KYC verification is one of the most important steps to check compliance and security for businesses, and Cashfree has been a popular choice for automating this process. As a complete payment and API banking platform, Cashfree allows businesses to send money instantly via bank accounts, UPI, cards, or wallets without relying on traditional corporate banking portals.

Additionally, Cashfree offers a KYC verification and onboarding platform that automates identity verification, making it easier for businesses to comply with regulations and prevent fraud.

However, while Cashfree provides a robust ecosystem, businesses look for alternatives due to pricing, feature limitations, integration challenges, or a need for more advanced compliance solutions. If you’re looking for a scalable, cost-effective, or feature-rich KYC verification tool, this guide explores the 9 best Cashfree alternatives, offering enhanced security, automation, and seamless onboarding experiences.

Why consider alternatives to Cashfree?

Nowadays, bad actors no longer operate alone. They use human fraud farms and AI-powered chatbots to exploit security gaps, using the latest advancements in generative AI (GenAI).

A report by Regula revealed that 49% of companies experienced both audio and video deepfakes in 2024, up from 37% and 29%, respectively, in 2022. This surge in AI-driven fraud is forcing businesses to rethink their digital identity verification and KYC strategies to protect against evolving threats.

Recognizing the urgency, companies are ramping up their investments in security. In fact, global KYC spending will increase by 140% over the next five years, building on the already substantial $9.2 billion in 2024.

As mentioned earlier, Cashfree Payments is widely recognized for its API-driven banking and payments solutions, including KYC verification for onboarding customers securely. However, while Cashfree works well for many businesses, it may not be the ideal solution for everyone due to the following reasons:

- Incomplete payment gateway features: Some functionalities, such as Authorization (Auth), may not work as intended, affecting transaction reliability

- Slow customer support: The support team often delays responses, and the SLA can create hurdles for clients, leading to unresolved issues

- Lack of onboarding & platform walkthrough: First-time users may struggle due to the absence of a proper onboarding process or platform guidance

- High pricing: Cashfree’s pricing can be expensive, especially for businesses handling large transactions

- GST requirement for some payment methods: Certain payment methods may require a GST number, adding complexity for some businesses

- High charges on Amex transactions: Cashfree charges 4-5% on Amex card payments, which can be costly compared to other providers

If any of these challenges apply to your business, it might be time to explore better-suited Cashfree alternatives that offer enhanced security, automation, and compliance features.

Stay ahead of evolving fraud threats!

Explore the best KYC solutions to enhance security and compliance. Schedule a DemoHow do we evaluate the top alternatives?

To identify the top Cashfree alternatives, we analyzed 40+ KYC verification tools, focusing on pricing, success rate, customer support, integration ease, security, and features. Our evaluation was based on user feedback and ratings from trusted sources like G2, Capterra, TechJockey, Reddit, SoftwareWorld, and Software Advice.

We also reviewed competitor comparison lists and cross-checked industry recommendations to find solutions that truly stand out. After a thorough assessment, we shortlisted the top 10 alternatives that offer more efficient, secure, and scalable identity verification solutions for businesses of all sizes.

Overview of the top 9 Cashfree alternatives

Now that we understand why businesses are looking for Cashfree alternatives, we’ve selected 9 of the best options below to help you find the best fit for your unique needs.

| Top alternatives | Free trial availability | Standout features |

| HyperVerge | 30-day free trial available | Fraud detection, biometric authentication, document verification, Face de-duplication, AML screening |

| Digio | N/A | Document creation, management, and secure storage, real-time screening, workflow builder |

| Trulioo | Free trial available | Advanced fraud detection, risk intelligence, AML and KYC capabilities |

| Jukshio | Free trial available | Rapid fraud detection, extensive ID support |

| Jumio | N/A | Data Tagging, liveness detection, geographic coverage, ID version support |

| ShuftiPro | 15-day free trial available | AI-powered identity verification, OCR, AML screening, Liveness detection |

| Perfios Karza | N/A | Integrated finance solutions, extensive KYC coverage, real-time monitoring and on-screen guidance |

| BureauID | Free trial available | AML compliance and fraud prevention, Protection against account/device takeovers, fraud ring identification |

| IDFy | Free trial available | No-code, customizable workflows, advanced fraud detection with predictive risk modeling, enterprise-grade security |

A detailed list of the 9 best Cashfree alternatives in India

Here’s a detailed overview of 9 Cashfree alternatives for your business.

1. HyperVerge

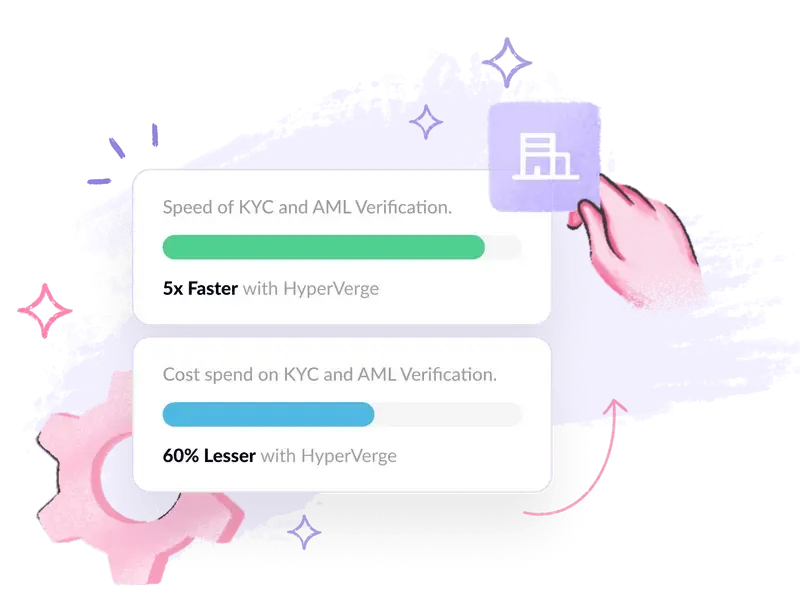

HyperVerge is a full-stack identity verification suite built for businesses that need precise KYC and AML compliance. It uses AI-powered deep learning models to verify documents, authenticate biometrics, and detect passive liveness with unmatched accuracy.

Unlike Cashfree, with HyperVerge ONE, you get a 95% auto-approval rate. That means fewer manual reviews and faster onboarding without sacrificing security.

Here’s what sets it apart:

- Real-time fraud detection with advanced AI risk scoring

- Deepfake-proof biometric authentication that flags manipulated media

- OCR-powered document verification for instant identity proofing

- Face de-duplication to prevent duplicate KYC profiles

- AML screening across global watchlists, PEP databases, and adverse media

- Minimizing false positives with highly accurate AI technology

HyperVerge offers over 100 APIs for smooth integration across various industries, such as financial services, education, crypto, and gaming. With web and mobile SDKs, you can be up and running in just 4 hours, making KYC deployment quick and easy.

In fact, more than 900 million users have been verified through HyperVerge. Big players like Swiggy, Jio, L&T, ICICI, Kotak, and Razorpay trust it for scalability, security, and compliance at the right price.

Best for: Banks, NBFCs, insurance providers, gaming platforms, crypto firms, logistics operators, and marketplaces industries.

Pricing

| Plan | Features |

| Start Plan (For Startups) | Free trial, integration in 4 hours, basic identity verification tools for KYC and ID verification (1-month access) |

| Grow Plan (For Mid-sized Companies) | Includes all Start Plan features, plus end-to-end identity verification, AML checks, custom workflows, and central database checks |

| Enterprise Plan (For Large Organizations) | Everything in the Grow Plan, with custom pricing and advanced collaboration tools |

Hyperverge gets your business compliant quickly and efficiently, with powerful tools at every step.

What do HyperVerge users say?

Adam P., Chief Compliance Officer

Adam P., Chief Compliance Officer

Adam P., Chief Compliance Officer

2. Digio

As a cloud-based digital documentation solution, Digio is designed for businesses that need to go paperless with its secure, legally compliant solutions for electronic signatures, KYC verification, and payment mandates. With Digio, you can automate compliance workflows and digitally verify identities, all while staying fully compliant with regulatory standards.

The platform supports both self and agent-assisted Video KYC for thorough verification. It also offers fully compliant KRA data submissions, including multi-KRA support and real-time updates.

When you consider the challenges and trends in online identity verification, Digio outshines Cashfree with tools designed to keep your compliance in check:

- DigiStudio: A business workflow builder that lets you create end-to-end customer onboarding flows. It’s customizable with drag-and-drop options and includes auto-approval mechanisms, ensuring compliance at every step.

- DigiKYC: Offers full identity and business verification with enhanced due diligence

- DigiShield: Real-time screening and monitoring to prevent onboarding of risky individuals

- DigiDocs: A complete platform for document creation and management. It includes secure document storage, version control, and e-stamping across India

- DigiSign: The trusted digital signing solution for India that supports Aadhaar eSign, USB-based digital certificates, and document signer certificates

- DigiCollect: Automates recurring collections with NACH-compliant integration

- Digiolink: Account aggregator that securely shares customer information between financial institutions. It offers consent-driven data sharing and tools to assess financial risk

The platform also offers bank account verification with methods like Penny Drop, Reverse Penny Drop, and Penniless.

Best for: Capital markets, lending units, banks, and insurance companies

Pricing

- Custom pricing

What do the users say?

Adam P., Chief Compliance Officer

Read More: Top 10 Digio Competitors and Alternatives for Your Business

3. Trulioo

Trulioo combines KYC, KYB, and AML capabilities to meet the most intricate regulatory demands across global markets. You gain access to over 450 data sources covering 195 countries, making it easier to verify identities no matter where your customers are located.

With just a single API, Trulioo provides you access to all the verification features you need, from fraud detection to regulatory compliance. The integration is simple, the tools are powerful, and your regulatory compliance becomes seamless.

Here’s why Trulioo stands out from competitors like Cashfree:

- One simple API: Access a suite of verification tools through a single token and endpoint, reducing complexity

- Comprehensive compliance: Stay aligned with regulations from major bodies like FINCEN, FINRA, and FCA effortlessly

- Advanced risk detection: Use integrated fraud intelligence to detect suspicious activity before it impacts your business

Best for: Banks, fintechs, payment service providers, online retailers and marketplaces, and healthcare, real estate, and insurance companies

Pricing

- Custom pricing

What do the users say?

Adam P., Chief Compliance Officer

4. Jukshio

AI-powered identity verification services from Jukshio protect businesses against identity theft and fraud. Designed to simplify KYC compliance in India, the platform offers fast and reliable document verification and text extraction.

Jukshio uses a multi-layered KYC++ approach, which extracts faces and text from customer documents and cross-references them with live images and details. You can trust Jukshio’s AI-driven technology to detect fraud, prevent tampered documents, and spot spoofed images, all in real time.

No need to worry about the quality of customer documents—Jukshio supports worn, old, and damaged documents, ensuring reliable verification regardless of conditions. Additionally, the platform is cloud and device-agnostic, making it easy to deploy on various cloud platforms without limitations.

Some of the best features of the platform include:

- High accuracy: With a 99.98% accuracy rate, powered by over 300 models, Jukshio delivers precise verification

- Real-time verification: AI-based systems offer rapid fraud detection feedback, making compliance efficient and effective

- Data privacy: No Personally Identifiable Information (PII) is stored, keeping end customer privacy intact

- Low bandwidth compatibility: Jukshio functions efficiently even in low bandwidth areas, ensuring reliability in varied environments

Best for: Businesses looking for an all-in-one risk management solution with automated evaluations across SMS, social media, cash flow, and government document verification, plus easy-to-integrate APIs and scalable options for growth

Pricing

- Custom pricing

What do the users say?

Name,Designation/ Industry ★★★★★ (4.5/5)

Jio

Read More: Top 10 Jukshio Alternatives in India (2025): Best Identity Verification Solutions

5. Jumio

Jumio is an AI-driven identity verification platform focused on fraud prevention. It uses machine learning and advanced analytics to offer real-time, accurate identity verification and risk management. By analyzing both current and historical data, Jumio helps businesses predict and mitigate fraud risks before they happen.

The platform uses behavioral data to predict and mitigate fraud risks in real time. What’s even better is that it combines identity verification methods like biometric analysis and document checks, so you get a comprehensive view of a user’s authenticity.

When it comes to fraud prevention and risk management, Jumio’s tech gives you an edge over competitors like Cashfree. Instead of waiting for problems to arise, you proactively address them with intelligent, data-driven insights:

- Risk scoring: Customizable scoring based on real-time data and historical fraud patterns

- AML screening: Automates screening against global watchlists, including sanctions and PEPs

Best for: Companies in the financial services, sharing economy, digital currency, retail, travel and online gaming sectors

Pricing

- Custom pricing

What do the users say?

Sergey M., QA Engineer

6. ShuftiPro

Used in more than 240+ countries and territories, ShuftiPro is a top-tier digital identity verification platform that combines facial recognition, liveness detection, and anti-spoofing techniques to prevent fraud, speed up customer onboarding, and meet KYC regulations. It’s electronic identity verification solutions cover a wide range of use cases and keep you compliant no matter where your business operates.

It’s a reliable alternative to Cashfree, offering a robust set of features tailored to meet the needs of businesses:

- Identity verification engine: Powered by AI, ShuftiPro offers high-accuracy identity checks. It taps into a global database that spans millions of IDs from 240+ regions

- OCR for businesses: ShuftiPro allows you to process multilingual identity documents and extract data from scanned copies or images with ease

- AML screening: Stay compliant with AML regulations and manage risks effectively. Shufti Pro helps businesses meet global standards for anti-money laundering

Best for: Banks, payment processors, ICOs/STOs, and service providers

Pricing

- Custom pricing

What do the users say?

Denise M.,, Small-Business

7. Perfios Karza

Now part of Perfios, Karza offers financial institutions a robust suite of solutions for due diligence and risk management. It automates critical processes like customer onboarding, credit underwriting, and risk assessment.

The platform integrates data from over 700 government and regulatory sources. This gives businesses real-time customer screening and deep insights, particularly when it comes to fraud detection. As a result, you can cut down on turnaround time and accelerate your onboarding process.

Unlike Cashfree, Karza takes it a step further by offering more comprehensive services:

- In-depth analytics: Karza’s platform includes powerful analytics, giving you in-depth insights into customer data and risk

- Language efficacy: With support in 11 regional languages, Karza provides real-time monitoring and on-screen guidance to improve customer experience

- Integrated finance: Karza delivers customized financial integrations across industries, helping you improve customer engagement and retention

- Extensive KYC: From document verification to credit scoring and identity checks, Karza covers all aspects of KYC to optimize your onboarding process

Best for: FinTech businesses, specifically lending platforms

Pricing

- Custom pricing

What do the users say?

- Not enough reviews

8. BureauID

As an AI-powered identity verification platform, BureauID transforms customer onboarding into a faster, more efficient, and fully compliant process. Though primarily designed for the financial sector, its flexibility makes it suitable for businesses across industries aiming to improve their KYC procedures. The platform uses over 150 risk signals to track user behavior, providing a detailed view of their digital footprint.

If you’re seeking a Cashfree alternative, BureauID combines advanced fraud detection and seamless user experience. Here’s how:

- AML compliance: Monitor and detect potential money laundering activities to block illicit funds from entering your system

- Fast-tracking trusted users: Simplify the process for trusted users while implementing extra checks for flagged risky ones

- Protection against account/device takeovers: Prevent unauthorized access to your customers’ accounts and devices to avoid fraud

- Fraud ring identification: Identify and stop sophisticated fraud rings and coordinated attacks before they cause damage

Best for: Banks, fintechs, financial institutions (FIs) and enterprises

Pricing

- Custom pricing

What do the users say?

Vineet Amin,l Aditya Biral Capita

9. IDFy

As Asia’s leading integrated identity platform, IDFy a range of solutions designed to simplify compliance, improve security, and enhance customer experience. With eKYC, video KYC, document verification, and real-time data validation powered by AI, IDFy simplifies and secures complex verification processes.

Over the years, the platform has processed more than 70 million verifications for over 600 clients, including HDFC, Axis Bank, Paytm, and Zomato. Plus, with banking-grade security features like encryption and audit trails, IDFy makes sure compliance is always in check.

Here’s why it’s one of the best Cashfree alternatives:

- No-code, customizable workflows: Build your journey from scratch with drag-and-drop simplicity. White-label the entire user experience

- Data insights: Gain real-time intel to optimize your processes and stay ahead of the competition

- Advanced fraud detection: Detect document tampering, impersonation, and other fraud attempts with cutting-edge tech. Predictive risk modeling helps you stay a step ahead

- Enterprise-ready: IDFy’s platform is highly scalable and resilient. It meets ISO and SOC 2, Type 2 certifications to grow with your business

Best for: Businesses in banking, ecommerce, telecom, and gaming looking for ID verification solutions

Pricing

- Custom pricing

What do the users say?

Verified User in Computer Software

How to choose the best verification solution for your business

When you have to choose the right verification solution, you don’t just check off boxes or pick the cheapest option. It’s about what works for your business right now, and in the future.

So, to make sure you’re on the right direction, ask the right questions: Does it meet your needs today? Can it scale with you as your business expands? Is it equipped to tackle compliance challenges head-on? Above all, you need a platform that adapts to your changing requirements.

If you’re exploring identity and finance verification options and considering Cashfree alternatives, here are key factors to weigh before making your choice—and why HyperVerge could be the perfect fit.

Payment success rate & fraud prevention

The ability to detect and prevent fraud is a top priority for any business handling transactions. But not all fraud detection systems are created equal.

HyperVerge’s AI-driven fraud detection system excels in identifying and preventing fraudulent activities. Our advanced AI solutions are trained on a wide variety of facial variations and ID formats, ensuring highly accurate detection. With over 750 million users onboarded, we’ve created a system that consistently delivers results, helping businesses avoid financial loss:

- Identify fraudulent behavior in real time with best-in-class AI technology

- Minimize drop-offs while maximizing conversion rates without compromising security measures

- Reduce manual hours by automating fraud detection processes, achieving a pass rate of 95%+

The platform also includes biometric face checks during high-risk activities like registration, transactions, and logins to prevent account takeovers. Additionally, AI-based checks such as forgery detection, deep image analysis, fraud pattern recognition, known face searches, and face matching with liveness detection ensure thorough fraud prevention.

Finally, face deduplication flags duplicate faces in the system, preventing multiple accounts by the same individual, further enhancing security and reducing fraud risk.

Transaction fees & cost-effectiveness

Hidden charges? No, thank you. When it comes to payment gateways, pricing transparency is crucial. HyperVerge stands out by offering clear, upfront pricing with no surprise fees. It’s one of the most cost-effective solutions out there, especially considering the value you’re getting.

The Start Plan, for instance, includes all features without additional costs, allowing businesses to predict expenses accurately.

Integration & developer friendliness

No one wants to be stuck dealing with a complicated integration process. With HyperVerge, you don’t have to.

Its API is designed to be easy to integrate with your existing tech stack—whether you’re working with ERPs, CRMs, or e-commerce platforms. You can choose from over 100 integrations to seamlessly craft your complete onboarding journey from start to finish.

Multi-currency & international payments

If you’re working globally, you know that currency and international payments are non-negotiable. While HyperVerge specializes in identity verification, its solutions support businesses operating across multiple regions. By verifying identities globally, HyperVerge enables businesses to confidently engage in international transactions, expanding their reach without compromising security.

Uptime, speed & customer support

You know how frustrating it is when a platform goes down or responds too slowly. It can result in missed opportunities and frustrated customers. HyperVerge is designed for high-speed performance with 99.99% uptime, so you complete transactions faster and keep your customers happy. After all, no one wants to wait around for approvals.

And when issues arise, HyperVerge’s customer support is ready to step in. We offer 24/7 support, so you never have to worry about getting stuck. It’s a win-win for everyone!

AI-powered fraud prevention: The future of secure digital payments

We hope from the list of Cashfree alternatives above, we’ve given you a fair idea of the options available for securing your digital transactions. But no matter how many alternatives you explore, one thing remains clear—payment fraud is on the rise, and the stakes are high.

So, how can you protect your business from these sophisticated threats?

Traditional fraud detection methods simply aren’t enough. As fraudsters get smarter, they adapt their tactics, using everything from stolen identities to advanced bots.

HyperVerge ONE’s AI-powered liveness detection guarantees that the person attempting to access an account or make a transaction is not a bot or using stolen credentials. It verifies the user’s presence in real time, making it nearly impossible for fraudsters to spoof identities using fake photos or videos. Plus, it secures digital payments with its AI-driven fraud detection, helping businesses like yours stay safe from emerging threats.

Ready to secure your digital payments and reduce fraud risk? Check out how HyperVerge can help you today.

FAQs

Q1. Which is the best alternative to Cashfree in India?

For a robust alternative to Cashfree in India, consider HYperVerge, BureauID, or IDFy, each offering a wide range of payment methods, strong fraud protection, and good support for the Indian market.

Q2. How does AI improve payment security?

AI boosts payment security by analyzing large transaction datasets in real-time to identify anomalies. This process flags potentially fraudulent activities while minimizing false positives, ultimately enhancing security and trust in digital payments.

Q3. Are there free alternatives to Cashfree?

While some platforms offer limited free plans, most payment gateways charge transaction fees. Look for affordable solutions with essential features and security, like HyperVerge, for comprehensive protection.

Q4. How do I choose the best payment gateway for my business?

To choose the best payment gateway, evaluate factors like pricing (fees, transaction costs), security compliance (PCI DSS), integration ease, accepted payment methods, mobile payment support, customer support, and reputation.