What is proof of income?

Proof of Income is a set of documents required to verify an individual’s or a business’s monthly or annual income. Proof of income helps financial institutions determine a person or company’s ability to make payments when they apply for credit. This also helps financial institutions and lending businesses to trace the origin of the person’s or business’s income and check whether it is from a clean source.

What Documents Serve as Proof of Income?

Most financial institutions inform their potential clients of the authentic documents and affidavits they need to submit; these may differ from company to company or as per the transaction, like for credit cards, mortgages, business loans, or unsecured personal loans.

In some cases, only a Proof of Income Letter suffices. It outlines the person’s occupation, employment status, and income. An accountant or HR can draft this proof of income letter for an organization’s employee. This letter will detail annual income, the number of work hours per week, and some information about how that income will be sustained or improved in the future.

An income certificate can be submitted as proof of income. It is a government-issued document that states the annual income of the individual or the family. All individuals such as salaried employees, business people, non-salaried individuals, etc are eligible to apply for the income certificate

Financial institutions generally ask their clients to present any of the following documents as proof of income:

1. Pay slips

2. Bank statements (three to six months)

3. Tax return statements

4. Wage and Tax Statements

For PAYE (pay as you earn) employees:

1. Payslips for the past two or more months

2. Identification documents

3. Passport size photograph

4. Total annual income

Other sources of income – pension or other investments will require some of the following documents:

1. Annual pension

2. Trust fund income

3. Maintenance bills

4. Benefit Payments

Self-employed individuals may be asked to produce the following:

1. Wage and Tax Statements

2. Bank statements (of a specified period)

Read more:

- What is bank statement analysis?

- 20+ Documents Acceptable For Identity Verification

- Ultimate guide to document verification

What is Proof of Income used for?

Financial institutions may need proof of income from their customers for several reasons. Most often, they need proof of income to verify that the sources of funds are legitimate and regular. At the same time, the amount matches the one the customer stated in their applications or details.

Here are some reasons why proof of income is important:

1. Educational institutions may have quotas for those that fall into a specific income group.

2. Access to scholarships for those with low income.

3. Access to loans from various financial institutions.

4. Certain job applications require proof of income for salary calculation.

5. It can help applicants in availing medical benefits and subsidies.

6. Help them get loans from different government agencies.

7. Access to various types of pensions.

8. Access to natural disaster relief.

9. Financial aid for veterans.

10. Getting access to free food ration.

11. Access business grants or loans under specific criteria.

Proof of income is especially important when it comes to businesses and their clients. The business will need to verify that its clients have access to such income and that it is legitimate income. This is especially so when a business conducts financial transactions such as receiving investments, making investments for them, or other remittances.

This is also important for banks and other financial institutions when onboarding a customer.

Proof of Income is essential to perform a credit analysis. This information can be garnered from financial information agencies, credit insurance, client banks, and payment history to corroborate the documents and information provided by a client.

Read more:

- What is the loan origination process?

- Comprehensive guide to credit underwriting rules

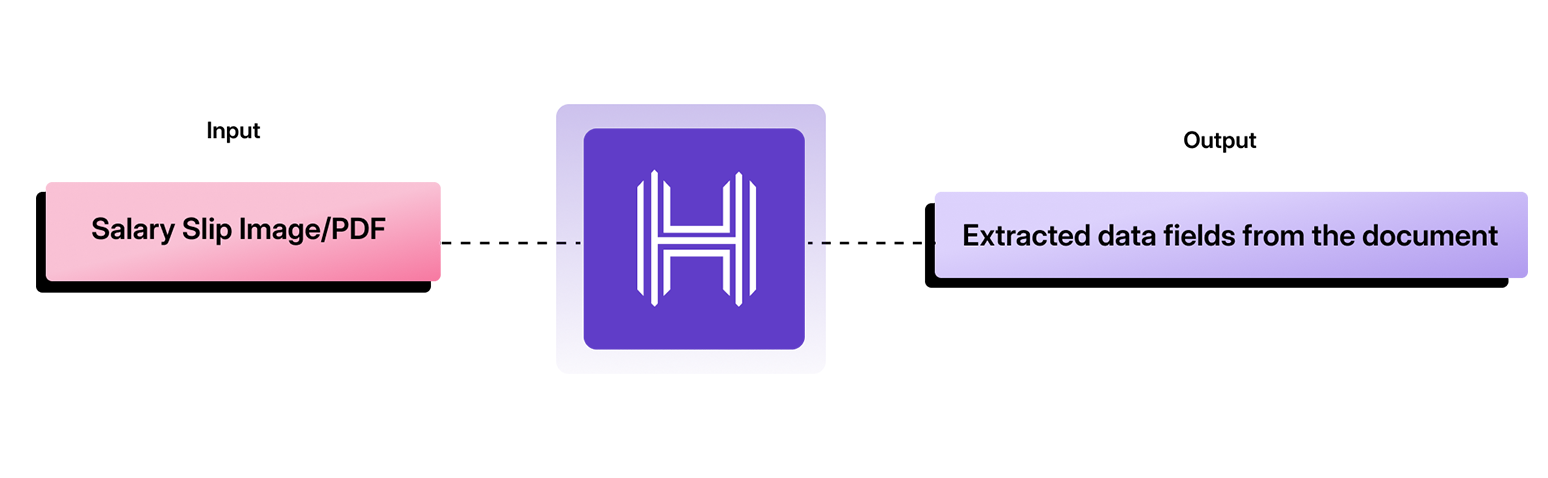

How does salary slip OCR work for proof of income?

Optical Character Recognition (OCR) for proof of income works by utilizing computer algorithms to identify and extract text information from images or scans of proof of income. Here’s a general overview of how it works:

- Submit the picture of the ID

- Detect the text region

- Identify the characters using machine learning

- Extract the required information into a digital format

The extracted information from the ID is as follows:

- Employer name

- Address

- Bank account details

- Gross salary

- Net salary

- Salary period

Explore more: HyperVerge’s salary slip OCR API and OCR technology

Analyzing Income Beyond Proof of Income

While proof of income acts as a crucial document, companies need to check several other aspects:

Fixed charges on assets

Suppose business owners have fixed charges over company assets, meaning they will be compensated in the event of liquidation. In that case, they are likely to take more risks, which means more risk for a financial institution lending to them.

Unsecured creditor

A financial institution must consider the size of an individual or company’s bad debts relative to net worth. If the net worth significantly outweighs bad debts, the risk is lower.

Late charges

Overdue payments regularly, several instances of late charges, or changes in filing periods are potential warning signs that the individual’s income is poorly managed or susceptible to unexpected risks.

What is the bottom line?

Whether onboarding a new client or issuing a new loan, financial institutions and lending businesses need clear insight into whom they are dealing with.

Proof of income can be complex to obtain, especially to form an accurate, error-free picture that considers all factors. It is best to partner with specialists who are tied up with qualified partners, have a proven track record, and use the latest tech to guarantee error-free results.

With HyperVerge ONE, you can easily build custom end-to-end financial and lending onboarding journeys. With the help of our integration capabilities, you can:

- Create user-friendly UI/UX experiences and easily configure user onboarding workflows without a single line of code.

- Set up automated fallback options to reduce user drop-off while onboarding.

- Get detailed analytics on conversion rates and the friction points in the onboarding journey.

Want to see it in action? Sign up now!

FAQs

What documents are needed to show proof of income?

An income letter can be used as proof of income. In general, these are the documents needed: 1. Payslips 2. Bank statements (three to six months) 3. Income tax return statements 4. Salary certificate 5. Parent’s income certificate 6. Employers’ form

What does an income certificate mean?

Proof of income documentation shows an individual’s earnings for a specific period.

What are the documents required to obtain an income certificate?

You need to submit documents for identity and verification. The documents required for address proof are a Ration card | Voter ID card | Passport | Driving License | Electricity/water bill. The documents required for identity proof are an Aadhaar card | Ration card | Voter ID | Driving license

US

US

IN

IN