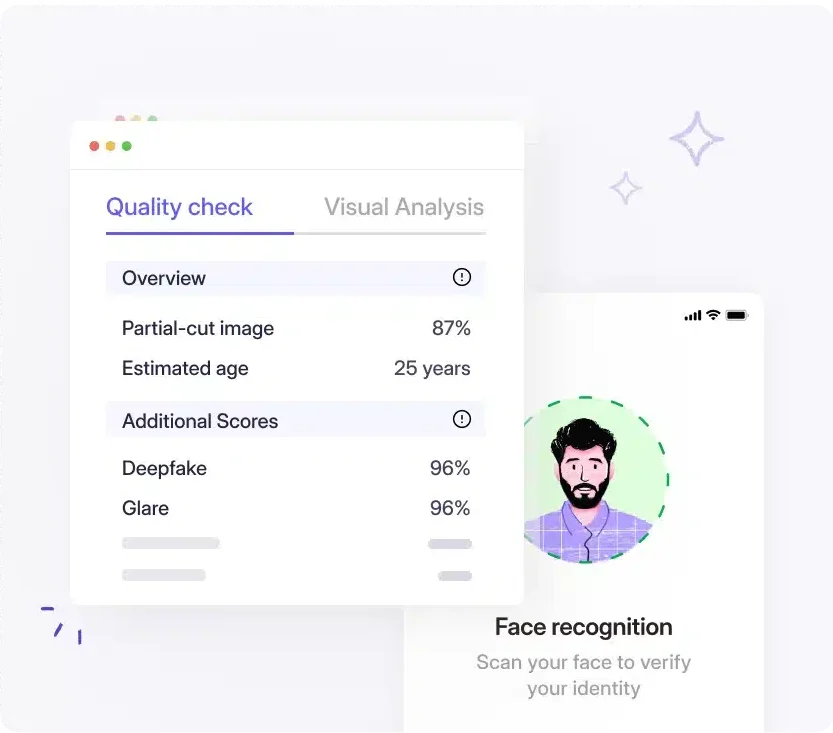

Real-time guidance to prevent bad-quality images.

Glare

Glare

Blur

Blur

Partial/cut images

Partial/cut images

Black & white images

Black & white images

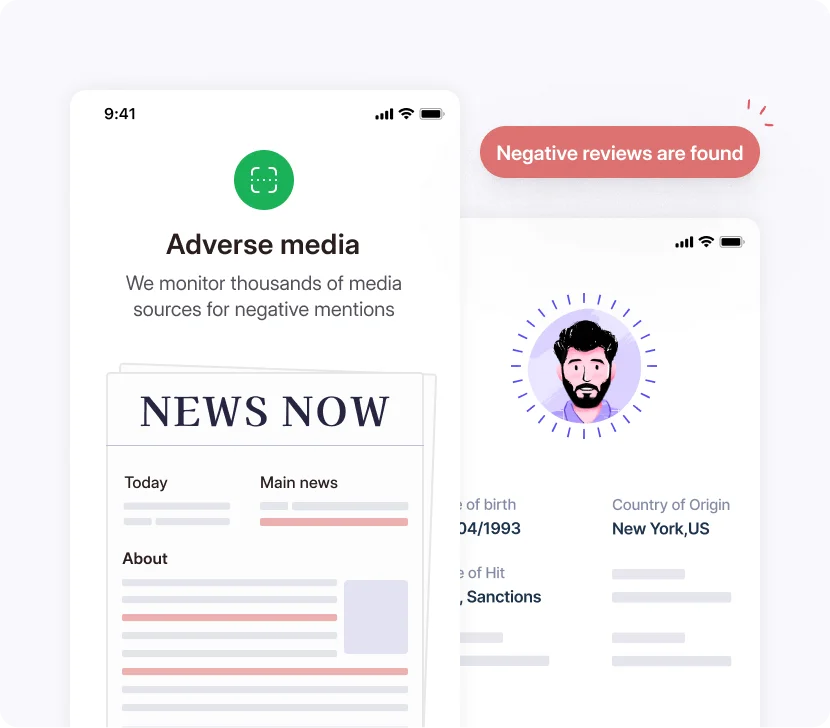

Combine KYC & AML solutions for robust and smooth verification.

Global sanctions and watchlists check

Global sanctions and watchlists check

Politically Exposed Person check

Politically Exposed Person check

Adverse media check

Adverse media check

Constant monitoring

Constant monitoring

Choose the best KYC solution

Compare all global competitors and chose G2’s top pick

| Hyperverge | Sumsub | Jumio | Onfido | Persona | Trulio | |

|---|---|---|---|---|---|---|

| NPS | 72 | 70 | 46 | 54 | 50 | 56 |

| Ease of use | 94% | 91% | 83% | 83% | 89% | 90% |

| Ease of setup | 93% | 95% | 92% | 90% | 96% | 89% |

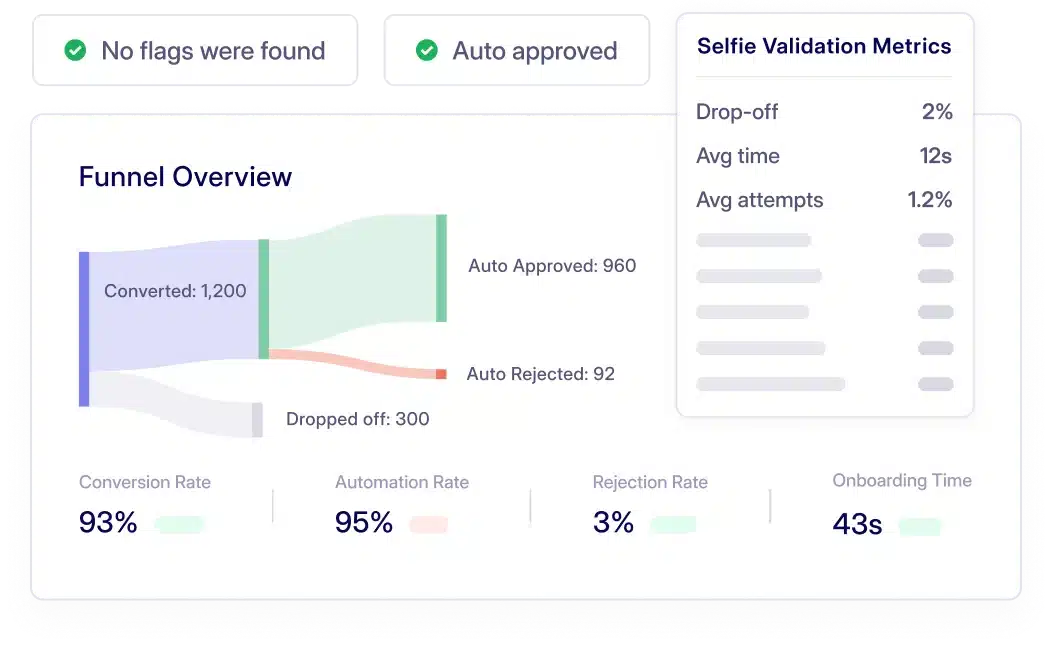

Streamline user journey analysis

and performance monitoring

Take data-driven decisions

Analyse user journey in a Single Platform, empowered with easily Customizable Filtering Options.

Monitor conversion rates, drop-off stage, pass rates and time taken to complete the verification.

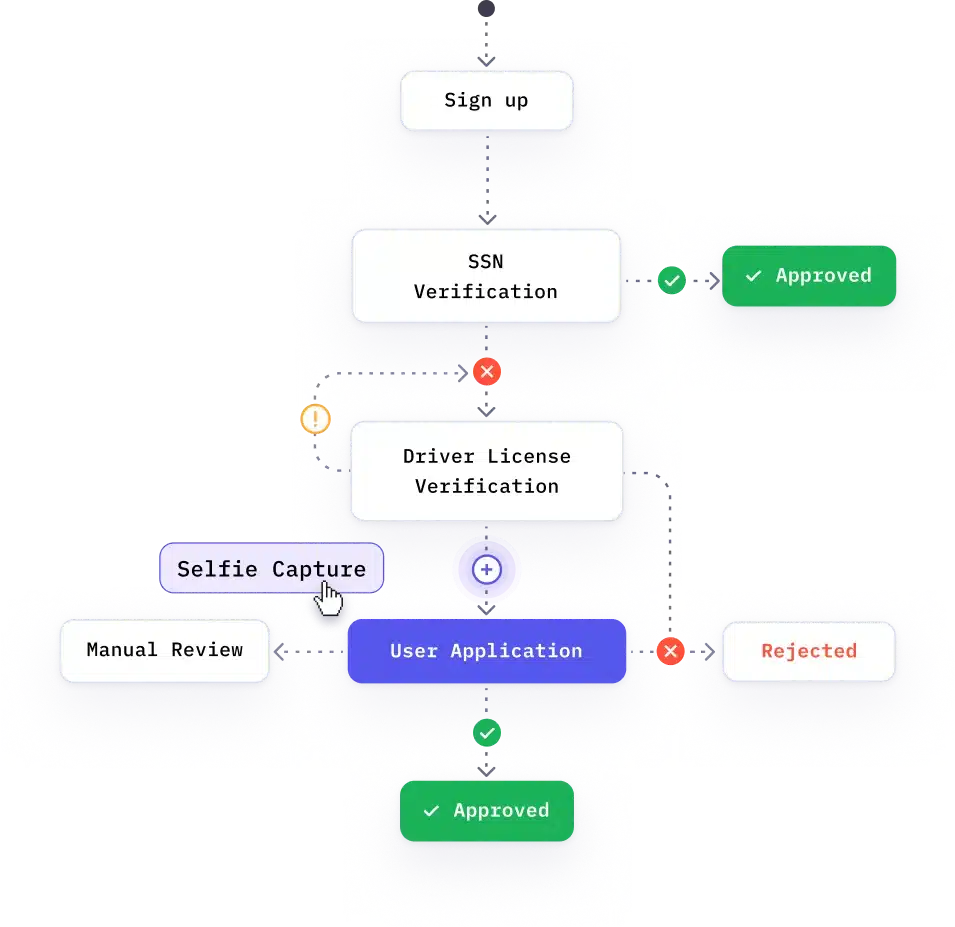

Customize and build

your own workflow

Strengthen security measures using a multi-layered approach of combining document verification with selfie matching.

Strengthen security measures using a multi-layered approach of combining document verification with selfie matching.

Easily configure and modify workflows, ensuring seamless integration into your existing systems.

Easily configure and modify workflows, ensuring seamless integration into your existing systems.

Give HyperVerge a try!

Significantly reduce drop-offs, manual reviews, fraud and compliance issues

Schedule a call with our team

Tailored business workflow

Get 30-day free

trial

Subscribe if you

find value

Trusted by startups and the world’s largest companies

End-to-End Security and Compliance Assurance

#1 in Global Face

Recognition in US & APAC

Best-in-class

Regtech solution 2022

Frequently

asked Questions

How does digital identity verification contribute to a seamless onboarding system for businesses globally?

Why is digital identity verification systems crucial in preventing identity fraud during new account opening and new customer onboarding?

How does digital ID verification monitore customer risk and help comply with regulations in various regulated industries?

How do digital identity verification solutions address the challenge of ensuring the authenticity of government-issued identity documents during the onboarding process?