In today’s fast-paced digital world, handling your finances can be challenging. With multiple financial accounts to keep track of, securely sharing data across various institutions can be daunting. As technology advances at breakneck speed, safeguarding personal data has never been more crucial. Concerns over data privacy and protection have skyrocketed, casting a shadow of uncertainty over the digital realm of finance.

While applying for a loan, the applicant needs to share their financial history with the bank/NBFC. The options available might seem less than ideal:

- They could print their bank statements, self-attest them, and physically hand them over to the lender.

- Alternatively, they could forward all their SMS and emails to the lender for data parsing.

- There’s also the option to share their net banking login credentials for direct account analysis.

- Or they could permit the lender to scrape relevant banking pages.

- Lastly, they could share pictures or PDFs of their bank statement for OCR analysis.

Unfortunately, all of these options have their downsides. They’re either risk-prone, inefficient, or prone to tampering, resulting in the customer dropping off even before completing the journey or verification.

These concerns faced by users can significantly impact your business, leading to a significant drop-off rate which results in losing out on potential revenue. Let’s delve into the reasons behind this.

1. Friction in User Onboarding: Requesting sensitive Net Banking Login credentials during onboarding can significantly slow down the process. It creates a fragmented experience, resulting in more drop-offs and fewer conversions.

2. Risk of Tampering and Fraud: Sharing bank statements as scanned copies or PDFs exposes them to potential tampering and fraudulent activities. This manipulation can inflate financial profiles, necessitating increased verification efforts and driving up processing costs.

3. Lengthy Document Collection Time: Gathering statements manually, whether by downloading PDFs from the mobile app or visiting a branch, consumes considerable time. This leads to extended Turnaround Time (TAT) for onboarding, ultimately increasing drop-off rates and causing loss of Lifetime Value (LTV) for customers who abandon the process.

This inconvenience is precisely what the Account Aggregator ecosystem aims to eliminate. Essentially, Account Aggregators (or AAs) represent a category of Non-Bank Financial Companies (NBFCs) under the regulation of the Reserve Bank of India. Although the concept has been around for a while, it officially came into being through an RBI Master Directive in September 2016. It took nearly five years for AAs to become operational, finally launching publicly in August 2021. Since then, the system has been rapidly scaling up.

With the Account Aggregator System, you can leverage your financial data to access a wide array of financial services for both personal and business needs. Importantly, your information remains confidential and cannot be shared without your explicit consent.

So, what exactly is an AA?

Account Aggregators are entities regulated by the RBI, holding an NBFC-AA license. They empower individuals to access and share information from one financial institution to another securely.

They serve as intermediaries between users and Financial Institutions, enabling secure collection and organization of financial data from various accounts across different financial institutions. This gives users greater control and authority over the data they share, ensuring that sharing only occurs with their explicit consent, which can also be revoked if needed.

Alright, putting aside the formalities and technical jargon, let’s dive into how account aggregators like HyperVerge actually operate.

The main job is pretty straightforward: to securely and efficiently move user’s financial data from where it’s stored to where it’s needed, all with their explicit permission. Now, let’s decipher this process by looking at the key players involved in this ecosystem:

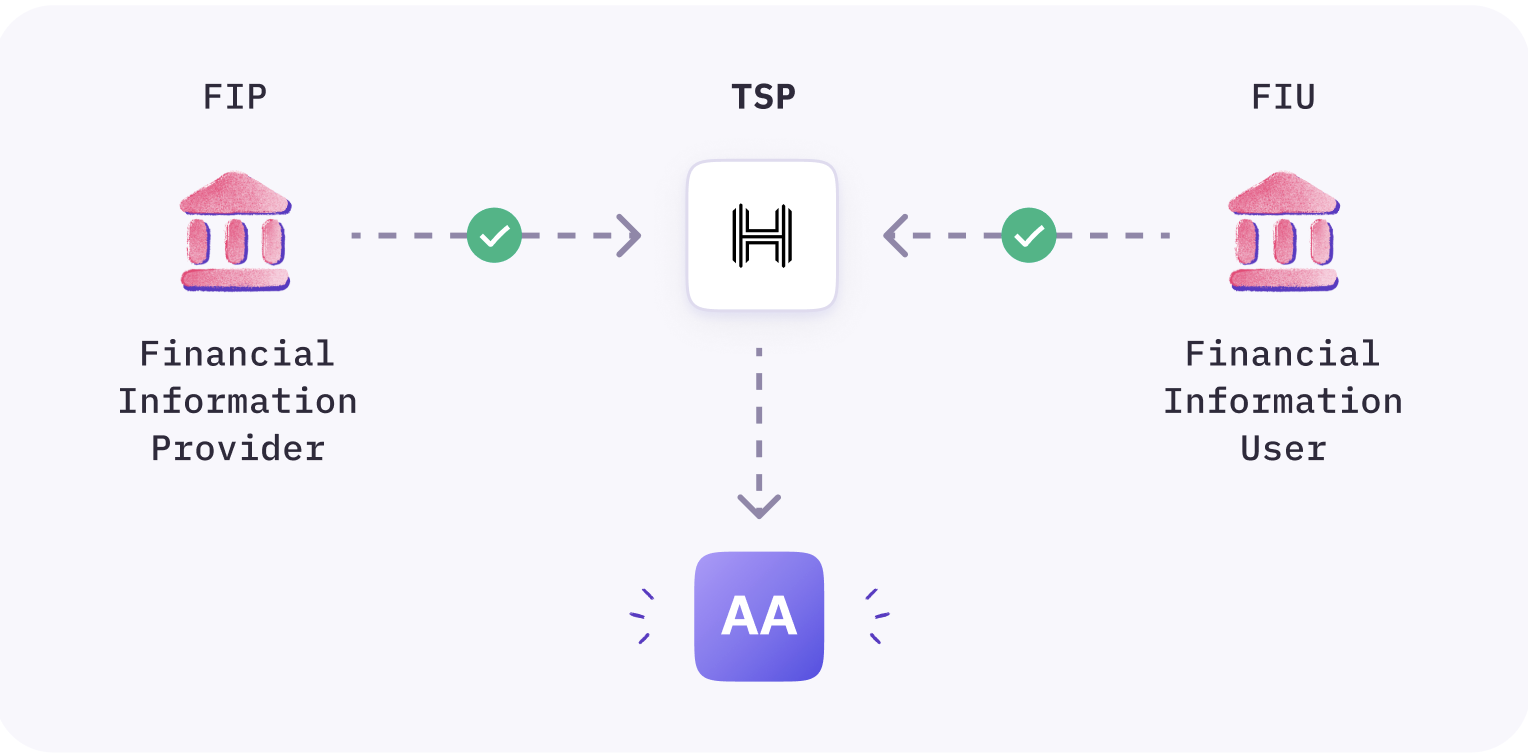

- Financial Information Provider (FIP): These are the institutions holding the user’s financial data, like banks, non-banking financial companies (NBFCs), mutual fund depositories, insurance repositories, and pension fund repositories.

- Financial Information User (FIU): FIUs are the ones who use this data to offer various services, like lending banks and agencies providing financial services.

- Account Aggregator (AA): AAs act as intermediaries. They collect data from FIPs holding user’s financial data and share it with FIUs. Plus, they’re regulated by the Reserve Bank of India (RBI).

- Technology Service Provider (TSP): TSPs work alongside FIUs and FIPs to deliver AA products and services. They’re responsible for developing the basic modules for the account aggregators in this ecosystem.

It is important to know that data doesn’t land in the hands of the AA at any point. Instead, it flows from the Financial Information Provider (FIP) to the Financial Information User (FIU), through the AA interface. The whole idea here is to ensure that you always have full visibility and control over how your data is shared.

Relevant read: Evolution of AA ecosystem

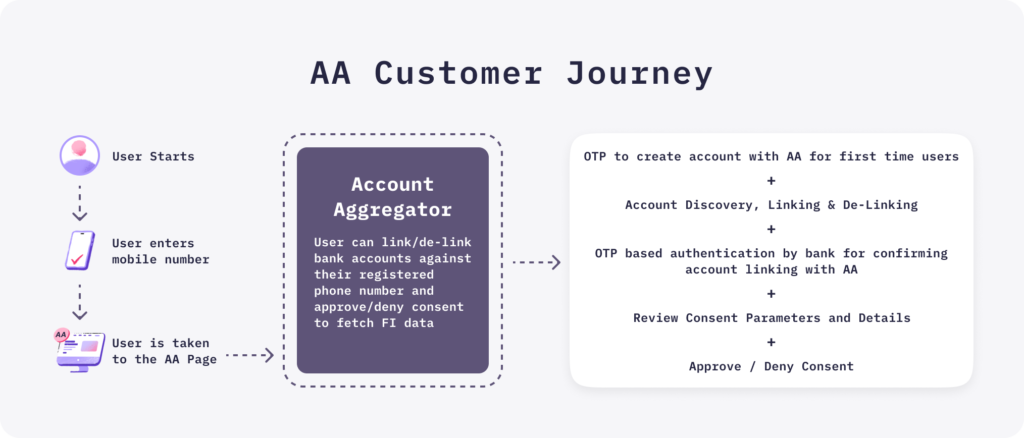

Here’s how a customer flow looks like with an AA framework:

HyperVerge is a TSP, meaning we help facilitate the exchange of information between FIPs and FIUs.

Here are the key advantages of using HyperVerge Account Aggregator Services:

- Efficient Workflow: Connecting your Financial Information Provider (FIP) account is a quick one-time task, taking less than two minutes. Approving consent requests is as simple as a single click.

- Revocable Consent: You have the power to revoke consent at any time. When you do, the Financial Information User (FIU) must delete the stored data associated with your account.

- Enhanced Privacy: Using our service eliminates the need to share sensitive login details online. Additionally, users can potentially filter the financial data they share, tailoring it to their preferences.

- Fraud Protection: Data is sourced directly from the FIP in a digitally signed format, eliminating the risk of fraudulent data.

- Cost Efficiency: With reduced fraud risk and streamlined processes, your business can benefit from significantly lower processing costs.

Increased Revenue: The user drop-off rates in AA-enabled processes are super low compared to traditional methods. This translates to more completed journeys and conversions leading to increased revenue for online lenders. - Customizable Journeys: Our single SDK integration allows clients to tailor their journey by selecting modules according to their needs.

- Streamlined Integration for FIUs: We offer a simplified integration process for Financial Information User (FIU) Modules, ensuring compliance and easy connection to the Account Aggregator ecosystem.

In conclusion, the landscape of financial data management in India is rapidly evolving, especially with laws such as the Digital Personal Data Protection Act (DPDP) of 2023 emphasizing the importance of consumer rights and data protection. The DPDP law grants individuals the authority to access, update, and request the deletion of any data held about them by third parties. In essence, the government is committed to prioritizing and safeguarding people’s data protection rights. This underscores the importance of adopting Account Aggregator (AA) frameworks like HyperVerge, to ensure compliance and foster trust in the financial sector.

By choosing HyperVerge as your account aggregator, you gain access to a comprehensive suite of services that go beyond simply fetching raw data. Our platform offers advanced data interpretation and insight extraction, tailored to meet the needs of modern financial institutions.

Moreover, our cross-platform solution ensures seamless integration across mobile and web platforms, with customizable features to suit various device types. With our analytics dashboard, you can track key metrics like drop-off rates and optimize conversion, empowering you to make data-driven decisions for your business.In this exciting era of Indian fintech, where technologies like Aadhaar, UPI, and the AA framework are reshaping the financial landscape, HyperVerge stands out as a trusted partner.

Are you ready to revolutionize your onboarding journey and stay ahead of the curve? Sign up for a free demo today to learn more about how HyperVerge can transform your financial data management experience.