According to Javelin, child identity theft fraud costs U.S. families nearly $1 billion annually. It affects one out of every 50 children and takes parents and guardians a tremendous amount of time to resolve. With the increasing use of social media, remote learning, and digital purchasing, the signs of child identity or child ID theft and fraud have taken on new and concerning relevance.

Our article helps you understand child identity theft, including how it occurs, warning signs to watch for, and strategies to prevent it.

What is child identity theft?

Child identity theft occurs when someone uses a minor’s details like their name, date of birth, or child’s Social Security Card to get credit or other benefits fraudulently.

Read more about identity theft here.

Since major credit agencies don’t always verify the age of applicants, this crime can go unnoticed until the child grows up and applies for credit, discovering that they are a victim of identity theft and that they have a credit history full of falsely obtained credit using synthetic identity.

Parents typically apply for a child’s Social Security number (SSN) shortly after the child’s birth certificate, which is sufficient to open many credit accounts. However, it may be years before a child applies for credit in their name.

The damage to a minor child’s credit report can range from a single fraudulent utility bill to a foreclosed mortgage, underscoring the importance of being alert in protecting your own child from becoming a victim of identity theft.

If a criminal uses the child’s social security card or other information temporarily, the child’s identity and theft from credit bureau may go unnoticed, leading to serious consequences:

- If someone, even a family member, uses your child’s identity to get credit or a job, it could damage their future chances for loans or careers.

- If the identity thieves are known for other offenses, those crimes might become associated with your child’s credit report, further complicating matters.

How does child identity theft happen?

A child’s identity can be stolen in several ways:

Theft within the family:

Sometimes family members or caregivers misuse a child’s personal information for fraudulent purposes.

Phishing scams on email or social media:

Scammers may use fake emails, phone calls, or messages on social media to trick children or their guardians into revealing personal information.

Data breaches from companies with the child’s SSN:

If a company storing a child’s Social Security number experiences a data breach, the child’s information could be compromised.

Account hacking:

Hackers might gain unauthorized access to accounts containing the child’s personal information potentially leading to a child’s identity theft and financial loss.

Physical theft of sensitive information:

Documents or cards containing the child’s details could be stolen, putting their sensitive information at risk of exploitation.

Signs that child identity theft has occurred

Here are a few of the signs that child identity fraud has happened:

- The child starts to receive bills in their name. It could be a sign that their identity has been compromised. These bills may be for services or purchases that the child never made.

- The child receives credit cards or pre-approved card offers in the mail indicating that someone has likely used their personal information to open lines of credit.

- You start to receive calls from collection agencies asking for the child about debts in your child’s name is a clear indication of identity theft. These debts could be for ghost loans, credit cards, or other financial obligations.

- The child already has a credit report in their name despite their young age and lack of credit activity, which is a significant red flag. It suggests that identity thieves have been using their personal information to establish credit accounts.

- You get a notification from the Internal Revenue Service (IRS) that the child’s name or SSN has been used on another tax return or that the child has to pay income taxes.

- The child is denied government benefits such as Social Security or Medicaid. It could be because their information has been compromised and used fraudulently elsewhere.

- Receiving age-inappropriate junk mail addressed to the child for products or services they wouldn’t typically use is a subtle but significant sign of identity theft. It indicates that their personal information is being used inappropriately.

How to prevent child identity theft?

You can take a few steps to check your child’s information and prevent them from becoming a victim of identity theft:

- Be cautious when sharing your child’s Social Security number (SSN). Before disclosing it, inquire about the necessity of its use, such as for medical records. Keep the child’s SSN card in a secure place like a safety deposit box or locked safe. Tear any papers containing the SSN before disposal.

- Teach your children about the risks associated with sharing personal information online or over the phone. Explain the importance of keeping certain information private. Delete personal information before disposing of a computer or cell phone as your computer and phone might contain personal information about your child.

- Regularly review the websites and online platforms your family uses. Monitor the submission of any personal identifying information and ensure it is done securely.

- Start by checking to see if your child has a credit report. If they do, that may be a red flag indicating possible identity theft. If a credit report is found, inform the credit bureau it may be fraudulent. You may need to provide documents to credit bureaus to verify your child’s identity and your own.

- If your child is 16 or older, educate them about obtaining free credit reports annually from the three major credit bureaus: Experian, TransUnion, and Equifax. Visit the Annual Credit Report website or call 1-877-322-8228 to request these reports. Teach your child to carefully review the credit reports for accuracy and report any discrepancies to the credit bureaus.

- For children under 16, consider placing a “protected consumer” credit freeze or security freeze on their credit record. This prevents anyone from accessing your child’s credit report without their explicit permission, reducing the risk of unauthorized activity.

Strategies for businesses to combat of child identity fraud

Here are some strategies for businesses to stay ahead of identity theft:

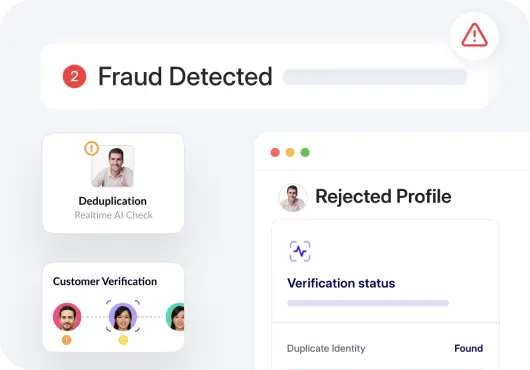

Use a reliable fraud detection solution

Implementing a robust fraud detection solution is important for businesses to detect and prevent child identity fraud. These solutions employ advanced algorithms and machine learning techniques to analyze patterns, detect suspicious activities, and flag potential instances of child identity theft.

By using credit reporting agencies to continuously monitor transactions, credit files, online accounts, credit card accounts, credit monitoring, and account activities, credit reporting agencies and businesses can identify anomalies indicative of fraudulent behavior and take immediate action to mitigate risks.

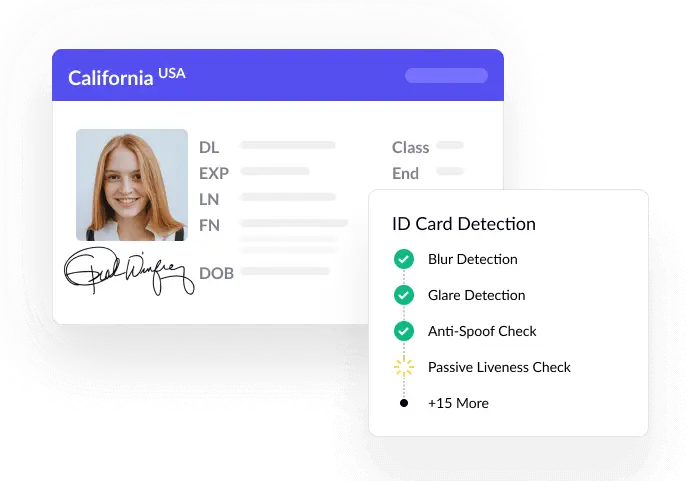

Perform document verification

Document verification involves verifying the authenticity of identity documents provided by customers, such as driver’s licenses, passports, or a child’s birth certificate or certificates. Businesses can use specialized document verification software to scan and validate these documents, assuring they are legitimate and not forged or altered.

By verifying the identity of individuals during account creation or transaction processes, businesses can reduce the risk of fraudulent bank accounts being opened fraudulent accounts using stolen or fake identities.

Implement biometric verification

Biometric verification uses unique physical or behavioral characteristics, such as fingerprints, facial recognition, or voice patterns, to authenticate individuals’ identities. By incorporating biometric authentication into their systems and processes, businesses can add an extra layer of security that is difficult for fraudsters or identity thieves to replicate or bypass.

Biometric verification methods offer high accuracy and reliability, making them effective tools for preventing identity theft protection, and fraud, and ensuring the integrity of customer identities.

Regularly conduct review audits

Regular review audits involve conducting systematic reviews and assessments of customer accounts, transactions, and internal controls to identify potential vulnerabilities or irregularities. Businesses should establish protocols for conducting periodic audits of their systems, processes, and security measures to assure compliance with regulatory requirements, local law enforcement, and industry standards.

By identifying and addressing weaknesses in their security posture, businesses can strengthen their defenses against becoming victims of identity theft and fraud and minimize the risk of unauthorized access or misuse of customer-sensitive information further.

Combat identity fraud today

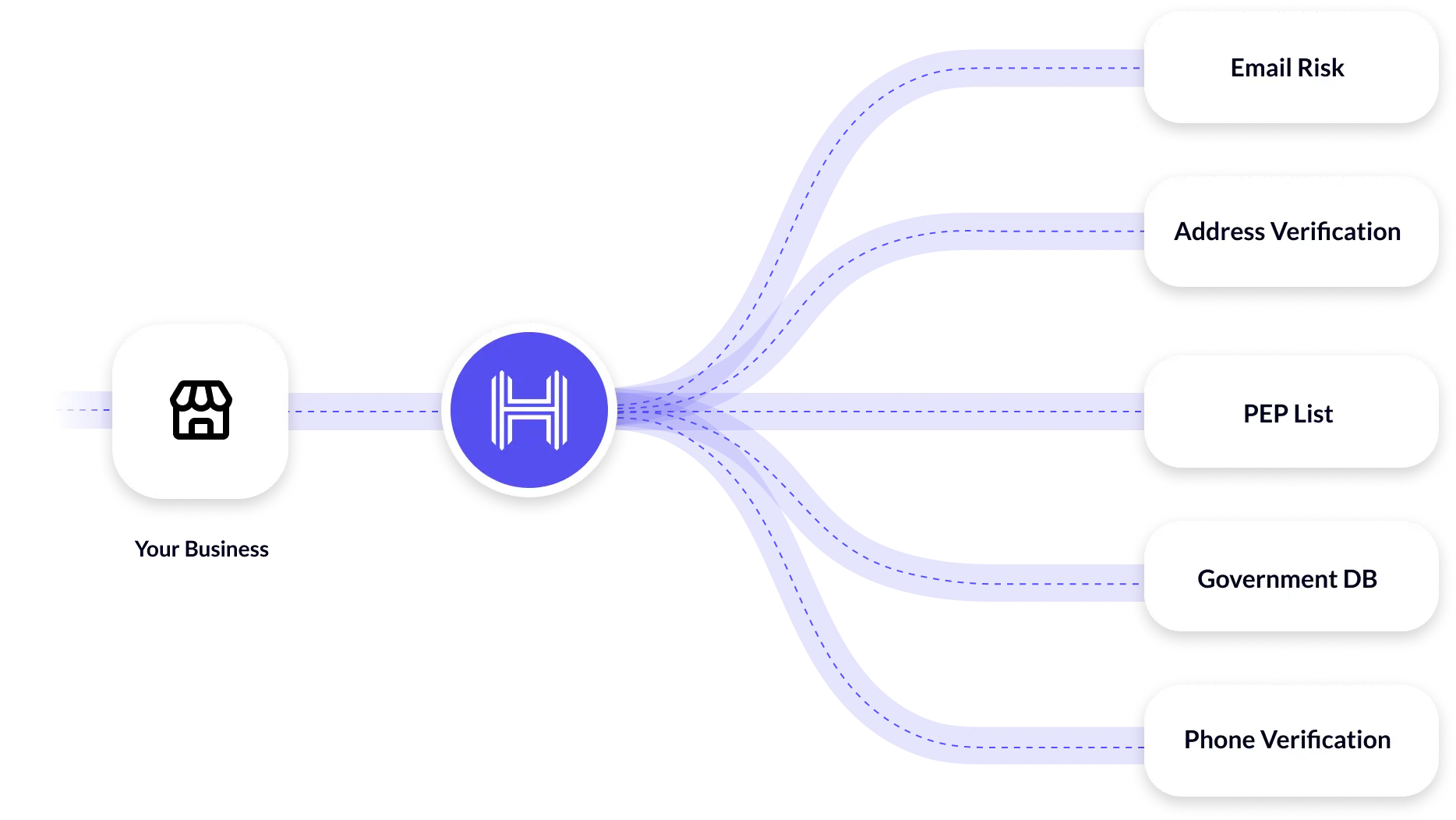

Prevent child identity theft victims from fraud in your business with HyperVerge’s identity verification solutions. Our advanced algorithms and biometric verification methods ensure the authenticity of customer identities, reducing the risk of fraud.

Our proprietary AI models are engineered to work in real-time even in low bandwidth environments, on low-end devices, and enable us to innovate fast and add custom AI checks as new needs are identified.

Sign up now to safeguard your business and customers.

US

US

IN

IN