Navigating through AML compliance requirements is challenging for payment processing service providers. As transactions increasingly become digital and cross-border, illicit activities like money laundering pose a major threat to payment processing businesses’s integrity and safety.

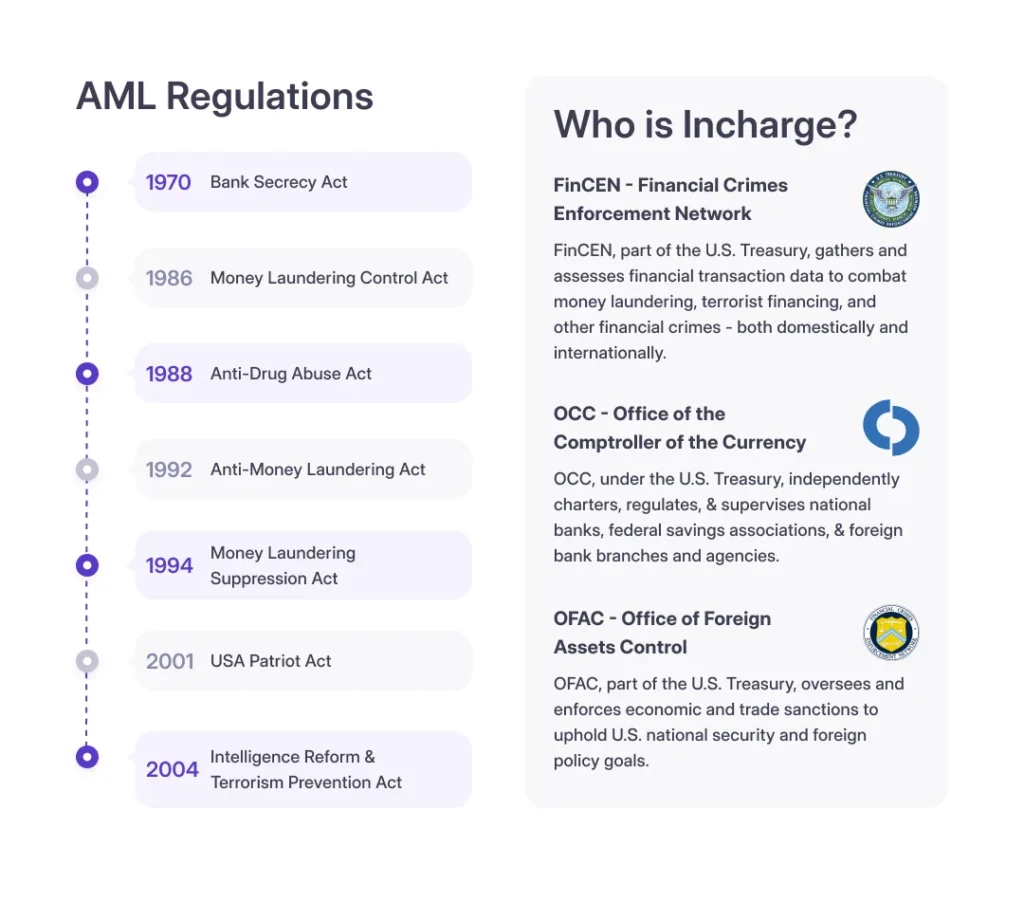

To combat this challenge, many countries require payment processors to comply with Anti-Money Laundering (AML) regulations. Every country has regulations, laws, and jurisdictions regarding AML compliance, which payment processors are expected to follow.

This blog offers detailed information on AML requirements for payment processors. Learn how complying with AML regulations makes your payment processor secure, legally safe, and risk-free. Let’s start.

What is a payment processor?

A payment processor is a service that facilitates digital fund transfers between customers and sellers. It enables organizations to accept cards, recurring payments, and digital funds easily.

Many third-party payment processing service providers, such as PayPal, Stripe, and Braintree, offer payment processing services. Businesses can use these companies’ services or even build their own.

Using payment processors makes transferring funds worldwide easy, barrier-free, and quick. However, many criminals misuse these advantages of payment processors to transfer illicit funds- a criminal activity known as money laundering.

Money laundering: A common issue in payment processors

Money laundering is fraud in which criminals make money or transfer funds illegally. This money is used to fund criminal activities like human trafficking, terrorist financing, and drug dealing. A United Nations report states that up to 2 trillion US dollars are laundered worldwide.

Today, fraudsters exploit platforms like payment processors to launder money globally. Since payment processors facilitate easy fund transfers across countries, transferring illicit funds internationally becomes easy for criminals.

Naturally, this criminal activity harms the payment processing company’s integrity and safety. Ideally, third-party payment processing companies can stop money laundering by:

- Verifying merchant and buyer identities against watchlist individuals.

- Continuously monitoring financial transactions to identify fraudulent activities.

AML regulations prevent money laundering through financial institutions like banks, credit card companies, payment processors, and others. They require such financial institutions offering finance-related services to impose practices that detect and report suspicious activities.

AML compliance benefits payment service providers in terms of legal and regulatory aspects. Keep reading to know how.

Importance of AML compliance for payment processors

- Ensure legal adherence: Countries like the USA, the UK, Canada, and EU nations have laws enforcing AML compliance. Failure to adhere to these laws can result in lawsuits and even prevent you from offering payment processing services in these countries.

- Safeguards brand image: Brand image is critical for financial institutions and money services businesses. Following AML requirements for payment processors prevents financial crimes on your platform and helps safeguard your brand image.

- Protects from penalties: A 2022 Deloitte report documented that AML non-compliance resulted in USD 5bn. worth of fines for credit and financial institutions. AML compliance safeguards your payment processor from monetary penalties.

- Enhances client experience: There are cases where payment processor customers become targets for money laundering. AML compliance helps you offer secure payment services and protects your customers, elevating their brand experience.

These were a few points that prove the necessity of complying with AML requirements for payment processors. If you work in the third-party payment processor or finance industry, your company needs a solid plan to ensure adherence to AML regulations.

By now, you know the importance and benefits of AML compliance. Now, let’s discuss the AML requirements for payment processors in different countries.

What are the global AML requirements for payment processors?

Each country has its own set of laws and regulations for AML compliance. Here, we will discuss the requirements for AML in the USA, Canada, the UK, and the EU.

- US AML requirements for payment processors

The Bank Secrecy Act of the US does not provide clear guidelines for AML. The Federal Financial Institutions Examination Council, on the other hand, recognizes the increased money laundering risk on payment gateways and processors due to unmonitored transactions.

Another bill is being processed, the ENABLERS Act. While this act has yet to be enforced, it requires Payment Service Providers (PSPs) to comply with AML best practices. The core of this act is to align the PSPs’ processes with those of regulated financial institutions (like banks), hence eliminating the scope for money laundering.

- EU AML requirements for payment processes

The European Union classifies payment processors as regulated financial institutions. All third-party payment processors must follow Payment Services Directives, which focus on fail-proof customer authentication to forbid criminals from laundering money through payment processors.

Moreover, the 7th AML Directive is an EU AML directive emphasizing customer due diligence. Strong customer verification helps ensure users’ genuineness and avoids money misuse in criminal activities.

- UK AML requirements for payment processes

In the UK, payment processors must comply with His Majesty’s Revenue and Customs (HMRC) regulations. These regulations enforce strict customer verification processes to ensure that only verified customers transfer money through payment processors.

- Canada AML requirements for payment processes

Canada’s Financial Transactions and Reports Analysis Center (FINTRAC) considers payment processors and merchant account providers as regulated institutions. These regulated financial entities are classified under money services businesses or foreign money services businesses.

As directed by FINTRAC, regulated institutions must adhere to electronic fund-transferring obligations. These obligations enforce AML compliance for payment processors operating in Canada.

These were the global AML requirements for payment processors. Adhering to AML requirements and staying compliant is a major challenge for third-party payment processors. However, there are a few best practices you can adopt for seamless compliance. The coming section will shed light on these best practices.

4 best practices to ensure end-to-end AML compliance in payment processors

- Use AML compliance automation solutions

Anti-money laundering software solutions, like HyperVerge’s, offer end-to-end functionalities for complete AML compliance. These systems offer solutions for global sanctions and watchlist checks, Politically Exposed Persons (PEP), and adverse media checks.

Integrating your payment processor with an AML system helps effectively mitigate money laundering risk through automation. This is the best way to ensure AML compliance processors for your payment processor.

- Have a dedicated AML compliance officer

A dedicated anti-money laundering compliance officer helps implement compliance practices in payment processing companies. The compliance officers continuously monitor the transactions to identify and report suspicious money laundering transactions.

- Automate AML workflows

End-to-end AML compliance requires continuous monitoring of payments and users. Automating AML workflows helps streamline AML compliance while maintaining efficiency and precision.

An automated workflow automatically screens suspicious users if one is identified on the platform. The workflow conducts steps to verify user identity, report fraudsters, and generate alerts, reducing the chances of negligence and human errors.

- Use KYC and KYB

Know Your Customers (KYC) is essential for verifying customer identities. KYC verification helps identify potential fraudsters from the onboarding stage and ensures that only legitimate customers use the merchant’s payment gateway.

Moreover, Know Your Business (KYB) also helps verify the legitimacy of the merchant’s account used for the payment process. KYC and KYB help monitor transaction patterns, identify possible laundering activities, and avoid fraud.

These are some best practices to help you fulfill AML requirements for payment processors. A smart and automated software solution can help you implement these best practices, fulfill all your AML compliance requirements, and make your payment processor secure and safe.

Automate payment processor AML compliance with HyperVerge

Complying with AML requirements for payment processors can be a complex task. However, doing so is mandatory in countries like the USA, the UK, EU nations, and Canada. Using a software solution helps avoid transaction laundering and makes processors AML-compliant.

HyperVerge offers a complete software suite of identity verification for AML compliance. HyperVerge offers a complete suite of software solutions for AML compliance. We help businesses comply with legal requirements smartly through AML software, KYC, KYB, and AML workflow builders.

With 1,000+ checks, 100% PEP profile coverage, and 30,000 daily profile updates, we are your reliable partner for anti-money laundering regulation compliance. Book a demo call with our team today to learn how HyperVerge can help your payment processing platform.

Frequently asked questions on payment processor AML requirements

Is AML compliance necessary for payment processors?

AML compliance is not mandatory for payment processing companies in many countries. However, implementing AML practices in your payment processor makes it safe and prevents misuse in activities like money laundering. Moreover, if you want to expand your services to markets like EU countries, the UK, the USA, or Canada, AML compliance is necessary.

What are the consequences of non-compliance with AML requirements?

Non-compliance with AML regulations and laws can result in lawsuits, legal penalties, and business shutdowns for payment processing service providers. AML non-compliance worldwide resulted in penalties worth USD 5bn. Therefore, it is important to ensure compliance with your country’s and target market’s AML laws and requirements.

Is it possible to outsource AML compliance?

Yes, it is possible to outsource AML compliance. HyperVerge offers services like AML automation solutions, user identity verification (KYC), and business identity verification (KYB) to help you ensure AML compliance for your payment processor without any hassle.

How do payment processors ensure data security while complying with AML requirements?

AML compliance requires payment processors to analyze and evaluate customer data and payment information. While this can often result in compromised data security for users, there are steps you can take to ensure data security. These steps are two-way data encryption, security audits, and access control.

Do eCommerce payment processors also require AML compliance?

If the eCommerce business is operating in a country where AML laws are implemented, the payment processor needs to be AML compliant. Additionally, AML compliance is a good business practice that preserves your brand image and facilitates trustworthy transactions.