As a business, you’re under constant pressure to create a smooth, frictionless onboarding experience for genuine users while preventing fraudsters from passing by and infiltrating your system.

But fraud tactics are getting smarter. Whether AI-generated deepfakes, synthetic identities, or advanced forgeries, the advancements make it harder to tell real customers from high-risk users.

A system with gaps in detection, slow processing, or poor scalability is now a liability. If your verification tool can’t keep up, you risk losses, compliance issues, and customer churn.

While Jukshio supports comprehensive identity checks and has good fraud detection capabilities, users have faced issues with their not-so-seamless integrations.

We have 10 Jukshio alternatives that may be an excellent fit for your verification and risk assessment needs.

Why consider Jukshio competitors?

Jukshio might be a reliable tool for identity verification and fraud prevention. However, when compared with the alternatives, Jukshio lags in detecting advanced behavioral anomalies and supporting in-depth KYC compliance checks.

Here’s why you should be considering Jukshio’s alternatives for your business needs:

- Limited features: Lacks multi-layered fraud detection, behavioral biometrics, and advanced device fingerprinting, making it less effective against sophisticated fraud attempts

- Unclear pricing: Jukshio does not publicly disclose its pricing structure, making it challenging for businesses to assess cost-effectiveness

- Unsatisfactory customer support: No verified user reviews on G2 or Capterra, making it difficult to assess the quality of customer service and response times

- Custom requirements: Lack of advanced customization options, making it less suited for a business with unique regulatory and risk assessment needs

How do we evaluate top Jushiko alternatives?

To get you a reliable and unbiased list of Jukshio’s alternatives, we made a comprehensive list of tools offering similar or better features as Jukshio. We further evaluated them based on their pricing, AI capabilities, adaptability with e-identity verification trends, data security measures, and customer support.

We also considered reviews from websites like G2 and Capterra and scrolled through relevant Reddit threads to pick our ultimate 10 Jukshio alternatives.

Overview of the top 10 Jukshio competitors

Before we discuss each tool in depth and compare it with Jukshio, here’s a quick table to offer you a macro overview.

| Top alternatives | Free trial availability | Standout features |

| Hyperverge | Yes | Customer conversion funnel analyticsExtensive onboarding APIs, no-code workflow automation- AIbased liveness and fraud checks |

| Digio | No | Instant digital and electronic signing |

| Perfios Karza | Yes | Automated KYC and comprehensive skip-tracing |

| Bureau ID | Yes | Behavioral analytics for frictionless login |

| IDfy | Yes | NameCheck and FaceMatch APIs, Auto-scalability |

| Signzy | No | RM-assisted journey creation |

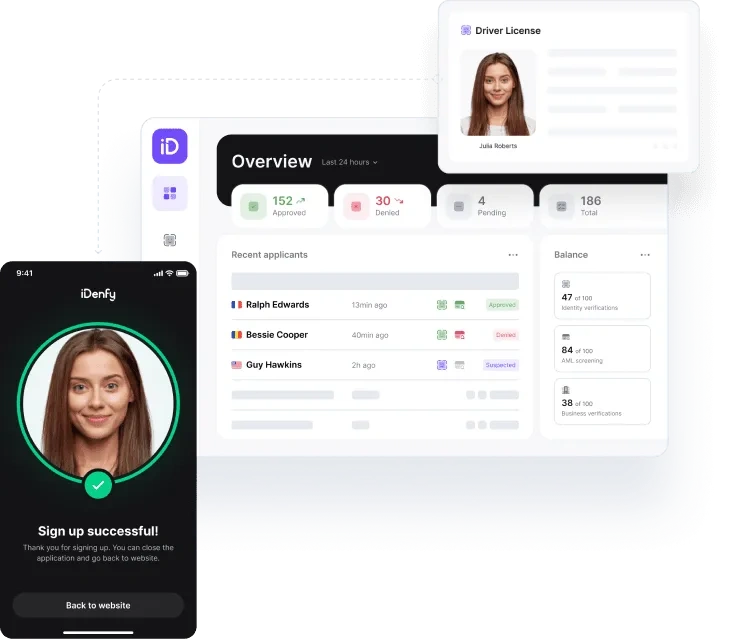

| iDenfy | Yes | 24/7 human supervision within 3 minutes |

| Cashfree | Yes | Instant payouts to any bank, UPI, card, or wallet |

| Newgensoft | No | Hyper Automation with AI-enabled low-code platform |

| Socure | Yes | Predictive document verification technology |

A detailed list of the 10 best Jukshio competitors for automated loan journeys

Here’s a detailed overview of 10 Jukshio alternatives for your business.

1. HyperVerge

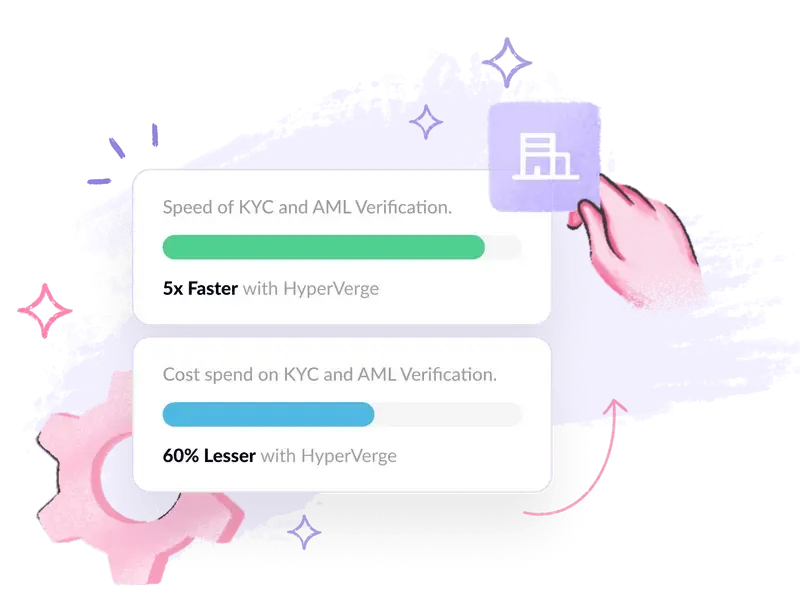

Hyperverge offers a comprehensive suite of verification solutions for businesses that need to comply with KYC and AML checks. It uses AI-powered deep learning models to verify documents, authenticate biometrics, and detect passive liveness with high accuracy.

With HyperVerge ONE, businesses can streamline their end-to-end onboarding journeys with a remarkable 95% auto-approval rate. This means much less manual intervention without compromising on security.

The top identity verification platform offers:

- Real-time fraud detection

- Deepfake prevention

- OCR-powered document verification

- Face de-duplication

- AML checks (global watchlists, PEP screening, adverse media monitoring)

Having verified over 900 million users worldwide, HyperVerge is relied upon by leading enterprises, including Swiggy, Jio, L&T, ICICI, Kotak, Razorpay, and many more. Its fast, secure, and scalable technology supports various industries, providing customized solutions to remain compliant at cost-effective rates.

Best for: Banks, NBFCs, insurance providers, gaming platforms, crypto businesses, logistics providers, and marketplaces

Features better than Jukshio

- No Code workflow builder: Drag and drop options to build custom workflows that enhance user experiences while maximizing conversions

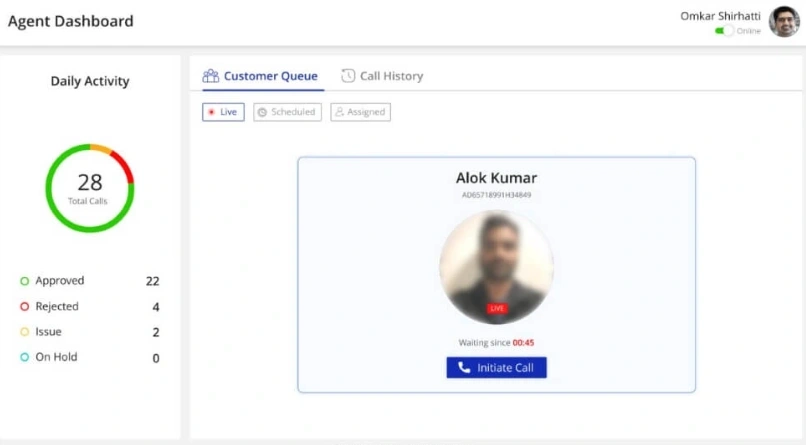

- Analytics dashboard: Offers a funnel overview on drop-offs, retry rates, and conversion trends, helping businesses identify friction points and optimize the onboarding journey with real-time data

- Marketplace integrations: Offers over 100+ category-best APIs for various customer onboarding use cases

Other key features

- End-to-end journey automation: Provides comprehensive workflow automation solution streamlining end-to-end customer onboarding

- Rapid verification: Reduces onboarding drop-offs by completing verifications in under three seconds

- Advanced fraud detection: Hyperverge supports multiple identity verification methods such as facial recognition, passive liveness detection, biometric authentication, fraud pattern analysis, spoofing tests, and behavioral analysis

- Mobile-first solution: Allows users to extract and upload relevant documents from their mobile devices without any hassle

- Cross-platform verification: Works seamlessly across web, mobile SDKs, and APIs, ensuring easy integration into existing systems

- OCR data extraction: Extracts data from any document globally (supports 150+ languages), be it structured or unstructured, with over 90% accuracy

HyperVerge pricing

HyperVerge offers three pricing plans:

- Starter: This plan is best suited for startup companies. It offers a free trial, complete integration set-up, SDK, biometric analysis, and more

- Grow: Grow is an ideal choice for mid-size companies. Here, you get everything in the starter plan, plus a dedicated customer success manager, face liveness check, custom user roles, and more

- Enterprise: If you’re a large organization, this is the plan to opt for. You get a dedicated support team, custom collaborative innovation, and a custom pricing structure

| Start (startups) | Grow (mid-size companies) | Enterprise (enterprise-level organizations) |

| Free trial (30 days)Integration in less than 4 hours View and manage verifications | Everything is Start plan, plus: End-to-end ID verification suite Central Database Checks Access to AML Checks Custom workflow for business | Everything in Grow plan, plus:Collaborate – Lead – SolveCustom Price Structure Dedicated Support Custom Collaborative Innovation |

What do HyperVerge users say?

2. Digio

Digio is a cloud-based digital documentation platform that helps businesses go paperless with its secure and legally compliant solutions for electronic signatures, KYC verification, and payment mandates.

With Digio, businesses can digitally verify identities, manage documentation, and automate compliance workflows while maintaining regulatory compliance throughout. This platform accelerates customer onboarding and secures digital transactions by reducing processing time and eliminating manual paperwork.

Best for: Capital markets, lending units, banks, and insurance companies

Features better than Jukshio

- Automated payment collections: Digio streamlines payment processes by automating recurring payments and managing eNACH mandates

- No-code workflow builder: Digio allows businesses to create and modify onboarding workflows using an intuitive drag-and-drop interface

Other key features

- DigiKYC: Enables individual and business KYC via Aadhaar eKYC, DigiLocker integration, video KYC, and much more

- DigiDocs: Manages and digitizes documents with e-stamping and pre-filled templates

- DigiSign: Provides Aadhaar eSign, KYC-backed signing, electronic signs, USB-based digital signers, etc

- DigiCollect: Simplifies and automates recurring payment collections

- Digiolink: An account aggregator that securely and digitally shares information between financial institutions

- DigiShield: Prevents regulatory violations and unauthorized access with secured onboarding and compliance

Digio pricing

Custom pricing

What do Digio users say?

3. Perfios Karza

Karza, now part of Perfios, offers financial institutions end-to-end due diligence and risk management solutions. The platform automates and simplifies critical processes such as customer onboarding, risk assessment, credit underwriting, and monitoring while ensuring complete compliance with regulatory requirements.

Karza’s AI-powered analytics provide deeper insights into fraud detection and customer data. Karza integrates data from over 700 government and regulatory sources, performing real-time customer screening. This integration helps reduce turnaround time and accelerate your business’s onboarding process.

Best for: FinTech businesses, specifically lending platforms

Features better than Jukshio

- Comprehensive data sources: Karza uses over 700 public government sources, offering a broader scope for KYC and risk assessment

- Complete lifecycle support: Unlike Jukshio, which mainly handles KYC, Karza covers the entire lending lifecycle, from onboarding to collections

- Advanced analytics: Perfios KYC is paired with advanced analytics and risk assessment, offering a more funneled overview

Other key features

- Language efficacy: Karza offers extensive support, live-queue monitoring, and on-screen instructions in 11 regional languages

- Embedded finance: Customized financial integrations for varying industries helping you enhance customer engagement & retention

- Extensive KYC: KARZA offers features such as document verification, credit scoring, and identity checks during the KYC phase to streamline the overall onboarding process

Karza pricing

Custom pricing

What do Karza users say?

NA

4. BureauID

BureauID is an AI-powered identity verification platform designed to make the customer onboarding process seamless, fast, and compliant. While the platform primarily focuses on the financial industry, its flexible and customizable tools are ideal for nearly any business looking to streamline its KYC processes.

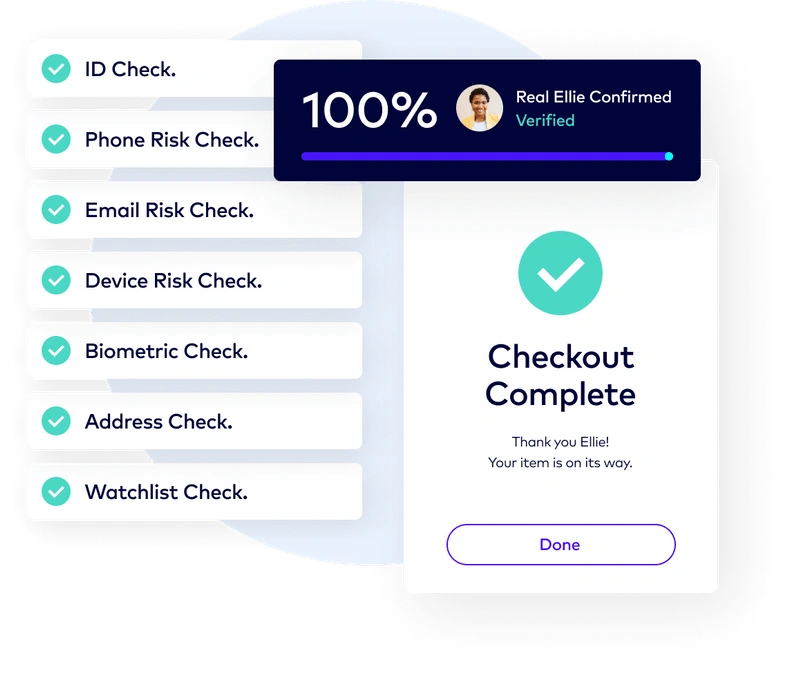

BureauID analyzes 150+ risk signals across the user journey, providing you with complete visibility of users’ digital footprints. These details will help you make informed onboarding decisions and weed out potential mules.

Best for: Risk management and ID verification in the financial sector

Features better than Jukshio

- Customizable KYC workflows: BureauID offers flexible templated workflows that can be customized to meet industry-specific regulatory requirements

- Frictionless onboarding: BureauID emphasizes minimal customer friction by silently authenticating and verifying users upon sign-in

Other key features

- Multi-layered verification: Combines OCR, AML, document verification, and device intelligence to offer a thorough identity check

- Account and device takeover: Stop unauthorized transactions and the illegal access of customers’ accounts and devices

- Bureau device intelligence: Instantly identifies bots, fraud rings, and bad actors in its tracks

Pricing

Custom pricing

Read more:

5. IDfy

IDfy offers end-to-end onboarding solutions to simplify and secure businesses’ identity verification processes. The platform delivers various services, including eKYC, video KYC, document verification, and real-time data verification with its AI-driven solutions.

Best for: Financial institutions, e-commerce, telecom, and gaming businesses looking specifically for ID verification solutions

Features better than Jukshio

- Self-healing systems: IDfy’s self-healing capabilities offer high system reliability for businesses dealing in high-volume verifications

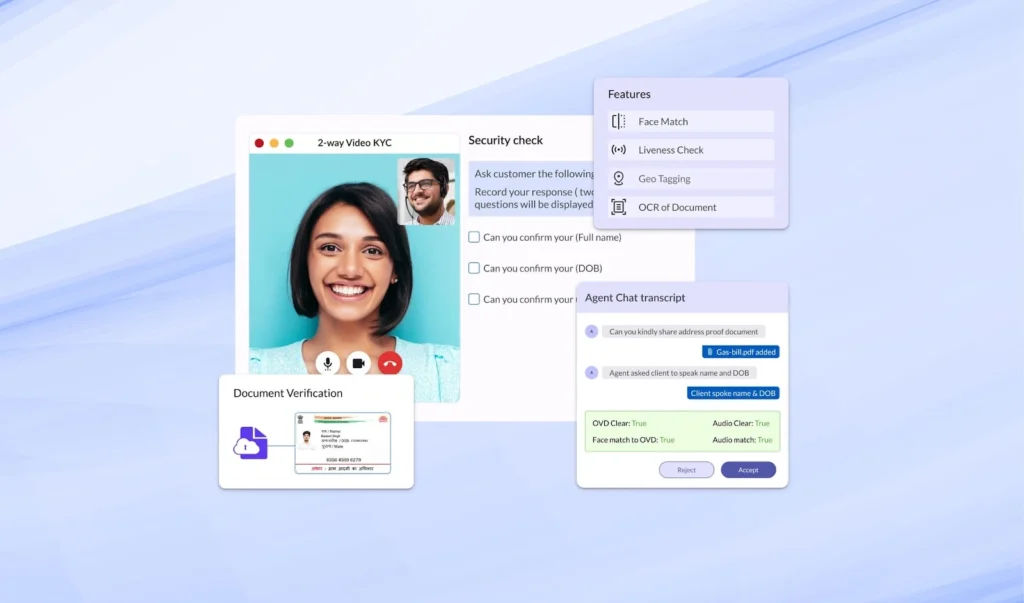

- Video KYC: IDfy offers a robust video KYC solution, complete with pre-call checks checking for device and network readiness

Other key features

- Extensive APIs: IDfy offers a suite of 140+ onboarding and risk APIs for businesses in different industries

- Real-time dashboards: Allows you to track and optimize your journeys with real-time intel

- No-code builder: No code drag and drop builder to customize your workflows

IDfy pricing

Custom pricing

What do IDfy users have to say?

6. Signzy

Signzy provides solutions for the digital banking infrastructure, allowing its users to create seamless user journeys from “lead to activation”. Its no-code platform allows companies to build automated onboarding processes and integrate online identity verification services without requiring technical expertise.

Best for: Banking, investment, payment, and lending businesses requiring high-volume verifications

Features better than Jukshio

- AI-based decision engine: Designed to process over 200 custom rules and

validations at the same time - API stack: Most comprehensive pre-integrated API stack of over

240+ APIs across all financial use cases - Video KYC: Signzy’s video KYC solution works seamlessly even with low bandwidth (as low as 75kbps), making it more versatile than Jukshio’s video verification process

Other key features

- AML & fraud detection: Includes AML checks and fraud prevention tools to ensure regulatory compliance and reduce risk

- Extensive identity verifications: Supports over 10+ forms of documents to verify Indian identity

- Security & compliance: Designed with banking-grade security and ensures compliance with industry standards

Signzy pricing

Custom pricing

What do Signzy users have to say?

7. iDenfy

iDenfy helps businesses manage their identity verification needs with its comprehensive suite of KYC and fraud prevention stack. It supports onboarding in over 200 countries with 24*7 human supervision to double-check identity verifications.

iDenfy secures startups, financial institutions, and digital services with a three-layer identity verification process to prevent severe identity fraud.

Best for: Global businesses that must comply with country-specific regulations

Features better than Jukshio

- 3D liveness detection: While Jukshio checks for facial recognition, iDenfy offers 3D liveness detection, adding an extra layer of security during the verification process

- AI + human oversight: Ensures higher accuracy in identity verification compared to Jukshio’s fully AI-driven system

Other key features

- Approved-only pricing: Helps you save costs on denied verifications by only charging you for approved verifications

- OCR extraction: iDenfy extracts data in 0.02 seconds from 3500+ active government-issued documents

- Global compliance: Access watchlists, sanctions lists, and PEPs (politically exposed persons, filter adverse media

- KYB business registries: Access 180+ company registries from 120 countries

iDenfy pricing

| Service | Startup | Silver | Gold | Platinum |

| Identity verification | $1.30/ verification | $1.10/ verification | $0.90/ verification | Custom |

| Know Your Business | $250/ monthly license | $1250/ monthly license | $2000/ monthly license | – |

| AML verification | $.045 per single PEP & Sanction check | $.040 per single PEP & Sanction check | $.035 per single PEP & Sanction check | Custom |

What do iDenfy users have to say?

8. Cashfree

Cashfree isn’t a dedicated identity verification solution but a payment and banking platform that includes KYC and verification services as part of its broader offering. Businesses can automate their KYC onboarding through custom no-code workflow builders, and the platform uses ML-powered technology to detect anomalies during verification.

Cashfree provides full-stack payment solutions for businesses in India. It allows them to accept payments and make payouts via 180+ payment modes with simple integration. It supports swift and instant payouts through social media, Shopify, websites, UPI, cards, and wallets.

Best for: Fintech and lending businesses seeking a reliable solution for payment collection and disbursals

Features better than Jukshio

- Comprehensive payment solutions: Cashfree offers a full suite of payment processing services, including payment gateways and instant payouts

- KYC links: Recover abandoned KYC flows and boost conversions by sending targeted KYC links via SMS, WhatsApp, or email

- Advanced integrations: Seamless Omnichannel Onboarding via SDK and API integrations or bulk uploads

Other key features

- My blacklist: Custom Rule Engine that offers the flexibility to block transactions based on specific criteria, giving you complete control over your security measures

- Rule engine: Add conditional logic [if/else] [and/or] to move users through the proper verifications at the right time

- KYC automation: Automates the KYC verification process with a custom no-code workflow builder

Cashfree pricing

Custom pricing

What do Cashfree users have to say?

9. Newgensoft

Newgen is a digital transformation company that provides AI-driven automation solutions for businesses. It helps organizations streamline their business processes, content management, customer onboarding, compliance, and identity verification through its low-code platform, NewgenONE.

Newgen allows hyper-automation of your KYC workflows while offering seamless scalability and robust security. The tool integrates AI and machine learning to enhance process efficiency and accuracy while its built-in governance ensures compliance.

Best for: Financial institutions, insurance firms, government organizations, healthcare payers, energy and utilities companies

Features better than Jukshio

- Integrated compliance checks: The platform includes built-in compliance checks that reduce the risk of non-compliance for businesses

- Intelligent process automation: Newgen minimizes the time and resources required for KYC and onboarding processes with its end-to-end automation

Other key features

- Omnichannel customer onboarding: Facilitates seamless onboarding across multiple channels, enhancing customer experience

- Centralized document management: Comprehensive document management ensures all customer information is stored centrally and securely

- Low-code platform: Rapid deployment and easy customization of applications

Newgen pricing

Custom pricing

What do Newgen users have to say?

Secure the operations and boost conversions

With Hypeverge’s global verification solutions Schedule a Demo10. Socure

Socure is a leading platform for digital identity verification and trust. Its predictive analytics platform applies artificial intelligence and machine learning technology to verify identities, catch fraudsters, prevent brute force attacks, and reduce fraud-related losses.

Socure offers instant, accurate, and risk-based identity verification by analyzing thousands of data points from email, phone, IP, device, geolocation, behavioral biometrics, and more.

Best for: Government agencies and FinTech that need real-time identity verification and compliance automation

Features better than Jukshio

- Multi-layered risk assessment: Socure scrutinizes phone possession, SIM swaps, device ownership, geolocation, and behavioral patterns to detect fraud on its track

- Conditional workflows: Adjusts verification steps in real-time, allowing seamless approval for low-risk users and extra checks for high-risk cases

- Image alert: Detects multiple IDs or fraud patterns across Socure’s consortium using photos

Other key features

- Document verification: AI-driven instant document verification with 98% accuracy

- Sigma synthetic fraud detection: Identifies and blocks fraudulent identities created using stolen or synthetic data

- Digital intelligence: Passively verifies user devices and behavioral biometrics to detect fraud

Socure pricing

Custom pricing

What do Socure users have to say?

Choose HyperVerge to automate the customer identity verification process

You need a tool that keeps up with evolving threats, adapts to new fraud patterns, and verifies identities instantly without unnecessary delays or manual intervention. You also need a tool that won’t compromise the onboarding experience to catch fraud.

That’s where HyperVerge One leads the way. Powered by advanced AI and deep learning models, it offers:

- 100+ custom APIs for your unique business needs

- Single image-based liveness detection

- AI-powered forgery checks

- Funneled overview offering you deeper insights into friction points

- Enhanced biometric checks

- Deep image analysis

Hyperverge’s no-code workflows help you start your onboarding journeys in less than 4 hours. The tool has verified over 800 million identities and helped businesses reduce their drop-offs by 50%.

Frequently asked questions

1. What does Jukshio do?

Jukshio is an AI-driven identity verification and digital KYC provider that helps businesses authenticate users, detect fraud, and ensure compliance using facial recognition, document verification, and real-time liveness detection.

2. Which are the best Jukshio competitors in India?

Some of the best Jukshio competitors in India include Hyperverge, Cashfree, and IDfy. These tools offer extensive APIs and fraud detection functionalities or are more cost-effective than Jukshio.

3. Who are the popular identity verification providers in India?

Some popular identity verification providers in India include Hyperverge, IDfy, Signzy, and Cashfree.