In the wave of India’s digital transformation, Aadhaar eSignatures has become an indispensable tool for secure and efficient document handling, particularly in regulated sectors like financial services, fintech, lending, and insurance. These industries demand quick, reliable, and legally compliant methods to verify documents and minimize fraud. With real-time, verified signatures, Aadhaar eSignatures not only enhance security but also ensure adherence to regulatory standards. This guide will walk you through how to verify a signature with an Aadhaar card, the functionality and legality of Aadhaar eSignatures online, and the advantages for financial services and fintech companies.

Understanding Aadhaar eSign and its growing importance

An Aadhaar eSignature is a digital signature facilitated through an individual’s Aadhaar number, verified by the Unique Identification Authority of India (UIDAI). It acts as a digital stamp of approval that’s just as valid as a handwritten signature but is faster and more secure. For industries reliant on digital transactions, using Aadhaar eSign services reduces paper dependency, expedites processes, and increases trust and compliance.

Why Aadhaar eSignatures matter:

- Enhanced speed and efficiency: Ideal for sectors handling high volumes of documents, such as banking and insurance, as it minimizes document handling time.

- Robust security and compliance: Backed by UIDAI validation, Aadhaar eSignatures are designed to prevent forgery and are inherently secure.

- Legal recognition: Under Indian law, Aadhaar eSignatures hold the same validity as traditional signatures, making them legally binding.

Check out HyperVerge’s Aadhaar eSign service

for a robust, compliant solution for digital document verification. Schedule a DemoLegal framework and functionality of Aadhaar eSignatures

The Information Technology Act of 2000 and the Aadhaar Act of 2016 recognize Aadhaar eSignatures as legally valid and enforceable. This regulatory framework ensures that Aadhaar eSign is stringent on security and privacy standards, making it an ideal choice for various applications.

- Legal validity: Aadhaar eSignatures are admissible in court, offering the same legal standing as traditional signatures.

- Compliance with regulatory standards: Aligned with KYC mandates essential for industries governed by the RBI, SEBI, and IRDAI.

- UIDAI Certification: Certified by UIDAI, Aadhaar eSign services protect the signatory’s data confidentiality and prevent unauthorized access.

How to verify documents through Aadhaar eSign: A step-by-step process

Ensuring the authenticity of using Aadhaar eSign is crucial for secure document handling. Here’s how the verification process typically works:

- Consent for Aadhaar-based signing: Users provide explicit consent to use their Aadhaar details for digital signing. This consent is obtained on an Aadhaar eSign service provider (ESP) page, where the user is informed about how their Aadhaar information will be used.

- Authentication via OTP: After consent, an OTP (One-Time Password) is sent to the user’s Aadhaar-linked mobile number. This secure method confirms the identity of the person signing the document, ensuring that only the legitimate Aadhaar holder can access the OTP.

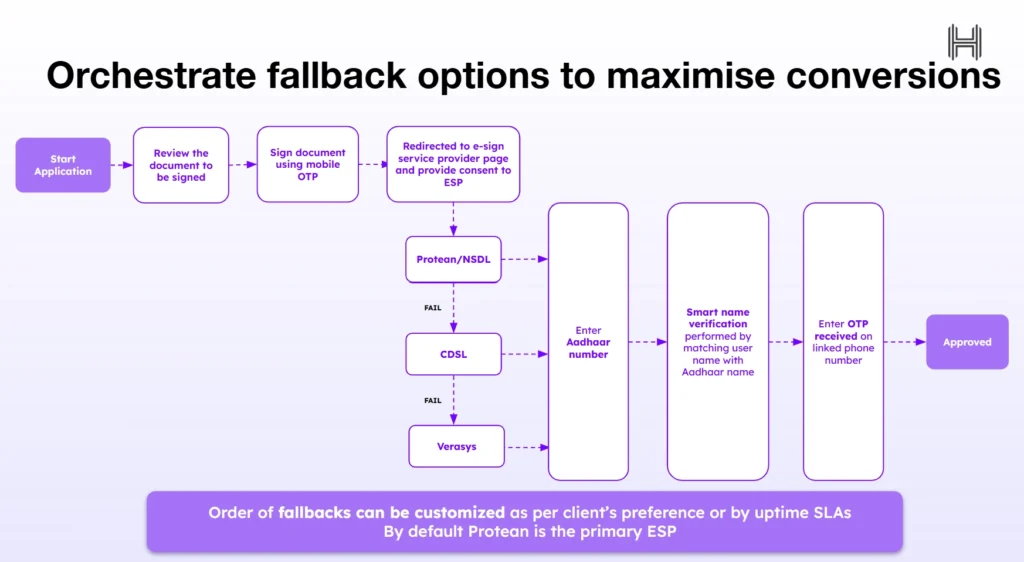

- Signature generation by an eSign service provider: Once OTP verification is complete, the ESP generates an Aadhaar eSignature using the user’s Aadhaar details. Platforms like HyperVerge integrate with certified ESPs like Protean (formerly NSDL), CDSL, and Verasys for reliable e-signature generation.

- Fallback options for maximum uptime: In cases of ESP downtime, platforms like HyperVerge provide a multi-layered fallback mechanism, allowing seamless switching between authorized ESPs and ensuring uninterrupted service.

- Signature verification: Businesses can then use verification tools, such as those from HyperVerge, to authenticate the Aadhaar eSignature. This verification step ensures that the document was signed by the correct individual and that the e-signature is legitimate and tamper-proof.

Advantages of using Aadhaar eSignatures

Aadhaar eSignatures bring multiple advantages, particularly for sectors that rely on efficient and compliant document handling. Here’s how:

- Enhanced security: Backed by UIDAI, Aadhaar eSignatures are difficult to forge. The multi-step verification, including OTP and name matching, reduces fraud risks.

- Cost efficiency: Eliminating the need for physical paperwork saves operational costs, which highly benefits high-volume industries like finance.

- Regulatory compliance: Fully compliant with the Information Technology Act of 2000 and the Aadhaar Act of 2016, Aadhaar eSign meets KYC and data privacy requirements essential for regulated sectors.

- Improved user experience: Remote document signing offers a seamless experience, allowing customers to complete transactions faster.

- Environmentally friendly: Reducing paper dependency aligns with sustainability goals and supports eco-friendly document handling.

HyperVerge’s Aadhaar eSign solution allows companies to enjoy these benefits with seamless integration into their existing workflows.

Top use cases of Aadhaar e-Signatures in the lending and securities Industry

Lending Industry

- Loan Application Approvals: Digital signatures streamline loan application processing, ensuring quick, compliant sign-offs, and reducing turnaround time for both lenders and borrowers.

- Customer Onboarding: Aadhaar e-signatures facilitate digital onboarding, allowing for remote and instant verification, essential for scaling loan distribution in rural areas and underserved markets.

- Disbursement of Loans: Ensures secure and compliant signing of loan agreements, enhancing transparency and reducing the risk of fraudulent documentation.

Securities Industry

- Opening demat and trading accounts: Aadhaar e-signs allow for rapid and compliant account opening, reducing manual checks and enabling online KYC.

- Investment management: Enables real-time, secure signing of mutual fund applications, equity purchases, and other investment documents, enhancing security and reducing paperwork.

- Regulatory compliance: Aadhaar e-signatures ensure that document signing aligns with SEBI regulations, providing both compliance and security for securities firms.

By integrating HyperVerge’s Aadhaar eSign service, companies in lending and securities can handle documentation in a secure, efficient, and compliant manner, essential for handling high transaction volumes and meeting regulatory mandates.

How HyperVerge’s Aadhaar eSign service elevates your business:

HyperVerge’s Aadhaar eSign service provides businesses with a comprehensive, efficient solution for secure and compliant digital transactions. Here’s how it can transform your operations:

1. Fast and secure remote onboarding

With HyperVerge’s Aadhaar eSign, companies can complete digital onboarding quickly and securely, using Aadhaar e-signatures to verify identities online. This Aadhaar eSign service eliminates the need for physical paperwork, significantly reducing onboarding times and ensuring a smoother experience for both companies and their clients. By leveraging Aadhaar eSign online, businesses can expedite the onboarding process, minimizing administrative burdens while ensuring data security and compliance.

2. Enhanced compliance and regulatory adherence

In regulated sectors such as financial services, banking, and insurance, maintaining compliance with regulatory standards is critical. HyperVerge’s Aadhaar eSign service aligns with India’s legal standards, including KYC and Aadhaar e-KYC requirements set by regulatory bodies like RBI, SEBI, and IRDAI. By using a trusted Aadhaar eSign service provider, companies can avoid the risk of non-compliance, fines, or reputational damage, securing their operations with a legally recognized digital solution.

3. Advanced name authentication

To enhance security and accuracy, HyperVerge incorporates “smart name matching” as an extra layer of verification. This feature cross-checks the user’s name in the Aadhaar database with the application data, ensuring the authenticity of the individual signing the document. This added step in Aadhaar eSign verification reduces potential identity discrepancies and fraud risks, giving businesses an extra layer of assurance.

4. Reliable fallback options for maximum uptime

Service downtime can disrupt critical business processes, especially when handling high volumes. HyperVerge offers a multi-layered fallback system to maximize availability. If the primary e-sign service provider (ESP) is temporarily unavailable, HyperVerge’s platform seamlessly switches to an alternative, ensuring uninterrupted service. This unique feature provides businesses with reliable, always-on Aadhaar eSign services, meeting high-demand periods and technical contingencies without compromising user experience.

5. Seamless API integration for efficient deployment

HyperVerge’s Aadhaar eSign API integrates smoothly with existing systems, allowing businesses to leverage Aadhaar eSign services without extensive technical deployment. This seamless integration helps companies scale quickly or enhance current workflows, providing an efficient pathway to adopting Aadhaar eSign solutions without major disruptions or overhauls to their existing infrastructure.

6. Scalability for high-volume transactions

For industries like finance, fintech, and lending that require rapid, high-volume processing, HyperVerge’s Aadhaar eSign service is built to handle a substantial number of transactions simultaneously. With the ability to support high transaction loads, HyperVerge’s Aadhaar eSign service allows businesses to meet demand efficiently and maintain security, making it ideal for enterprises needing fast, reliable document-signing capabilities.

7. Cost efficiency and operational savings

Switching to Aadhaar eSign online helps businesses cut down on costs associated with physical paperwork, storage, and manual administration. By digitizing the signature process, HyperVerge’s Aadhaar eSign service reduces operational costs, lowers error rates, and eliminates delays associated with traditional processing, ultimately providing significant long-term savings.

8. Customize your fallback order

HyperVerge provides the flexibility to customize fallback order preferences, allowing clients to prioritize specific ESPs based on uptime SLAs or business requirements.

Future of Aadhaar e-Signature Verification in India

As India’s digital economy continues to grow, Aadhaar e-signature verification is set to become a standard for document handling in highly regulated sectors. Advances in AI, machine learning, and data security will further enhance the e-signature process, making it an even more valuable tool for business operations. HyperVerge remains at the forefront of these developments, continually innovating to offer solutions that meet industry demands.

Aadhaar e-signatures provide a legally recognized, secure solution for document verification, tailored to the needs of India’s dynamic financial sector. With HyperVerge’s Aadhaar eSign service, businesses can achieve higher efficiency, compliance, and security, helping them stay competitive in a fast-paced digital landscape.

Sign up todayto explore how our Aadhaar eSign solutions can empower your business with secure, efficient document verification.