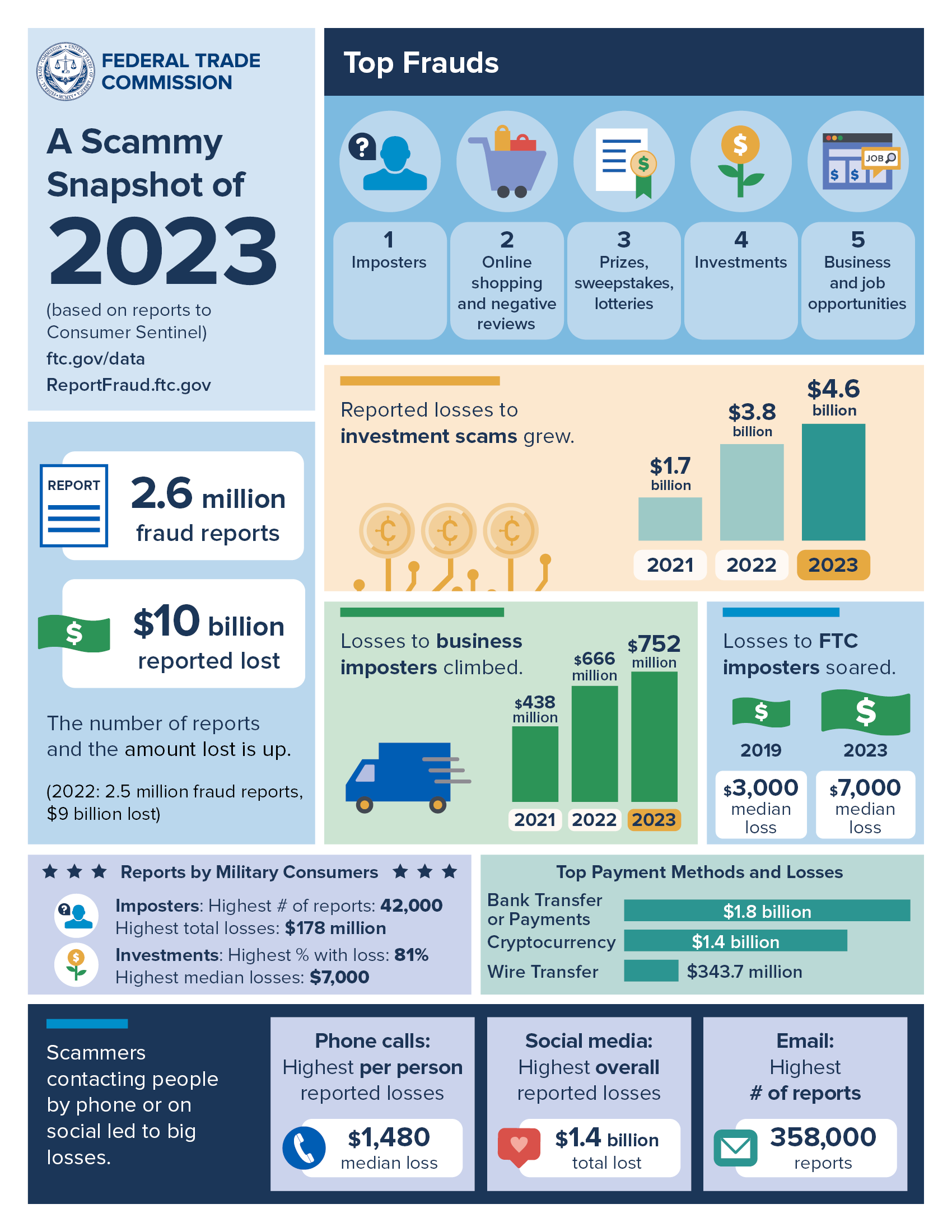

According to the FTC, nationwide fraud losses exceeded $10 million in 2023, with financial fraud accounting for a significant portion of it. As fraudsters and scamsters get more advanced each passing day, fraud prevention is more crucial than ever.

(Source)

This definitive guide will dig deep into fraud detection in financial institutions and review some of the various methods scammers use to pull it off. In addition, we will discuss methods to detect and mitigate fraud and its effects.

What is bank fraud detection?

The introduction of digital technology and online transactions in banking procedures has led to a rise in the complexity of fraudulent operations. For this reason, any financial institution must protect its transactions, systems, and, above all, its clients. Banking fraud detection is a technique for identifying and monitoring any questionable conduct in payments and banking transactions.

Understanding the several forms of fraudulent activity is essential for spotting bank fraud. Banks can safeguard their customers’ money and systems from losses by identifying suspicious transactions.

Different types of bank fraud

To employ efficient detection techniques, it is essential to understand the many types of bank fraud.

New account fraud

In new account fraud, fraudsters open bank accounts with stolen or fabricated data to launder money. In this type of financial crime, people appear as authentic customers by stealing identity cards or forging their identities. Cybercriminals often use technological tricks like image editing and deepfake to try to bypass the KYC process.

Financial identity theft

When did banking fraud detection become critically affected by financial theft of identity? As criminals get smarter about stealing and using people’s personal information for fraud, financial identity theft has become a bigger problem in the banking industry. Criminals committing this type of theft gain access to the victim’s accounts or start new ones using the victim’s stolen credentials. This can result in unlawful transactions and the victim’s financial loss.

To counteract this increasing threat, banks are constantly enhancing their security procedures. Customers are urged to stay careful in securing their personal information to prevent falling victim to these fraudulent schemes.

Money laundering

Money laundering is a pervasive financial crime that involves disguising the origins of illegally obtained money to make it appear legitimate. This process typically involves a series of complex transactions that obscure the trail of illicit funds, making it difficult for authorities to trace and detect the illegal activities that generated the money.

Money laundering poses significant risks to the integrity of financial systems, as it can facilitate other criminal activities, such as drug trafficking, terrorism financing, and corruption. To combat money laundering effectively, governments and institutions worldwide have implemented stringent regulatory compliance measures, including Know Your Customer (KYC) and anti money laundering procedures, transaction monitoring, and reporting requirements.

Read more about anti money laundering compliance.

Synthetic identity fraud

Acquiring knowledge about the sneaky nature of synthetic identity fraud is crucial as you explore the field of banking fraud detection. In this form of theft, fraudsters create false profiles by merging actual and phony details to open new accounts or gain access to new ones.

Due to the fact that fake or synthetic IDs create whole new identities rather than depending just on stolen personal data, it is extremely difficult to detect. With the use of these false identities, fraudsters can slowly build up credit profiles, evading typical fraud detection procedures.

Account takeover fraud

You need to be aware of the methods that hackers use to obtain unauthorized access to your accounts. Spear phishing, social engineering, and malware are just a few of the ways cybercriminals try to gain access to your account.

Emails that attempt to deceive you into providing sensitive information are known as phishing, whereas social engineering is the practice of manipulating individuals into disclosing personal data. Undetected malware can secretly record your login information. This way, a cybercriminal can do account takeovers and extract customer data.

Loan fraud

In loan fraud cases, fraudsters or organizations intentionally provide false information while requesting a loan to avoid repaying the amount. Some common warning signs are forged paperwork, an overstated income, or a made-up work history.

Using stolen personal information to get loans is another way fraudsters cheat the system. They can even forge appraisals to borrow more money than a property is actually worth.

Additionally, ghost loans also fall under loan fraud, where fake loan documents are in the loan books and act as bad loans. This can affect the individual’s credit report adversely.

Payment fraud

This type of fraud occurs when unauthorized transactions are conducted using your account details. This is a serious risk to your financial security. Along with the loss of money, this fraud can hack your sensitive financial information and identity, which can lead to fraudulent charges on victims’ cards.

Banks use complex algorithms to audit your spending habits and identify any suspicious behavior in order to detect and prevent fraud. Banks also use measures like biometric verification or two-factor authentication as an extra layer of protection.

Physical theft of the ATM cards

Debit to credit card fraud is one of the most common forms of banking fraud that happens every day. Fraudsters call you as a banking agent and ask for your ATM card details, PIN, and card numbers. If you fall into this trap, criminals can empty your bank accounts in no time. Additionally, theft of these cards can lead to fraudulent purchases made in the victim’s name on occasion.

You should never let anyone else have your PIN or ATM card information. To avoid debit or credit card fraud, always keep an eye on your account for anything out of the ordinary, including withdrawals or purchases from somebody you don’t know.

Overcoming challenges in financial fraud detection

Staying ahead of developing strategies and implementing solid security actions is crucial for effectively combating bank fraud. However, the major concern is that, with the development of technology, fraudsters’ level of sophistication is also evolving, and they alter their approaches frequently.

Fraud prevention can be improved using sophisticated technologies like artificial intelligence and machine learning algorithms. These advanced tools can identify abnormalities and strange trends in real-time. By working together and exchanging fraud data, financial institutions can fortify their defenses and present a unified front against fraudulent operations.

Another essential step is to boost customer education on such financial losses. Banks and financial institutions should encourage users to use secure banking practices that reduce their chances of becoming victims of scams. It’s important to keep your fraud detection systems updated, build connections in the industry, and spread awareness to stay ahead of the game regarding bank fraud.

6 Actionable strategies for banking fraud detection

To avoid malicious activities and banking fraud, it is essential to implement preventive measures and bank fraud detection strategies. It helps to reduce the risk of unauthorized transactions and fraudulent activities and enhances the safety of the banking system and customers.

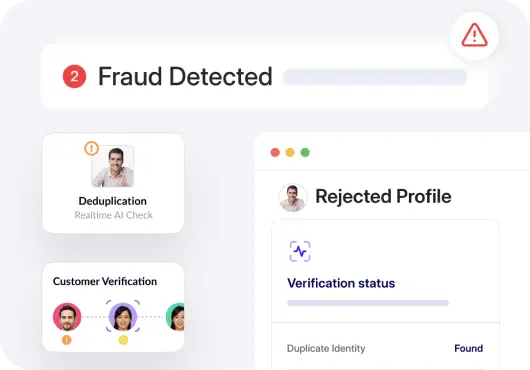

1. Use a reliable solution for fraud detection

Banks can adopt trustworthy AI-powered identity verification solutions to combat fraud.

The banking system can detect fraudulent transactions using data analytics, real-time data monitoring, AI algorithms, trend analysis, and anomalies that could suggest fraudulent actions.

Artificial intelligence can also assist in detecting false positives. It helps to improve productivity and efficiency by freeing up your team to concentrate on value-adding activities. Incorporating AI into your fraud detection approach improves security, streamlines procedures, increases operational efficiency and earns customer trust.

2. Perform biometric verification

Biometrics is another banking fraud detection technique considered as a means to reinforce the capacity to identify fraud.

Biometric verification uses unique biological characteristics like fingerprints, iris patterns, or facial features to verify the identification of account access users. Integrating biometric technology into your bank’s security methods can significantly reduce the likelihood of fraudulent actions and unauthorized access. Since biometric data is more difficult to copy or steal than standard authentication methods like passwords or PINs, it offers higher security. Biometric verification further strengthens security measures against account takeovers and identity fraud.

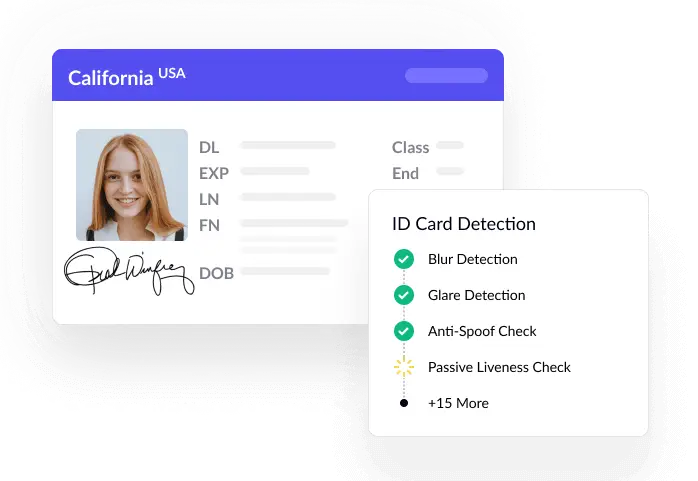

3. Implement document verification

A vital tactic to identify and avoid fraudulent activity is document verification.

During the document verification process, bank personnel examine customer accounts and identity documents like passports, driver’s licenses, and utility bills. Integrating automated document verification procedures into your system allows you to swiftly confirm the authenticity of documents, lowering the probability of fraud and theft of identity.

This process enables the bank to check customer information against trustworthy databases and identify any differences or inconsistencies that need to be investigated more. Further, document verification increases defenses, making it more difficult for fraudsters to alter or fabricate documents, which protects your business and its clients from possible financial problems.

4. Implement face authentication with liveness checks

To complement your bank’s existing fraud detection methods, use facial authentication in addition to liveness checks.

Face recognition technology with liveness checks adds an additional safeguard to confirm the identification of account access users.

This state-of-the-art biometric authentication technology checks the user’s presence to prevent fraud and hacking attempts.

Liveness checks for face authentication can identify facial expressions like blinking or movement, making it more difficult for fraudsters to circumvent security safeguards.

There will be less opportunity for fraud and illegal access to your financial systems if you utilize this technology, which improves security while still making using your systems super easy.

5. Continuous transaction monitoring

One effective tactic in the battle against fraud is implementing comprehensive transaction monitoring systems. This measure is mostly reactive but highly effective in detecting bank fraud. Watch your bank transactions closely to identify and stop fraud in its tracks. It’s essential to report to the bank if you observe any malicious transactions in your bank account.

One smart move is to set alerts for large transactions, unusual spending patterns, or transactions in high-risk locations. This way, you can stay one step ahead of possible fraudsters. Bankers can use sophisticated analytics and machine learning algorithms to find and mark out-of-the-ordinary things for additional auditing. To protect your finances and keep your customers’ trust, remember that proactive monitoring can help you prevent fraud before it escalates.

6. Regularly conduct review audits

Review audits, when performed regularly, can help you find fraudulent activities and strengthen your bank’s security.

It is recommended that financial dealings, accounts, and internal controls be routinely examined to spot unusual or suspicious activity proactively. After these audits reveal any anomalies that might suggest fraudulent activity, you can take swift action to reduce risks.

To top it all off, frequent audits make keeping your bank’s security protocols current and in line with regulatory standards easier. To get the most out of these reviews, you must set up a solid auditing schedule and properly manage resource allocation.

Conduct review audits on a regular basis to stay on top of potential bank fraud.

Fraud prevention tailor made for financial institutions

As technology is rapidly evolving, banks must incorporate cutting-edge tools to detect fraud. You can stay ahead of fraudsters by implementing technologies such as behavioral analytics, biometric authentication, AI, and machine learning applications. Backed up by robust security systems, these tools can identify suspicious activity, spot patterns, and trigger alerts in real-time to stop fraudulent transactions. It is also necessary to update the system and strategies. Banks can achieve a proactive defense mechanism by integrating machine learning and AI-powered systems that can adapt and evolve to new fraud tactics.

Integrating these cutting-edge solutions into your fraud detection and prevention strategies will help you better protect your customers’ assets. Harness the potential of technology to safeguard your institution from financial fraud. Maintain vigilance and keep up with the ever-changing fraud detection landscape by investing in advanced solutions.

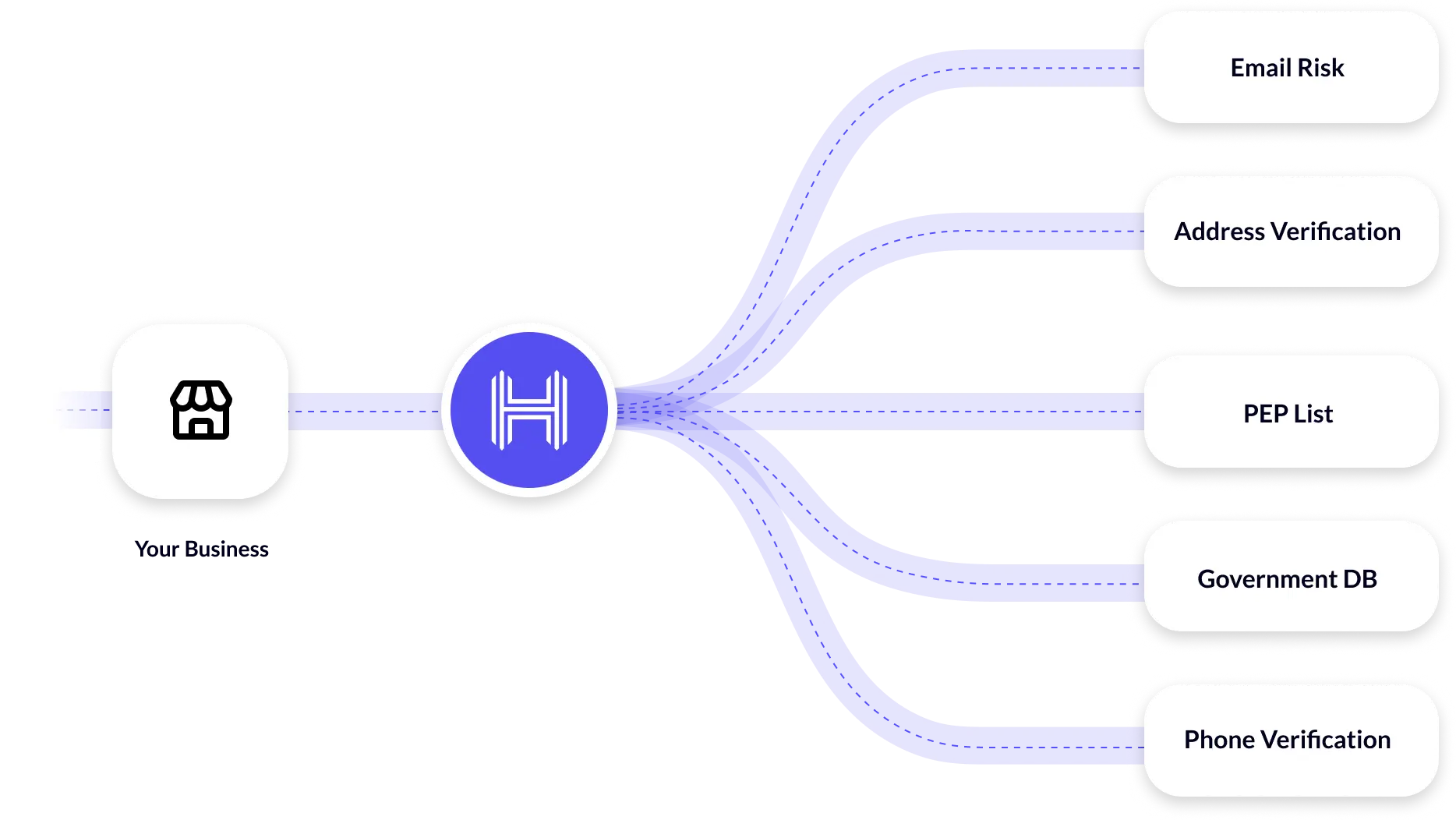

Modern KYC verification technologies like HyperVerge ensure that there is no fake verification process. Its digital and video KYC processes, selfie verification, liveness checks, and advanced face-matching solutions are designed to offer supreme accuracy.

Consult an expert in banking fraud detection strategies to strengthen security against financial crimes and fraud risk.