In business, establishing new business relationships is important yet ensuring compliance with Anti-Money Laundering (AML) laws is equally crucial to avoid issues like fraud and financial crimes. Know your customer (KYC) procedures can be employed to verify the identities of the customers. This can help companies escape from paying the regulatory fine or becoming victims of fraud.

Now with eKYC, this process can be conducted online. The two main types of KYC customer due diligence (CDD) and Enhanced due diligence (EDD) assess the risks of customers. CDD is used for customers with low risk and EDD is employed for high-risk customers.

These two procedures play an important role in assessing customers’ risk profiles, identifying suspicious transactions, and preventing money laundering.

What does EDD (Enhanced Due Diligence) mean?

Enhanced Due Diligence (EDD) is a KYC verification process designed to assess a customer’s risk level and monitor significant financial transactions. It employs a risk-based approach to identify high-risk customers who may not be detected through standard CDD procedures.

Enhanced Due Diligence is usually mandated for customers flagged as high-risk or with high net worth because they can carry out large, risky transactions. Therefore, financial institutions go one step above CDD and perform EDD to properly examine the customer.

Why is EDD Important?

As technology evolves, fraudsters are discovering new ways of money laundering. As a result, businesses also need to use the latest technologies to combat these cybercrimes. Hence, EDD helps in the fight against money laundering.

The Patriot Act of 2001 made EDD a compulsory procedure in collaboration with the Bank Secrecy Act. EDD is useful for high-risk cases where large sums of money are at stake, risks that may evade detection through CDD alone. Companies can stay ahead of emerging threats by continuously refining and adapting their EDD practices. This will help them safeguard their reputation and prevent money laundering.

CDD vs EDD

Customer Due Diligence (CDD) serves as the basic level of due diligence for all customers irrespective of their risk level. It is used to verify the identity of the customers and their associated risks are measured. This diligence targets the customers who are considered to have a low-risk profile. CDD procedures involve collecting basic information about the customers such as name, address, and identification documents which should be verified against reliable sources.

Enhanced due diligence (EDD) is considered for customers with high-risk factors. The high-risk customer is subjected to a thorough inquiry by employing additional verification steps. This aids in the proper evaluation and monitoring of the business relationship. EDD requires additional verification steps such as background checks, adverse media searches, analysis of funding sources, and, in some cases, on-site visits to verify business operations.

In summary, both CDD and EDD work to meet the regulatory requirements and reduce financial risks. However, EDD is stricter and focuses on high-risk customers and transactions, providing more thorough checks compared to CDD.

When do companies need EDD?

Companies need EDD when dealing with high-risk clients. These high-risk customers may be

- Politically Exposed Persons (PEPs) or clients who may be closely associated with any PEP

- Clients with a previous track record of financial crime

- Any organization in a sector that is at high risk of money laundering

- Clients undertaking unusually complex or large transactions

- High net-worth individuals

- Shell corporations

- Ultimate beneficial ownership (UBO)

- Any business that originates from the list of high-risk third countries

- High-risk Countries that have sanctions declared against them

Financial institutions need to be extra careful when doing business with such clients. Hence they should employ edd methods to minimize any risks.

Read more:

- What are the AML red flags?

- What are the three money laundering stages?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

Enhanced due diligence procedures: Step-by-step approach

To leave nothing to chance, many steps are followed during the EDD verification process. Here’s a list of the major edd measures.

1. Employ a risk-based approach

A risk-based approach will help us identify high-risk clients. It is important to identify the risk factors that are important for the EDD process. These factors include the individual’s country of origin, company’s type, and reputation. The Financial Action Task Force (FATF) recommends that companies, especially financial institutions, conduct EDD as part of AML compliance to stay away from businesses/persons engaged in money laundering.

Read more:

- AML risk assessment process: a step-by-step process

- What is a customer identification program (CIP)?

- Anti-Money Laundering Checks Explained: Everything You Need to Know

- KYC and AML: Key Differences and Best Practices

2. Analyzing source of funds and UBO (Ultimate Beneficial Ownership)

To verify the legitimacy of the source of wealth, both the non-financial and financial assets of customers are evaluated. In case of inconsistencies between the actual earnings and overall net worth, the customer may be flagged as unsuitable by the team conducting the EDD process.

Subsidiaries and shareholders of businesses also get assessed to determine the UBO (Ultimate Beneficial Ownership) of the customer’s organization.

Read more:

- What is sanctions screening?

- What is PEP screening?

Verifiable adverse media searches

Information published by reputed media houses plays a pivotal role in uncovering the secrets of a business or an individual customer. While performing EDD, press articles related to high-risk customers are thoroughly reviewed for red flags. Consequently, this type of research helps to build a detailed customer profile. A negative result indicates that the person or company’s risk level is high. In the event of too many negative reports, financial institutions are alerted about the risk involved in doing business with the evaluated customer.

Read more:

- What is Adverse Media Screening: A Step-by-Step Process

On-site visit

On-site verification is essential for banks and financial institutions. There have been numerous cases where individuals claim a single room in a building as their office to secure loan approvals. Once the amount is credited to their account, these customers avoid the authorities.

Hence, teams conducting EDD cross-reference the physical address provided with the one stated in the submitted documents. In case of discrepancy, the risk-based threshold is deemed as breached.

Read more: what is an address verification service?

Monitoring ongoing transactions

To understand customers properly, it is important to check transaction details closely and understand their purpose and nature. Financial institutions keep this in mind while performing EDD. They also keep an eye on other crucial details like processing time, interested parties, etc. to study customer behavior. Even the purpose of scheduled transactions gets checked to ensure that they are within the expected threshold.

Read more: What is transaction monitoring in AML?

Preparing reports for further investigation

At the end of the assessment, a comprehensive report is drafted about the customer for future reference. It is worth noting that such reports are developed based on a score-based system, and customers with high scores are approved and considered eligible for business dealings with the organization.

All the reports are stored on a secure server to easily be accessed whenever regulators want. The data is stored by the GDPR (General Data Protection Regulation) norms, thereby ensuring the security of confidential information.

Read more: What is a Suspicious Activity Report?

Conclusion

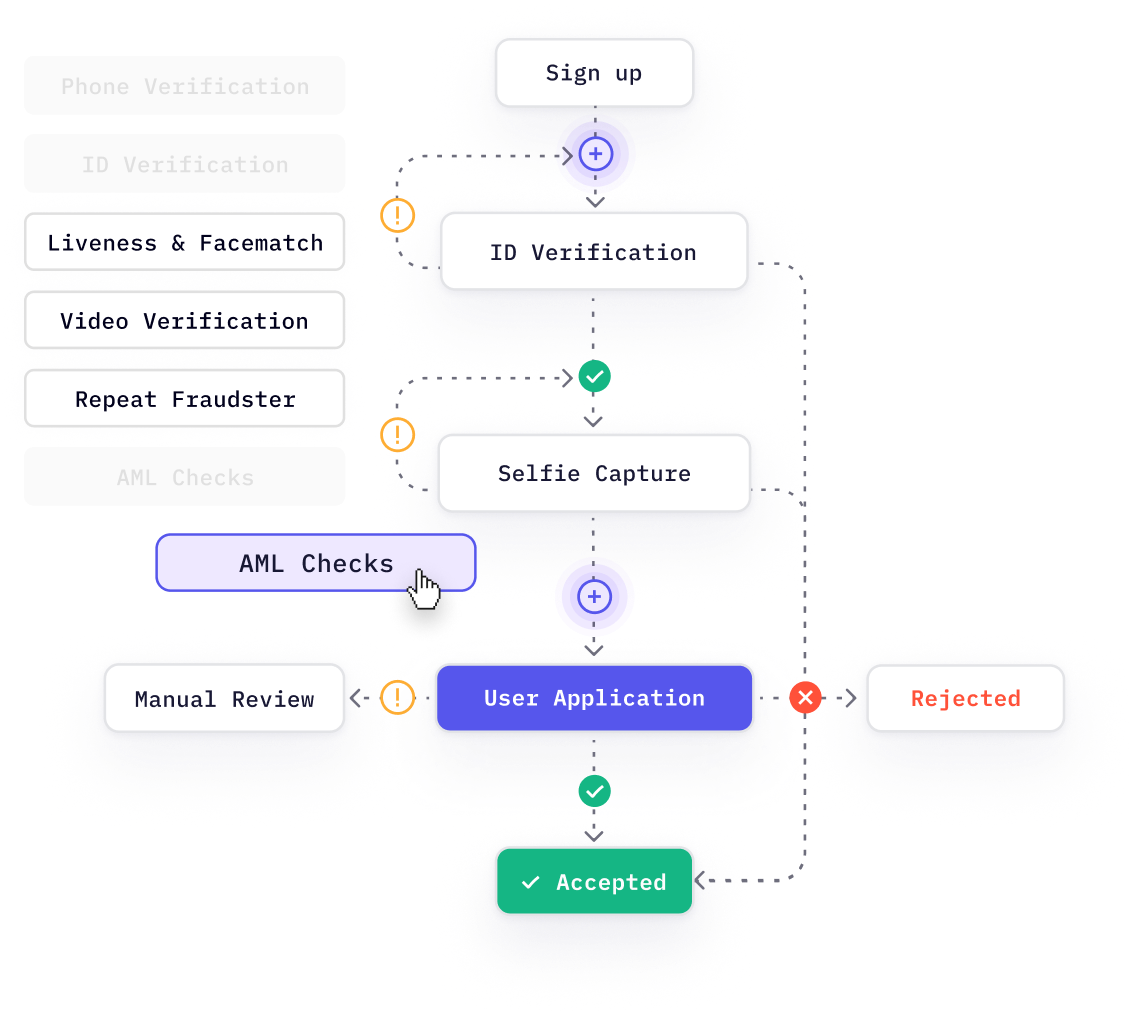

In the recent past, problems related to fraud, cybercrime, money laundering, etc., have been agonizing for financial institutions, and that’s why both eKYC and continuous monitoring procedures are strictly followed before getting a customer on board as a part of AML compliance.

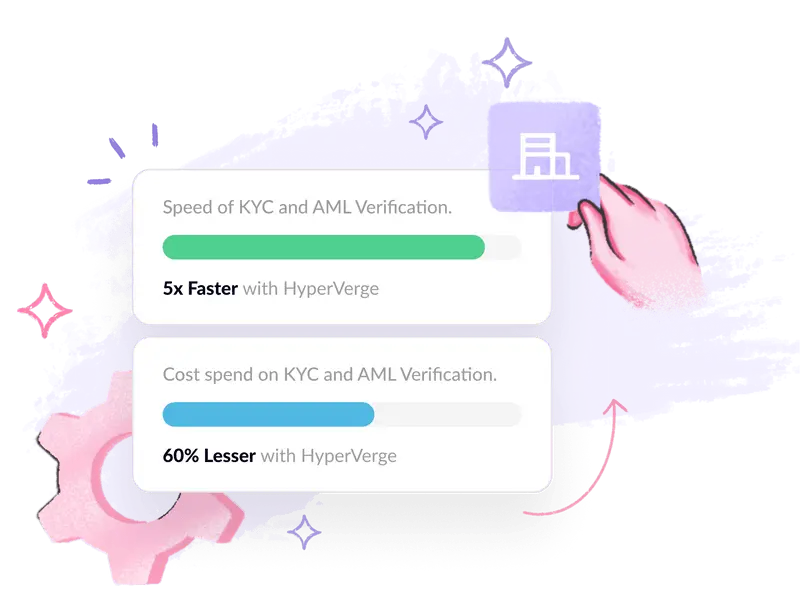

HyperVerge can provide AML solutions compliant with regulations. With cutting-edge AI and machine learning technologies, Hyperverge automates the EDD process seamlessly. Sign Up to take the first step towards a safe, compliant future.

Read more: Best AML software and how to choose one

FAQs for Enhanced Due Diligence (EDD)

1. What is EDD?

EDD is a KYC verification process. It is designed to assess customer’s risk levels. It can monitor significant financial transactions. It employs a risk-based approach to identify high-risk customers.

2. When do companies need to conduct EDD?

Companies need EDD for high-risk clients. These high-risk customers may be Politically Exposed Persons (PEPs) and high net-worth individuals and individuals with a history of financial crime. This list also includes businesses operating in high-risk countries. Therefore, for these high-risk consumers, enhanced due diligence measures should be taken by the financial institution to verify the legitimacy of the customer and also to prevent criminal activity.

3. What is the Difference between EDD and CDD?

CDD verifies the identity of customers. It also assesses their risk level. EDD involves additional verification steps for high-risk customers. While CDD is a baseline requirement, EDD is reserved for higher-risk customers and transactions. Hence it requires more thorough checks and analysis to mitigate potential financial crime risks effectively.

4. What are some key EDD procedures?

EDD procedures include employing a risk-based approach to identify high-risk clients. Then we have to monitor ongoing transactions to detect suspicious activity. We can conduct verifiable adverse media searches to uncover potential red flags. The companies should analyze the source of funds and ultimate beneficial ownership (UBO). On-site visits should be performed to verify business operations. The companies should prepare comprehensive reports for further investigation and regulatory compliance.

5. What are the consequences for financial institutions that fail to conduct Enhanced Due Diligence (EDD) on high-risk customers or transactions?

Financial institutions can face severe consequences if they neglect EDD procedures for high-risk customers or transactions. This includes regulatory fines, reputational damage, and legal action. Also, institutions expose themselves to increased risk of money laundering, terrorist financing, and other financial crimes.