In 2022, a staggering $52 billion was lost to identity theft fraud, impacting over 42 million individuals in the U.S. As we navigate the complexities of digital ecosystems, understanding and implementing robust identity verification methods is not just a regulatory requirement—it’s a cornerstone of trust and safety.

The realm of identity verification has expanded rapidly, with the global market valued at approximately USD 9.87 billion in 2022, and anticipated to grow at a CAGR of 16.7% by 2030. This expansion is fueled by the need to combat the increasing frequency of identity fraud and cybercrime.

This detailed guide will walk you through the intricacies of identity verification, the sophisticated technology behind it, and how HyperVerge is leading the way to a safer onboarding experience for customers across the globe.

What is Digital Identity Verification and Why is it Important?

In our collective quest to secure digital transactions and interactions, identity verification is the first defense line. It’s the bedrock upon which trust between consumers and services is built. By confirming the authenticity of individuals during pivotal moments like account registration, account opening, customer onboarding, and financial transactions, we safeguard personal information and uphold the integrity of our digital engagements.

For organizations, the stakes are high. Digital ID verification process is critical in preventing fraudulent activities, upholding customer trust, and protecting reputations. The finance, healthcare, gig economy, and telecommunication industries, among others, are bound by stringent regulatory frameworks such as anti-money laundering (AML) and know-your-customer (KYC) regulations. These frameworks enforce digital identity verification methods, as a countermeasure against illegal activities. Failing to comply can lead to severe penalties and damage to an organization’s standing.

Challenges and Considerations in Identity Verification

When it comes to the intricate process of verifying identities, businesses face a set of unique challenges that can significantly impact customer experience and operational efficiency. These challenges not only test the robustness of verification systems but also call for innovative solutions to streamline and enhance the digital identity verification process.

Let’s explore these issues (and our solutions) in detail, backed by the latest industry findings and expert insights.

Process Takes Too Long

The digital identity verification landscape, while evolving rapidly, is not without its challenges. A significant hurdle is the time-consuming nature of the process. Manual inspection and verification, especially when dealing with large volumes of documents, can lead to substantial delays in customer onboarding, extended wait times, and potential operational bottlenecks. This is particularly prevalent in scenarios that require in-depth verification for high-risk transactions or in highly regulated industries.

Traditional methods often lack real-time verification capabilities. Without immediate results, the verification process may delay access to digital services or transaction execution. Real-time verification is more important than ever for an efficient identity verification process and seamless user experiences.

HyperVerge Pro Tip 💡

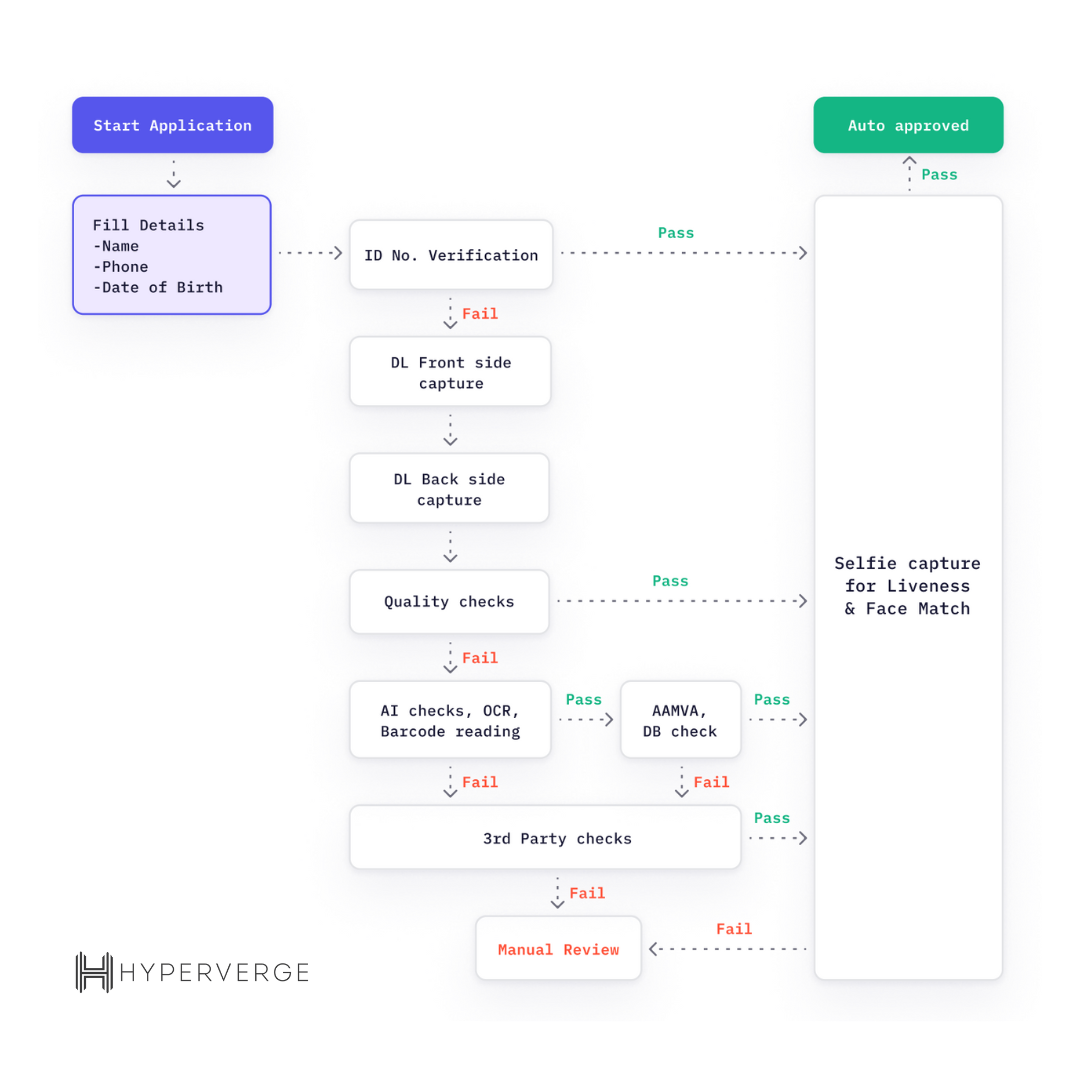

Build personalized auto-approval workflows (with fallback options) to reduce manual reviews. Our proprietary algorithm auto-identifies and flags suspicious profiles accurately using AI and OCR, drastically reducing false positives and negatives. This also reduces the turnaround time (TAT) and boosts efficiency.

High Customer Drop-off

Another significant challenge is the lack of visibility on customer drop-off rates during the verification process. Friction in the onboarding process can result in as much as 75% of customers opting for an alternative provider. Banks and online payment services have particularly felt this impact, with abandonment rates as high as 70% reported in some cases.

Why does customer drop-off happen during ID verification?

- Limited automation in approval or rejection flow

- Unnecessary steps in verification cause friction

- Non-personalized workflows leading to drop-off

- Not enough fallback options if the first flow fails

- Lack of visibility on users’ KYC journey to optimize

HyperVerge Pro Tip 💡

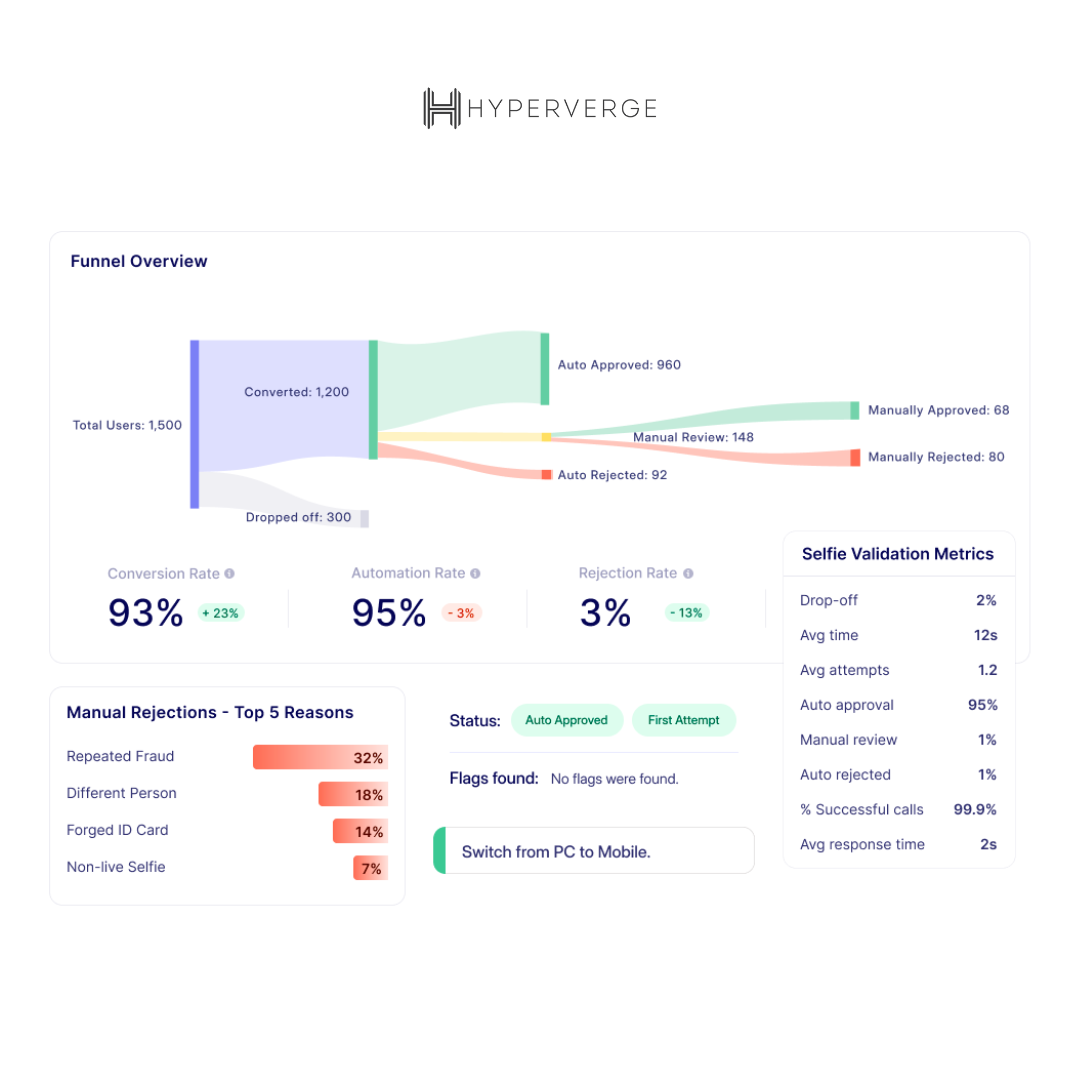

Get a comprehensive understanding of the user journey and minimize drop off by:

- Delving into detailed data and insights at each stage of the user verification process.

- Tracking key metrics such as automation rate, drop-off rate, TAT, and other crucial indicators to identify and address pain points.

- Embracing a data-driven strategy to enhance the verification process, guaranteeing a smooth and user-friendly experience.

Read more: Challenges in online identity verification how to solve them

Benefits of Digital Identity Verification

Digital identity verification brings benefits that streamline and secure the online activities of businesses and consumers alike. Let’s explore how these systems improve operations, enhance security, and contribute to economic growth.

Security Enhancement

Digital ID verification fortifies the security of transactions, providing a robust foundation for individuals and organizations to operate safely. Enhanced security measures are crucial in today’s landscape where digital transactions are commonplace.

Economic and Social Empowerment

Digital identity verification systems are not just about security; they also empower people with limited access to internet and contribute to long-term economic growth. They provide a framework for reliable identification and improve the user experience during critical interactions like onboarding.

Operational Efficiency

By automating identity verification, businesses can enjoy quicker turnaround times and higher accuracy, reducing the risk of human error. This transition also enhances customer due diligence and continuous transaction monitoring, leading to more efficient operations.

How Does Digital Identity Verification Work?

Digital identity verification is a multifaceted process designed to confirm an individual’s claimed identity. This involves collecting personal information like name, address, date of birth, and identification number, which is then rigorously verified against various databases for authentication. It can also include email and phone verification to confirm an individual’s identity. The process includes detailed document verification, examining security features and checking for alterations, as well as validating the provided address and ensuring compliance with age requirements.

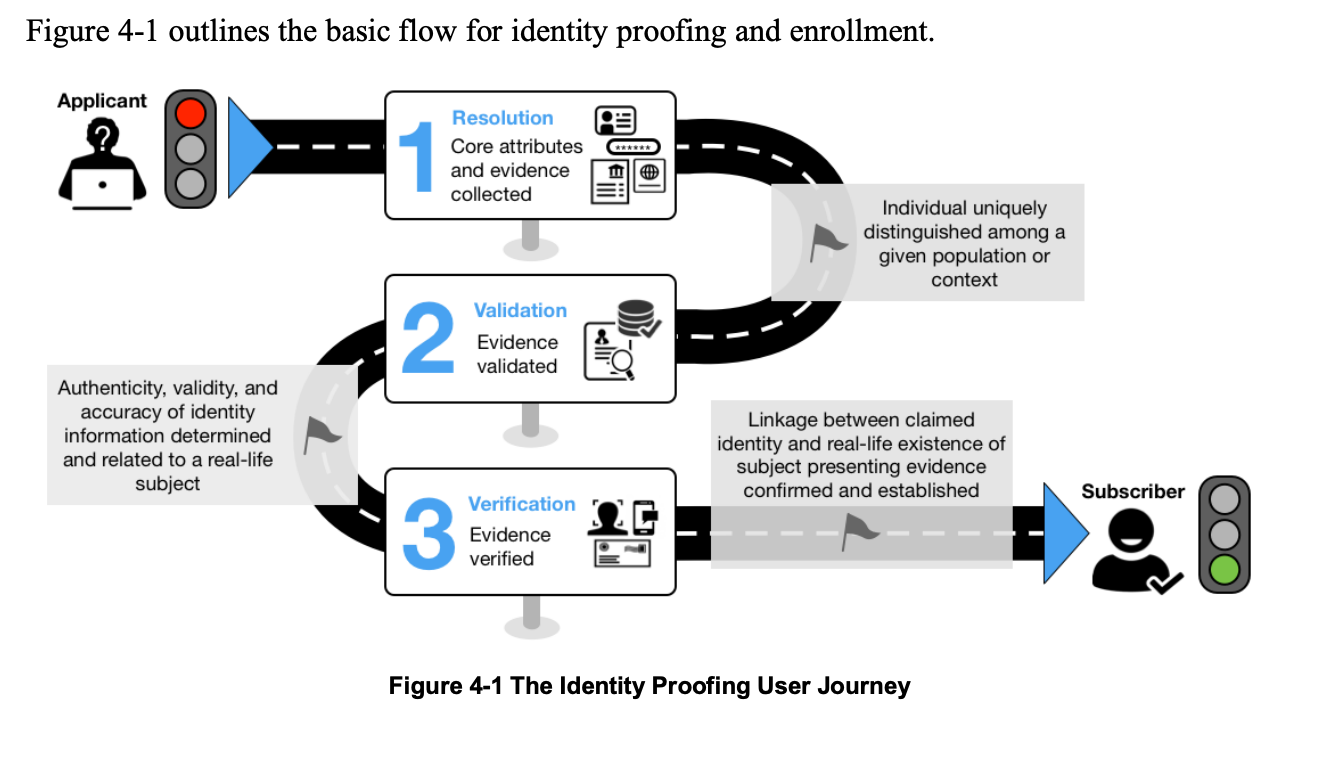

Identity Proofing

A broader concept, identity proofing involves establishing and validating a person’s identity through a combination of ID verification methods such as:

- Identity documents verification

- Multi-factor authentication

- Face authentication with liveness detection

It plays a pivotal role in the overall digital identity verification framework. Check out our detailed exploration of identity proofing.

Different Methods of Digital Identity Verification

As the digital economy continues to grow, so does the need for reliable digital identity verification solutions. Multiple methods exist to confirm a user’s identity, each with its strengths.

Document Verification

This traditional method involves data verification using a government issued identity document like passport verification or driver’s license verification. It’s a fundamental process for confirming personal details against official records. Here’s a list of valid proof of address documents for document verification.

Read more: HyperVerge’s ultimate guide to document verification.

Biometric Verification

A more modern approach uses unique biological traits such as fingerprints, facial recognition, or iris scans. Biometric verification is becoming increasingly popular due to its high level of security and difficulty to forge.

Read more: Everything you need to know about biometric identity verification.

Knowledge-Based Authentication

This method asks for information that only the user should know, like the answer to a personal security question. Knowledge-based verification adds a cognitive element to the verification process, relying on the user’s memory and personal information to establish their identity.

Two-factor Authentication

This method requires two different methods of verification; often something you know, like a password, and something you have, like a mobile device that receives a one-time code. This dual-layered approach adds an extra level of protection against unauthorized access.

Credit Bureau-based Verification

Commonly employed in financial services, credit bureau-based verification cross-references an individual’s financial history with credit records from credit bureaus.

For a detailed exploration of these methods, read the insights on the top identity verification methods. It provides a deeper understanding of each method and guides on selecting the right one for different scenarios.

Electronic Identity Verification vs. Traditional Methods

The landscape of identity verification is witnessing a shift from traditional to electronic methods. Here we compare both, listing their advantages and drawbacks.

Electronic Identity Verification (EIDV)

Pros:

- Efficiency: EIDV systems offer rapid verification, often in real-time, streamlining customer onboarding and access to services.

- Accuracy: By automating the verification process, EIDV minimizes the risk of human error, leading to more accurate outcomes.

- Cost-effectiveness: Over time, EIDV can be more cost-effective due to reduced labor costs and paperless operations.

- Global Reach: EIDV can be performed from anywhere, making it ideal for online global transactions and services.

Cons:

- Technical Dependency: Relies heavily on digital infrastructure, which can be a limitation in regions with poor connectivity.

- Complexity: The initial setup and maintenance of EIDV systems can be complex and require significant investment in technology and training.

Read more about eIDV and upcoming trends.

Traditional Methods

Pros:

- Simplicity: Traditional methods are often more straightforward, requiring only physical documents without the need for complex systems.

- No Digital Barrier: They do not require a digital infrastructure, which can be beneficial in areas with limited technology access.

Cons:

- Time-Consuming: Manual, in-person verification processes are slower and can lead to longer wait times for verification.

- Resource Intensive: Traditional methods often require more staff and physical space to manage documents, increasing operational costs.

- Scalability Issues: Scaling up traditional verification processes can be challenging as it often means more staff and physical resources.

Implementing Identity Verification Solutions for Your Business

Incorporating identity verification is a pivotal step in safeguarding your business and building trust with your customers. To ensure you choose the right identity verification solution, consider the following:

Choosing the Right Identity Verification Solutions

- Assess Your Needs: Evaluate the specific needs of your business, including the level of security required and the type of transactions you handle.

- Regulatory Compliance: Ensure the solution meets the regulatory requirements applicable to your industry, such as KYC and AML directives.

- Integration: Look for solutions that can seamlessly integrate with your existing systems to maintain workflow efficiency.

- User Experience: Choose a solution that provides a balance between stringent security measures and a user-friendly experience.

- Scalability: The chosen solution should be able to grow with your business, handling increased volumes without compromising performance.

- Support and Reliability: Reliable customer support and service uptime guarantees are crucial for maintaining continuous operations.

Implementing the right identity verification solution is an important decision. To help you make the right choice, we’ve put together a detailed resource about How to Choose the Right Identity Verification Solution. This will provide you with the necessary framework to make an informed decision tailored to your business needs.

Conclusion

Identity verification stands as a critical pillar in today’s digital economy, ensuring secure online transactions, compliance with regulations, and building trust with customers. We’ve explored the importance, challenges, benefits, workings, and various methods of identity verification, alongside the electronic advancements transforming traditional practices. As you consider implementing or upgrading identity verification solutions for your business, remember the importance of choosing a system that aligns with your operational needs and enhances the user experience.

Ready to take the next step? Discover how HyperVerge ONE can streamline your identity verification processes, offering robust, AI-powered identity solutions tailored to your business requirements. Explore HyperVerge ONE today and elevate your customer onboarding experience.