In 2022, identity theft caused more than $189 million in losses in the US—a trend that had been rising over the past two decades. With this increase, identity verification has become critical, especially for businesses operating in highly regulated sectors. As banking and financial services increasingly shift to digital platforms, ensuring that robust identity verification methods are in place is essential to prevent exploitation by fraudsters.

When it comes to electronic identity verification, IDfy stands out as a trusted solution. Known for its thorough and accurate verification process, IDfy offers a wide range of services, making it a popular choice for businesses that require stringent compliance and security in their operations.

However, while IDfy is effective, it may not meet every business’s unique needs. For instance, some users feel the platform could benefit from enabling more API services for broader use cases, and there have been mentions that a sync method API for validating document IDs or numbers isn’t yet available.

Thankfully, there are several alternative solutions to IDfy that can better align with your business requirements and strategic objectives.

In this article, we’ll explore the top IDfy competitors and help you understand why you might want to consider them.

Why Consider Alternatives to IDfy?

When you’re looking for IDfy competitors, it’s essential to evaluate how well another solution aligns with your business’s specific needs.

Here are some key reasons you might look for alternatives:

Specific Feature Requirements

IDfy provides comprehensive identity verification services, but some businesses may need specialized features that IDfy doesn’t currently offer.

For example, some users have expressed the need for additional API services to cater to more varied use cases. Here’s what a user had to say regarding the platform’s API services:

Source: Capterra

If your business needs advanced verification features like biometric authentication or multi-factor authentication (MFA) that IDfy doesn’t support, an alternative solution might provide these additional capabilities.

Price Specifications

Pricing can be a significant factor, especially for smaller businesses or those with tighter budgets. While IDfy offers various services, the company has not disclosed its cost structure. Moreover, the services provided by IDfy may not always align with every company’s financial or overarching goals.

Here’s what a user reported:

Source: Capterra

Some alternatives might offer more flexible pricing models, such as pay-as-you-go or packages tailored to specific industries. Opting for a more cost-effective solution without compromising on essential features can help businesses manage their expenses better.

Process Time

In highly competitive industries, speed is crucial, especially when onboarding customers or verifying transactions. While IDfy provides fast and accurate identity verification, the process time might not meet every business’s requirements, especially in cases where instant verification is necessary.

If your operations depend on real-time data processing or require faster response times, switching to an alternative with quicker verification processes could enhance operational efficiency.

Integration with Existing Systems

Seamless integration with existing systems is critical for ensuring smooth operations, and not all identity verification solutions work well with every tech stack.

While IDfy integrates with various platforms, it may not fit perfectly with your business’s specific infrastructure, especially if you rely on niche software or custom-built systems.

Some alternatives offer more flexible APIs, greater compatibility, and easier integration with CRMs, ERPs, or other tools, minimizing disruptions during implementation and improving workflow automation.

How We Evaluate the Top Alternatives

To identify the best IDfy alternatives for your needs, we have:

- User reviews and ratings: We carefully examined feedback from platforms like G2 and Capterra to gauge user experience and satisfaction with various identity verification solutions.

- Community insights: Relevant discussions and feedback from the Reddit community were taken into account to provide a well-rounded perspective.

- Peer Recommendations: We recorded identity verification solutions that IDfy’s competitors recommend, ensuring you have a broader view of what may work best for your unique business.

Now, before diving into each IDfy competitor, here’s a quick overview in the table below.

Overview of the Top 10 IDfy Alternatives

| Top Alternatives | Free Trail Availability | Standout Features |

| HyperVerge | A 30-day free trial is available | Deepfake detection, face authentication, Customer conversion funnel analytics, Extensive onboarding APIs, No-code workflow automation, and AI-based liveness and fraud checks |

| Perfios Karza | N/A | Real-time verification of identities without the need for a stable Internet connection |

| Signzy | N/A | RM-assisted journey creation and AI-based risk/decision engine |

| BureauID | N/A | Tokenized intelligence |

| iDenfy | Free trial available | 24/7 human supervision within 3 minutes |

| Cashfree | Free trial available | GSTIN &UPI ID verification |

| Jukshio | N/A | Facial recognition with 99.98% accuracy under a second |

| Digitap | N/A | Artificial Intelligence and Machine Learning SAAS solutions for all BFSI, Fintech, and other Financial institutions |

| Newgensoft | N/A | Extraction of location coordinates for identified entities to facilitate easy redaction |

| Digio | N/A | Instant digital & e-signing |

A Detailed List of the 10 Best IDfy Alternatives for Automated Loan Journeys

Given below are the 10 best competitors to IDfy to help you verify identifications accurately:

1. HyperVerge

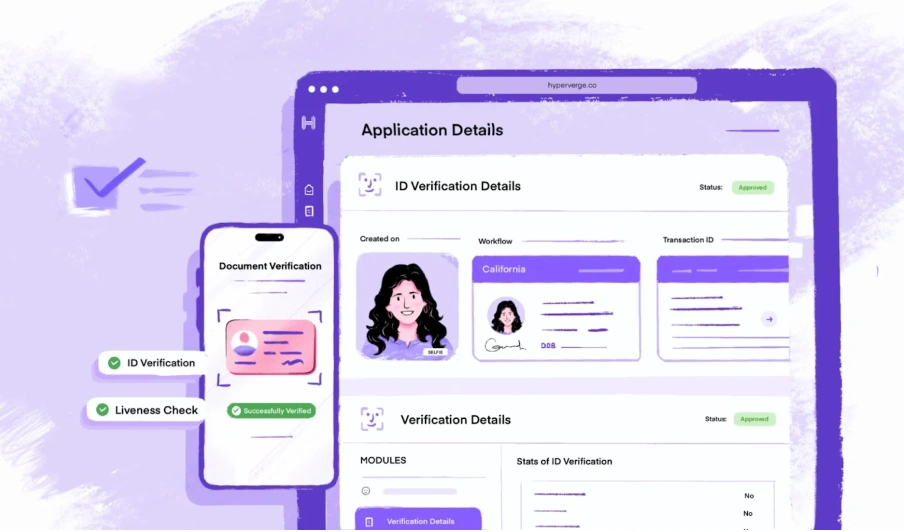

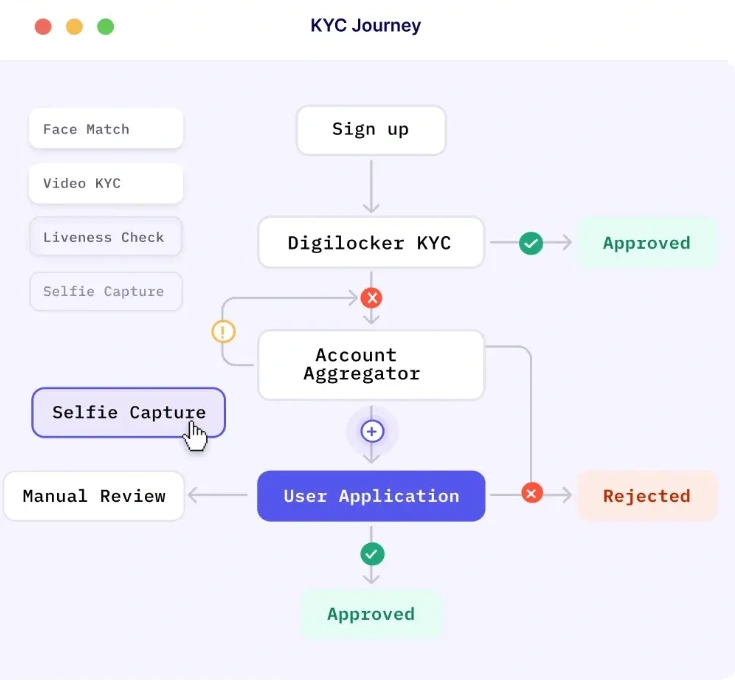

HyperVerge delivers a powerful solution for all things related to identity verification, including KYC, through its HyperVerge ONE platform. It’s designed to make onboarding smooth and easy, using AI to drive the process from start to finish.

With HyperVerge ONE, you can quickly deploy KYC within just 4 hours using their web and mobile SDKs. The platform’s identity verification features include essential elements such as:

- Finance verification

- Liveness detection

- Deepfake detection

- Anti-money laundering

- OCR for document verification

- Face de-duplication

- Biometric verification

- Compliance with AML checks across global sanctions, watchlists, and politically exposed individuals

One thing that makes HyperVerge stand out is its highly trained AI. It’s accurate, efficient, and keeps false positives to a minimum. This helps ensure that your business not only meets compliance but does so with minimal disruption to the user experience.

Having verified over 750 million IDs, this platform has established itself as a leader in the marketplace industry. Its AI-powered KYC solutions deliver identity verification in just three seconds, making it the preferred option for automated identity checks and KYC compliance.

If you’re curious about what makes HyperVerge stand out compared to IDfy, let’s dive into its key features.

- Fraud monitoring: It uses real-time AI to detect and prevent fraudulent activities throughout the verification process. This proactive approach keeps everything secure.

- End-to-end journey automation: This solution streamlines the entire consumer onboarding process, starting from day one. It really covers all the bases to make things smoother.

- Address validation: HyperVerge ensures accuracy by matching the provided addresses with trusted databases. This helps catch any potential fraud from fake addresses.

- Analytics dashboard: HyperVerge ONE offers a powerful analytics dashboard that gives businesses clear metrics and insights. With this data, companies can boost their profits and improve conversion rates.

All these features make it a great alternative to IDfy, as well as other identity verification tools, such as Socure and Jumio.

Best For

Financial services, education, gaming, remittance, crypto, marketplaces, logistics and eCommerce.

HyperVerge Pricing

| Start Plan (for startups) | Grow Plan (for mid-sized companies) | Enterprise Plan (for larger organizations) |

| Includes a free trial, easy integration, and basic identity verification tools for one month. | This covers everything from the Start plan but adds a full identity verification suite, AML checks, and customizable business workflows. | All features of the Grow plan are included, with additional custom pricing and collaboration tools. |

What Do HyperVerge Users Say?

Jeel P.Chief Executive Officer, Small-Business ★★★★★ (4.5/5)

Anand S,IT Head,Consumer Services, Mid-Market ★★★★★ (5/5)

Alpesh V.,Chief Executive Officer, Mid-Market★★★★★ (4.5/5)

2. Perfios Karza

KARZA is an all-encompassing platform that specializes in KYC and risk assessment. After Perfios acquired KARZA in 2022, the platform has evolved to offer a unified solution for businesses across various industries. Yet, its primary strength remains in serving the FinTech sector, especially assisting lending institutions by automating KYC processes, which accelerates customer onboarding and compliance checks.

As mentioned before, the company is known for its extensive KYC capabilities. It provides robust tools for document verification, credit scoring, and identity checks, helping businesses streamline the onboarding journey. This level of automation can save valuable time and minimize errors, which is crucial for fast-paced industries like finance.

Additionally, KARZA offers enhanced verification processes that validate customer identity and evaluate the financial history of FinTech consumers. This allows lending institutions to confidently extend services only to trustworthy customers, reducing risks associated with lending.

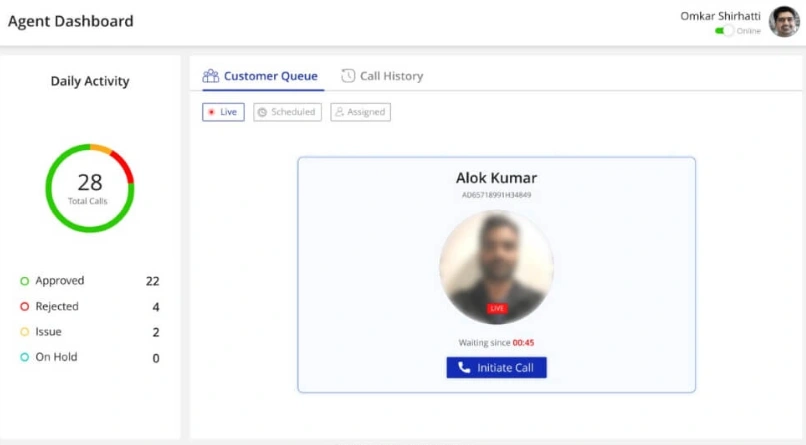

The platform features real-time tools such as dynamic call allocation, live queue monitoring, and on-screen instructions available in 11 regional languages. This is an essential feature for businesses catering to diverse demographics across India.

Best For

Banks, insurance, payment, diligence, and corporates.

Perfios Karza Pricing

Details on pricing for Perfios KARZA aren’t publicly available on their website.

3. Signzy

Signzy, based in India, specializes in providing digital infrastructure solutions for banks and businesses, with a strong focus on KYC processes. Their standout offering is a no-code platform that allows companies to customize and automate their onboarding journeys easily, making the process more flexible and adaptable to various business needs.

One of Signzy’s innovative solutions is its Video KYC (vKYC), which provides support even on networks with low bandwidth—down to 75 kbps. This makes it a versatile tool for reaching customers in regions with less reliable internet connections. On top of that, Signzy’s platform supports over 200 APIs, enabling businesses to design and automate complex customer journeys without needing extensive coding knowledge.

When it comes to security and compliance, Signzy’s solutions are designed to meet strict regulatory requirements while ensuring the safety of sensitive customer data. This balance of security and ease of use has earned them partnerships with major corporations such as Mastercard and Microsoft.

In terms of scale, Signzy claims to process a massive 10 million customer onboardings per month with a high degree of accuracy, showcasing the robustness of their technology and API integrations.

Best For

Banks and NBFCs, customers in Wealth management, insurance, and credit cards, and other financial institutions

Signzy Pricing

Pricing information for Signzy’s services is not available on its website, so interested businesses must contact it directly for detailed pricing structures.

4. BureauID

BureauID focuses on fraud prevention and digital identity solutions, providing deep data insights across the user journey. Its goal is to protect businesses from financial losses and damage to their reputation.

What makes BureauID special is its commitment to the latest security standards, ensuring that user data remains private and isn’t shared with third parties unless explicitly authorized. To make this happen, BureauID uses advanced technologies like HTML5, jQuery, and Google Analytics, which are designed to seamlessly integrate with various systems.

Backed by key investors such as Blume, GMO Venture Partners, and Okta, BureauID has positioned itself as a leading solution in the identity verification space.

One of BureauID’s most prominent features is its frictionless login option. Instead of the usual need for OTPs, passwords, or magic links, it offers a simple one-tap login process, making the experience smooth for users while ensuring security.

The platform’s tokenized intelligence is another powerful tool—profiling millions of risky identities behind phone numbers, offering businesses a more robust defense against fraud.

Lastly, BureauID ensures a protection guarantee, which not only shields businesses from fraud but also aids in the recovery from chargebacks, providing peace of mind.

Best For

Gaming, fintech and financial services, and compliance.

BureauID Pricing

Bureau customizes its pricing solutions, so you’ll need to fill out a form on its website to get detailed, tailored information based on your specific needs.

5. iDenfy

iDenfy, based in Lithuania, is a top player in identity verification. Their platform is comprehensive and offers a variety of services, including document verification and biometric authentication. Facial recognition is another key feature that they incorporate, boosting both performance and security during onboarding.

Here are some of the key features of iDenfy:

- Biometric and document verification: The platform leverages facial recognition to confirm customer legitimacy.

- Video KYC: The platform’s video KYC solution efficiently completes customer journeys, even on low bandwidth networks.

- Liveness detection: This tool is part of iDenfy’s verification suite, ensuring that no fraudsters slip through during the KYC and document verification process.

What really sets iDenfy apart is its focus on user experience. The company aims to create a smooth onboarding journey for users around the globe. However, it’s particularly favored by businesses in the FinTech sector that need a strong identity verification solution.

Best For

FinTech, blockchain and cryptocurrency, proxy networks, gaming, transportation, the sharing economy, and streaming services.

iDenfy Pricing

The pricing of iDenfy’s solution is not readily available on its website.

6. Cashfree Payments

Cashfree mainly focuses on payment solutions, but it also offers identity verification and KYC services as well. The design of their KYC service allows it to integrate effortlessly with their payment processing options.

This means that Cashfree provides a solid KYC solution for various businesses and delivers a more comprehensive offering tailored for banks and financial institutions. They prioritize an intuitive customer experience, ensuring quick and hassle-free onboarding.

Additionally, the platform has built a robust infrastructure that allows them to handle more than 100 million monthly verifications. Their system has successfully cut onboarding drop-offs by 50% and boasts response times of under one second for over 90% of requests.

Best For

eCommerce, retail lending, insurance, gaming, HR and staffing, banks and fintech, social media, and investments.

Cashfree Payments Pricing

When it comes to pricing, Cashfree is transparent about its payment solutions, though the costs for its verification suite aren’t easily found online.

7. Jukshio

Jukshio is an AI-powered face recognition platform that focuses on fraud detection and compliance solutions. It is popular for compliance and risk management, providing 360-degree identity and access management features.

Some of its fey features include:

- Facial recognition and liveness detection: Jukshio’s KYC++ platform utilizes cutting-edge face recognition and liveness detection technologies. This ensures top-notch security and helps prevent fraud.

- Real-time analytics dashboard: With a dynamic analytics dashboard, Jukshio enables businesses to track fraud metrics and KYC processes in real-time, allowing for swift decision-making.

- Customizable workflows: Jukshio provides a flexible solution that businesses can tailor to meet their needs.

With a track record of verifying 650 million identities, Jukshio has also detected over 3 million fraud attempts. Impressively, it has facilitated KYC verification for 52% of eligible Indians. Plus, the platform supports more than 150 languages and can verify an identity in under 1,000 milliseconds.

Best For

Organizations that need robust security, quick processing speeds, and support for multiple languages.

Jukshio Pricing

You won’t find the pricing for Jukshio’s services easily on its website.

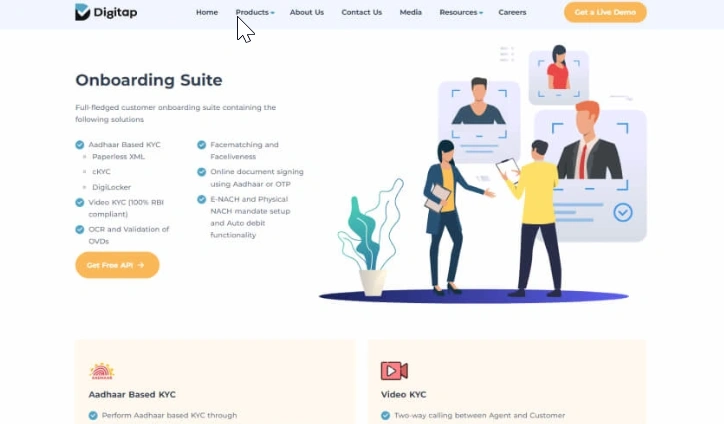

8. Digitap

Digitap is a fintech platform that provides credit underwriting and digital customer onboarding solutions tailored for BFSI enterprises. Its ID verification system streamlines the onboarding journey using AI and machine learning. The platform features a varied suite for customer onboarding, which includes Aadhaar KYC, Paperless XML, cKYC, DigiLocker, and Video KYC.

In addition to these offerings, Digitap’s KYC solution incorporates document verification, facial recognition, and real-time identity verification. This versatility makes it an excellent choice for businesses of all sizes and across various industries. Beyond KYC and identity verification, Digitap also assists in setting up e-NACH and physical NACH mandates for customers.

Digitap is also a solid alternative to Onfido, offering similar customer onboarding and identity verification solutions.

Best For

BFSI enterprises and financial institutions.

Digitap Pricing

The pricing details of Digitap are not readily available on its website.

9. Newgensoft

Newgensoft is a digital transformation company that offers a wide range of services.

For businesses in need of customer verification, Newgensoft’s suite includes KYC services powered by advanced technologies like AI and machine learning. As a result, their KYC solution delivers improved accuracy and efficiency throughout the verification process.

The company also prioritizes regulatory compliance, providing a comprehensive verification package suitable for businesses across various industries.

Newgensoft’s Newgen Intelligent IDXtract software also helps enterprises identify, extract, and redact information while maintaining top-notch security and privacy. This software uses AI, machine learning, and computer vision to automatically detect, locate, and classify entities on identity documents.

Best For

Banks, financial institutes, insurance firms, healthcare, and energy.

Newgensoft Pricing

Newgensoft’s pricing is not available on its website.

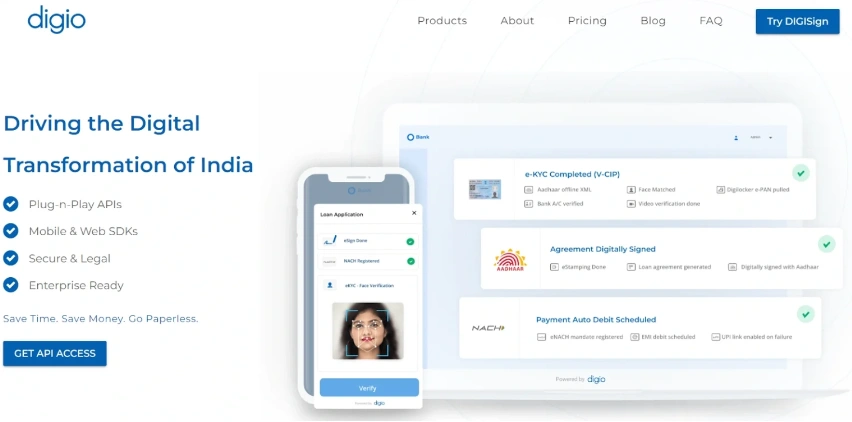

10. Digio

Digio is at the forefront of India’s digital transformation, working to eliminate paper-based processes with its range of digital solutions. They specialize in legal digital signatures, streamlining recurring payments through e-NACH, and user identity verification.

Since launching in 2016, Digio has made quite an impact, serving over 1 billion individual customers and more than 1,500 businesses. The platform has processed an impressive 8 million NACH transactions, created over 80 million documents, and digitized over 1 billion A4 pages.

The platform reports a significant 60% reduction in operational costs and a remarkable 95% cut in turnaround time. Their solutions also boost productivity by 75%. For developers, Digio provides robust plug-and-play APIs and SDKs for both mobile and web applications, making integration a breeze.

Best For

Financial services, real estate, retail, eCommerce, human resources, legal, education and health care.

Digio Pricing

To get complete details about Digio’s pricing, it’s best to contact them directly for personalized assistance.

How to Choose the Best IDfy Alternative for Your Business

With all the options we’ve shared, finding the right fit for your business can be a bit of a challenge. That’s why this blog offers some helpful guidelines to assist you in selecting the ideal service provider.

Here are seven steps to kick off your journey.

1. Functionality and Features

When looking for an alternative to IDfy, it’s essential to understand the software’s core capabilities. Verification accuracy and speed are critical—accuracy ensures you minimize errors like false positives, while speed improves the overall customer experience.

If your business operates in niche industries like fintech or gaming, the software needs to handle industry-specific verification tasks, such as Anti-Money Laundering (AML) checks or know-your-customer (KYC) compliance.

Furthermore, consider the platform’s AI capabilities; advanced machine learning models can reduce manual oversight, automatically flag suspicious activity, and streamline operations. Lastly, look for features like liveness detection, document verification, and face matching that cater to complex verification needs.

2. Look for an End-to-End Solution

A top-notch identity verification platform does more than just authenticate users; it enables businesses to build complete customer onboarding journeys.

An end-to-end solution simplifies the onboarding process by offering automated workflows that cover each stage, from data collection to identity checks and final customer approval. This not only saves time but ensures consistency across all customer interactions.

End-to-end platforms also typically include automated fraud detection features, such as monitoring for fake addresses or document tampering, which reduces operational risks.

3. Ease of Use and Onboarding

You want a solution that your team can start using without intensive training. A user-friendly interface ensures that employees can perform tasks quickly, boosting productivity. Hence, look for platforms with intuitive dashboards and clear workflows that don’t require technical expertise.

The onboarding process of the software itself is also crucial. For example,

- Does the vendor provide robust training materials, like video tutorials or knowledge bases?

- Is customer support available to assist during the initial setup?

A smooth onboarding process reduces downtime and helps your team adopt the new platform with minimal disruption.

4. Scalability and Flexibility

As your business grows, the demands on your identity verification platform will increase. Therefore, it’s vital to choose a solution that can scale to meet higher volumes of users, transactions, and verifications.

Additionally, businesses evolve, and so do their processes, so opt for software that offers flexibility. Whether you’re a startup or an enterprise, the software should be adaptable, allowing you to introduce new features or modules as your business expands.

5. Integration and Compatibility

No platform operates in isolation, especially in today’s interconnected business environment. Your ID verification solution needs to integrate seamlessly with your existing systems, like CRM tools, accounting software, or credit bureaus. Moreover, robust integration options reduce data silos, allowing for a more streamlined experience across departments.

Look for platforms that offer API integration, which enables the software to “talk” to other systems in real-time, making data exchange seamless and automated. This compatibility is crucial for businesses that rely heavily on interconnected workflows or have complex operational ecosystems.

6. Security and Compliance

According to the IBM Security Cost of a Data Breach Report 2023, breaches caused by malicious insiders are the most expensive, averaging around USD 4.9 million. These insider-initiated breaches also took an average of 308 days to detect.

This highlights how crucial security is when handling sensitive customer data. This is why it’s important for your chosen platform to have stringent security measures in place, such as encryption, multi-factor authentication (MFA), and access control protocols.

Additionally, ensure that the solution complies with industry regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA), depending on your business location. Security certifications, such as ISO 27001, also add an extra layer of assurance that the vendor takes data protection seriously.

Remember, the best platforms offer regular security audits and updates to safeguard against emerging threats.

7. Customer Support and Reputation

A product’s features matter, but so does the support that comes with it. Researching the vendor’s customer service track record is vital. Look for customer reviews that highlight the responsiveness and expertise of the technical support team. Strong customer support ensures that if you encounter any issues—whether technical glitches or integration problems—help is available promptly.

Moreover, a vendor with a solid reputation in the identity verification space is more likely to stay at the cutting edge of technological advancements, providing you with a reliable, future-proof solution.

By evaluating these factors closely, you’ll be able to choose a robust and adaptable alternative to IDfy that fits your business model and operational needs.

Improve Your Identity Verification Journeys With AI

User identity verification is a crucial part of onboarding new users to your company. It’s often the first step that shapes customers’ impressions of your brand. This makes selecting the right identity verification platform extremely important.

HyperVerge One simplifies your identity verification needs with quick and easy implementation, supported by over 100 custom APIs.

Additionally, HyperVerge features a highly trained AI model with 13 years of experience, excelling in ID verification and face authentication through features like:

No-code Workflow Builder

HyperVerge ONE offers a powerful No-Code Workflow & UI Builder that enables businesses to build custom onboarding journeys quickly and effortlessly. With drag-and-drop modules, users can configure and design the user interface without needing programming skills. This makes it easy to craft a visually appealing and functional onboarding process. The platform provides a simple, intuitive interface, enabling teams to quickly develop complex workflows while maintaining full control over the user experience.

By empowering teams to launch new custom journeys instantly, HyperVerge ONE saves time and reduces development costs, making it an ideal solution for businesses that want to stay agile in a fast-paced environment. This no-code approach significantly accelerates the time to market and ensures that businesses can adapt quickly to user behavior or regulatory changes.

Customizable UI

The platform also allows businesses to fully tailor their user interfaces to align with their brand identity. The customizable UI offers flexibility through drag-and-drop modules, enabling companies to configure user journeys without writing any code.

This feature empowers businesses to create unique and intuitive user experiences, ensuring that the onboarding process is visually cohesive and optimized for usability.

Downtime Protection

Downtime protection is a critical feature for businesses prioritizing continuous operations. It ensures that identity verification processes remain uninterrupted even during system maintenance or outages. This protection guarantees that users can still access key services, reducing the risk of customer drop-offs and improving trust in the platform.

HyperVerge ONE’s robust architecture minimizes downtime and ensures high availability, with automated fallback options, even during API downtimes.

Single Image-based Liveness Detection

HyperVerge ONE offers Single Image-based Liveness Detection, an AI-powered feature that ensures the user verifying their identity is physically present.

Unlike traditional liveness detection methods, this solution requires only a single image, making it quicker and more user-friendly. This feature protects against spoofing attempts, such as using photos or videos, by detecting signs of life through subtle image analysis.

For instance, a fraudster using a digital photo of a victim would struggle to pass a challenge that requires the user to blink.

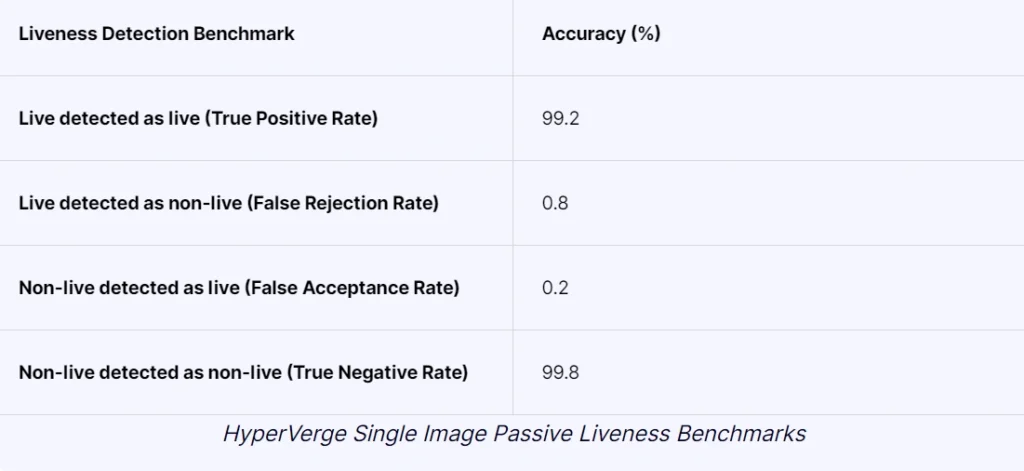

Any passive liveness system replacing an active one must match the performance of traditional active liveness methods. While passive liveness systems provide various advantages, they must maintain high performance and effectively prevent common spoof attacks. Additionally, these systems should aim for the lowest possible false-positive rates to ensure genuine customers have a smooth onboarding experience.

HyperVerge’s single-image passive liveness system has been rigorously tested against industry-standard benchmarks, achieving approximately 99.8% accuracy in live environments.

Face De-duplication Technology

The platform’s face de-duplication technology enhances security by ensuring that each user’s face is registered uniquely within the system. This AI-driven feature compares new face scans against an extensive database to detect and prevent duplicate registrations.

This is particularly useful for preventing fraud in industries like financial services, where multiple accounts using the same identity can lead to security breaches.

AI-based Forgery Checks

One of HyperVerge ONE’s standout security features is its AI-based forgery checks. This technology uses machine learning algorithms to detect forged documents and images during the verification process.

By analyzing pixel-level details, it can identify inconsistencies, tampering, or alterations, ensuring that only genuine documents are processed. This automated approach significantly reduces manual intervention and enhances the overall accuracy of identity verification.

Deep Image Analysis

Lastly, deep image analysis takes document verification to the next level by scanning images in great detail. This feature assesses various aspects of an image, such as lighting, texture, and document quality, to ensure that it is authentic and untampered.

The AI-driven analysis helps businesses accurately validate ID documents, improving fraud detection while reducing false positives.

Together, these features make HyperVerge ONE a comprehensive and secure platform for businesses looking to streamline their onboarding and identity verification processes while maintaining a high level of security.

Choosing the Best IDfy Alternative—HyberVerge!

As digitalization advances rapidly, the threat of fraud grows alongside it. Traditional identity verification solutions struggle to keep up, leaving businesses exposed to financial losses and damage to their reputation. As leading industry players like IDfy navigate these challenges, the demand for a future-proof solution has never been more critical.

This is where HyperVerge comes into the picture!

As your trusted partner, we harness AI and cutting-edge solutions to streamline identity verification, regardless of your industry. By choosing HyperVerge, you’ll gain access to a customer-centric identity verification solution that protects your business, fosters trust with your clients, and sets you up for long-term success.

In a world where companies are comparing Veriff vs. Persona, make the smart choice with HyperVerge. Sign up today to get started!

FAQs

1. What is IDfy?

IDfy is an AI-powered platform offering identity verification, KYC solutions, and fraud detection services to help businesses streamline customer onboarding and ensure regulatory compliance.

2. What are the best alternatives in India to IDfy?

Some leading IDfy alternatives in India include HyperVerge ONE, Signzy, Perfios KARZA, and Bureau, each offering unique identity verification and fraud detection features.

3. Why do you need an AI-powered identity verification solution?

AI-powered identity verification ensures faster onboarding, enhanced fraud detection, scalability, and compliance with industry regulations like KYC and AML.