Ever started a task online, only to quit halfway because it felt too complicated?

That’s exactly what happens to users during bank account verification—except this time, it hurts your business. If users hit roadblocks—unclear instructions, multiple failed attempts, or long wait times—they’re likely to give up. And once they leave, they rarely come back.

Today, the challenge for businesses isn’t just verifying accounts—it’s making sure users don’t walk away in the process. But, here’s the good news—fixing dropoffs isn’t as hard as you think. With a few smart tweaks, your business can make bank account verification smoother and boost completion rates.

In this blog, we break down in detail how to reduce dropoffs when verifying bank accounts. Bonus: Learn what Reverse Penny Drop (RPD) means and how your business can benefit from it!

Understanding drop-offs in bank account verification

A drop-off in bank account verification occurs when a user begins the process but doesn’t finish it. This often happens because of friction points that make the experience frustrating or overwhelming.

Below are some common reasons why users may drop off during bank account verification:

- Lengthy or glitchy process

Users expect quick and smooth interactions. If the verification process drags on or gets stuck due to technical issues, patience wears thin. For example, repeated errors or slow loading screens can make users feel like their time is being wasted. A process that should take minutes can feel like an eternity if it’s not optimized, leading to abandonment.

- Clunky UI

A poorly designed interface can turn a simple task into a confusing ordeal. Buttons that don’t respond, unclear instructions, or too many steps can overwhelm users. If they can’t easily navigate the process, they’re likely to give up.

A clean, intuitive design is crucial to keeping users engaged and guiding them effortlessly through verification.

- Downtimes

Nothing kills user confidence faster than a system that’s down or unresponsive. If the instant bank account verification process fails due to server issues or maintenance, users are left hanging. This not only disrupts their experience but also damages trust in the platform’s reliability.

- Extensive user inputs

Asking for too much information can feel invasive or exhausting. Users may hesitate to share sensitive details like bank account numbers, IFSC codes, or multiple documents. If the process feels like a chore, they’re more likely to abandon it. Simplifying input requirements while maintaining security can make a big difference.

- Security concerns

Trust is critical when handling sensitive financial data, especially as data privacy laws take center stage. If users feel unsure about how their information is being protected, they’ll hesitate to proceed. Clear communication about security measures, such as encryption or data privacy policies, can reassure users and reduce drop-offs.

Businesses need to create a verification process that’s efficient, user-friendly, and trustworthy, ensuring their users stay engaged from start to finish. But, how do they do this? Read below.

Effective strategies to reduce drop-offs/ How to reduce dropoffs?

Bank account verification is critical to establishing identity; but it’s also a stage where many users drop off due to friction, confusion, or delays. Reducing these drop-offs requires a thoughtful approach that prioritizes user experience, efficiency, and reliability. Let’s explore some effective methods to achieve this—

- Simplify the verification process

A complicated verification process is one of the biggest reasons users abandon the process. Lengthy forms, unclear instructions, or too many steps can frustrate users and lead to drop-offs. To avoid this, focus on making the process as straightforward as possible. Break it into smaller, manageable steps and guide users through each one with clear instructions.

For example, instead of asking for multiple documents at once, request them one at a time. Another way to simplify is by using visual cues. If you need a photo of a checkbook or a bank statement, show an example of what it should look like.

Additionally, minimize the number of fields users need to fill out. Pre-fill information wherever possible, such as pulling details from linked accounts or using data already provided by the user. This reduces the effort required and speeds up the process.

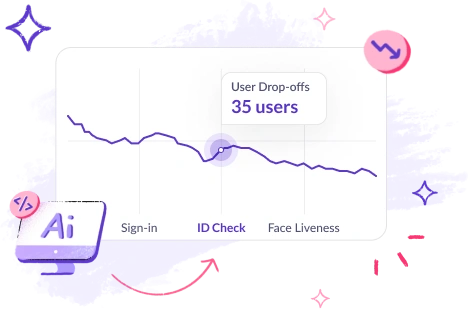

- Implement real-time tracking

Real-time tracking can significantly improve the user experience during bank account verification and build trust. For instance, if a user uploads a document, they should immediately see a confirmation that it’s been received and is being processed. If there’s an issue, such as a blurry image or missing information, they should be notified right away so they can correct it without delay.

Real-time tracking also helps businesses identify bottlenecks in the process. For example, if a large number of users are stuck at a particular step, it might indicate a problem that needs to be addressed. By providing transparency and instant feedback, you can keep users engaged and reduce the chances of them giving up out of frustration.

- Enhance user communication

Many drop-offs happen because users feel left in the dark or don’t understand what’s expected of them. To prevent this, use multiple communication channels—such as email, SMS, and in-app notifications to keep users informed at every stage.

For example, send a confirmation email as soon as the verification process starts, and follow up with reminders if the user hasn’t completed a step within a certain timeframe. If additional information is needed, explain why it’s required and how to provide it.

Personalized messages that address the user by name and reference their specific situation can also make the process feel more human and less robotic.

- Leverage technology for automation

Automation can play a huge role in reducing drop-offs by speeding up the verification process and minimizing errors. For instance, optical character recognition (OCR) technology can automatically extract information from uploaded documents, eliminating the need for manual data entry.

Similarly, AI and machine learning algorithms can quickly analyze documents for authenticity, flagging potential issues without human intervention. Automation also allows for instant decision-making in some cases. For example, if a user’s uploaded document matches the information they provided, the system can approve it immediately, reducing wait times and drop-offs.

- Ensure data accuracy

Inaccurate data is a major cause of verification failures and subsequent drop-offs. Users often provide incorrect information unintentionally, such as mistyping their account number or uploading the wrong document. To address this, implement validation checks at every step. For example, use algorithms to verify that the account number matches the bank’s format or cross-check the name on the document with the name provided by the user.

When errors do happen, be clear about how to fix them. Instead of a generic ‘Invalid document’ message, say something like, ‘The name on your bank statement doesn’t match the name you provided. Please double-check and upload again.’ Specific, actionable feedback helps users correct mistakes quickly and keeps the process moving.

- Fallback mechanisms

Even the best systems can hit a snag. Maybe the user’s bank isn’t cooperating, or the uploaded document keeps getting rejected. In these cases, having a fallback plan is crucial. For example, if automated verification fails, offer the option for a manual review. While it might take a bit longer, it gives users an alternative instead of leaving them stuck.

Another useful fallback is providing multiple verification methods. For instance, if a user struggles with uploading a document, allow them to verify their account through alternative means, such as answering security questions or using a one-time password (OTP) sent to their registered phone number. By offering flexibility and alternatives, your business can accommodate a wider range of users and fight back drop-offs.

Tired of losing customers during verification?

Experience HyperVerge’s hassle-free and super-fast bank account verification and keep them engaged. Schedule a DemoThe role of Reverse Penny Drop (RPD) verification

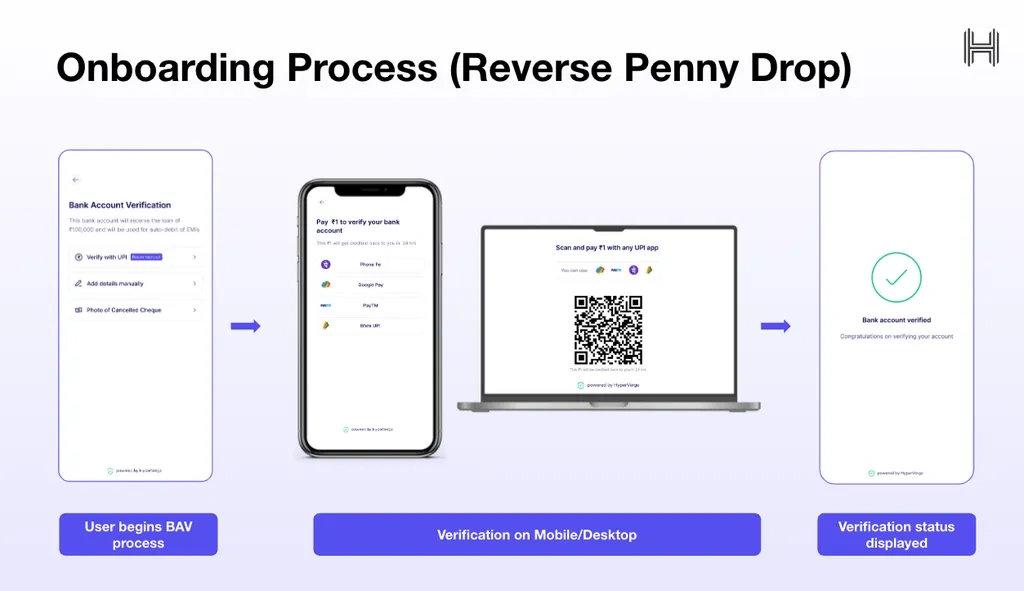

Reverse Penny Drop (RPD) is an innovative method for verifying bank accounts in India. Unlike the traditional penny drop, where a small amount is credited to the user’s account, RPD requires the user to initiate a ₹1 debit transaction. This approach confirms account ownership and ensures the account is active.

Benefits of Reverse Penny Drop (RPD) verification:

- Enhanced security: By requiring a debit from the user’s account, RPD ensures the user has control over the account, adding a layer of security against unauthorized access.

- Regulatory compliance: RPD assists businesses in adhering to regulatory requirements by ensuring thorough and accurate account verification processes.

Limitations:

- Transaction costs: While minimal, the ₹1 debit and subsequent refund involve transaction processing, which could be a consideration for businesses at scale.

Combining multiple verification methods:

Relying solely on one verification method may not address all fraud scenarios. Integrating multiple methods, such as RPD, traditional penny drop, and penny-less verification, provides a more comprehensive approach.

HyperVerge’s comprehensive verification solution:

HyperVerge offers a suite of bank account verification methods tailored for the Indian market, including:

- Reverse Penny Drop (RPD): Facilitates user-initiated ₹1 debit transactions to verify account details without requiring users to recall account numbers or IFSC codes.

- Penny Drop verification: Credits a small amount to the user’s account to confirm validity.

- Penny-less verification: Validates bank account details without any monetary transaction.

- Cheque OCR and IFSC verification: Extracts and verifies details from canceled cheques and validates IFSC codes.

HyperVerge offers your business the right mix of verification tools meaning less fraud, fewer drop-offs, and faster onboarding.

Read more: Top 5 Bank Account Verification Providers in India

Trust HyperVerge for your verification needs

Why do users abandon bank account verification? Is it the lengthy process, unexpected failures, or security concerns? Whatever the reason, every drop-off means frustrated users, and ultimately loss of revenue.

Clear instructions, fewer manual inputs, and instant feedback can help. But to truly cut down drop-offs, businesses need a verification method that is both seamless and highly reliable.

That’s where HyperVerge’s verification suite makes a difference. It verifies account ownership in seconds, eliminating errors and user confusion. No more users leaving because the process was slow or confusing.

Want to boost verification success? Try HyperVerge’s bank account verification—it’s built to keep users happy and your business moving.

FAQs

1. What are common reasons for user drop-offs during bank account verification?

Users often abandon bank account verification due to complex procedures, lengthy processing times, and verification failures. For instance, if a verification method fails and there are no alternative options, users may disengage from the process.

2. How can real-time tracking reduce drop-offs in the verification process?

Real-time tracking provides instant updates on a user’s progress during verification, allowing businesses to quickly identify and address friction points. It is a proactive approach that helps resolve issues before users abandon the process, thereby reducing drop-off rates.

3. What role does automation play in enhancing the bank account verification experience?

Automation streamlines the verification process by reducing manual interventions, leading to faster and more accurate results. Automated systems can quickly validate account information, decreasing the likelihood of errors and enhancing the overall user experience.