Is your business still drowning in paperwork? From invoices and contracts to customer forms, manual data entry slows everything down and leaves room for costly mistakes. That’s where OCR, or Optical Character Recognition, comes in.

Many businesses lose valuable time and money because their OCR vendor isn’t the right fit.

That is why OCR vendor evaluation is important. It can make or break your workflow, team efficiency, and document processes.

In this guide, we’ll walk you through what OCR is, why it matters, and how to pick a vendor that fits your needs, without wasting time or money.

What is OCR technology, and why does it matter for your business?

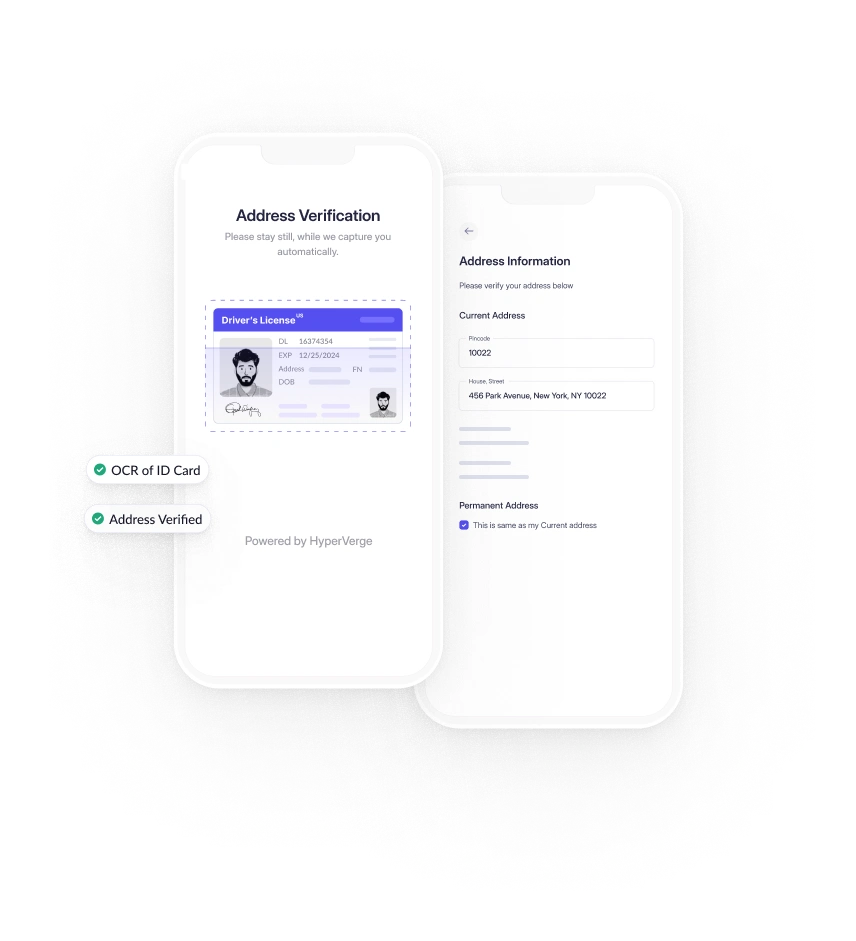

OCR, or Optical Character Recognition, is a type of technology that reads and extracts text from scanned documents, images, or handwritten notes, then converts it into digital, editable text. Imagine snapping a photo of a receipt, and instead of just seeing an image, your phone instantly extracts the amounts, dates, and store names; that’s OCR in action.

Modern OCR goes beyond simple text. It can recognize different languages, fonts, and even messy handwriting with surprising accuracy.

OCR saves time, ensures compliance, and reduces errors. Instead of retyping a contract or business card, you can scan it and edit the text instantly.

Still comparing OCR solutions?

Put HyperVerge OCR to the test. Experience fast setup, secure data handling, and proven results across industries. Schedule a DemoWhy is choosing the right OCR vendor important?

Choosing the right OCR solution can be challenging because there are so many factors that you must keep in mind.

For businesses processing a high volume of documents, time is a crucial factor. For financial institutions, accuracy is especially important. A simple mistake could have serious consequences; for instance, if a name or ID number is misread, a fake account might get approved, or a wrong digit in an account number can block legitimate transactions.

These issues highlight why it’s so important to choose an OCR vendor that ensures both speed and precision while maintaining smooth operations.

To help with this, below are six key points to keep in mind when selecting an OCR vendor:

1. Impact on operational efficiency

A good OCR tool saves time by processing documents quickly and accurately. If the software struggles with messy handwriting or complex layouts, your team wastes hours fixing mistakes. For example, a healthcare provider processing patient forms needs OCR that reads messy doctor notes without constant manual corrections.

2. Cost considerations

Cheaper OCR tools might seem appealing, but hidden costs add up. Some vendors charge per page, while others have subscription plans. If your business deals with high volumes, per-page pricing can get expensive fast. Others may require expensive training or additional software, increasing long-term costs.

3. Accuracy and adaptability

Low-quality OCR misreads numbers, dates, or critical details. Just imagine an invoice where ‘2025’ becomes ‘ZOZ5.’ Just mistakes can sometimes prove to be very costly. Solutions such as HyperVerge’s AI-powered OCR solution are the best bet, as it offers an impressive accuracy rate of over 95%!

A strong OCR adapts to different fonts, languages, and formats, reducing errors. A retail business processing multilingual receipts, for instance, needs OCR that handles various languages without extra setup.

4. Integration and API support

Your OCR should work smoothly with your existing systems. If it doesn’t integrate with your document management software or CRM, you’ll waste time transferring data manually. Also, API access is critical if your team wants to automate actions, trigger workflows, or build custom features around the OCR output.

5. Data privacy and compliance

Handling sensitive data? Your OCR vendor must comply with regulations like HIPAA (for healthcare) or GDPR (for customer data). Some cloud-based OCRs store documents on external servers, risking breaches.

6. Support and customization

When something goes wrong, you need quick help. Vendors with poor support leave you stuck. Customization is also key if your documents have unique layouts; the OCR should adjust without requiring endless tweaks.

Always remember this: choosing the right OCR vendor isn’t just about technology; it’s about finding a solution that fits your workflow, budget, and security needs. The wrong choice can create more problems than it solves.

Read More: A Complete Guide to Bank Statement OCR

How to evaluate and choose the right OCR vendor?

With so many options out there, how do you pick the best OCR vendor for your needs? Check these pointers:

- OCR accuracy and adaptability

Accuracy is non-negotiable. Test how the vendor handles your specific documents, be it printed forms, handwritten notes, or multilingual text. Some OCR tools perform well with standard formats but struggle when dealing with odd layouts or blurry scans. Flexibility matters too; your needs might change as your business grows.

- Integration with existing systems

OCR shouldn’t disrupt your current workflow. Check if the vendor supports easy connections with your CRM, ERP, or document management systems. If you’re handling invoices, for instance, the data should flow right into your accounting tools (you shouldn’t have to do extra copy-pasting).

- Data security and regulatory compliance

If you handle sensitive data, like healthcare records or financial info, your OCR vendor must meet standards like HIPAA, GDPR, or SOC 2. Look for encryption, access controls, and clear data retention policies. Avoid vendors that store your data indefinitely or in unsecured locations.

- Performance at scale

If your document volume increases suddenly, like during tax season or an enrollment spike, can the vendor handle it? Ask about speed, uptime, and any limits on processing. Performance issues can affect everything from customer onboarding to internal reporting.

- Vendor support and SLAs

When something breaks, you need quick help. Check response times in the vendor’s Service Level Agreement (SLA). Do they offer 24/7 support, or just email tickets?

- Transparent pricing and ROI

Hidden fees can surprise you later. Compare pricing models and calculate ROI. Will automating data entry save your team 20 hours a week? That’s worth paying for.

Want faster, more accurate document processing?

Evaluate smarter with HyperVerge’s OCR software that is built to handle high volumes and complex formats. Book a demo today!Common challenges in OCR vendor selection and how to overcome them?

Choosing the right OCR vendor can be tricky. One major challenge is accuracy, some tools struggle with messy handwriting or complex layouts. Another issue is compatibility. Not all OCR solutions work well with your existing software.

Cost and scalability are also concerns. Some vendors charge per page, while others offer flat rates. If you process high volumes, unpredictable pricing can hurt your budget. Also, a vendor with slow response times can delay critical tasks.

Benefits of using the right OCR vendor

So far, we’ve read all about OCR vendor features and factors to watch out for. Let’s now read why your business must invest in an OCR vendor:

- Increased efficiency and accuracy

Manual data entry is slow and prone to errors. A good OCR tool reads documents quickly and with high precision, helping your teams avoid typos, skipped entries, or duplicate records. For example, finance teams can extract data from invoices or receipts without double-checking every line.

- Improved cost savings and ROI

By automating document processing, you reduce reliance on manual labor. That translates to fewer hours spent on repetitive tasks and fewer costly mistakes. Over time, this adds up, especially for businesses handling high volumes of forms, IDs, or contracts.

- Scalability across business functions

Regardless of whether you’re handling 100 documents or 10,000, the right OCR system grows with your needs. A logistics firm could use it for shipping labels one day and freight bills the next, without switching tools.

- Enhanced customer experience

Faster form processing, quicker responses, and fewer errors all lead to happier customers. For instance, if your OCR can instantly read and verify a customer ID, onboarding takes minutes instead of days.

- Better compliance and risk management

Industries like finance or legal demand strict record-keeping and compliance with laws like GDPR and more. OCR helps by creating searchable, auditable digital records, reducing compliance risks.

- Customization for industry needs

Each industry has unique documents and workflows. The right OCR vendor offers flexibility, tailoring how data is extracted, formatted, or validated to fit your exact use case.

- Real-time processing capabilities

In time-sensitive environments like banking or healthcare, real-time OCR helps move things faster. Patient info, loan forms, or fraud alerts can be processed and acted upon within seconds.

- Easy integration with existing tech stack

Finally, the right OCR tool fits into what you already use–CRMs, cloud storage, accounting tools, and more, without disrupting your workflow. This ensures smoother adoption and faster results.

Conclusion

Selecting the right OCR vendor is crucial for enhancing accuracy, efficiency, scalability, and compliance in document processing.

HyperVerge’s AI-powered OCR stands out by delivering over 90% accuracy across diverse document types, including IDs, invoices, and contracts, in more than 150 languages; plus, its seamless API integration ensures adaptability to various workflows.

Built on 13 years of AI training, HyperVerge’s solution offers real-time processing, unmatched security, and compliance features, making it the most reliable choice for any business aiming to modernize their document handling processes.

Book a demo now!

FAQs

1. What is the importance of OCR accuracy when choosing a vendor?

High OCR accuracy ensures that the text extracted from documents is correct. This reduces manual corrections, saves time, and prevents errors in critical data, which is essential for tasks like invoice processing or record keeping.

2. How can I assess an OCR vendor’s integration capabilities?

Check if the OCR tool can easily connect with your current systems, such as accounting software or databases. Look for available APIs, compatibility with your platforms, and whether the vendor offers support during the integration process.

3. What are the common challenges businesses face when evaluating OCR vendors?

Businesses often encounter issues like:

- Inaccurate text recognition, especially with poor-quality scans

- Difficulty integrating with existing systems

- Hidden costs or complex pricing structures

- Limited scalability as the business grows

- Lack of support or customization options

4. What does OCR stand for?

OCR stands for Optical Character Recognition. It’s a technology that converts different types of documents, such as scanned paper documents or images, into editable and searchable data.

5. What is OCR analysis?

OCR analysis refers to the process of examining scanned documents or images to extract text data. This is useful for digitizing printed materials, making them editable and searchable.

6. What does OCR mean in SAP?

In SAP, OCR is used to automatically read and extract data from documents like invoices or purchase orders. This data is then used to update records in the SAP system, improving efficiency and accuracy in data entry.

7. What does OCR mean in accounts payable?

In accounts payable, OCR technology is used to scan and extract information from invoices. This automates the data entry process, reduces errors, and speeds up invoice processing and payments.