The loan origination journey can resemble a convoluted neural network rife with noise and suboptimal processing. Loan origination software (LOS) acts as a deep learning intervention in the mortgage lending process itself, meticulously architected to augment lender workflows.

What is loan origination software?

A loan origination system (LOS) is a software platform used by financial institutions in India, such as banks, non-banking financial companies (NBFCs), housing finance companies (HFCs), and other lending organizations, to manage and streamline the process of originating loans. The loan origination process involves various stages, from application submission to loan approval and funding. A loan origination system automates many of these steps, improving efficiency, accuracy, and compliance with regulations.

Top features of loan origination software

LOS functions as your risk prediction engine, wielding intricate algorithms to unveil potential anomalies pre-materialization. This fosters data-centric decision-making, empowering risk mitigation and compliance management and safeguarding financial stability. Here’s a closer look at some of the key capabilities of the loan origination software:

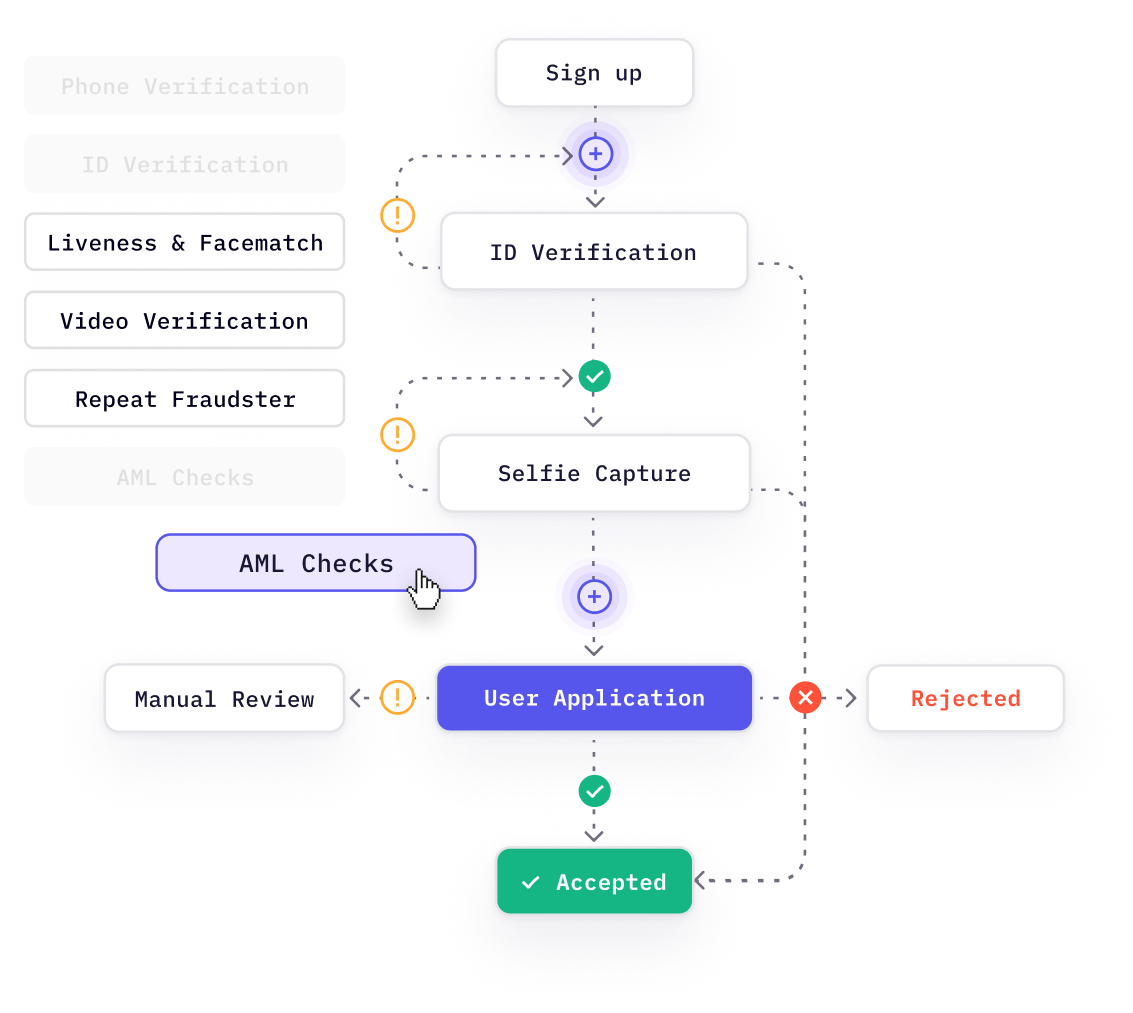

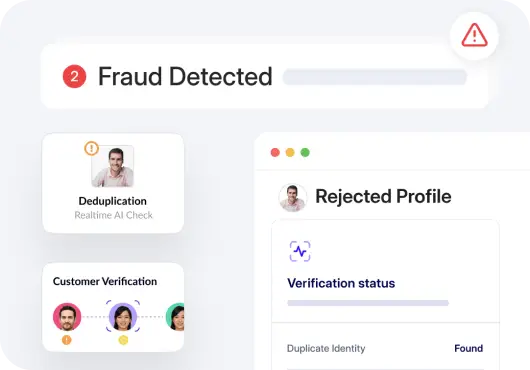

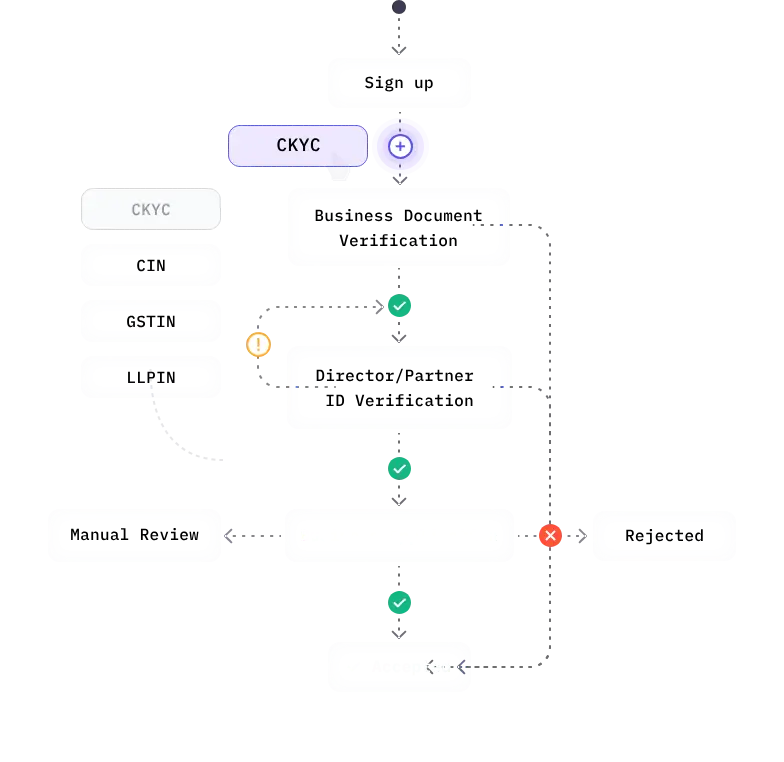

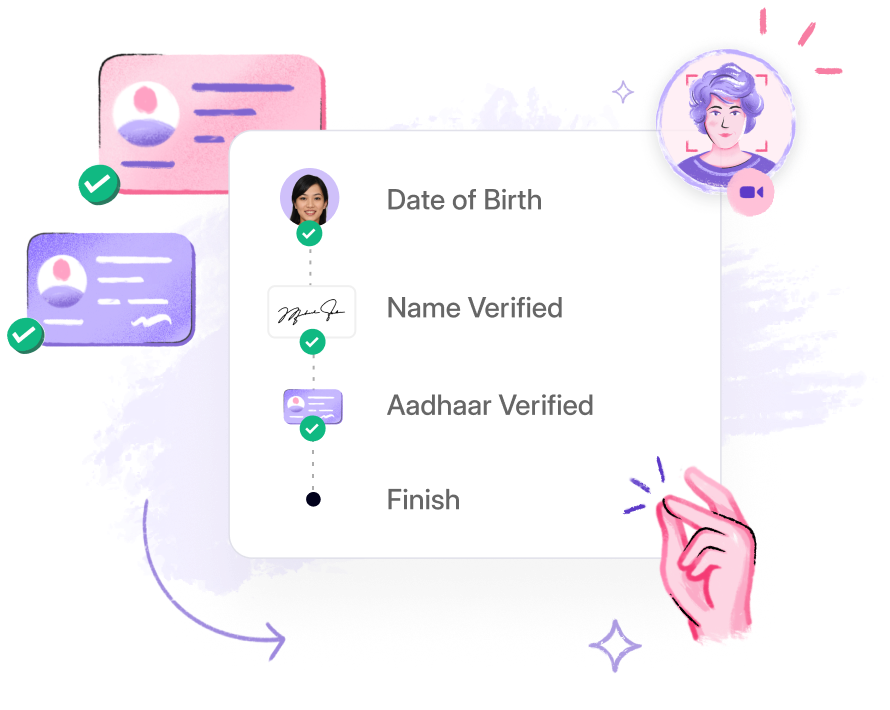

Identity verification

Bid farewell to blurry photocopies and unreliable identification methods. LOS leverages cutting-edge technology to ensure irrefutable borrower verification. Grant loans with absolute confidence, knowing precisely who you’re in business with.

Risk assessment and management

Loan approvals inherently involve uncertainty. Loan Origination System function as a risk management pillar for mortgage lenders, leveraging advanced machine learning algorithms to make credit decisions and proactively identify potential delinquencies. This enables lenders to make data-driven lending decisions now, minimizing credit risk exposure and ensuring portfolio stability.

Simplified underwriting

Historically, the traditional full loan servicing cycle underwriting process for mortgage professionals has resembled a cumbersome linear regression analysis mired in voluminous documentation and countless hours of manual feature extraction. Loan origination and loan servicing software now disruptively automates a substantial portion of this endeavor, liberating your team’s invaluable domain expertise.

Accurate reporting and analytics

LOS transcends the realm of financial accounting beyond mere document management task automation, compliance management and customer relationship management; it propels you toward becoming a data-driven lending institution. This accounting software furnishes comprehensive reports and insightful visualizations, offering a panoramic perspective of your loan portfolio and customer demographics. This empowers you to make statistically sound credit decisioning choices that optimize lending strategies and maximize return on investment.

Security and confidentiality

Borrower data is undeniably sensitive, and its protection is an imperative objective for mortgage industry. LOS is a digital fortress for financial institutions, wielding robust encryption protocols to safeguard all borrower information. You can be confident that your data is shielded from unauthorized access and potential vulnerabilities.

5 Best loan origination software and solutions

Now, let’s meet the top Loan Origination Software (LOS) players aiding financial institutions in their LOS operations:

1. HyperVerge

HyperVerge boasts a cloud-based, comprehensive loan origination software platform designed to streamline the entire loan lifecycle. From initial application intake to underwriting and closing, HyperVerge promises automation, efficiency, and a borrower-centric experience. It stands out for its unwavering commitment to user-friendliness and accessibility, streamlining digital lending with fraud detection, and reducing technical complexities. Save money and expedite the loan approval process.

Best features:

- Cloud-based and mobile-friendly: This platform boasts ubiquitous accessibility via a cloud architecture, enabling “anytime, anywhere” loan origination management.

- Intuitive interface: Its intuitive design eliminates the need for extensive training, catering to seasoned veterans and recruits.

- Scalable solution: HyperVerge’s highly scalable platform seamlessly adapts to your organization’s growth trajectory, irrespective of size or ambition.

- Open API: Its open API fosters a smooth integration with your existing systems, creating a unified and streamlined workflow.

Limitations:

User satisfaction speaks volumes – with HyperVerge, you might find yourself basking in the efficiency glow so much that you forget to look for downsides (although, if you do find any, we’d love to hear about them to improve our service continuously).

Pricing:

HyperVerge offers flexible pricing plans to fit your budget. Contact us for pricing and to see the solution in action.

2. Finflux

Finflux is a user-friendly, cloud-based loan origination software solution catering to financial institutions and lenders of all sizes. It emphasizes features that enhance borrower experience and improve loan processing speed. Here are some of its highlights:

Best features:

- Tailored for specific industries: This solution carves a niche by specializing in diverse industries, fostering an in-depth comprehension of sector-specific challenges.

- Streamlined document management: By leveraging Finflux, you can access an industry-tailored solution that streamlines workflows and optimizes outcomes. It boasts a robust document management system, ushering in an era of digital efficiency and eliminating paper-based burdens.

- Advanced reporting and analytics: Additionally, data-driven lenders will appreciate Finflux’s advanced reporting and analytics, empowering strategic decision-making by extracting hidden trends from loan data.

Limitations:

Finflux may necessitate a marginally steeper learning curve compared to some competitors.

Pricing:

Contact Finflux for a quote.

3. NewGen Software

This platform caters to a broad spectrum of lending institutions, including banks, credit unions, mortgage lenders, and mortgage brokers, specializing in consumer lending, construction loans, commercial lending, and NBFCs.

Best Features:

- Highly configurable: NewGen loan origination software empowers you to take complete control by offering a highly configurable platform. Like bending clay to your will, you can customize NewGen to align with your specific needs and workflows perfectly.

- Robust workflow management: This level of control in the loan origination system allows you to create a loan origination process that feels like a well-oiled machine, ensuring seamless operation and peak efficiency.

- Global reach: NewGen’s international reach is another noteworthy advantage. For financial institutions and lenders harboring international expansion aspirations, it offers the necessary tools and support to navigate this exciting frontier.

Limitations:

Extensive customization capabilities can be a double-edged sword, potentially introducing complexities. While the loan origination system fosters a perfect fit, overly intricate configurations could potentially lead to integration challenges with other systems.

Pricing:

Contact NewGen Software for a quote.

4. Jocata

Jocata has loan origination solutions and loan servicing compliance management software thatmight help you manage the entire loan, from application to servicing. Jocata, known for its cloud-based platform, focuses on empowering lenders to manage customers and deliver exceptional borrower experiences. Their solution is built with a focus on:

Best features:

- AI-powered decision-making: This loan origination software spearheads a new era of intelligent loan origination by harnessing the power of AI. Imagine an indefatigable and insightful AI partner meticulously evaluating loan applications and accelerating decision-making.

- Focuses on borrower experience: Beyond its impressive AI capabilities, Jocata prioritizes the borrower experience. Their loan origination system fosters a smooth and frictionless loan application journey, ensuring a positive first impression for your potential customers. This user-centric approach can lead to higher application completion rates and improved customer satisfaction.

- Exceptional customer support: Additionally, Jocata provides exceptional customer support, offering a dedicated team to address your queries, troubleshoot challenges, and guide you through the LOS implementation process.

Limitations:

Jocata’s feature-rich loan origination software and AI technology may translate to a slightly higher price point than some competitors.

Pricing:

Contact Jocata for a quote.

5. Lentra

Lentra emerges as a potential contender, offering a cloud-based loan origination software and compliance management software solution specifically designed for SMEs. Their platform caters to the unique needs of SME lending, credit reporting and compliance management, offering features like:

Best features:

- Fast and easy implementation: It prioritizes user-friendliness for rapid setup and streamlined operations, minimizing delays and complex configurations.

- Affordable pricing: Budget-conscious lenders will find Lentra’s competitively priced plans attractive. Their competitively priced plans make them a compelling option for cost-effective loan origination, particularly for smaller lenders or those just starting out.

- Strong compliance features: Lentra prioritizes regulatory compliance, offering robust features to manage complex regulations and ensure peace of mind.

Limitations:

Lentra’s feature set might be less comprehensive compared to some higher-end loan origination software options

Pricing:

Contact Lentra for a quote.

Choose the best loan origination software

Selecting the optimal LOS for your loan management requirements resembles finding the perfect teammate – it should complement your strengths and empower you to achieve your goals. Here are some key considerations to guide your loan officers’ decision:

- The size and complexity of your lending operation: A small credit union might not require all the bells and whistles offered by a high-end LOS, while a large lending institution might benefit from a more robust and scalable solution for loan management needs.

- Your industry niche: Some LOS options cater to specific sectors, so if you specialize in healthcare or real estate lending, look for a solution that aligns with your industry’s unique loan management requirements.

- Budgetary constraints: LOS solutions come in a range of price points. Carefully evaluate your budget and choose a software that delivers the most value for your investment.

- Ease of use and user experience: A user-friendly interface is crucial. A complex LOS can hinder productivity and staff morale.

- Scalability and future growth: Consider your future ambitions. Will the LOS be able to adapt and grow alongside your expanding business needs?

HyperVerge can be your perfect fit

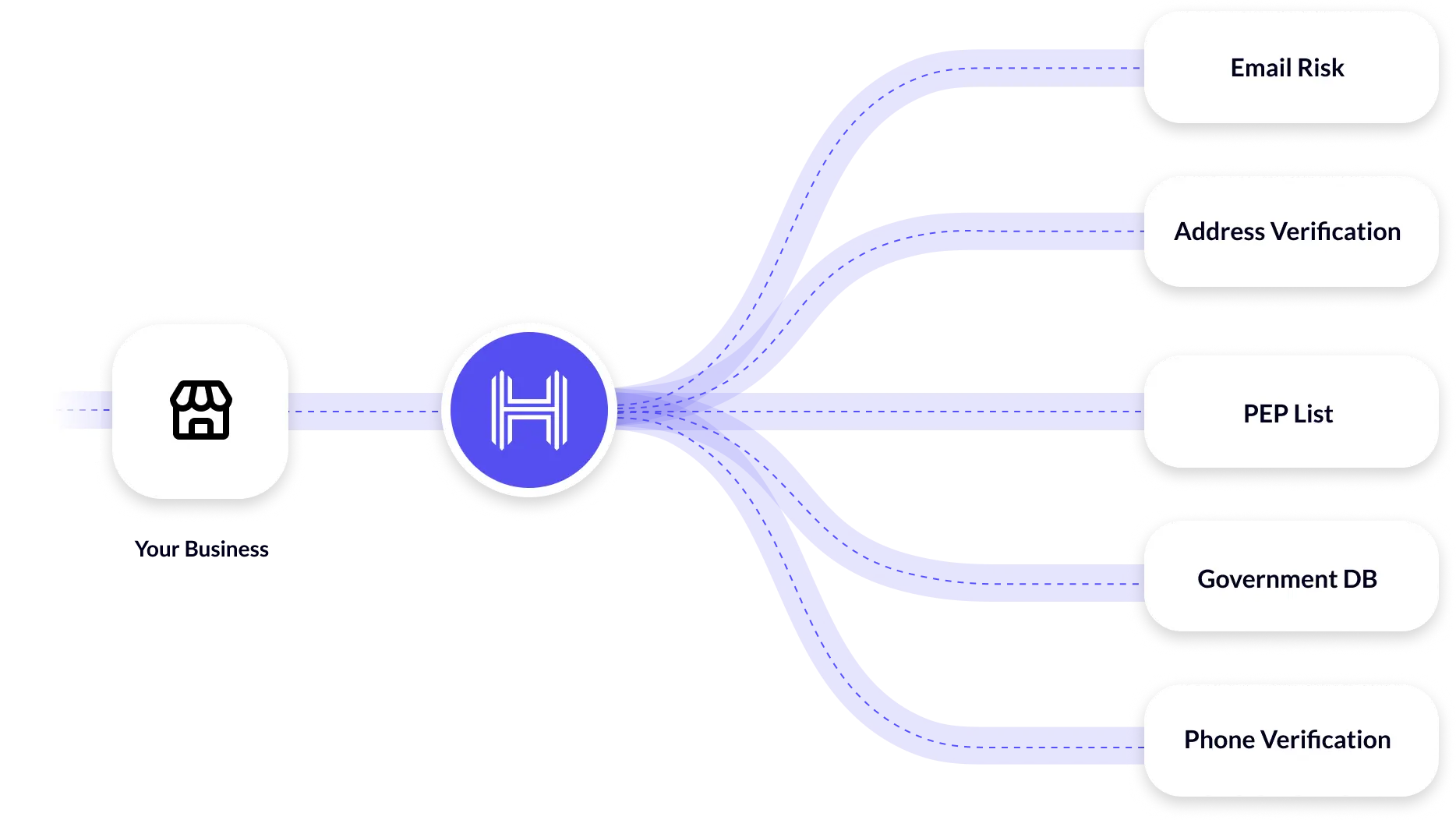

HyperVerge is no code platform architected for scalable agility, catering to lenders of all sizes. Built on a cloud-native foundation, our loan origination software system prioritizes intuitive usability, robust security, and a comprehensive suite of functionalities designed to optimize your loan origination workflow. This includes integrated identity verification modules (to validate income and other key factors) and sophisticated underwriting capabilities.

Modular adaptability

- HyperVerge’s design philosophy champions modular adaptability.

- Our architecture prioritizes seamless integration, enabling frictionless onboarding into your existing infrastructure.

- Additionally, our platform offers extensive configuration options, granting you granular control to tailor it precisely to your unique lending requirements and risk appetite.

Intricate AI engine

- In the nucleus of HyperVerge lies its intricate AI engine.

- This engine harnesses state-of-the-art machine learning algorithms to mechanize pivotal facets of the loan origination process.

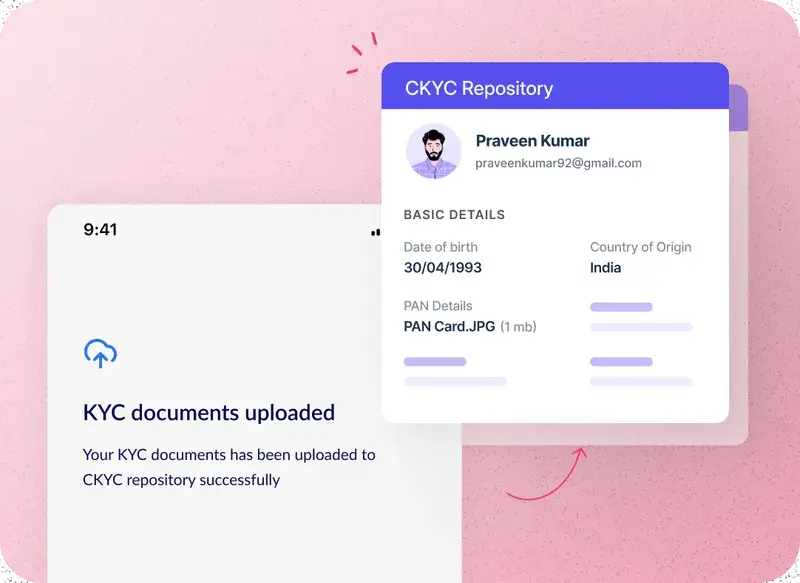

- Identity document verification, a traditionally laborious manual endeavor, undergoes a transformation via HyperVerge’s KYC (Know Your Customer) automation.

- This component employs advanced optical character recognition (OCR) and facial recognition technologies to extricate and authenticate borrower data from government-issued identification documents, thereby ensuring regulatory compliance and operational efficiency.

Hypercharge your loan origination

Are you ready to harness the power of HyperVerge’s loan origination system? Sign up for a demo today and experience the transformative impact of our loan origination platform and end-to-end lending journeys.

US

US

IN

IN