The United Nations estimates that $800 billion to $2 trillion worth of illicit funds are laundered worldwide each year, highlighting the vast scale of this criminal activity.

Anti-Money Laundering (AML) regulations help you stay strategically fortified against the clandestine maneuvers of money laundering, terrorist financing, and financial crime. At the core of the defense against money laundering risk lies the AML risk assessment process, a systematic tool for identifying and mitigating money laundering risks.

In this blog, we’re decoding the key components and complexities of AML risk mitigation and assessment for financial institutions.

What is AML Risk Assessment?

But what, precisely, is the AML risk assessment? At the center of AML compliance, the AML risk assessment process emerges as the lodestar. This systematic dissection stands sentinel, deciphering and nullifying the looming threats of potential money laundering activities. It transcends the perfunctory realms of regulatory conformity, assuming the mantle of a guardian, fortifying the integrity of financial institutions against potential assailants.

The AML risk assessment process isn’t a mere elective; it’s an imperative born of regulatory requirements, difficulties, and a steadfast commitment to maintaining a robust brand image.

Read more:

- KYC and AML: Key Differences and Best Practices

- Anti-Money Laundering Checks Explained: Everything You Need to Know

What are the Key Risk Factors in Money Laundering?

Understanding the key risk factors in money laundering is essential for effective risk assessment. These factors encompass customer types, geographic locations, products and services, transactions, and distribution channels. Quantifying and categorizing these risks based on severity and likelihood is integral to the risk assessment.

Read more:

- What are the three money laundering stages?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

How to Perform an AML Risk Assessment?

As we navigate the intricate process of AML compliancerisk assessment, the question arises: How does one execute it? Let’s unravel the step-by-step process in detail:

1. Identify the Risk Factors

Start by identifying relevant risk factors specific to your industry and business model. Examples of commonly encountered factors for each category should be explored.

Think of Key Risk Indicators (KRIs) as your roadmap for financial transactions, highlighting areas susceptible to money laundering and terrorist financing (AML/CFT) risks. This involves meticulous documentation of all transaction data and factors such as:

- Customer/Client Profiles: Who do you do business with? High-risk industries, politically exposed persons (PEPs), and geographically sensitive locations demand closer scrutiny.

- Products and Services: Certain offerings, like cash transactions or wire transfers, inherently carry higher risks.

Read more:

- What is a customer identification program (CIP)?

- What is PEP screening?

- What is sanctions screening?

- What is Adverse Media Screening: A Step-by-Step Process

- What is Enhanced Due Diligence?

- A guide to anti money laundering laws in the US (2024 updated)

2. Assess Inherent Risk

Now, it’s time to assess the inherent risk associated with your business operations. This involves analyzing each KRI and gauging the risk-based approach and its potential for misuse for illicit activities. Consider factors like:

- Volume and nature of transactions: Large, complex transactions or those involving high-risk products warrant closer examination.

- Customer behavior: Unusual activity patterns, sudden changes in transaction frequency, or dealings with sanctioned entities raise AML red flags.

- Geographic exposure: Operating in high-risk jurisdictions necessitates heightened vigilance.

Combining these elements will give you a better and more comprehensive understanding of your inherent risk landscape.

3. Build a Risk Model

A well-structured anti-money laundering risk model is a framework for analyzing relevant data and scoring potential risks together. Key elements include data sources, risk factors, and weighting mechanisms relevant to the data used.

After identifying key risk indicators and assessing inherent risks, you can leverage a risk model to quantify these risks and prioritize your resources effectively. This model essentially translates qualitative risk factors into numerical key risk indicators and scores.

Here’s how the model works:

- Selecting Risk Factors: Choose the most relevant KRIs identified earlier that significantly contribute to your overall risk profile.

- Assigning Weights: Assign weights to each factor based on its significance, likelihood, and potential impact. For example, a high-risk customer profile might carry a greater weight than using a specific product.

- Defining Scoring Methodology: Determine how individual risk factors will be combined to generate a composite risk score. This could involve simple addition, weighted averages, or more complex statistical methods.

- Setting Risk Tiers: Establish different risk tiers (e.g., low, medium, high) based on the calculated score ranges. This helps categorize customers and transactions for applying appropriate control measures.

The following are some benefits of a Risk Model:

- Objectivity: Provides a data-driven approach to risk assessment, reducing subjectivity and bias.

- Prioritization: Enables efficient allocation of resources by focusing on higher-risk areas.

- Consistency: Ensures consistent application of controls across different customer segments and transactions.

4. Mitigate and Control Risks

Once the inherent risks are identified in a financial system, it becomes imperative to then implement controls to fortify our defenses. These controls may take the form of:

- Elevated Customer Due Diligence (CDD): Enforce stringent verification protocols tailored to high-risk individuals.

- Transaction Monitoring: Integrate sophisticated systems capable of discerning intricate patterns indicative of suspicious activity.

- Reporting: Timely and diligently file Suspicious Activity Reports (SARs) to competent authorities.

It’s pivotal to remember that the efficacy of comprehensive risk assessments, mitigation measures, and internal controls lies in their dynamic nature. Regular reviews and updates are critical for their effectiveness.

5. Monitor and Review

Even after implementing controls, the residual and risk level persists. While doing so, consider factors like:

- Control effectiveness: Are your controls adequately designed and implemented to address the targeted risks?

- Monitoring efficacy: Are your monitoring systems capable of capturing suspicious activity effectively?

- Reporting efficiency: Is your SAR filing process timely and accurate?

A thorough risk evaluation of residual risk helps you identify areas for further improvement in risk assessments and risk mitigation measures and efforts and ensures your compliance program remains robust.

6. Reporting

Document the entire risk assessment process comprehensively. This report becomes a vital record for regulatory scrutiny, showcasing your dedication to AML compliance. Remember, conducting and enhancing AML risk assessment is an ongoing journey, requiring regular revisitation and updates. Learn more about BSA and SAR reporting and international watchlist screening best practices here.

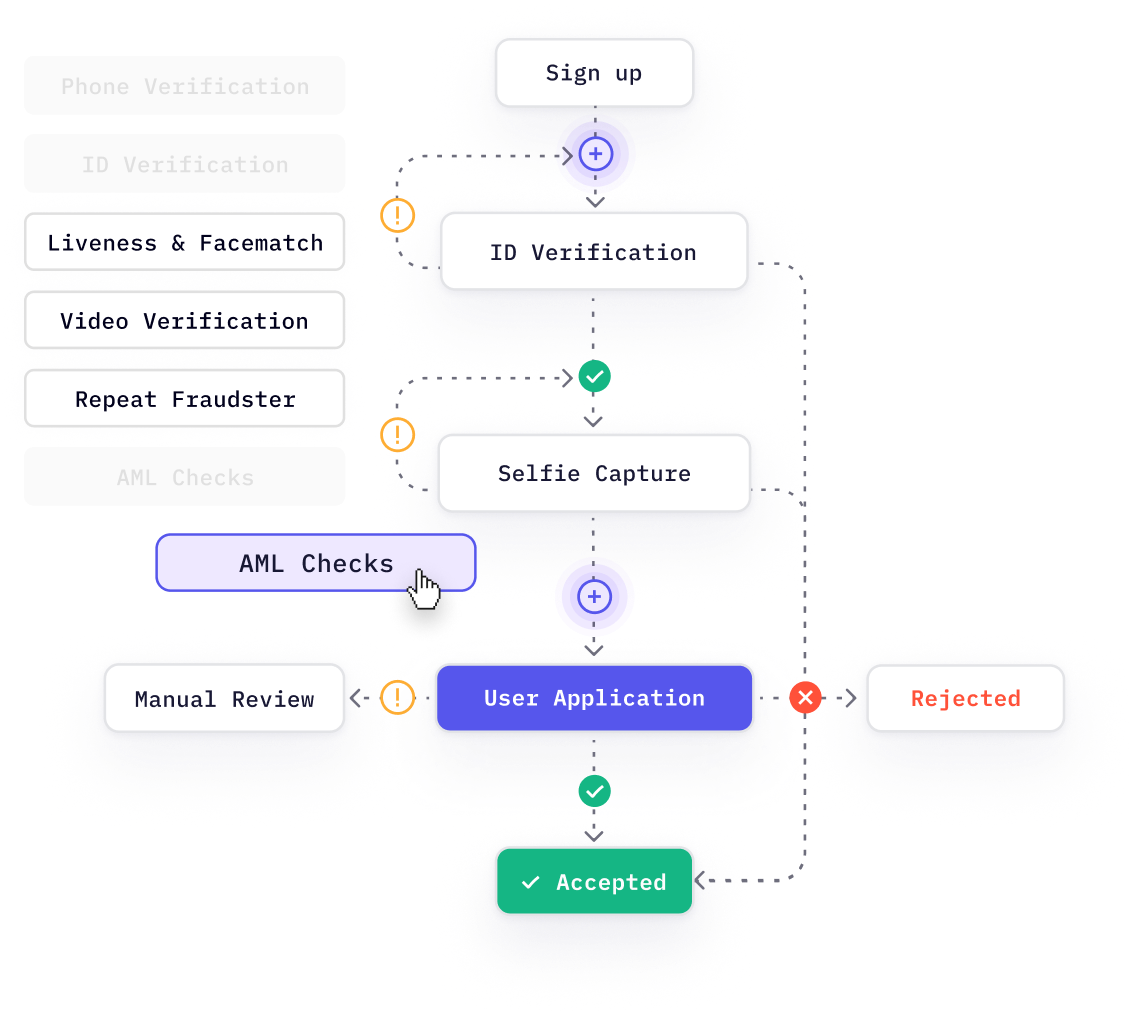

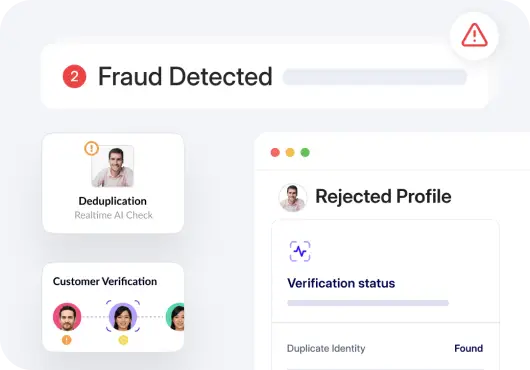

Optimize AML Risk Assessment with effective AML Solutions

HyperVerge’s AML solution helps you identify risk, ensure compliance, assign risk scores, enhance risk scoring accuracy, and attain regulatory compliance.

Want a reliable companion in your battle against financial crimes? Talk to us today.