Navigating the complexities of finance, particularly in the domain of lending, can present unique challenges. For lending businesses in India, understanding the intricacies of the loan origination process is essential. This process serves as the critical pathway connecting borrowers with the necessary financial resources.

Below, we delve into the pivotal role of identity verification and KYC within this well-established framework, shedding light on its significance and potential for optimization through automation.

What is Loan Origination?

Loan origination is essentially the inception of the loan journey. It’s where borrowers seek financial assistance from lenders, like a small business owner seeking funds to expand. The process spans from applying for approval and funding to loan disbursement itself. Picture this: the business owner or borrower completes a form, you, as the lender, conduct a review, and voila! The loan is primed to fuel their growth.

Lenders often levy a loan origination fee to cover processing costs. The fee is typically a small fraction of the interest rate on the loan amount.

Documents Required for the Loan Origination Process

Here’s a breakdown of common documents typically required for a loan application, acting as keys to unlock various loan options for borrowers:

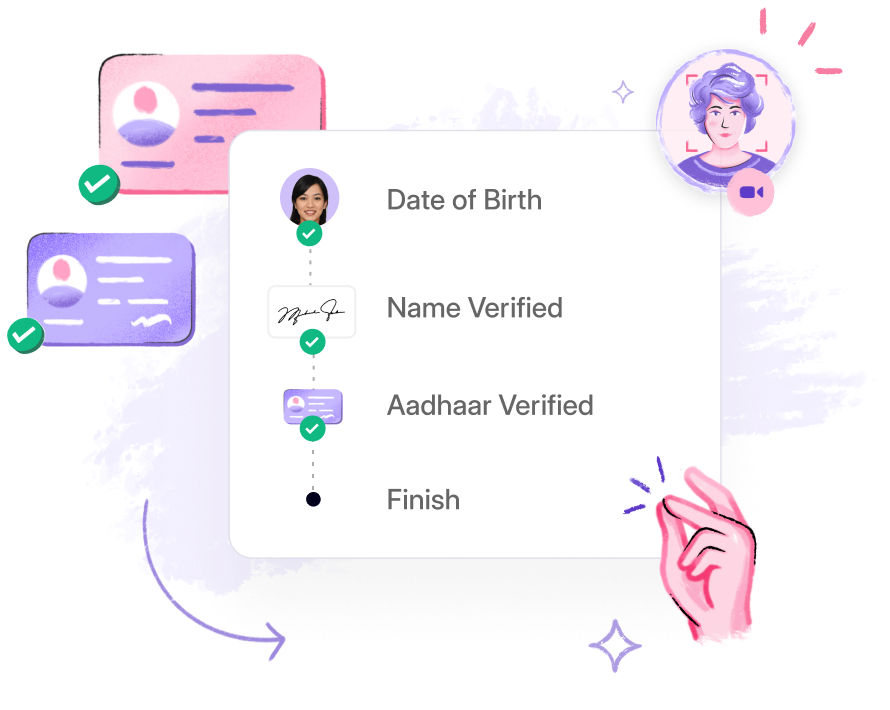

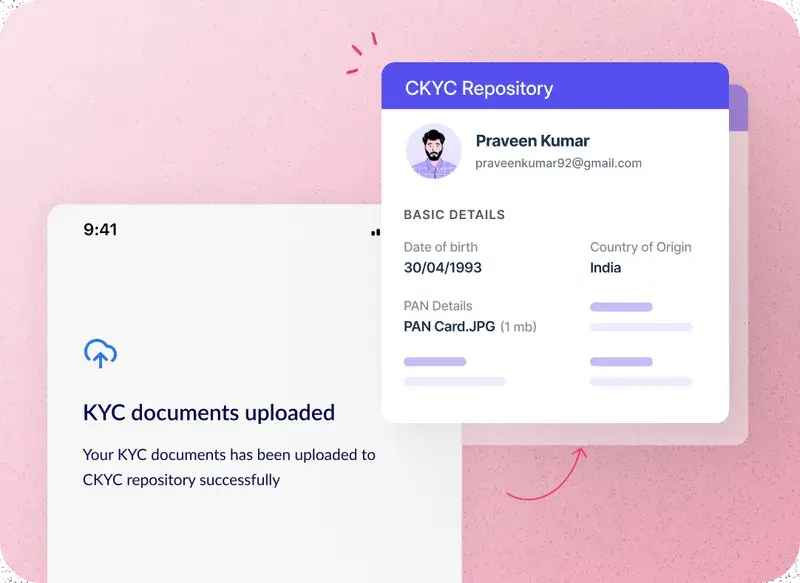

- Proof of Identity: Establishing the borrower’s identity is crucial. Valid government-issued IDs such as one’s Aadhar card or passport suffice.

- Proof of Address: You need to know where your borrowers reside. Utility bills or rental agreements serve as proof of residence.

- Income Proof: Conducting an analysis of income proof (salary slips or income tax returns) helps in understanding the borrower’s ability to repay.

- Bank Statements: Bank statements offer insights into a borrower’s financial history and fiscal habits.

- Business Financials (for Business Loans): A business’s financial health is a pivotal factor when evaluating a business loan. This includes audited financial statements.

- Property Documents (for Mortgage Loans): The property itself becomes part of the mortgage equation. Documents like ownership certificates or sale deeds are essential.

Additional documents may be required based on loan eligibility, lender policies, or loan types. Timely submission of these documents streamlines the entire process and showcases borrower readiness.

Read more:

- What is a proof of income?

- What is bank statement analysis?

What are the Steps Involved in the Loan Origination Process?

Here is a detailed guide to the loan origination process. Let’s simplify it into manageable steps, making the entire loan estimate and process effortless:

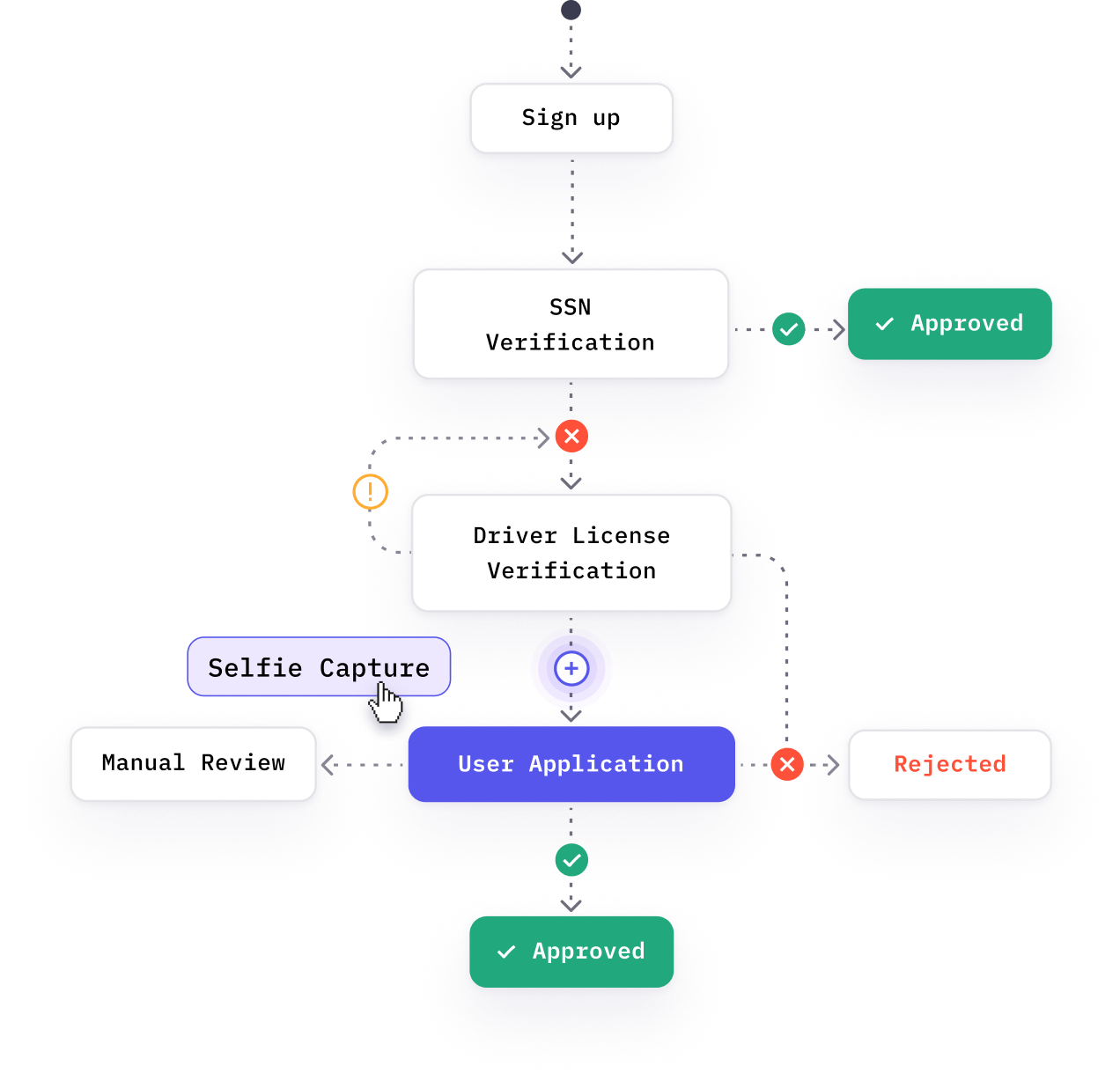

Loan Application

The journey begins here. For lending businesses, the loan application is the initial step toward assessing the borrower’s suitability for a loan. Your borrowers have to provide pertinent details, including loan purpose, desired amount, and comprehensive personal and financial information. As a lender, you need to emphasize the importance of gathering necessary documents for identity and financial verification, as these documents play a crucial role in validating the borrower’s credibility.

Pre-Approval

Once your borrower hit submit on his or her loan application, you need to kick off with a quick scan. This involves assessing the borrower’s creditworthiness, income stability, and overall suitability for the loan. Pre-approval signifies a preliminary green light to proceed with the application process.

Processing

Once the initial assessment is passed, the loan enters the processing phase. In this phase, you need to meticulously review the application, ensuring all details are accurate and complete. Any discrepancies or missing information may prompt you to request additional documentation or seek clarification from the borrower.

Underwriting

In this stage, you need to delve into the technical aspects of the borrower’s financial profile. Through rigorous analysis, you must evaluate credit history, income stability, and collateral (if applicable). Based on this assessment, loan terms such as interest rates and repayment terms are determined. Emphasize the significance of thorough underwriting in mitigating risks associated with lending.

Read more: What is credit underwriting?

Approval

Upon successful completion of underwriting, you need to grant approval for the loan. This signifies confidence in the borrower’s ability to fulfill repayment obligations. Borrowers are notified of approval and provided with loan documents for review and signature.

Closing

The final step involves formalizing the loan agreement. Borrowers sign the necessary documents, solidifying the loan transaction. Following document execution, you disburse the loan funds. It’s essential to inform borrowers about potential closing fees, such as origination fees and legal expenses, which may vary depending on the loan type and lender policies.

It is imperative to understand that throughout the loan origination process, identity verification and document verification play a pivotal role. You must ensure the authenticity of borrower information to mitigate fraud and comply with regulatory requirements. Failure to conduct thorough verification may expose your business to financial risks and legal consequences. Therefore, incorporating robust verification mechanisms is imperative for maintaining the integrity of the lending process and fostering trust with borrowers.

How Does an Automated Loan Origination Process Work?

Imagine this: your borrower needs a loan but dreads the lengthy application process. Enter the automated loan origination software, your tireless companion that swoops in to simplify things for you and your borrower. By harnessing advanced data analysis and machine learning, automation revolutionizes the loan origination process for many lenders, making it seamless and efficient. Let’s delve deeper into how automation empowers lenders to make informed decisions, accelerate loan approvals, and, ultimately, ensure a gratifying borrowing experience.

Decrease Credit Risk Through Data-Driven Decisions

Traditionally, loan officers would pore over documents and make judgments based on experience.

Automation injects a powerful upgrade to lending institutions: data-driven insights. This allows lenders to make much more informed decisions about who qualifies for a loan.

Cut Operational Costs and Eliminate Human Error

Navigating the loan origination system with complexities can resemble sluggish traffic. Automation acts like a speeding bullet train, eliminating bottlenecks that cause delays. Repetitive tasks like document management, verification, and data entry are effortlessly handled, freeing up time for complex aspects like underwriting. The result? A significantly expedited loan approval process.

Improve Customer Experience

The mortgage loan origination process needn’t be an anxiety-inducing maze. Automation serves as your affable guide, ensuring a smooth and error-free experience. Picture a world where loan applications are seamlessly processed, with clear communication at every step. Automation eradicates human errors, ensuring accurate and efficient handling of information, translating to a transparent and stress-free journey for lenders and borrowers alike.

By embracing automation, mortgage lenders can take business processes and create a win-win scenario for both themselves and borrowers. Faster approvals, reduced risks, and heightened customer satisfaction – that’s the magic automation brings to loan origination.

Make Your Loan Origination Process Seamless With Automation

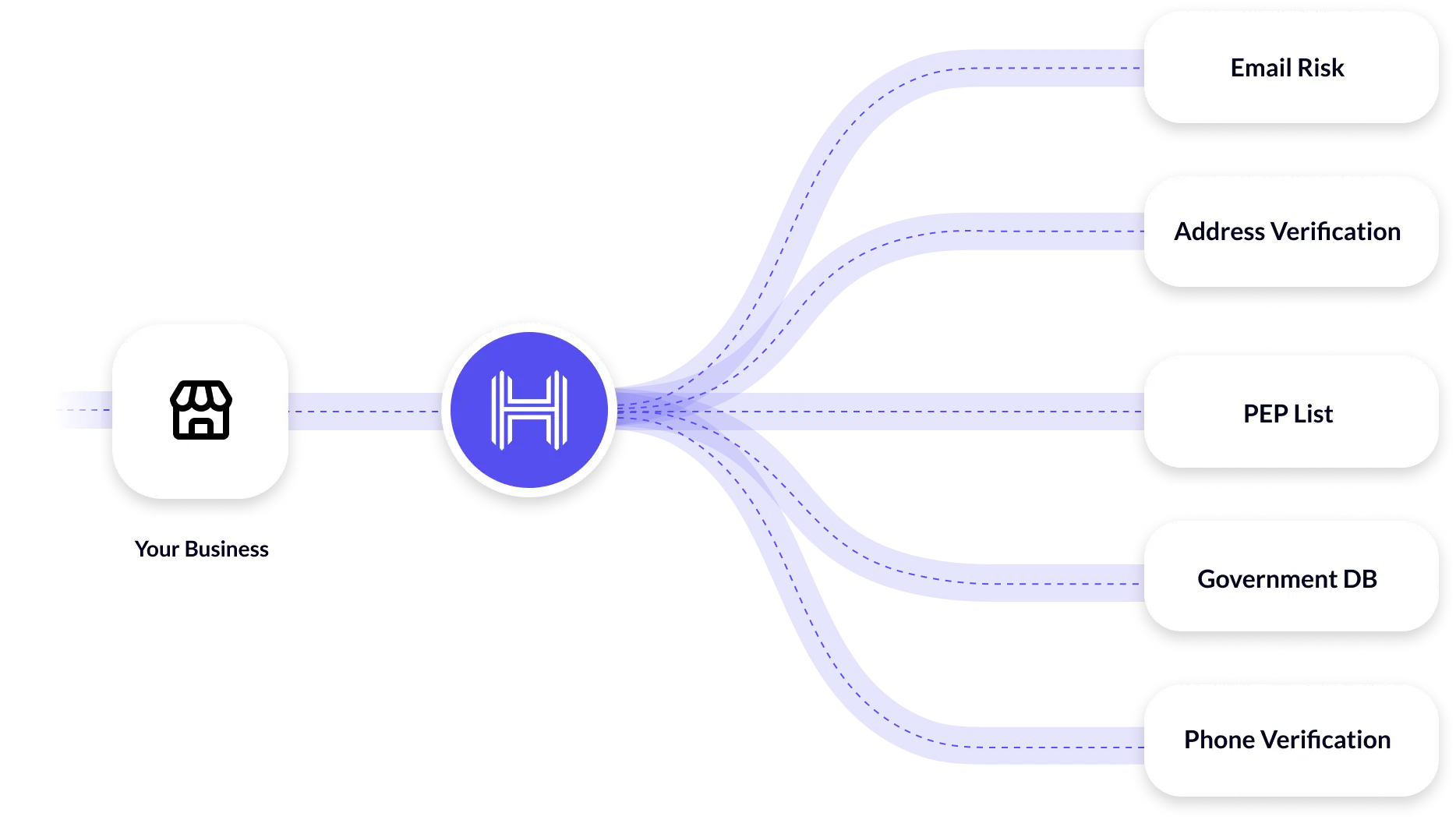

In today’s digital era, automation is disrupting loan origination, streamlining operations with cost savings, reducing risks, and enhancing customer experience. Solutions like HyperVerge ONE automate the entire loan value and process effortlessly. Packed with features to boost approval rates, it’s the ultimate toolkit for modern lenders.

Visit HyperVerge ONE today and unlock boundless possibilities for your lending business.

Mastering the loan origination process is pivotal for success in lending. Lenders and other financial institutions can ensure a smooth, efficient, and customer-centric experience by understanding the steps, leveraging automation, and embracing innovation. Now, venture forth and sign up to embark on your automation journey!

FAQs

Why is the underwriting process essential for loan approval, especially in credit unions and other financial institutions?

The underwriting process involves assessing the borrower’s creditworthiness and the risk associated with the loan. It ensures that loans granted align with the financial institution’s policies and regulatory requirements, thereby safeguarding against potential defaults and mitigating risks.

What documents are typically required during the loan application process at a lending institution?

Supporting documents such as pay stubs, profit and loss statements, and credit reports are commonly requested during the loan application process. These documents provide lenders with insights into the applicant’s financial standing, facilitating the approval process.