What is Financial Identity Theft?

Financial identity theft is a type of synthetic identity theft where someone illegally obtains and uses another person’s financial information, such as credit card numbers, bank account details, Social Security numbers, or other personal identifiers, to commit fraud, economic gain, or other crimes.

This can include unauthorized credit card charges, fraudulent withdrawals from bank accounts, applying for ghost loans or credit in the victim’s name, and other forms of monetary scams perpetrated by identity thieves.

Ensuring the security of financial information is important in preventing identity theft. Individuals should regularly check their bank and credit card statements for any unusual activity. Identity theft can harm credit scores and delay progress toward financial goals.

That’s why it’s smart to learn about how financial identity theft happens and what you can do to keep your personal info safe.

Additionally, consider using a reliable identity theft identification service like HyperVerge, which can provide advanced detection, identity verification methods, and monitoring to help keep your personal information secure.

The impact of financial identity theft

Scammers or financial identity theft often use various approaches to acquire this information, including phishing scams, data breaches, stealing physical documents (credit cards, debit cards), phone calls, or even social media scams.

Once they have the victim’s personal or financial information anyway, they can use it for personal gain, often leaving the victim to deal with the financial and legal consequences. There are numerous laws and regulations at the federal, state, and international levels that address identity theft, data security, and consumer protection.

Businesses and financial institutions may be required to report data breaches and other security incidents to regulators, law enforcement agencies, and affected individuals per applicable laws and regulations.

Businesses and financial institutions may be held liable for damages resulting from identity theft if they are found to have failed to implement reasonable security measures or adequately protect customer information from medical identity theft.

How does financial identity theft happen?

Financial identity theft occurs when someone uses another person’s information, like a bank account, credit card, or social security number, for their financial gain. This could involve making purchases, stealing money, or the misuse of a Social Security number to open new credit accounts.

It’s important to check account statements and credit history very regularly to catch unusual charges and improve fraud awareness. If fraud is suspected, one must contact their bank or credit card company.

Additionally, placing a security freeze or fraud alert on the credit reports can help prevent any new accounts or fraudulent accounts from being opened using your information.

Types of financial identity theft

Strategies for preventing financial identity theft are important for individuals to protect themselves from scams and fraud. These strategies help keep personal and financial information safe, reducing the risk of financial loss and damage to credit scores.

Here are a few common examples of financial identity theft:

Phishing

Scammers pretend to be reputable companies like credit unions or online stores, reaching out through phishing emails, texts, or calls about fake purchases on victims’ accounts. They use alarming messages to trick people into clicking links, opening attachments, or sharing personal info. With this data, scammers access accounts and may transfer funds to other accounts for their financial gain.

Card skimming

Card skimming involves criminals placing fraudulent card reading devices, known as card skimmers, over or inside legitimate card readers at point-of-sale locations. These devices are designed to collect banking information from the magnetic stripe on cards, or sometimes through hidden cameras, to carry out fraudulent transactions or create counterfeit debit cards.

Common target locations for card skimmers include ATMs, gas pumps, parking meters, ticket kiosks, restaurants, and other point-of-sale terminals.

Data breach

When a company experiences a data breach, personal information, such as login credentials, social security numbers, or account details, could be compromised. Financial criminals may then employ additional tactics, like phishing or social media profiling, to gather more data, potentially allowing them to hack your online financial accounts again, open fraudulent credit lines, or conduct unauthorized financial transactions.

Industries housing extensive personal information and financial databases are prime targets for such breaches. Major companies like Microsoft, Yahoo, Alibaba, LinkedIn, Facebook, MyFitnessPal, Spotify, Equifax, Experian, Capital One, and Home Depot have been previous victims of significant data breaches.

Personal information sharing

By sharing their online banking details with an unregistered individual, a person unwittingly allows unauthorized access to their online account. The unregistered individual begins transferring funds out of the online account without detection by the financial institution.

Strategies for preventing financial identity theft

Strategies for preventing financial identity theft are important for individuals and businesses to protect themselves from scams and fraud. These strategies help keep personal and financial information safe, reducing the risk of financial loss and damage to credit scores.

Here are the best strategies for combat identity theft and preventing financial identity theft:

Use a reliable fraud detection solution

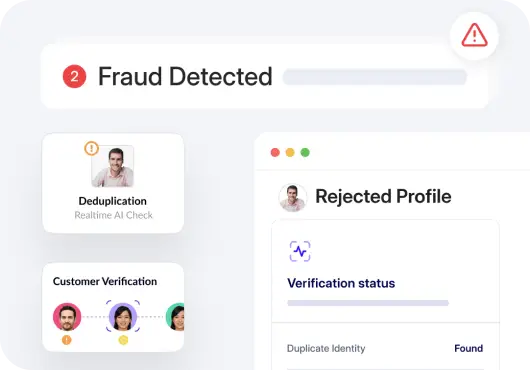

Implementing robust identity theft identification services like HyperVerge’s Fraud Detection solution can help identify and flag suspicious activities in real-time, providing advanced detection and monitoring to help keep your personal information secure.

These solutions use advanced algorithms and machine learning techniques to analyze patterns and detect anomalies, offering an extra layer of protection against identity theft. By integrating such solutions into security measures, businesses can further improve their defenses and mitigate the risks associated with financial identity theft.

Perform biometric verification

Biometric verification adds an extra layer of security by using unique physical characteristics, such as fingerprints, facial features, or iris scans, to verify the identity of customers accessing financial accounts.

Financial institutions are increasingly adopting digital identity verification methods, such as biometric authentication, due to their effectiveness in combating child identity theft and the difficulty fraudsters have replicating biometric identifiers compared to traditional passwords or PINs.

Credit reports and bank statements analysis

Regularly reviewing credit reports and bank statements analysis is essential for promptly detecting any unauthorized activity or suspicious transactions. This helps individuals identify discrepancies or unfamiliar charges and take immediate action to address potential instances of financial identity theft.

Additionally, many financial institutions offer fraud detection and notifications for unusual account activity, providing an additional layer of protection against fraudulent transactions.

Reporting the suspicious activity

Reporting suspicious activity right away to the bank, the police, the credit report, and agencies are important in combating financial identity theft. It helps stop unauthorized transactions, and medical identity theft prevents more sneaky stuff with the credit and increases the chances of getting the money back and catching the bad guys.

If you suspect that you are a victim of identity theft, report it to the police report the FTC via IdentityTheft.gov. The website will walk you through the process of reporting an identity thief and how to get a recovery plan in place.

Combat fraud with robust identity verification solutions

At HyperVerge, we offer solutions for fraud detection and identity verification that are designed to enhance social security and prevent identity theft. Our ID card fraud check module employs advanced techniques to ensure document authenticity during verification.

Through features like signature/thumbprint detection, photo-on-photo verification, and tampering detection, we provide robust protection against fraudulent attempts.

Explore HyperVerge’s ID Verification solutions to strengthen your security measures. Ready to get started? Sign Up now for a free trial.

Identity

Verification –

Onboard

users instantly across the globe with our high accuracy AI

models.

Identity

Verification –

Onboard

users instantly across the globe with our high accuracy AI

models. Video

KYC – Onboard

users remotely with very high confidence over video.

Video

KYC – Onboard

users remotely with very high confidence over video.

Central

KYC – Reduce

processing time and eliminate manual KYC data entry.

Central

KYC – Reduce

processing time and eliminate manual KYC data entry.

OCR

software –

Extract

data accurately from all global document formats.

OCR

software –

Extract

data accurately from all global document formats.

Anti-Money

Laundering –

Simplify

AML compliance and protect your business

Anti-Money

Laundering –

Simplify

AML compliance and protect your business