In 2022, the Federal Trade Commission (FTC) received over 725,000 scam reports, resulting in a staggering loss of $2.67 million. For businesses, the consequences of ATO can be costly, with the average corporate breach costing nearly $5 million, according to IBM.

Account takeover protection is critical because it safeguards personal and sensitive information, prevents financial losses, maintains trust, avoids identity theft, and ensures legal compliance.

In this article, we will help you understand the three-step process involved in account takeover. We will explain how it happens and discuss the various methods to detect account takeovers and strategies for individuals and businesses to strengthen their account security against takeover attempts.

What is an account takeover?

Account takeover (ATO) is a type of identity theft involving attackers stealing an account with credentials or personal information like social security numbers, addresses, and banking details to use for fraud. In account takeover attacks, they often use malicious bots to access real people’s online accounts, especially those with financial information, like e-commerce accounts.

Larger organizations are particularly vulnerable to ATO attempts due to their appeal to cybercriminals. However, there are straightforward steps we can take to protect ourselves against these threats.

The three-step account takeover process

Account takeover works through a series of small steps:

- Account access: A fraudster gains access to the victim’s accounts. They do this by sending fake emails or messages or installing malicious software on victim’s devices to steal login information.

- Make changes: After they gain access, fraudsters make non-monetary changes to account details such as:

- Modifying personally identifiable information (PII)

- Requesting a new card

- Adding an authorized user

- Changing the password

- Unauthorized transaction: If a fraudster is successful in any of these seemingly small tasks, it can lead to unauthorized transactions, resulting in financial loss and damaging the relationship between the victim and the service provider.

How does an account takeover occur?

- Phishing attacks: The attacker deceives potential victims into sharing their information willingly through methods like fake login pages or emails pretending to be someone familiar to the victim. These attacks can be highly deceptive and may even target specific individuals, known as spear phishing.

- Credential stuffing attacks: Credential stuffing attacks occur when hackers use stolen login credentials from one website to gain unauthorized access to other websites, hoping that the victim has reused their login details. This method is widespread and often used to initiate ATO attacks.

- Stolen cookies: Cookies are like digital keys stored on your device when you visit a website. These cookies contain important login details that hackers can use to break into your account without requiring your password.

- Compromised API keys: If a hacker gets hold of a user’s API key, they can use it to access the user’s account through the API. This could happen if the API key is stolen or leaked through a security breach or the user unintentionally shares it with someone malicious.

- Malware infection: Malicious infection occurs when a user’s device, such as their computer or smartphone, becomes infected with malware. This malware can infect devices through malicious websites, email attachments, or compromised software. It can be in the form of viruses, trojans, or spyware and is often downloaded unknowingly. The hacker behind the malware can then use these stolen credentials to access the user’s online accounts without their permission, leading to an account takeover.

Signs for Detecting Account Takeover Attacks

- IP addresses from unusual countries: If you notice a sudden increase in IP addresses from countries outside your usual access locations, it could be a sign of an account takeover. The fraudster may not know your original location and might use different IP addresses to access your account. Be extra cautious if you see changes in access locations shortly before or after changing your account credentials.

- Unknown device models: Cybercriminals frequently conceal their gadget identity by spoofing devices, making it challenging to detect if the same device is attempting to access multiple accounts. Your system may label these spoofed devices as “unknown.” If you notice an unusually high number of unknown devices, it may indicate an ATO attack.

- Multiple accounts accessed by the same device: In some cases, attackers don’t bother to hide their devices when logging into different accounts. As a result, if they gain unauthorized access to multiple accounts, all the logins will be traced back to the same device. However, it’s essential to note that legitimate users may also share devices with friends or family members. Therefore, it’s crucial to consider other factors to confirm whether it’s an ATO attack.

- Several changes in the login credentials: When an ATO attacker gains control of an account, they often change key details like the email address and password, effectively locking out the original owner. If you observe similar changes, such as a single email address being linked to multiple accounts, it is a strong indication of a potential ATO attack.

Strategies for individuals to prevent account takeover

Below are some of the best practices to proactively prevent account takeovers:

1. Strong password policies:

Creating complex and unique passwords for each online account is crucial in reducing the risk of successful brute-force attacks and credential-stuffing attempts. Strong passwords, which include a mix of uppercase and lowercase letters, numbers, and special characters, are more difficult for attackers to crack.

Additionally, prompting periodic password reset enhances overall security by making it more challenging for attackers to access the accounts.

2. Phishing protection

Phishing attacks are a prevalent method for attackers to get compromised credentials and steal user passwords. Individuals can mitigate this risk by filtering risky emails or blocking suspicious domains through Internet filtering. This proactive approach reduces the likelihood of users inadvertently compromising their credentials by interacting with malicious emails or websites.

3. Multi-factor authentication

Enabling Multi-Factor Authentication (MFA) adds an extra layer of security to your accounts. MFA combines different authentication factors, like passwords and one-time codes, making it tougher for attackers to exploit compromised passwords.

By enforcing MFA, organizations can significantly enhance the security of the user database and mitigate the risk of further ATO attacks. Two-factor authentication (2FA) and MFA are powerful tools that require users to provide multiple forms of identification, offering a robust defense against unauthorized access and stolen information.

4. Set rate limits on login attempts

Setting rate limits on login attempts based on users’ typical behavior, such as username, device, and IP address, is a proactive step to prevent account takeover. Additionally, incorporating limits on proxies, VPNs, and other factors further strengthens security measures.

By restricting the number of login attempts, organizations effectively mitigate the risk of brute-force attacks, where attackers use automated tools to guess credentials. This approach denies malicious actors the opportunity to mine stolen user credentials or to gain unauthorized access to sensitive data, enhancing overall account security.

5. Request alert for suspicious login activity

Real-time notifications are essential for spotting and stopping account takeovers early on. By immediately alerting users via email or SMS about account changes, like password updates or unfamiliar login attempts, they can take swift action if anything seems suspicious.

Also, providing the users the option to confirm or dispute changes adds another level of security. Always keep users informed to help them catch any unauthorized activity quickly, reducing risk and preventing further damage or harm to their accounts.

Strategies for businesses to prevent account takeover

Businesses can’t afford to lose customers due to restrictive account access or takeovers. Combating this fraud requires understanding account activity in real time across all channels and product areas. This proactive approach helps maintain customer trust and prevents financial losses.

Organizations can take several steps for account takeover fraud detection and prevention and minimize the impact of these attacks.

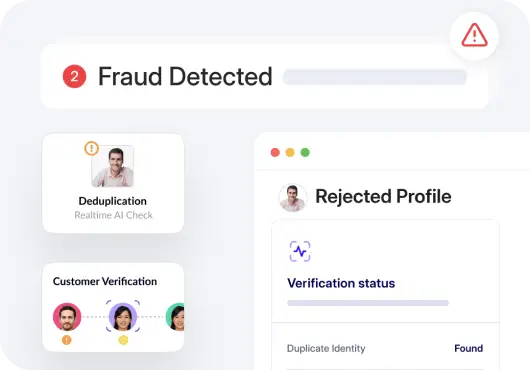

1. Employ a trustworthy fraud detection solution

Employing a reliable fraud detection solution is crucial for preventing account takeover. These solutions offer early detection and real-time monitoring capabilities to identify suspicious activities promptly. Leveraging advanced algorithms, they analyze large datasets to detect fraudulent patterns efficiently.

Businesses can customize rules and alerts based on their risk thresholds and integrate multi-factor authentication for added security. By minimizing false positives, trustworthy fraud detection solutions help organizations focus on genuine threats, ensuring robust defense against account takeover attempts.

2. Implement biometric verification

Implementing biometric verification strengthens user accounts and security by using unique physical traits like fingerprints or facial expressions. It deters impersonation attempts, streamlines user experience, and detects fraudulent activities. Integrating with multi-factor authentication adds an extra layer of protection against any account takeover attacks, ensuring secure access.

3. Perform behavioral analytics to detect suspicious activity

Performing behavioral analytics is crucial for detecting suspicious activity and preventing account takeover. Organizations can safeguard accounts by detecting deviations in human behavior, such as login times and device usage, which could indicate fraudulent activity.

4. Regularly conduct review audits

Regular review audits are necessary for security. By systematically checking user accounts and activity logs, organizations can swiftly identify and address any anomalies or unauthorized changes, reducing the risk of account takeover.

Combat account takeover fraud with a comprehensive fraud detection solution

Account Takeover prevention requires a comprehensive fraud detection solution. Identity verification plays a vital role in preventing online identity theft by confirming that users are who they claim to be, making it harder for fraudsters to gain unauthorized access to other accounts. Learn more about how solutions for verifying identity online can strengthen your security measures.

Ready to strengthen your account security? Sign up for HyperVerge’s identity verification services and take the first step towards combating account takeover attacks.

US

US

IN

IN