What is Active vs. Passive Fraud Detection?

Active and passive fraud detection are two different methods of detecting and dealing with fraudulent activities.

Active fraud detection is a proactive method in which organizations actively monitor transactions, conduct audits, and implement steps to catch fraud at early stages. Passive fraud detection is where one discovers fraudulent activities by chance. It does not involve active searching.

The main benefit of active fraud detection is reducing the time and money lost to fraud. Moreover, businesses maintain their reputation and build trust with customers by avoiding fraud risks. Passive fraud detection relies on accidental findings, confessions, and tips from third parties. This approach usually identifies fraud after it has already caused damage. Its main benefit is that this method is less costly in terms of resources compared to active fraud detection systems.

Active detection offers robust, immediate protection, while passive methods are less disruptive. Both are essential for comprehensive security.

How does active fraud detection work?

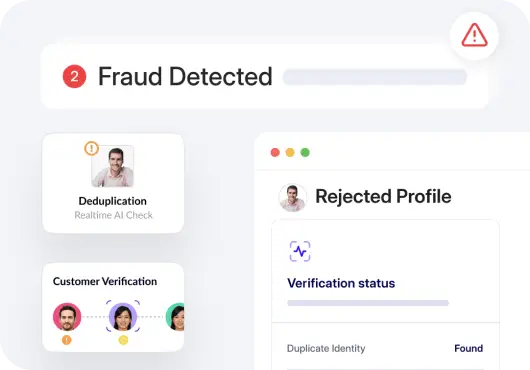

Active detection methods use real-time monitoring and advanced analytics to identify and prevent fraud as it happens. This hands-on approach studies transaction patterns and finds unusual activities.

This includes the following:

- Data monitoring and analysis constantly check transaction patterns. This helps catch any signs of unusual activities that might indicate fraud.

- Regular account reconciliation ensures all accounts are correct. This makes it easier to spot discrepancies that could suggest fraud.

- Conduct internal and surprise audits to review financial records and operational practices. This ensures compliance and uncovers any hidden fraud.

- Management reviews evaluate the effectiveness of fraud detection strategies.

- Machine learning models continuously improve by learning from new data, enhancing their ability to detect increasingly complex fraud schemes.

- Real-time alerts enable immediate investigation and response. This helps minimize the impact of fraudulent activities.

Moreover, businesses deploy methods like identity verification to actively catch fraud of all types, including financial fraud, identity theft, and more.

How does passive fraud detection work?

Passive fraud detection relies on indirect methods to uncover fraudulent activities. This method comes into play in various, less controlled ways such as the following:

- Incidents of fraud are sometimes discovered purely by chance.

- In some cases, the perpetrator might confess to the fraud, bringing it to light.

- Often, information might come from an unintentional communication or tip-off from a third party.

- It can also involve identifying passive signals of fraud. This can be done with social media monitoring, device anomalies, unusual access to accounts and so on.

What is the difference between active and passive fraud detection?

In the world of fraud detection, both approaches help safeguard businesses. However they are quite different from each other. Here is how:

Origin

- Active fraud detection is a strategic initiative designed to prevent fraud.

- Passive fraud detection often starts by accident or is identified during unrelated activities.

Purpose

- The purpose of active fraud detection is to detect and stop fraud before it causes significant damage.

- The purpose of passive fraud detection is to acknowledge fraudulent activities when they are discovered when no one is looking for it actively.

Process

Active fraud detection includes:

- Continuously monitoring transaction data for anomalies.

- Regularly matching transaction records against authorized activities.

- Conducting both planned and random audits to inspect financial records and operations.

- Engaging management review in the oversight process.

- Businesses can also use digital identity verification for secure onboarding and compliance among active methods.

Passive fraud detection involves:

- Discovering fraud through unexpected discrepancies noted by customers or during routine checks.

- Depending on confessions from individuals involved in the fraud.

- Receiving unsolicited information from external sources about fraudulent activities.

Benefits

Active fraud detection benefits include:

- Early detection of fraud minimizes its duration and impact.

- Reduced financial damage by catching fraud early.

- Maintenance of stakeholder trust and company integrity.

Passive fraud detection benefits include:

- Identification of oversights in current control systems.

- Lower upfront costs compared to continuous monitoring.

Scope

- Active detection methods cover a broad scope making it the leading fraud detection method. It provides opportunities to prevent, identify, and address fraudulent activities at a larger scale. Moreover, real-time tracking makes sure that potential fraud can be detected and addressed early.

- Passive detection scope is limited, primarily focused on detecting fraud that has already occurred or is in process, typically through inadvertent discoveries. It lacks systematic proactive measures of active detection and instead offers opportunities to react to fraud detected based on external triggers or accidental findings.

Best practices to avoid fraud

Fraud can cripple you financially and tarnish your reputation. To combat this, it’s essential to implement robust fraud prevention and detection strategies.

Use a reliable fraud detection solution

Investing in a reliable fraud detection solution is crucial. Such systems use verification processes and advanced algorithms to monitor transactions and flag potential fraud. Active detection method allows businesses to respond quickly to suspicious activities. Ensure the solution updates regularly to keep up with new fraud tactics.

Deploy a multi-layer verification solution

Create multiple layers of verification to ensure the customer is who he claims to be. This can include:

You can also learn more about fighting digital fraud with intelligent identity verification.

Regularly conduct review audits

Conducting regular review audits is another critical practice. Regular reviews of all financial transactions by certified fraud examiners can help spot any irregularities early or potentially active risks. Surprise audits are also effective as they keep everyone on their toes. This makes sure that there is constant compliance with regulations.

To learn more about how to find and stop fraud, read HyperVerge’s guide on fraud detection and prevention strategies.