Introduction:

In our fast-paced digital era, the need for quick and secure authentication methods is paramount. Traditional paperwork is being replaced by digital bank account verification, revolutionizing financial transactions. This is where digital bank account verification emerges as a groundbreaking innovation in the landscape of financial transactions. In this comprehensive guide, we delve into the nuances of Bank account verification, exploring its evolution, and the regulatory landscape that shapes its importance.

The Significance of Bank Account Verification:

Bank account verification is a critical procedure that involves validating the information provided by customers to ascertain the authenticity of ownership and the accuracy of the provided details. This process is indispensable in the onboarding of new customers and facilitating transactions. Furthermore, stringent compliance with KYC and AML regulations necessitates thorough account verification. When compared to the traditional methods, there has been an increasing dependency on automated methods to enhance accuracy. Notably, the automation of this verification process has drastically reduced the verification timeline compared to the traditional manual scrutiny of bank statements, which could extend up to ten days.

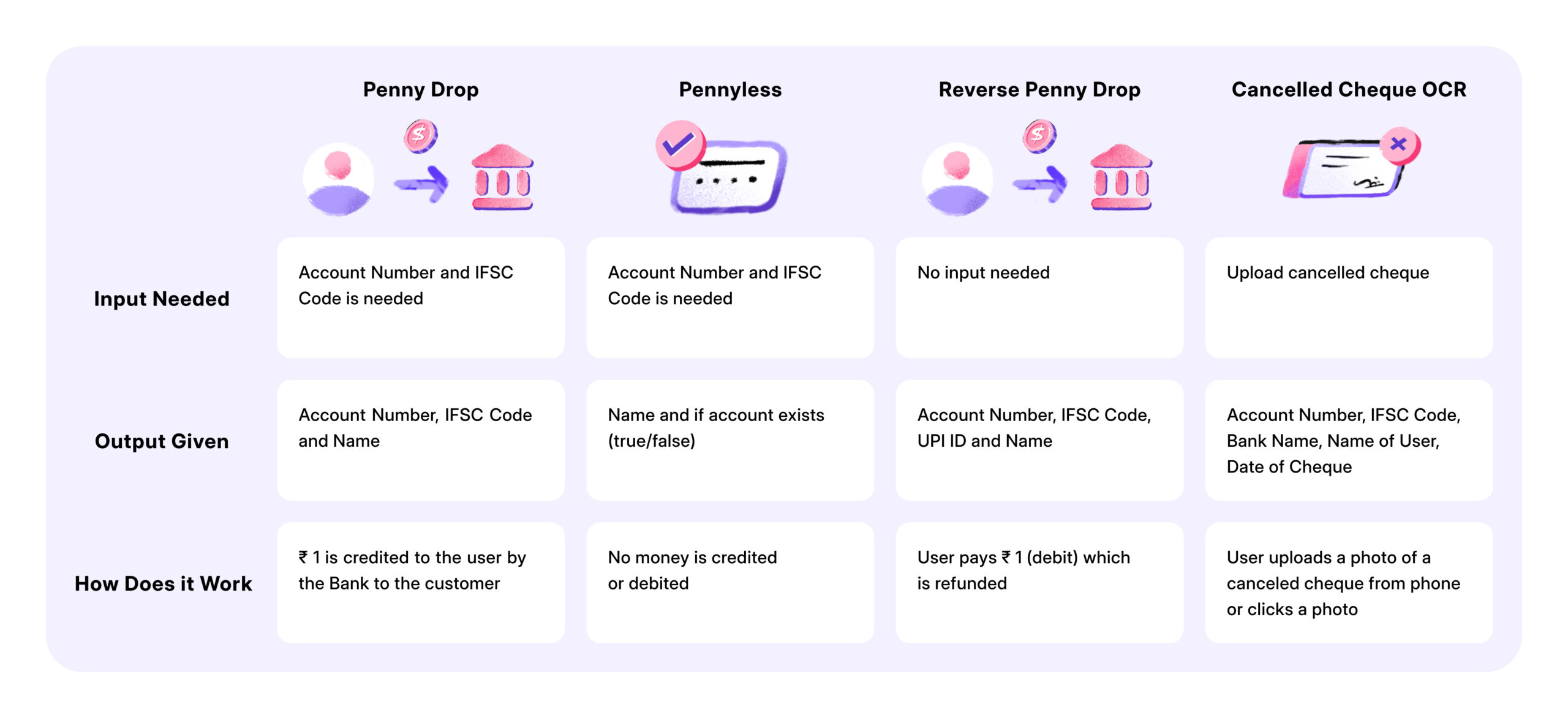

Exploring the four predominant BAV methods –Canceled Cheque OCR, Penny Drop, Reverse penny drop, and Pennyless verification.

- Cancelled Cheque OCR: Cancelled Cheque OCR is a technology that uses optical character recognition (OCR) to extract information from banking cheques. This technology can quickly read information such as Bank name, IFSC code, account number, etc eliminating the need for manual data entry.

- Penny drop: Penny drop verification is a form of bank account validation in which a penny, usually INR 1 (hence, the name), is deposited into the bank account.

- Reverse penny drop: Reverse Penny Drop, or UPI-Based Authentication, users initiate the authentication process by paying a nominal amount of INR 1 using their preferred UPI app. Importantly, this nominal fee is refunded to the customer’s bank account post-verification.

- Pennyless: Pennyless bank account verification API helps you to check the legitimacy of onboarding users just by using their bank account number and IFSC code. No amount is sent to the end user’s account for verification.

While all the above three are used for different sectors, let us understand what the basic differences between each one of them are.

Why Cancelled cheque is not ideal:

Cancelled checks are not considered ideal for verification due to several reasons. Firstly, they introduce significant user friction in the verification process. Users need to physically obtain a check, write “cancelled” across it, and then upload it, which can be inconvenient and time-consuming.

Moreover, cancelled checks are susceptible to fraud because they can be easily replicated. There’s no guarantee that the details on the cheque are genuine or if they have been forged.

Additionally, the verification process usually involves extracting specific details from the cancelled check, such as the account number and routing number. However, this method only verifies the information provided on the check itself and does not confirm the legitimacy of the account or the individual associated with it.

Overall, while cancelled cheques may seem like a straightforward verification method, they come with inherent limitations and risks that make them less than ideal for ensuring the security and authenticity of financial transactions.

Pennydrop: Pros and Cons

The concept behind the penny drop is to carry out a trial transaction to validate the user’s account. This is usually done by crediting a small amount (₹1) to the customer’s bank account. If the transaction is successful, it confirms the validity of the bank account. Although the penny drop method has simplified bank account verifications, it comes with its own set of drawbacks:

1. It is susceptible to scams where fraudsters exploit multiple fraudulent accounts to siphon off small amounts.

2. There is a high rate of drop-offs because customers may struggle to recall their bank details and have to manually input them.

Pennyless Verification: A Closer Look

The pennyless verification presents an alternative method that eliminates the need for any financial transactions. However, it still experiences a notable drop-off rate, mainly because customers may face challenges in recalling their bank details.

Reverse Penny Drop Verification: A Game-Changing Revolution

When we compare the various methods discussed earlier, the Reverse Penny Drop (UPI-based) verification emerges as a game-changer in the landscape of financial transactions. This simple yet highly effective process guarantees secure verification and confirmation of account details, and it seamlessly supports all UPI variants. What makes Reverse Penny Drop stand out is its ability to ward off concerns related to drop-offs, typically associated with high-friction steps as it does not require any inputs to be entered by the user, thus boosting conversion rate.

But the most significant advantage of the Reverse Penny Drop lies in its potential to shield any institution from falling victim to fake bank account holders. This process acts as a safeguard, ensuring that your money is directed to the correct bank account and preventing any financial missteps.

Why Bank Account Verification isn’t Fool-proof:

While many existing solutions incorporate the above-mentioned verification methods, critical aspects of the journey are often overlooked, leading to a notable increase in customer drop-offs. The prevalent challenges include:

- Vendor downtimes.

- Lack of fallback options.

- Instances where users don’t receive OTPs

- The necessity for users to have their Aadhaar card readily available

- The involvement of multiple steps, resulting in a subpar user experience.

Addressing these challenges, HyperVerge provides the best identity verification software that is designed to simplify and enhance the verification process. With HyperVerge, downtime is eliminated, and multiple fallback mechanisms are seamlessly integrated to ensure continuous service. For instance, in case of verification method failure, HyperVerge redirects Reverse Penny Drop to Penny Drop, ensuring a smooth and uninterrupted verification process.

Our plug-and-play solution further streamlines the implementation process for clients, eradicating unnecessary time and effort required to develop a solution independently. To combat customer drop-offs, our analytics dashboard offers valuable insights at each step of the journey, empowering businesses to choose the most effective method for their customers and thereby ensuring a seamless and frictionless verification experience.

Ready to Revolutionize Your Bank Account Verification?

If you’re ready to transform your Bank Account Verification process, sign up with HyperVerge today.

US

US

IN

IN