One of the biggest disadvantages of digitization or new-age technological advancement is the threat of losing personal identity forever.

While most companies ensure getting online agreements from their clients on their terms and conditions of using clients’ data for different purposes, the risk of losing control of your data and falling for different types of ID theft, hacking financial accounts, and cybercrimes is prominent.

What is identity theft?

Identity theft is the use of someone else’s personal or financial information or credit report for any illegal purpose like money laundering, mail ID theft, opening new accounts, mail identity theft, child identity theft, making any illegal purchases like loans or credit lines, or buying any expensive product that is offered with a buy now and pay later scheme using someone else’s identity.

As per a recent survey in the US, close to 2000 people were surveyed on their experiences with different thefts, identity theft, social media ID theft, SMS phishing, identity theft precautions they take now, and more. Federal Trade Commission helps protect people from deceptive or unfair business practices and promotes civil antitrust law and consumer protection.

The Federal Trade Commission, the Internal Revenue Service Agency in the US, and various local law enforcement agencies record more than a million cases every year while identity thieves continue to find nefarious ways of scamming people. Read on to learn about the different kinds of identity theft that exist, and we will also discuss how to prevent them.

Different types of identity theft

Let’s look at different types of identity thefts that happen worldwide and how you can safeguard yourself from becoming a victim of identity theft.

Social Security Number (SSN) identity theft

Social Security Number (SSN) identity theft is when somebody steals your social security number to misuse it in different ways; this may include taking more credit in your name, taking more loans, and not paying them back, eventually damaging your credit score.

Read more: How to detect and prevent social security identity theft?

Synthetic identity Fraud

Synthetic identity theft is when criminals create fake identity proofs using the victim’s real SSN or birth details and then use those proofs to commit illegal activities – this is called identity compilation. Another type of synthetic identity theft is when fraudsters combine the stolen information. For instance, they may use valid SSNs, credit reports, and original addresses with a different name and DOB – the most dangerous part of this type of theft is cause manipulation of ID proofs, which makes it even more difficult to track, as there is no actual person with that identity. Mostly, children/kids, old age people, and homeless people become victims of such crimes.

Child identity theft

As the name suggests, this type of fraud happens when someone uses a child’s identity to commit a crime. Identity thieves use a minor’s personal information, such as name, DOB, and SSN, to gain credits or do some illicit activities.

In most cases, when seeking loans or credit lines, the creditors do not verify the age; hence, these identity thieves take advantage of the system and misuse the IDs of a child. This type of identity theft can be disastrous.

From fraudulent bills in collections to a foreclosed mortgage, anything can be done using a stolen identity, which may not be found unless the child is mature or has been contacted by legal authorities.

In such cases, the victim of identity theft must collate all required documents like past bank account history, child’s credit report, bills, Internal Revenue Service (IRS) notices, or anything that is relevant and can help the as-and file it with the report at the nearest police station.

Read more: How to identify and prevent child identity theft?

Elder identity theft

The most common way of stealing the identity of elderly people is through phone calls. In these types of identity theft, scammers may pretend to be calling from a credit card company or an orphanage asking for OTPs or donations or tell you that you have won a lottery and then ask to transfer a fee online to claim that prize amount.

Senior citizens or elderly people are more vulnerable and easily become victims of identity theft as they are less exposed to technology and are likely to trust people more easily than millennials or GenZ.

This is where it is important to regularly check your credit reports, be regular in filing a tax return and securing your documents, keep seeking advice from identity theft protection service providers, and immediately seek help in case of any suspicious activity.

Medical identity theft

Medical identity theft happens when a person’s personally identifiable information (PII), mostly like a Social Security number or medical records, is stolen and misused for submitting a fake bill to a health insurer or an insurance company that the victim of identity theft has no clue about.

This type of identity theft can be very damaging and costly to the victim as medical treatments, insurance, and doctor consultancies are quite expensive in the state.

Fraudsters mostly take advantage of the process, as federal and state governments, along with national insurance carriers, don’t have a cross-checking team or protocols in place that could avoid such instances.

Financial identity theft

These types of identity theft happen when a fraudster uses another person’s personal information, such as a social security number or credit card number, to gain financial benefits in various ways.

These may include, but are not limited to, loans, credit card fraud or credit lines, taking a new credit card, or transferring money for illegal activities.

Regularly checking credit reports and credit card statements becomes imperative for any individual, entity, or organization. Anyone can be a victim of financial identity theft.

Read more about financial identity theft.

Account takeover fraud

This is one of the most common thefts where hackers or fraudsters use different techniques to hack someone’s account, create new accounts, and commit other frauds. Some of these techniques include:

- Phishing Attacks: This happens when fraudsters send emails, texts, or social media messages to influence people to click on those links, which makes it easier to identify their bank account or commit fraud.

- Session Hijacking: This can happen when someone’s online transaction session is hacked through brute-forced or reverse-engineered attacks to gain control of the user’s ongoing session. These activities are performed using the dark web, so they are not tracked or scanned by anyone.

- Social Engineering: This happens when victims are lured or tricked into sharing specific information or performing a task to earn money.

- Keylogging: Keylogging tracks a person’s typing history on a computer or mobile device. Fraudsters use this technique to run malicious scripts, mostly on online checkout forms, which helps them to transmit data into their devices from the users and then use it to their benefit.

Various ID theft protection service providers help victims of identity theft and potential victims, as well as organizations, keep a check on their transactions and bank updates to prevent such thefts.

Read more about strategies to prevent account takeover fraud.

Tax identity theft

This type of theft occurs when a fraudster uses someone’s personal information to file an illegitimate tax return or tax claim. In most cases, the victims do not get a tax identity theft fraud alert, making it even more challenging to learn about such fraud.

To safeguard and avoid loss of recovery, most citizens and organizations have started credit monitoring and taking benefits of identity theft insurance from identity theft protection companies or taking a standalone policy.

Estate identity theft

State identity theft happens when someone uses a deceased person’s personal information to create a financial account, open fraudulent accounts, or use their bank details to commit any illegitimate financial activity.

Various credit report monitoring service companies can help combat identity theft by checking previous records, scanning the dark web for SSNs that criminals may misuse, and helping the deceased’s family prevent such illegal use of the bank account details of the deceased person.

Employment identity theft

This type of theft is one of the most absurd and disturbing kinds of theft, where people use someone else’s personal details or social security numbers to apply for a job.

In most cases, people who do not have a citizenship status or have a checkered work history are the people who commit such thefts and use someone else’s identity to commit fraud.

Criminal identity theft

Criminal identity theft happens when someone steals a person’s personal identity details like name, date of birth, social security number, driver’s license number, bank account or credit card numbers, PINs, electronic signatures, fingerprints, passwords, or any other information to commit illegal or fraudulent purchases or to harm the victim.

There are three major credit bureaus – Equifax, Experian, and TransUnion that help manage your credit data to help you report dispute errors on your credit report and put a security freeze on your credit. Checking credit card statements regularly or using the latest protection technology can help prevent these thefts.

Unemployment identity theft

Unemployment insurance is a committed amount of money given to unemployed people provided they are unemployed for a defined time and the government provides them with money to support them.

Unemployment fraud happens when an identity thief claims unemployment insurance (UI) benefits using stolen personal identity proof from someone else. In such cases, the victim may be denied government benefits and may not be eligible for economic support.

Theft of physical IDs

This type of theft happens when someone steals hardcopies or original copies of someone’s personal identity proofs like lost or stolen passports, driver’s licenses, Social Security cards, or other forms of identification that can be used for illegitimate financial gain.

Home title identity theft

This type of fraud is most common in the real estate industry. This identity theft occurs when fraudsters use someone else’s details to forge a deed, steal their home, or apply for home loans in their names. This can lead to long-term credit damage to the victim.

Elderly family members or deceased people may become victims of identity theft.

Biometric identity theft

Fingerprints or facial recognition are the most common biometrics stolen by fraudsters to commit financial fraud, gain unauthorized gain, commit online shopping fraud, or open credit accounts that cannot be revoked. This type of theft is done through interception of the data’s transmission into a computer or storage device.

Ghost loan fraud

A ghost loan is a type of identity fraud done by taking a fictitious loan that is recorded in the books using someone else’s identity. These thefts are identified when debt collectors contact the victims for repayment of loans. Otherwise, it becomes tough to track. It’s better to contact law enforcement immediately in such cases.

Read more:

- What is document fraud?

- What is bank fraud detection?

- What is active vs passive fraud detection?

- What is payment fraud?

Strategies for individuals to protect themselves from identity theft

It’s unfortunate how criminals seek financial and other benefits from these frauds and let the victims suffer for life. However, it’s possible to prevent falling for these thefts and keep your families secure. Let’s look at the strategies that can help you keep safe.

Secure your account with a strong password

With a secured password, securing all your accounts, including email, bank statements, online banking, or even gaming accounts, is always better. Hence, it’s difficult for fraudsters to track your devices.

Multi-factor authentication

Many applications like Gmail have started using two-factor authetication that helps you ensure each transaction happening with your account and control all your synced applications and devices.

Scan your devices for malware

Many anti-virus software helps you scan all your devices for malware detection. This helps from online account hacking or synthetic identity theft and other thefts.

Phishing protection

Many phishing software help identify and block attempted phishing attacks before they pose a risk to any individual or organization. Mail theft or mail fraud may be similar to this type of fraud.

Strategies for businesses to prevent identity theft

Larger organizations require more precautions and better technology to secure themselves from theft. Let’s look at strategies to help you keep your worries at bay.

Find a trustworthy fraud detection solution

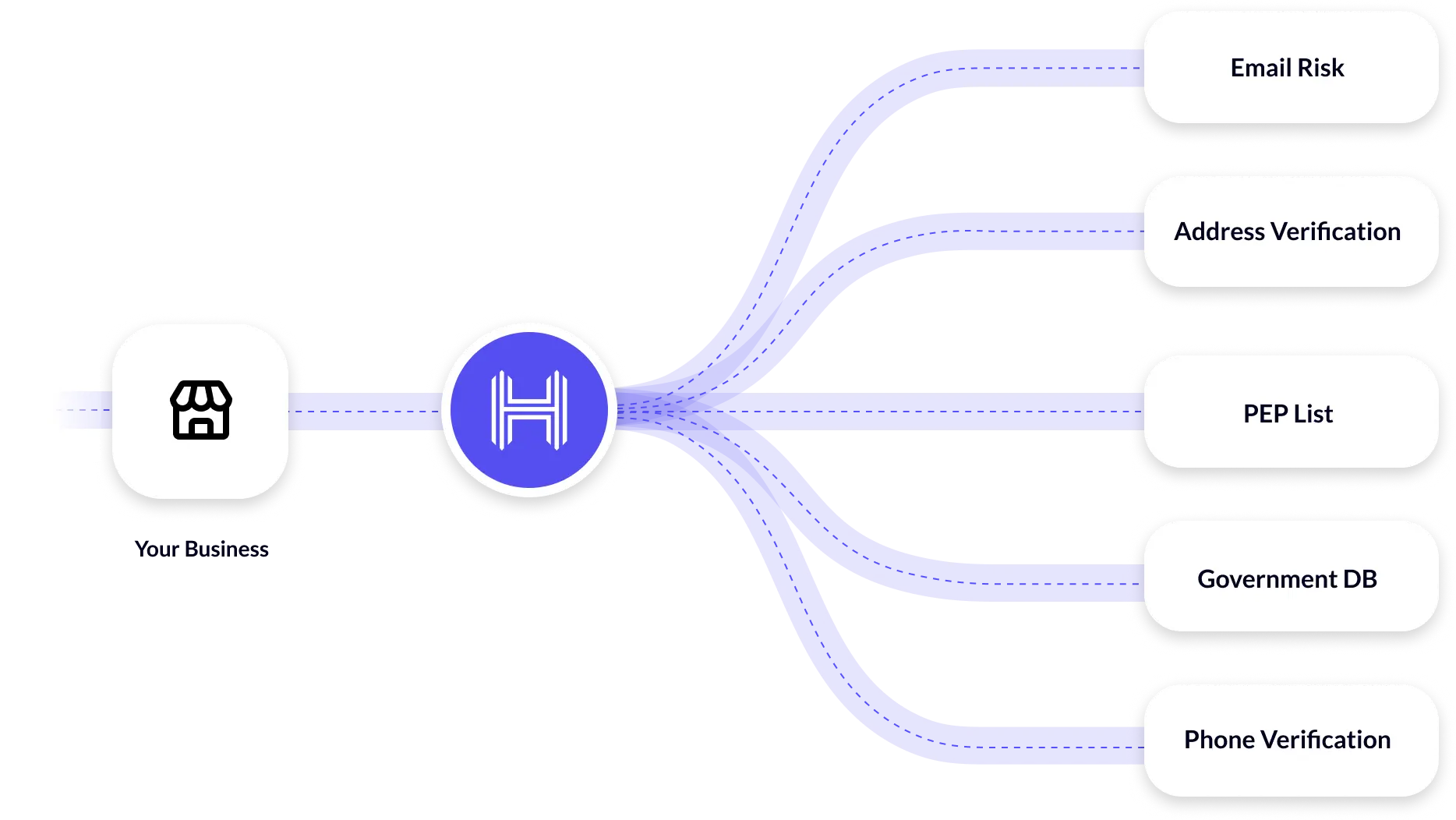

Various fraud detection software programs, such as HyperVerge, help prevent different types of ID theft. Many financial institutions, businesses, and organizations offering medical services use different fraud detection solutions to keep data security at par with the industry trends.

Implement biometric verification

Biometric verification is the process of scanning and using unique human characteristics to authenticate a person’s identity. These measures help to prevent physical theft, safeguard personal documents, and keep away from mail identity thefts and other thefts.

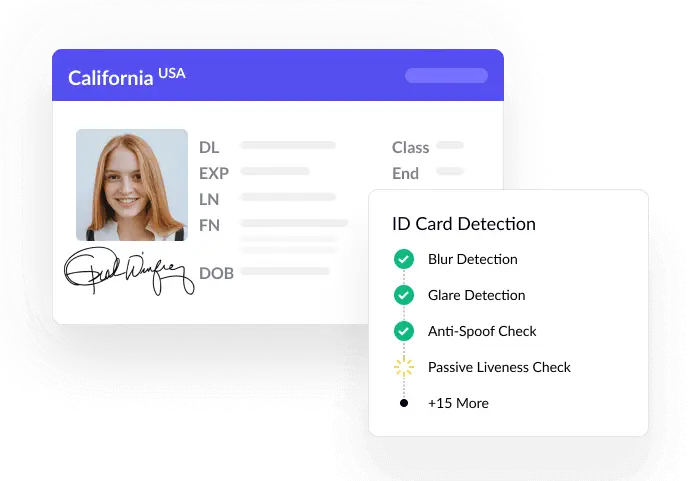

Perform document verification

Document verification is the process of verifying whether documents like credit reports, bank statements, employment records, business documents, etc, are authentic or not.

Apply face authentication with liveness checks

Also known as the proof of life, liveness detection is a technology that confirms the presence of a real person during identity verification and prevents ID theft.

Regularly conduct review audits

Checking credit card statements & financial statements regularly, buying an ID theft policy, securing your online accounts, credit card accounts, & bank accounts, checking a free credit report, hiring a credit monitoring service provider, and conducting audits and reviews regularly can help you prevent these thefts.

Fight identity fraud with HyperVerge

Identity fraud is a growing concern, with hackers and scammers finding new ways to steal personal information and commit fraud. HyperVerge is a leading provider of identity verification services that can help you fight back against identity fraud.

Our advanced technology uses machine learning algorithms and artificial intelligence to accurately verify and authenticate identities in real-time. With HyperVerge, you can quickly and easily verify the identities of your customers, employees, and partners, ensuring that your business is protected against identity fraud.

Fight identity fraud with HyperVerge today and protect your business from the costly and damaging effects of identity theft.

US

US

IN

IN