Smurfing is an illicit financial strategy, which involves breaking large sums into multiple smaller transactions to evade detection in money laundering operations. This method leverages the vulnerabilities in financial systems and presents a significant challenge for regulatory authorities.

Enhanced Due Diligence, Transactional Monitoring, Customer Due Diligence, prompt audits, and collaboration with law enforcement agencies can significantly help reduce the risk of smurfing and consequential money laundering.

In this piece, we shed light on the detrimental effects of smurfing, which adversely affect financial institutions and banking verticals. Further, we will delve deep into emerging tacks that help combat smurfing and negate its harmful effects.

What is smurfing in money laundering?

Smurfing is a financial crime designed to avoid detection by thresholds and conceal the origin of illicit funds. Smurfs, or money launderers, discreetly divide large transactions into smaller transactions and multiple bank accounts to avoid detection. These transactions are often below the reporting threshold in order to avoid regulatory scrutiny and the serious consequences associated with their illegal activities.

Smurfing poses serious risks for both the smurfer and their accomplices. For the main account holder, engaging in smurfing can lead to legal repercussions, including hefty fines and imprisonment. Money mules play a critical role in these complex detection efforts by distributing funds across various accounts.

How does smurfing affect various industries?

Smurfing can have severe detrimental effects on financial institutions and ecosystems. It’s not only related to AML compliance — it also involves protecting the integrity of financial systems and significantly thwarting economic threats.

A recent report by the United Nations Office on Drugs and Crime (UNODC) implies that global money laundering estimates rank between 2% to 5% of the global GDP, meaning multi-billions of dollars in general.

Finance and banking verticals need to invest in effective anti-money laundering (AML) controls, meet their regulatory obligations, and considerably reduce the negative effects of money laundering.

Smurfing affects a broad range of industries. For example, iGaming platforms and financial institutions have to constantly deal with the challenges of tracing funds laundered through Smurf networks. Money Services Businesses (MSBs) have to enable risk-based approaches to AML, based on their operational workflows.

Real estate firms and crypto exchanges are also impacted significantly due to Smurfing. Thus, implementing stringent AML measures across industries helps curb smurfing and its relevant risks significantly.

Smurfing is often used in online gaming communities, where players can easily create secondary accounts to conduct transactions without attracting suspicion. The competitive nature of online gaming provides an ideal environment for smurfers to operate without detection.

Smurfing vs. structuring

Smurfing and structuring have different objectives and execution methodologies. Smurfing is used to disguise the nature and origin of funds to evade regulatory scrutiny.

Whereas, structuring is a method used to bypass the reporting requirements. It involves splitting larger deposits into smaller amounts, usually executed by an individual, to eschew triggering reporting requirements.

However, both smurfing and structuring are considered criminal offenses as they violate AML regulations and compromise the integrity of our financial systems.

How is smurfing carried out?

Smurfing is executed by individuals known as Smurfs or money mules. Their objective is to integrate illicit funds into the legitimate financial system. Once the funds are successfully laundered, they are usually consolidated back into a single account.

The smurfing process can be divided into three primary stages:

Placement stage: This is the initial stage where a significant amount of illicit money is fragmented and distributed across various accounts. Criminals often use standard user accounts on real-money gaming platforms to convert larger sums into multiple smaller deposits, to reduce suspicion.

Layering stage: Here, the funds are shuffled between various bank accounts to create confusion, thereby making it difficult to trace the origins and track their movement.

Integration stage: In this step, criminals reintroduce the laundered funds back into the legitimate financial system. They may invest in assets like art or real estate to showcase as if the money originated from legal sources.

How to detect and handle smurfing?

The Bank Secrecy Act, incorporates the requirements of the USA PATRIOT Act so that banks or financial institutions implement a customer identification program (read CID).

Regulatory authorities have established clear reporting thresholds to discourage such activities. The PATRIOT Act set forth reporting requirements for any financial transactions exceeding $10,000. When transactions exceed the mentioned thresholds, financial institutions have to submit a Currency Transaction Report to law enforcement agencies.

In the banking sector, smurfing helps launder money obtained from criminal activities. Financial institutions need to compulsorily report any transactions over a certain amount so that criminals cannot sidestep this scrutiny.

Addressing smurfing necessitates a concrete regulatory framework from financial institutions. Detecting smurfing often requires the identification of patterns of suspicious behavior while scrutinizing reporting requirements and enabling efficient anti-money laundering systems.

Best practices to prevent smurfing

Organizations can proactively identify and reduce Smurfing-related risks by implementing the following mentioned practices. This will help them considerably meet the regulatory requirements and mitigate the risks associated with money laundering.

Conduct risk assessments

Regular risk assessments are imperative to trace potential susceptibilities. Implementing robust AML policies helps mitigate these risks and ensure adherence to standards. They also assist in the identification of vulnerabilities and gaps in their systems, processes, and controls.

Read more:

- What is sanctions screening?

- What is pep screening?

- What is Adverse Media Screening: A Step-by-Step Process

Establish internal controls and AML policies

Based on thorough risk assessments, fintech and banking institutions need to implement custom controls and strategies. Enabling real-time transaction monitoring systems to quickly detect and report suspicious transactions is a must in identifying smurfing activities. This also involves assigning a dedicated officer to supervise Anti-Money Laundering (AML) initiatives and ensure compliance with regulatory requirements.

Execute Customer Due Diligence (CDD)

Conducting CDD procedures to confirm customer identities and evaluate transaction risk levels is key. For this, continuous monitoring and auditing mechanisms need to be implemented within the AML program to address potential infractions. In addition, robust Know Your Customer (KYC) measures help evaluate industry-specific risks and profile customers.

Continuously monitor and audit the AML program

Regular reviews and updates in line with the latest AML regulations will ensure effective detection and protection of their financial systems. Internal escalations, independent audits, exhaustive training, and excellent recordkeeping are vital in ensuring compliance effectiveness.

Read more : What is a Suspicious Activity Report?

In essence, effective anti-smurfing measures require a blend of tangible governance, thorough risk assessment, continuous monitoring, and functional risk-based strategies.

Proactively detect smurfing with advanced fraud detection

Comprehensive Know Your Customer (KYC) processes have emerged as a solid framework to help manage regulatory requirements for banks and financial institutions.

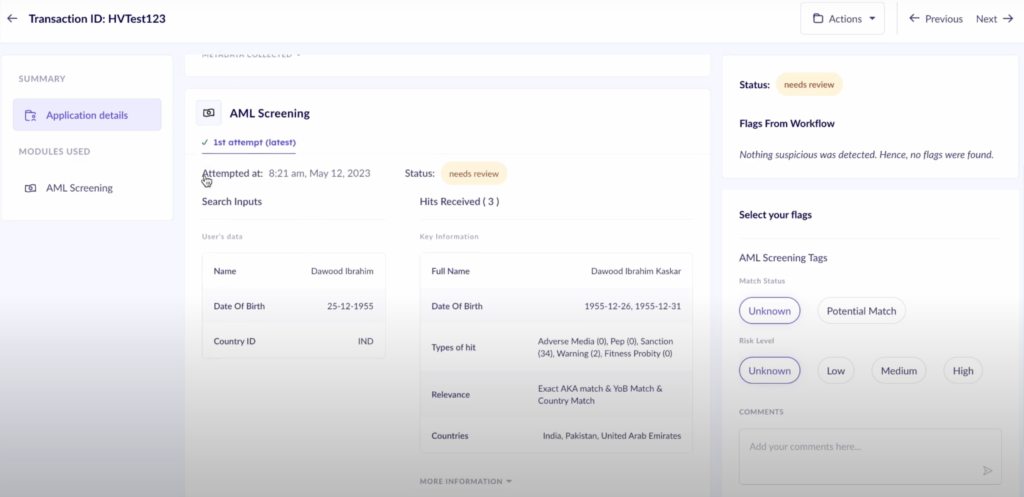

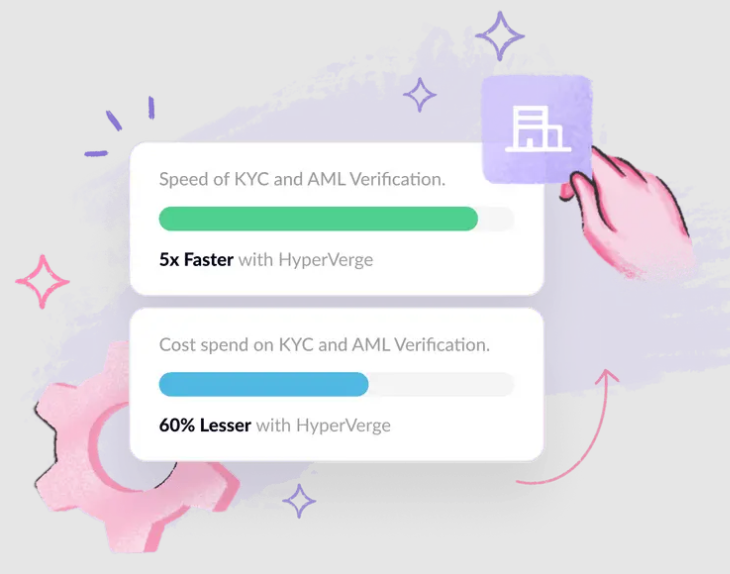

At HyperVerge, we offer a comprehensive AML Screening & Monitoring Solution, enabling organizations to identify customer risks and ensure AML compliance effectively. By providing real-time updates and comprehensive risk profiles, we enable seamless compliance and empower organizations to thrive in a dynamic regulatory environment with our AML software.

For a real-time demo, sign up here!

US

US

IN

IN