Money laundering is the process of taking ill-gotten money, or dirty money as it is also called, and engaging in illegal activities to hide or use the money. It usually involves some person who has acquired illicit money and makes those illegal funds appear as if they have used legal activities to gather them.

The money laundering process involves masking the source of these illicit funds by moving money between different accounts and financial institutions to create a complicated series of transactions. Therefore, it poses a massive challenge for authorities to trace the money back to its initial source and identify this financial crime.

Therefore, it poses a massive challenge for authorities to trace the money back to its initial source and identify this kind of financial crime.

What Are the Three Stages of Money Laundering?

Laundering illegally obtained funds is not a straightforward process. Launderers have to follow a layering process to effectively hide the money. As such, there are three different stages involved in creating laundered funds and layering is the second one.

Let’s take a look at the three money laundering stages, namely:

1.Placement:

This is the first stage of money laundering wherein financial criminals obtain illicit funds and transfer them into the legitimate business accounts of their family, friends, or associates, among other accomplices. In the placement stage, money mules break down large sums into smaller transactions to evade attention and deposit alerts. These transactions fall within the cash limit threshold. Transferring cash from these companies with the help of counterfeit invoices is one of the widely-used practices. This way, the money is funneled through the legal system, helping them elude scrutiny.

2.Layering:

This is the second stage of money laundering wherein illegitimate funds are first introduced into the financial system and later transferred into financial institutions, thereby masking the source. In the layering stage, money launderers purchase diverse liquid investment instruments using the illegally obtained amount. Detecting the source of illegal money, therefore, becomes very difficult.

3.Integration

This is the final stage where the money launderers inculcate the illegitimate into the legitimate ecosystem. Real estate, stocks, securities, jewelry, precious metals, or other luxury goods can integrate laundered money into the financial system.

What is Layering in Money Laundering?

As mentioned earlier, layering is the second stage of the money laundering process. A money launderer will execute a series of transactions with ill-gotten funds to cover up the initial source. Layering is a financial crime wherein the transaction history is manipulated to look legal and convincing enough so that it becomes difficult to find traces of the original illegal funds.

Techniques of Layering in Money Laundering

Now, let’s get some insights into how money laundering works by understanding the techniques a money launderer uses to carry out layering:

Complex Financial Transactions through Intermediaries: Launderers usually use intermediaries to carry out these types of financial transactions. Electronic cash transactions to foreign parties are a common ruse to handle laundered money.

Offshore Banking and Shell Companies: A money launderer uses offshore bank accounts, specifically in countries with fewer or lax AML regulations. Shell companies/Foreign shell banks in regions notably known as tax havens are also used to layer complex transactions.

Trusts and Multiple Bank Accounts: Establishing trusts is an easy way to hide the initial source of illicit money. These trusts use numerous bank accounts across various jurisdictions to complicate the original traces of the funds.

Real Estate and Precious Metals: Launderers invest in foreign assets like real estate and precious metals to conceal the paper trail.

Trade-Based Money Laundering: Fake invoices and shipping documents are effectively used in transferring money to international markets.

Cryptocurrency Trading: Cryptocurrencies have been increasingly used for structuring or layering.

In-bank Transfers: Launderers use electronic money transfer mechanisms to shuffle illegal funds between self-controlled multiple accounts. This creates confusion for authorities when attempting to conclude whether these funds are obtained from ill-gotten means.

Read more:

- What is Trade-Based Money Laundering?

- What is Smurfing and How You Can Prevent it Proactively

Indicators of Layering in Money Laundering

Money launderers are always looking for new methods to exploit the financial system. Finding loopholes and subsequently carrying out schemes to launder illegally obtained money helps them eventually transfer the illegally acquired funds to legitimate accounts and disrupt the financial ecosystems.

However, certain vigilant measures can be used for identifying suspicious transactions to launder money.

Recurring Transactions for Exact Amounts

Multiple transactions of specific amounts can be a key indicator of layering. Alternatively, a money launderer may conduct a series of transactions that fall just below the reporting threshold. This helps them launder money into the legitimate economy with the use of existing financial instruments.

Rapid Transfers Within an Account

Another key indicator is when money is being deposited and withdrawn frequently from a specific account. Alternatively, money transferred between numerous bank accounts within the same organization may indicate money laundering layering.

Frequent Use of Uncommon Deposit/Transfer Methods

Money launderers often use a blend of financial instruments like money orders, wire transfers, and traveler’s cheques to execute money laundering layering. By doing this, they escape scrutiny and make it difficult for authorities to audit the funds properly. However, if a person uses these techniques regularly, it may indicate involvement in structuring.

High Volume of International Transactions

Money launderers or criminals often move funds through different countries to avoid scrutiny. In some jurisdictions, they usually leverage the benefits of lax AML (Anti-money laundering) systems. Further, they convert it using Forex facilities or invest in shell companies to confuse the money trail.

How to Prevent Layering in Money Laundering?

Money laundering is a global issue, and an estimated sum of 2-5% of the global GDP, or USD 800 billion to USD 2 trillion, is laundered annually. Therefore, AML systems have been established in financial programs (especially in the banking system) to fight money laundering activities and counter-terrorist financing. (Bank Secrecy Act, USA Patriot Act, Corporate Transparency Act (CTA), and Anti Money Laundering Act, to name a few).

Strict adherence to these measures helps detect suspicious transactions and combat money laundering.

Customer Due Diligence

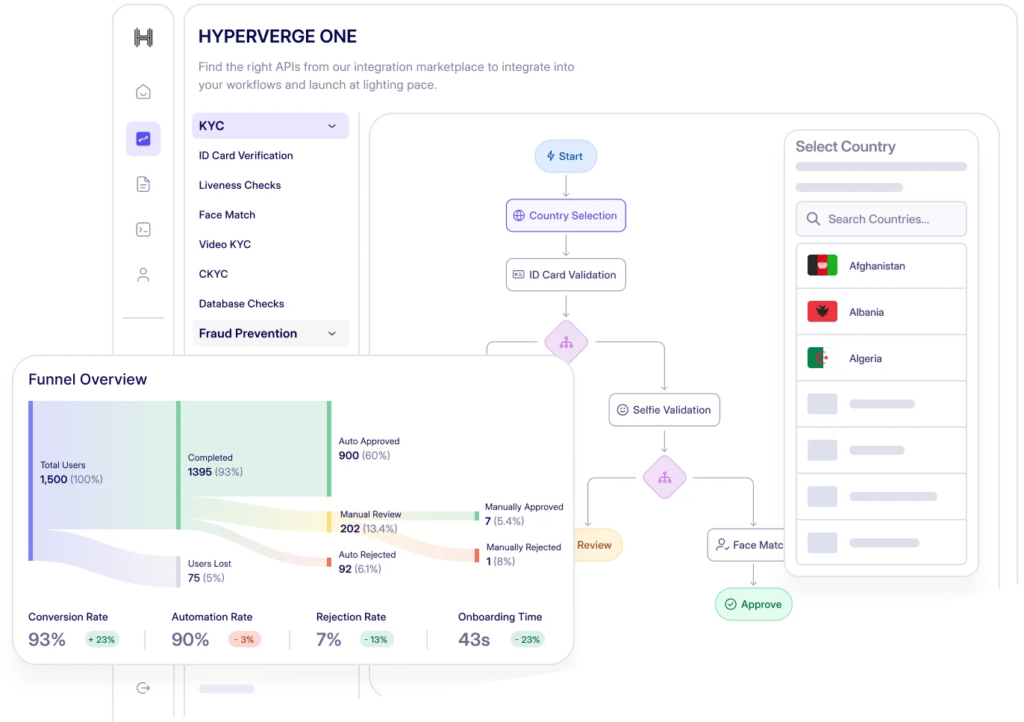

Customer Due Diligence (CDD) helps financial institutions adhere to AML regulations. This includes Know Your Customer (KYC), Enhanced Due Diligence (EDD), and identification of Ultimate Beneficial Owners (UBOs). By using these tacks, regulated entities can detect and mitigate the risk of using their financial portals for exploitation and any consequent money laundering scheme. In addition, customers are screened against sanctions lists and identified for possible connections with politically exposed persons (PEPs) or financial crimes.

Continuous Monitoring

Frequent and continuous real-time customer transaction monitoring is key to preventing potential structuring. Law enforcement agencies can chalk out suspicious activities by consistent vigilance that indicates the possibility of money laundering layering. Further, customer behavior and constant AML risk assessments help identify complex patterns in the potential laundering of funds. In addition, addressing emerging threats and vulnerabilities while adapting to the latest AML laws are primary factors that help in maintaining effective compliance.

Read more:

- What is sanctions screening?

- What is pep screening?

- What is Adverse Media Screening: A Step-by-Step Process

Documentation and Reporting of Suspicious Activity

Monitoring systems should incorporate comprehensive documentation and any potential risk indicators must be immediately shared with the higher-ups, regulatory authorities, and law enforcement agencies. This helps identify money laundering of dirty money, fortify financial systems, and facilitate proper audits. This also assists in identifying AML red flags or anomalies to prevent money laundering.

Read more: What is a Suspicious Activity Report?

Prevent Money Laundering with Effective AML Solutions

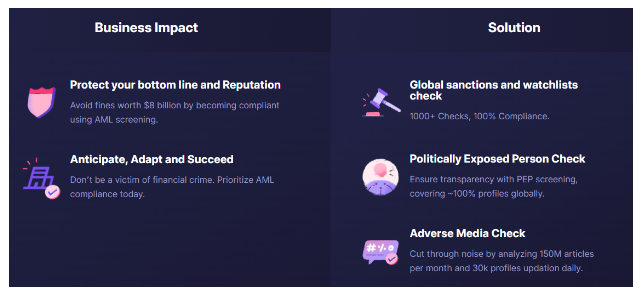

Financial crime is evolving rapidly, helping money launderers in converting cash into legitimate money. Therefore, businesses need robust solutions to tackle money laundering and protect the legitimate financial system. HyperVerge emerges as the primary choice for AML compliance with its intuitive AML solution that not only protects your bottom line but also helps elude potential fines amounting to over $8 billion.

The AML solution incorporates 1000 AML checks with 100% compliance in line with global sanctions and watchlist checks. It also considers Politically Exposed Person (PEP) screening covering (100% of profiles globally) while its Adverse Media Check feature analyzes 150 M articles per month and updates 30K profiles daily.

HyperVerge’s system cuts false positives and helps ascertain a complete risk profile, leading to accurate AML screening. Add to it flexible pricing, technical support, and a 4-hour integration process. HyperVerge is an effective AML software that fits right into your compliance framework. To learn more, get a demo.

US

US

IN

IN