Watchlist screening is a necessary aspect of Anti-money laundering (AML) compliance. It ensures that financial institutions, businesses, and regulated entities adhere to regulations by verifying whether their customers and business associates are listed in specific databases, such as global watchlists containing information on money laundering, financial crime, and sanctions.

AML watchlist screening helps companies minimize the risk of financial crimes, reduce high-risk countries and false alarms, and simplify compliance procedures. By systematically checking individuals against databases of known criminals and sanctioned entities, watchlist screening plays an important role in risk mitigation and maintaining integrity within the financial sector.

In this article, you’ll learn the importance of AML watchlist screening, the sources of watchlists, how it works, and how to choose the best AML watchlist screening solution for your business.

Understanding Watchlist Screening

Watchlist screening is a process of safeguarding against financial crimes like money laundering, terrorist financing, fraud, and other illegal activities by screening individuals and entities against watchlist.

These global watchlists, curated and maintained by various governmental and government agencies, independent regulatory bodies, international organizations, and law enforcement agencies, serve as databases of individuals and entities with potential risks.

Integrating watchlist screening into Know Your Customer (KYC) and anti money laundering (AML) compliance programs is essential for companies to identify and mitigate risks associated with high-risk individuals or entities.

Typically, these are individuals involved in criminal activities or linked to terrorist organizations, money laundering operations, or other illicit endeavors, including politically exposed persons (PEPs), government-sanctioned entities, and those engaged in such illegal activities as arms or drug trafficking.

Industries across various sectors, such as finance depend on watchlist screening to strengthen their compliance efforts and safeguard against financial crimes. By including watchlist screening into their protocols, companies can effectively identify and prevent fraud prevention identifying potential risks further, ensuring regulatory compliance, and maintaining integrity within their operations.

What are the Watchlist Sources?

The watchlist sources are given below:

- Office of Foreign Assets Control (OFAC) Sanctions List: This list includes individuals, entities, and countries subject to sanctions and restrictions.

- Interpol Most Wanted List: This is a list of individuals wanted by Interpol for committing crimes across different countries.

- Financial Action Task Force (FATF) High-Risk Jurisdictions List: This is a list of countries and jurisdictions that have strategic deficiencies in their AML/CFT regimes.

- European Union Consolidated Sanctions List: This list targets individuals, entities, and countries that are subject to EU-imposed restrictive measures.

- Specially Designated Nationals and Blocked Persons (SDN) List: This is a list of individuals and entities identified by the U.S. government as having ties to terrorism, drug trafficking, or other illicit activities.

- United Nations Security Council Sanctions List: This list is a register of individuals, groups, or entities subject to sanctions imposed by the UN Security Council.

- World Bank Debarred Entities List: This is a list of firms and individuals that have been banned from participating in World Bank-financed projects due to fraud and corruption.

- U.S. Bureau of Industry and Security (BIS) Entity List: This is a list of foreign individuals, organizations, and companies that are restricted from accessing certain U.S. technologies or engaging in specific trade activities due to concerns related to national security, foreign policy, or other reasons.

- PEP (Politically Exposed Persons) Lists: This is a list of individuals who hold prominent public positions or have close associations with such figures.

How Does Watchlist Screening Work?

Let’s understand how watchlist screening works:

Collect the Data

Global watchlist data screening is an essential process for financial institutions to prevent financial crimes like money laundering, terrorist financing, and fraud. It begins with identity verification using data from reliable sources. This same watchlist data also includes information from various independent data sources to ensure accuracy and completeness.

Validate the Data

After collecting data from multiple sources, the next step is to mine a comprehensive database and validate its accuracy financial integrity, and reliability. This involves cross-referencing the collected data with other reputable data sources to confirm identities and eliminate any inconsistencies or errors.

Risk Screening

Once the data is validated, the system scans individuals or entities against various watchlists, including global crime and sanctions lists from transnational agencies and governmental ones. These global watchlists contain information about prohibited individuals or businesses involved in activities like money laundering, terrorism, human trafficking, and arms trafficking.

The lists may include the Department of Foreign Affairs and Trade, Consolidated List of European Union, OFAC’s Specifically Designated Nationals and Blocked Persons, Bank of England Sanctions List, European Union Terrorism List, World Bank Ineligible Firms List, FBI Most Wanted Terrorists and Seeking Information List, and PEP Lists.

Read more: What is the AML risk assessment process?

Investigate the Results

When a possible match is identified with any of the watchlists, the financial institution conducts further investigation to confirm the match, identify actual risks, and evaluate the level of risk associated with financial transactions with the individual or entity. This may involve gathering additional information or conducting background checks to make informed decisions.

Recordkeeping and Reporting

Financial institutions and businesses are required to maintain records of the comprehensive screening process, including any matches found and the actions taken in response. This documentation ensures transparency of customer screening and compliance with regulatory requirements.

Additionally, institutions may be obligated to report matches to relevant law enforcement authorities as part of their regulatory obligations.

Read more: What is a Suspicious Activity Report (SAR)?

Continuous Monitoring

Watchlist screening is an ongoing process that requires continuous monitoring of individuals and entities by the regulatory system. This helps the financial industry and institutions stay vigilant against emerging risks and ensure compliance with evolving regulations.

Regular updates to watchlists and sanctions screening programs and periodic reviews of screening procedures are essential to maintain effectiveness in combating financial crimes.

Read more: What is transaction monitoring?

Choosing the Best Watchlist Screening Solution

There are two main methods for conducting watchlist screening: manual review and automated software. While manual and automated watchlist screening relies on human effort and attention to detail, automated software is gaining popularity for its speed and precision.

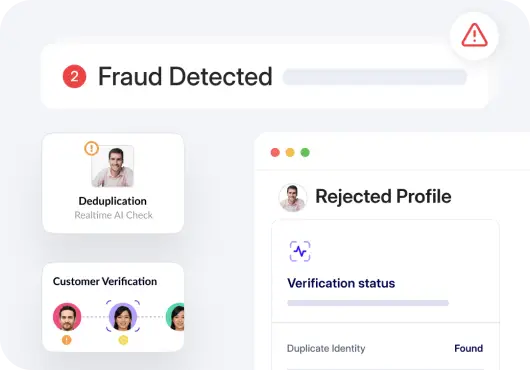

This software employs advanced technologies like artificial intelligence and machine learning to swiftly analyze vast amounts of data, pinpointing matches with watchlists. By employing automated screening, companies can effectively lower the risk of financial crimes, decrease false alarms, and simplify their compliance procedures.

When selecting an automated watchlist screening software or risk-scoring solution, several factors should be considered to ensure it aligns with your organization’s needs and resources.

Customization Filtering

An effective global watchlist screening and solution should offer robust customization capabilities. This includes the ability to adapt watchlist screening software provider parameters to match specific organizational needs and risk profiles. Customization filtering allows fine-tuning of global watchlist screening, sanction screening, and criteria, assuring relevant matches are captured while minimizing false positives.

Look for a solution that provides customizable filtering options to refine search results according to your industry or risk profile. Including the screening process allows you to focus on specific criteria relevant to your organization’s requirements.

Performance and Speed

The efficiency of a top watchlist management and screening solution significantly impacts operational workflows and compliance efficacy. Opt for solutions that provide superior performance and speed, capable of smoothly processing vast volumes of data without compromising accuracy.

Advanced algorithms, parallel processing capabilities, and optimized database structures are indicative of a solution’s ability to deliver rapid results, and reduce operational costs by enabling real-time screening and minimizing operational disruptions.

Evaluate the performance operational efficiency and speed of the screening solution. Automated screening technologies employ artificial intelligence and machine learning algorithms to swiftly process large volumes of data. While automated screening offers speed, operational efficiency, and efficiency, manual screening provides a more thorough review, albeit at a slower pace.

PEP and Adverse Media Checks Along with Watchlist Checks

Comprehensive watchlist screening extends beyond traditional lists to include checks for politically exposed persons (PEP) and adverse media. An ideal solution should seamlessly integrate PEP and adverse media screening alongside watchlist checks, providing a picture of risk exposure.

Look for platforms that use advanced data analytics, AI, and machine learning algorithms to identify and flag entities with potential regulatory or reputational risks. The ability to collect data from diverse sources and conduct ongoing monitoring enhances compliance with regulatory authorities and mitigates emerging threats effectively.

Ensure that the chosen solution includes checks for Politically Exposed Persons (PEP) and adverse media in addition to standard watchlist checks. This comprehensive approach helps identify high-risk individuals or entities beyond traditional watchlist matches, enhancing the effectiveness of the screening process.

In Summary

At HyperVerge, We offer an advanced AML compliance solution for automating and enhancing watchlist screening and processes.

With customizable filtering, superior performance, and seamless integration of PEP and adverse media checks, our AML compliance program ensures accurate and efficient compliance with regulatory compliance requirements.

To learn more about how HyperVerge can assist your compliance needs. Sign up to see it in action!

US

US

IN

IN