A fake version of you is now cheap to produce and hard to spot. That shift has pushed deepfake-driven losses past $1 billion in 2025. Add phishing, credential theft, and synthetic identities, and the attack surface keeps widening.

Biometric security is scaling in response. The market is projected to move from $34.27 billion in 2022 to $150.58 billion by 2030, and liveness detection sits at the center of that acceleration.

Liveness detection verifies that a real person is present. It analyzes facial movement and surface detail to flag 3D masks, replayed footage, and deepfakes in seconds while keeping the user flow intact.

The problem is choice. Many vendors promise fast verification with low false positives. Only a few actually hit that mark.

If you’re deciding between BioID, FaceTec, or a newer alternative, you need a clear view of what each system does and where it falls short.

This guide breaks down the strongest options.

Technical Foundation of Liveness Detection

Before you can evaluate alternatives, you need to understand what separates good liveness detection from security theater.

The technology breaks down into two approaches: active and passive liveness detection. Then there’s the underlying tech stack that makes detection possible. And finally, how you actually deploy it.

What’s the difference between active and passive liveness detection?

| Aspect | Active liveness | Passive liveness |

| User interaction | Requires users to smile, blink, or turn their heads | The system analyzes faces in real-time without any user interaction |

| Speed | Slower as a user requires to perform certain instructions | Faster, generally takes about 2-3 seconds |

| User experience | Interrupts the verification flow and frustrates the users (at times) | Users are just required to look at the camera, meaning a frictionless experience |

| What it detects | Natural movements that separate humans from static images or basic videos | Skin texture, light reflection, depth information, and micro-movements |

| Images required | Multiple frames captured during movement | A single image or frame is often sufficient |

| User abandonment | Higher due to friction | Lower due to frictionless (reduced) experience |

| Spoofing vulnerability | Fraudsters know the required actions and can prepare videos or animations that match them | Harder to trick edges, skin texture, and depth; hence, less vulnerable |

What are the key technologies in modern liveness detection solutions?

Modern liveness detection combines multiple sophisticated technologies to ensure biometric systems are both secure and user-friendly.

Here are some key technologies of a liveness detection software:

AI and machine learning (ML)

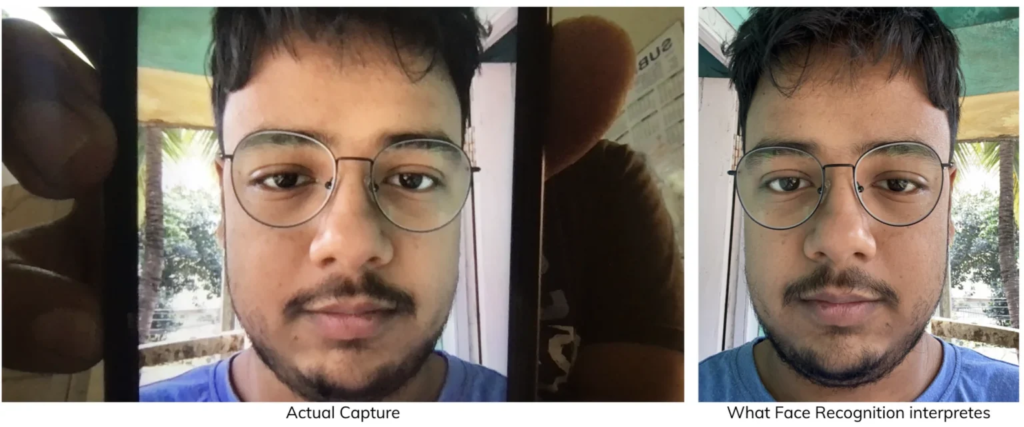

Deep learning models process huge amounts of information to examine facial features, micro-expressions, and subtle indications of fake inputs. These neural networks train on the latest fraud vectors, allowing systems to adapt as new attack methods emerge.

3D depth mapping

3D imaging captures and analyzes depth information to distinguish between genuine, three-dimensional human features and flat, two-dimensional attacks (like printed photos). It spots the spatial arrangement of facial features (unnatural edges or incorrect curvature) that signal masks.

Behavioral biometrics integration

Behavioral biometrics track parameters such as typing rhythm, mouse movement patterns, touch gestures, and scrolling. These unique behavioral patterns are integrated into liveness detection for continuous, non-intrusive authentication. It confirms that a real, genuine user is present during interactions.

Anti-spoofing mechanisms

Here, the system detects suspected presentation attacks through:

- Skin texture: Examines skin pores and how light behaves on surfaces to separate real skin from photos or masks

- Light reflection: Active flash uses light reflection patterns—white light from a device screen creates specific facial reflections that reveal whether someone’s holding up a flat image

- Motion analysis: Distinguish 2D objects from 3D faces by capturing images with sensitive automatic triggers

- Response actions: Watches for natural blinks, gaze shifts, and lip movements that are nearly impossible to replicate artificially

What are the implementation considerations for liveness detection?

For a frictionless verification to happen, you need an architectural framework that makes the backend operations seamless.

Here are the building blocks of any liveness detection software:

- API/SDK availability: Flexible APIs and SDKs improve time-to-market and allow for seamless embedding into broader onboarding or security workflows

- Cloud vs. on-premise deployment: Cloud deployment lets you integrate industry-proven technology faster without server infrastructure costs and also offers benefits like rapid updates and lower maintenance. On-premise solutions, however, give you total control over data and security

- Mobile platform support: Real-time image capture, quality validation, and liveness feedback should be optimized even for lower-end mobile devices

- Real-time processing capabilities: The technology should automatically flag or reject unusable inputs (blurred images, ineligible lighting) before liveness processing to reduce user burden

Comprehensive Comparison of Top Alternatives

Both BioID and FaceTec deliver certified liveness detection that meets international standards. However, BioID relies heavily on active challenge-response mechanisms (asking users to perform active actions), and FaceTec comes with implementation challenges.

Alternatives to these tools offer simpler integration paths, more flexible deployment options, and lower false positives.

Here’s their detailed comparison:

HyperVerge

HyperVerge lets you design and launch user onboarding journeys with its no-code workflow builder. The platform handles end-to-end customer onboarding with over 200 APIs designed for KYC, document verification, AML screening, fraud detection, and risk assessment.

HyperVerge adopts a selfie-based verification approach (just one image), meaning users won’t abandon verification and can get onboarded easily without compromising regulatory compliance. The platform’s robust passive AI analyzes selfie images for authenticity and performs flawlessly even in low-light and poor network environments.

HyperVerge delivers industry-leading conversion rates and is the only vendor to meet DHS benchmarks.

Target industries: Banking, Fintech, Insurance, Telecom, eKYC platforms

Core features and capabilities

- Exceptionally low user friction with 50% reduced user drop-off

- Supports multiple deployment models (cloud, on-prem, SDK)

- Single-image liveness detection

- <1 second processing time per session

- No-code workflow builder with drag-and-drop interface

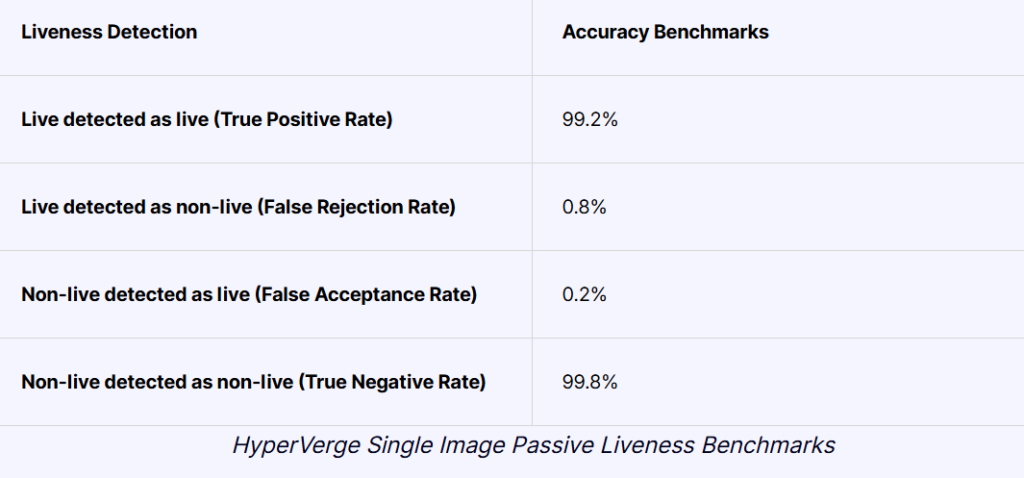

Technical specifications and performance metrics

- 99.8% accuracy rate

- Certified for ISO 30107-3 PAD Level 2 compliance

- Real-time processing

- Supports facial spoof detection for photos, videos, and 3D masks

- Only vendor to meet DHS benchmarks

What users have to say

“HyperVerge is one the best product for our customer onboarding process. The AI accuracy is world-class, and the KYC verification takes less than a minute, pretty smooth. The no-code platform is a big win, letting us go live super fast. It’s pretty simple and easy to use. Plus, it’s a one-stop shop, so no more juggling multiple vendors.”

Mayank P, G2

“Identity Verification typically offers fast processing times, and facial recognition, and liveness detection are good.”

Gowtham S, G2

Identomat

Identomat is designed for businesses that require seamless digital onboarding and robust regulatory compliance. It offers an adaptive liveness detection engine that intelligently adjusts between active and passive liveness based on user behavior and business requirements.

Its cloud-first architecture supports over 8,800+ document types and delivers rapid processing times—something that’s compatible for businesses with advanced regulatory standards and tailored onboarding requirements.

Target industries: Banking and finance, fintech, government, RegTech, blockchain and crypto, insurance, healthcare, eCommerce

Core features and capabilities

- Adaptive engine with passive and active liveness checks

- Real-time AI-based face matching and anti-spoofing

- Live officer-guided video KYC with real-time liveness detection and document verification

- Customizable onboarding workflows and compliance tools

- Support biometric authentication, AML monitoring, and global ID documents from 165 countries with a multi-language interface

- Cloud-based API-first deployment, omnichannel support

Technical specifications and performance metrics

- iBeta Level 2 certification attests compliance with ISO30107-3 standard

- GDPR, CCPA, eIDAS, SOC2 compliant

- ISO 27001

- Configurable API and SDK for web/mobile integration

- 92 percent first-time pass rate

- 99.99 percent spoof prevention accuracy

Limitation

- Limited user reviews

- Active checks may introduce latency on low-end devices

What users have to say

No available user reviews

Microblink

Microblink is a developer-friendly solution built for businesses looking to automate secure identity verification at scale. It’s the only solution with liveness checks for forged ID documents, facial biometrics and payment cards, that mitigates identity theft and card-not-present fraud.

Microblink’s global document coverage, robust fraud protection (optimized for web and mobile), and pay-per-verification pricing make it appealing for sectors needing fast KYC without the burden of failed verification fees. Microblink caters to teams that prioritize fluid integration architecture and on-device processing over highly specialized regulatory workflows.

Target industries: Financial services, payments, hospitality and travel, crypto, marketplaces, healthcare, telecommunications, iGaming / gambling

Core features and capabilities

- API, SDKs, or no-code hosted UIs that work harmoniously with your existing architecture

- Real-time camera feedback guides users to avoid glare, blur, and poor lighting

- Pay-per-verification model (no charges for failed attempts)

- Automated global document and biometrics matching

Technical specifications and performance metrics

- iBeta PAD Level 2 compliance

- 6X smaller SDKs than leading alternatives

- <3s from capture to verification

- 100% deepfake capture in DHS-backed testing

Limitation

- Less customizable compliance modeling than enterprise-targeted solutions

- Volume discounts only at higher tiers

What users have to say

“It offers a wide range of solutions for scanning and verifying identity documents, and it can also give accurate details by showing the results of the API in a JSON with X and Y coordinates and image text, language, etc., and it supports most of the languages.”

Sudheer N, G2

Read Also: Top 10 Examples of Deepfakes Across The Internet

FacePlugin

FacePlugin focuses on delivering unobtrusive facial liveness detection for industries where passive checks and seamless user flows are critical. Its 3D Passive Face Liveness Detection SDK delivers military-grade security for facial recognition systems, blocking sophisticated spoofing attacks with 99.8% accuracy. FacePlugin analyzes 78+ biometric factors (texture, depth, micro-expressions) to prevent unauthorized access without disrupting UX.

The tool offers perpetual licenses rather than subscription models.

Target industries: Financial services, healthcare, travel, mobile banking, telemedicine

Core features and capabilities

- Passive 3D liveness detection (no challenges)

- Multi-platform SDK: Android, iOS, cloud/hybrid

- Blocks all sorts of spoofing attempts, including 3D masks, video replays, and AI-generated deepfakes

- Trial period with comprehensive PoC support and seamless integration services at no cost

Technical specifications and performance metrics

- iBeta level 2 ISO 30107 & GDPR certified

- Military-grade anti-spoofing

- Spoof detection with 99.8% accuracy

Limitations

- Limited workflow customization for complex regulatory cases

- Less focus on advanced analytics, reporting, or compliance configuration

What users have to say

“I love their liveness detection tech knowledge. It can detect any kind of spoofing attacks, including printed photos, screen replay, 3D masks, and end-to-end fakes. What is more, it runs on a mobile phone in real time. And their SDK is fully on-premise, and their price is the cheapest in the market.”

Tyrian P, G2

Feature Comparison Matrix

| Feature comparison | Hyperverge | Indentomat | Microblink | FacePlugin |

| User experience factors | Seamless selfie onboarding, minimal retries, mobile and web UX | Low friction, dynamic adaptive flows, retry prompts for failed attempts | Frictionless, pay-per-success pricing, rapid onboarding | Instant results, simple onboarding |

| Integration flexibility | Cloud, on-prem, open API, SDK, mobile-first, deep platform integrations | API-first, multi-channel | API, mobile/web SDK, modular deployment, multi-device | Multi-platform SDK (Android, iOS, cloud), on-prem option |

| Cost structure | Tiered pricing (SaaS/enterprise/usage) | Customized per-industry, usage | Pay-per-verification | SaaS or on-prem license |

| Support and documentation quality | 24/7 enterprise support, API docs, implementation guides, solution architects | Responsive enterprise support, onboarding docs, workflow consulting, compliance tools | Developer-focused docs, online resources, help centers, live updates | Standard integration guides, SDK/API docs, fast support channels |

Read More: Facial Recognition API Vs. SDK: The Right Choice For Liveness Verification

Common Implementation Challenges (And How Teams Solve Them)

Liveness detection is seamless on the user’s end. But in the backend, there are challenges with implementation and infrastructure that slow deployments.

Here are some common implementation challenges and how teams can tackle them:

Integration hurdles

Challenge: Integrating liveness detection with legacy or complex IT infrastructures, particularly where patchwork onboarding workflows or third-party systems are used

Solution: Most modern providers—including Hyperverge—offer robust APIs and SDKs, greatly reducing friction. Implementation is further streamlined by no-code/low-code platforms and comprehensive solution architect support. Teams favor single-image passive liveness, which requires only a single API integration, versus video-based methods with higher technical overhead.

Performance optimization

Challenge: Processing face liveness checks on low-end devices drains battery and causes lag. Users abandon verification when their phone freezes for 10 seconds. Network latency compounds the problem. Maintaining high accuracy and low error rates across varied lighting, device types, and network conditions is a challenge.

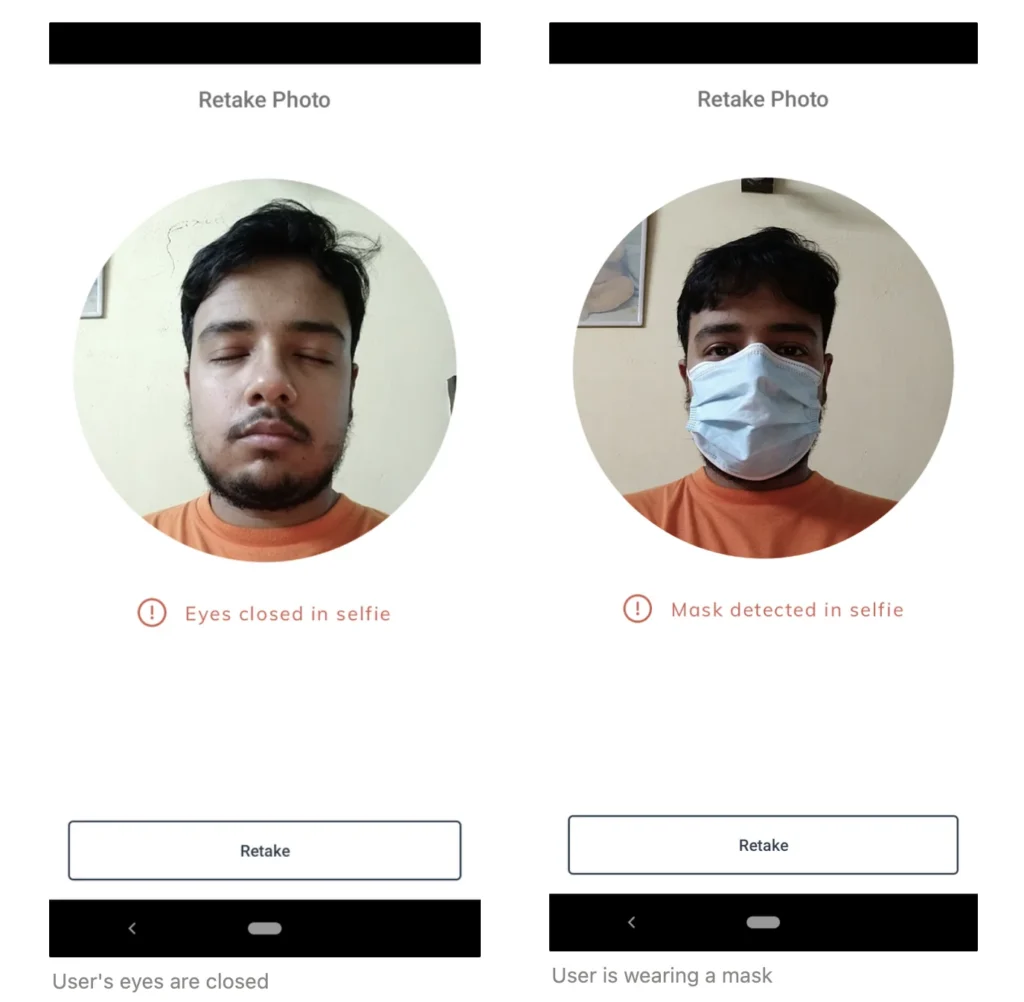

Solution: Advanced AI models adapt to real-world selfie quality variances; immediate feedback prompts help users correct issues before submission (e.g., prompts for better light or a different angle). Continuous model training and updates based on real deployment data keep the system resilient against emerging spoofing and deepfake tactics.

Addressing liveness detection failed scenarios

Challenge: False negatives (genuine users being rejected), especially due to poor image quality or unideal user environments.

Solution: Immediate, actionable user prompts to recapture non-compliant selfies or adjust the environment. Include specific feedback, i.e., remove glasses and try again instead of verification failed.

Pricing Models and ROI Analysis

Pricing isn’t just what you find on the pricing page.

You need to understand how much the tool actually costs you. This includes accounting for implementation time, failed verifications, manual reviews, and infrastructure changes.

A $0.50 per verification tool might cost less than a “cheaper” alternative once you factor in integration hassle and support quality.

Here’s how to evaluate the real cost.

Understanding vendor pricing models

| Tool | Pricing model | What should you watch out for? |

| HyperVerge | Subscription-based pricing tiers, namely Start, Grow, and Enterprise | Predictable costs if volumes are steady, and overage fees during unexpected spikes |

| Identomat | Per verification model starting at $0.28 per verification | Does the cost scale linearly regardless of verification volume? |

| Micro Blink | Volume discount plans starting at $210 per month | Is there a minimum volume or monthly commitment for verification, and the cost of failed verification? |

| FacePlugin | Perpetual license with optional maintenance | Upfront capital expense; technology might age as deepfakes evolve |

Total cost of ownership considerations

- Implementation costs: Budget for developer time beyond the API integration. 2-4 weeks for modern systems and 3-6 months for legacy infrastructure, also testing would add another 20-30% to your timeline before you can launch in production

- Maintenance and updates: Cloud solutions would handle updates automatically, but on-premise deployment would require additional effort and time

- Training and support: Does the tool offer clear API documentation and playbooks for handling failed verification?

- Scaling considerations: Does the pricing scale linearly, or does it offer volume discounts at certain thresholds? Does geographic expansion require additional infrastructure costs?

Return on investment calculation framework

You are going to spend hundreds and thousands of dollars on liveness detection. Before you invest, make sure you understand the ROI it would bring you.

- Calculate operational spend before and after deployment: Measure what you’re spending on manual reviews, fraud losses, and slow onboarding times. Then compare your current monthly operational costs against post-deployment numbers to find your baseline savings.

- Factor in customer dropout reduction: Calculate the reduction in customer drop-offs and how that adds to revenue

- Add regulatory or penalty costs avoided: Factor in time saved on audit preparation and potential fines you could avoid by meeting due diligence requirements

- Subtract annualized fees, training, and support investments: Take your total annual software cost, implementation expenses, and ongoing support fees, and subtract this from your combined savings to get your ROI

Industry-Specific Applications

Here’s an industry-by-industry breakdown of liveness detection applications

Financial services

- Liveness detection is used in digital KYC/AML workflows to verify new customers opening accounts and applying for loans remotely

- Biometric liveness confirmation is layered into transaction authentication (especially high-value or risky actions), providing multifactor anti-fraud protection beyond PINs or OTPs

Financial services implementation case study

The Flip case study highlights how Hyperverge’s AI-powered liveness detection and deepfake prevention slashed Flip’s false acceptance rates from 40–45% to nearly zero during digital onboarding. Verification times dropped to under 5 seconds, enhancing both fraud resistance and user experience. This partnership enabled Flip, one of Indonesia’s top fintech platforms, to deliver secure, seamless financial services at scale

Healthcare applications

- Liveness detection protects against insurance fraud and medical identity theft by confirming patient identity before telemedicine sessions, ePrescription issuance, or access to sensitive health data

- Providers use passive liveness as part of multi-factor login for virtual care portals

- Liveness adds a layer to patient portal logins, stopping credential sharing or social engineering attacks

Government and public sector use cases

- Liveness checks are used in digital voting, tax e-filing, social service access, and ePassport issuance

- Automated border kiosks deploy biometric liveness, stopping entry with fake IDs/photos

- Liveness-enforced login for government portals prevents account takeover and insider threats

Telecommunications industry solutions

- SIM card activation (KYC for telecom) widely uses liveness to prevent burner identity fraud

- Activation of value-added services, eKYC for mobile wallets, and number-porting all utilize liveness

Implementation Guide and Best Practices

Here’s an implementation guide and best practices for deploying liveness detection, combining industry-validated checklists and emerging recommendations:

Selection criteria checklist

- Security requirement assessment: Evaluate regulatory standards (ISO 30107-3, GDPR, HIPAA) and required spoof resistance (e.g., deepfake, photo, mask attacks)

- User experience considerations: Favor clarity and feedback in UI/UX for frictionless onboarding

- Technical integration evaluation: Assess API/SDK flexibility, device and platform compatibility (mobile, web), deployment model (cloud/on-prem), and legacy system fit

- Compliance requirement mapping: Map the solution’s certification and audit capabilities against industry and jurisdictional mandates for data protection and authentication

How to implement liveness detection technologies?

Planning and preparation steps

- Map your current user flow

- Identify where liveness detection fits—account opening, transaction authorization, or password reset

- Define success metrics before you start, i.e., acceptable false positive rate, drop-off rate, and user completion rates

Integration process

Use documented APIs/SDKs for rapid integration; leverage solution architect or vendor onboarding support. Start with test environments, applying your unique user flow requirements.

Testing and optimization

Test with diverse user samples, lighting, and device types; simulate spoofing (photos, videos, masks, deepfakes); gather feedback for iterative UI/process refinement.

Performance monitoring

Establish dashboards to track accuracy, pass rates, false rejects/accepts, completion times, and retry rates. Trigger regular reviews as fraud tactics or user patterns shift.

Summary and Recommendations

That said, here’s our pick to help you decide better:

- Choose Hyperverge for frictionless user experience and best-in-class conversion rates—perfect for customer-centric fintech, telecom, and insurance onboarding.

- Choose HyperVerge and Identomat for highly secure adaptive liveness and regulatory compliance—ideal for banking, government, online gambling, and regulated enterprises.

- Choose Microblink for maximum cost-effectiveness

- Choose FacePlugin for military-grade anti-spoofing

HyperVerge with its plug-and-play modules, 100+ APIs, and analytics dashboard, helps you launch end-to-end onboarding journeys in no time.

Book a demo now, and let’s show you how HyperVerge fits your specific use case the best.