Adding phone number identity verification is mandatory to reduce fraud and comply with regulations. Verification of the customer’s legal entity and verified phone numbers is part of ‘know your customer (KYC)’ requirements.

In this blog, we’re covering everything you need to know about the phone validation process, its benefits, and applications. Let’s dive in!

What is Phone Verification?

Phone verification refers to the process where someone cross-verifies the given phone number by calling the number or sending an SMS to validate phone numbers and getting a reply from the same number.

Before proceeding with business transactions or making any payments, the company cross-checks most of the information provided by the customer. To eliminate the possibility of fraudulent activities, businesses verify the customer’s phone number. Therefore, if the customer provides false phone number details, it will not be validated.

Just Dial, Any Who, Truth Finder, or True Caller are some sites for phone verification. Google’s or other sites’ two-step verification and one-time password (OTP) generation are a few examples of phone verification tools.

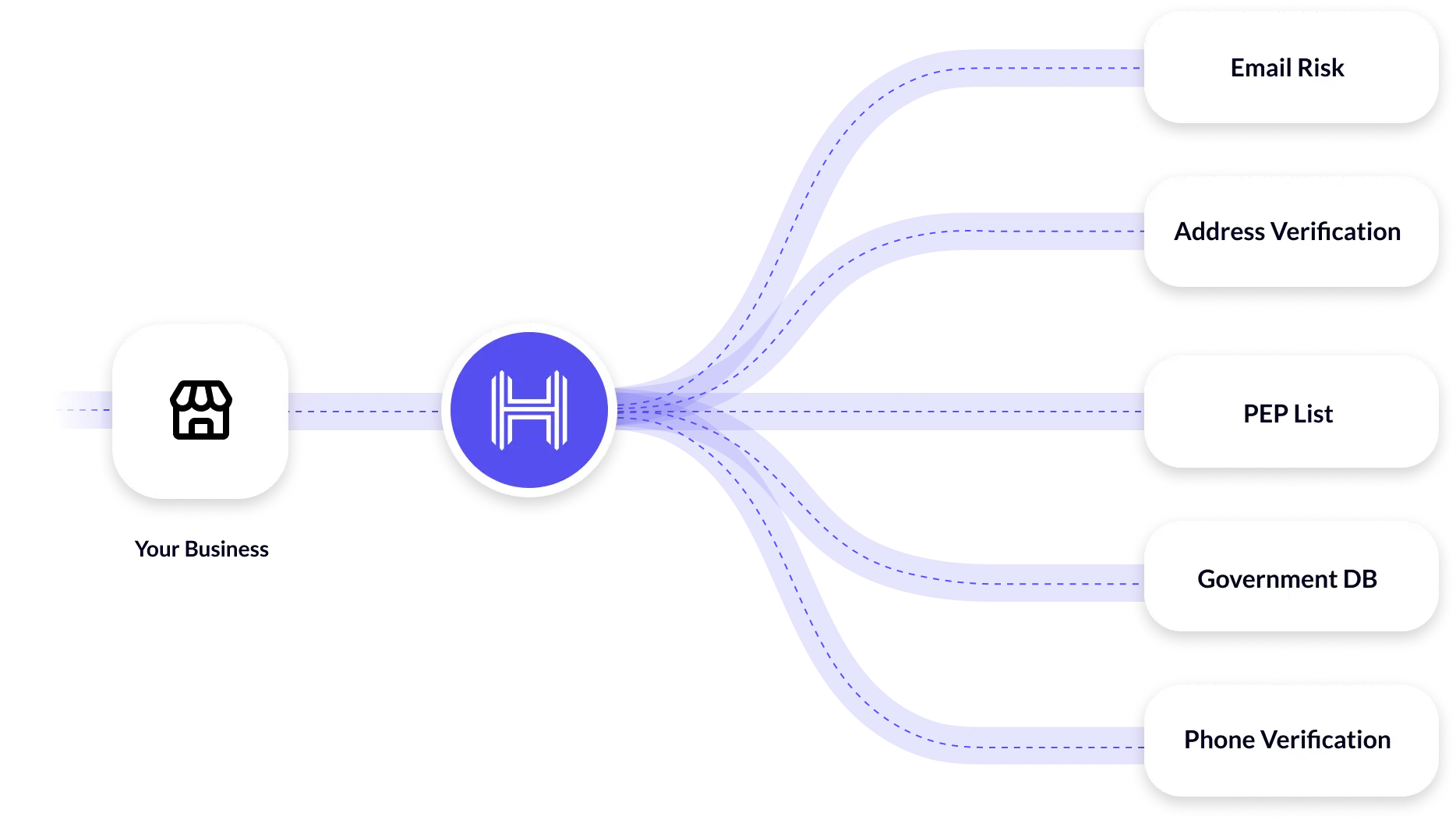

Businesses need to verify a person’s identity by checking the bank account data, residential address, and phone numbers. At HyperVerge, verifying phone numbers is part of a multilayer strategy for identity verification and regulatory compliance that includes email verification, address verification, AML checks, and government database checks.

How Does Phone Verification Work?

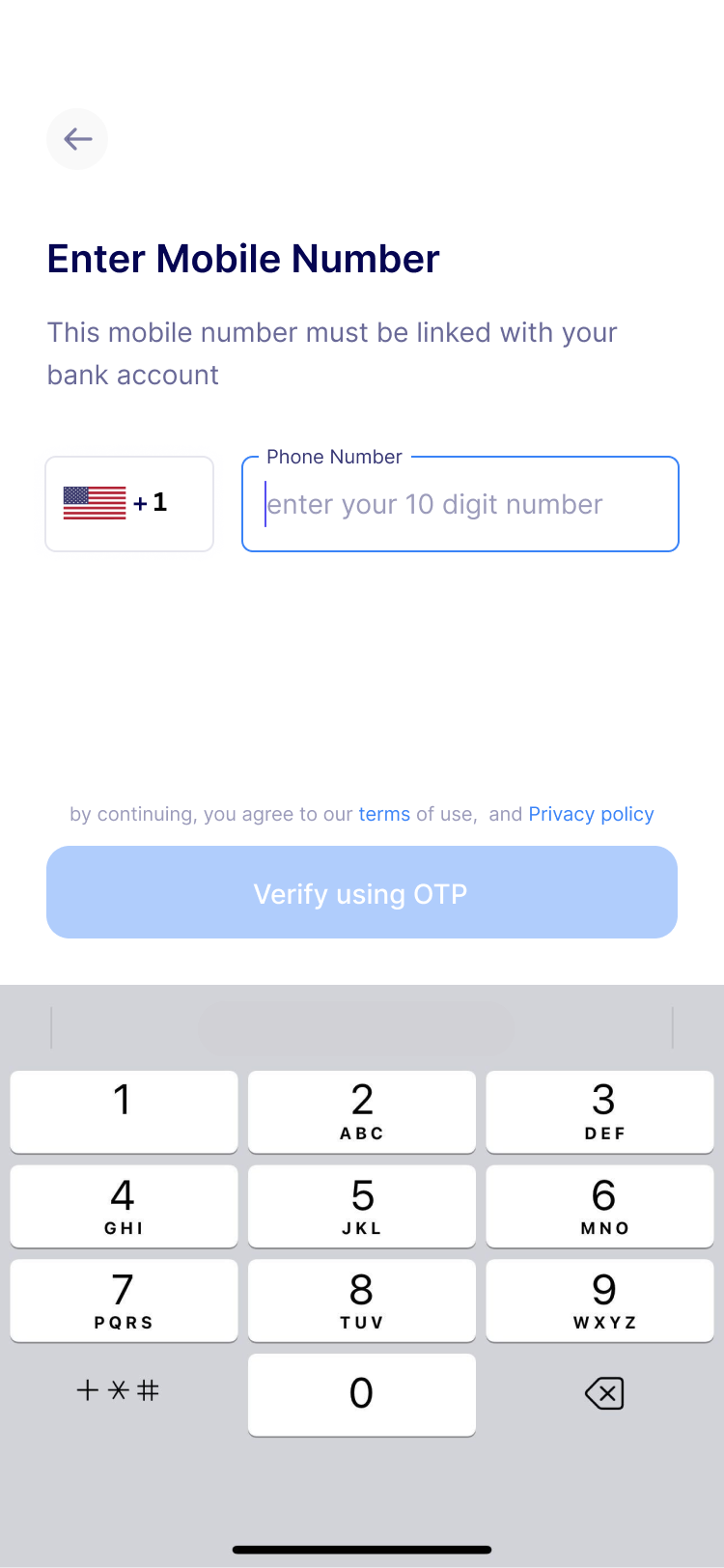

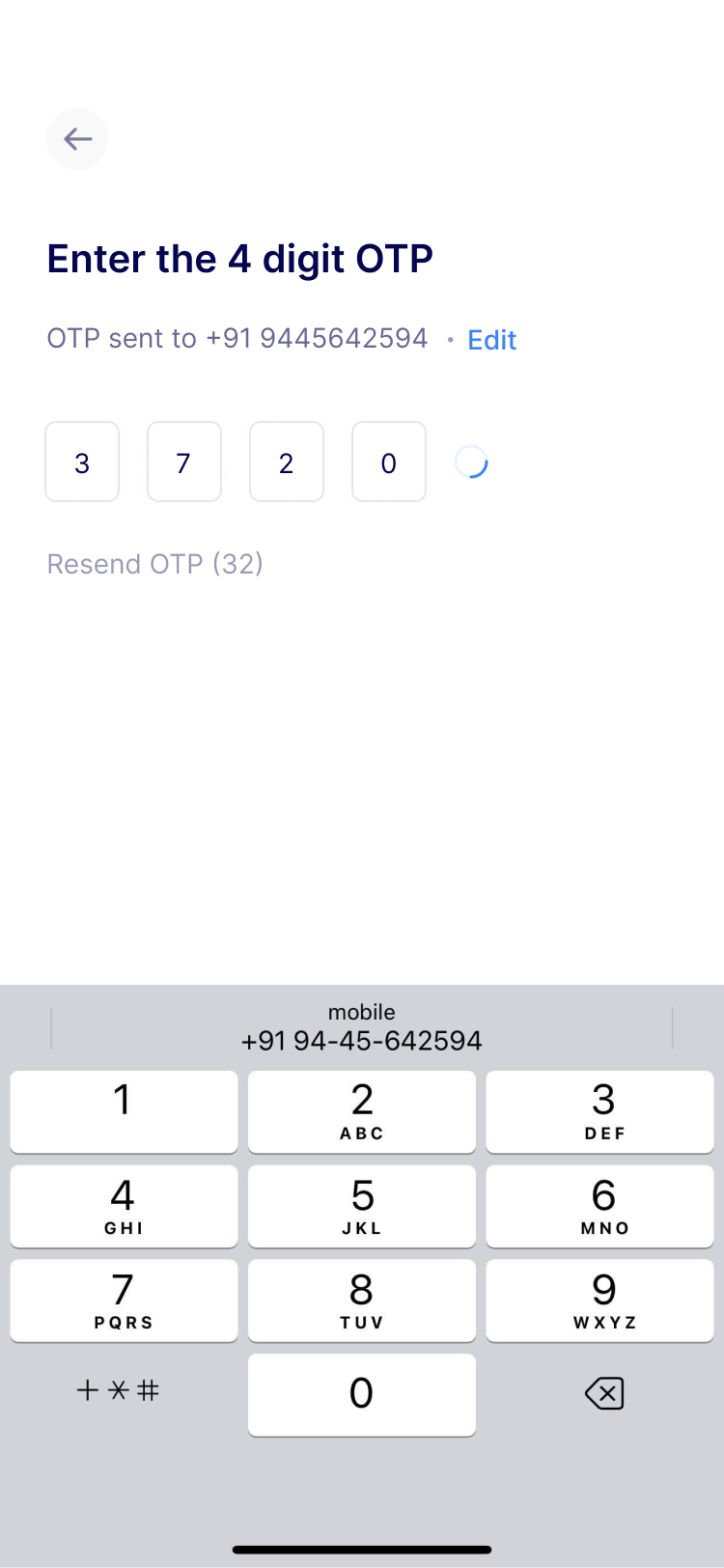

OTP Verification

The first digit should be between 6 to 9. The rest 9 digits can be from 0 to 9. Numbers can be 10 or 11 digits depending on the country code.

The simple procedure of phone verification entails the concerned business sending an OTP verification code to the prospective customer’s phone number, which they will need to enter while making an invoice to verify that the given phone number is real and reachable in case of any discrepancy in a transaction. They can also retrieve and use the number from their database later for promotional purposes. They may also use this number to send greetings for special occasions and make their presence in their customers’ minds for branding purposes.

Advance process to verify phone numbers:

A quick Application Programming Interface (API) call analyzes the phone number to fetch further detailed information. These details are essential for businesses to prevent fraudulent activities and identify patterns of fraud from the early stages. Some of these checks include:

- Risk score

- Country of origin

- Area code

- Original network

- Current network

- Roaming status

- Roaming country

- Roaming network name

- Availability (whether reachable or not)

- Validity

- Current Route

Special vigilance is required if the country of origin differs from that of the client or if customer data on the current network differs from that of the original network. Fraud risk factors are high in such cases, and proper monitoring is required. It does not say the other party is a fraud or involved in any criminal activity. Still, it’s an accurate indication that the probability of being associated with any fraud is high. Hence, it requires vigilance on the part of the dealing party.

Why Do Customers Provide a Fake Phone Number for Verification?

Customers often provide fake phone numbers for verification to prevent companies from sending them promotional and marketing information, as well as vouchers. They do so to protect their personal information from being leaked and to implement Do-Not-Disturb (DND).

Receiving too many promotional text messages can be a waste of time for customers who are not interested in buying a particular product. Moreover, not everyone is comfortable sharing their real personal data, which is why they may provide a fake phone number when asked to verify their phone number by marketing agents representing a brand.

Why Do Businesses Need a Verified Phone Number?

Phone number validation is a business use case beyond regulatory compliance. Businesses need to verify phone numbers in the following scenarios:

1. Onboard Legitimate Users

No business wants to onboard fake users! Phone number authentication during user registrations is a critical step to filter out fraudulent or unauthorized access, safeguarding the business and its customers from potential risks.

2. Authenticate Transactions

Confirming the legitimacy of the individuals involved in digital transactions becomes paramount. Verifying phone numbers is absolutely crucial in mitigating the risk of unauthorized transactions and fraudulent activities that could severely compromise the financial well-being of both businesses and their customers.

3. Update Existing Customer Data

Beyond the initial onboarding and transactional stages, maintaining an accurate and up-to-date customer database is an ongoing challenge for businesses. Validating phone numbers becomes a crucial component in updating existing customer data. With accurate contact information, businesses can foster better customer communication, ensuring improved customer experience and loyalty.

4. Reset Passwords

It’s highly recommended to secure user accounts against unauthorized access. Phone verification makes it more challenging for malicious actors to compromise sensitive information.

Benefits of phone number verification

- Phone validation ensures that a given number is a valid phone number, reachable, and available at times of need.

- Businesses rely on accurate phone numbers to send out important product updates, marketing and promotional vouchers, lucrative offers, and newsletters to both new and existing customers. If a phone number is not verified, or if a customer provides a fake phone number for verification, there is a high chance that the intended recipient will never receive the information.

- Phone verification is crucial for safeguarding against fraud and anti-money laundering activities. Fraudster uses someone else’s phone number for illegal activities, the actual owner of that number may be held responsible for any fraudulent actions.

- It’s a low-friction method of identity verification, ensuring a smooth customer experience.

Drawbacks of Phone Verification

SMS-based verifications are vulnerable to attacks such as man-in-the-middle attacks, SIM swapping, and phishing, posing risks to the security of the verification process. Additionally, SMS verification relies on real-time connectivity, requiring users to have active cell phone service during the verification. Some users are hesitant to share their phone numbers due to privacy concerns.

How to Get Started with Phone Verification?

Phone verification is a common service among vendors who offer identity authentication and fraud prevention solutions. HyperVerge’s identity verification platform takes care of your end-to-end verification needs, from phone verification to ID verifications. Read our detailed guide to know more about our identity verification and onboarding solutions.

FAQs

When does one need phone verification?

1st-time registration of a new account, authorizing upgrades, resetting passwords, reactivating users, refreshing user details, and authenticating transactions are some areas when one needs phone verification.

What are the other security alternatives to phone verification?

Passwords, biometrics, social website checks, and email verification are alternative authentication methods.

US

US

IN

IN