Fake documents are everywhere. From forged Aadhaar cards and altered bank statements to fabricated degree certificates. And with tools like Nano Banana and other AI-powered platforms, it’s alarmingly easy to create fake documents with convincing realism.

- But what are the legal consequences of creating, using, or even possessing a fake document under Indian law?

- Does it lead to imprisonment, fines, or any specific consequence?

- What rules govern fake document punishment in India?

This blog clarifies everything.

We’ll break down IPC and BNS sections with punishments, clarify cognizable vs bailable offenses, and offer real-world legal consequences you need to know.

What Are “Fake” or “Forged” Documents Under Indian Law?

BNS Section 335 (IPC section 464) defines a false document as one made dishonestly or fraudulently with the intention of deceiving others about its authenticity or authority.

Any document or electronic record is said to be false when it:

- Has been made, signed, sealed, or executed (in whole or in part) by someone without authority, i.e., creating a fake degree certificate

- Contains marks denoting execution or authenticity that were made dishonestly to deceive others, i.e., creating a counterfeit government stamp on a property document

- Is cancelled or altered in any material part after being made, executed, or signed (without lawful authority), i.e., changing the rent amount in a lease agreement

| Note: The understanding of fake and forged documents under Indian law can be gathered from the Indian Penal Code (IPC), Section 464, and the Bharatiya Nyaya Sanhita (BNS), Section 335. However, since BNS is the current provision (replacing IPC from July 2024), it’s the one that all current prosecutions and legal refer to. |

Punishment for Fake Documents Under IPC (Indian Penal Code)

IPC included specific sections defining punishment for different forged documents under Indian law.

Let’s check them:

Section 463 IPC – What Constitutes Forgery

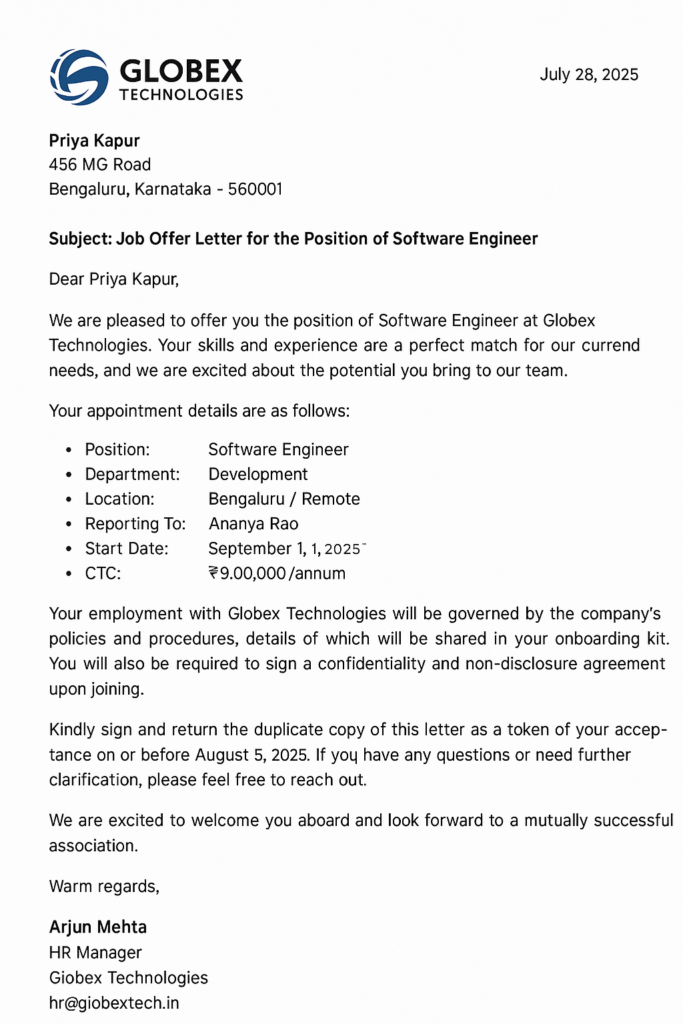

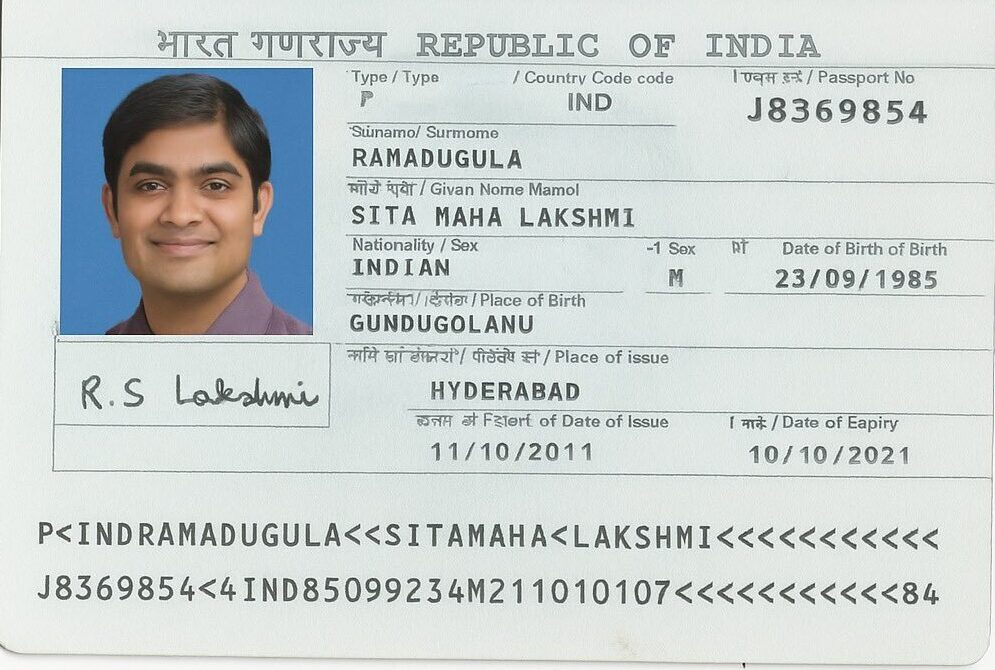

Creating a false employment record to deceive another person

Forgery is the act of making a false document or electronic record with the intent to cause harm, damage, or commit fraud.

This includes creating false documents and electronic records to:

- Cause damage or injury to the public or any person

- Support any claim or title (even false ones)

- Cause any person to part with property

- Make someone enter into any express or implied contract

Intent is at the center of the forgery definition. It establishes the necessary culpability for criminal liability.

Section 465 IPC – General Punishment for Forgery

A person committing forgery (as defined under Section 463) shall be punished with imprisonment of up to two years, a fine, or both.

Section 466 IPC – Forgery of Court or Public Records

Modified passport pages to deceive businesses

Section 466 IPC deals with forgery of official court and public records.

- What documents does it include: Court records/proceedings, public registers (births, marriages, burials), public servant registers, official certificates/documents/electronic records, suit authorities, powers of attorney, and documents authorizing legal proceedings

- Punishment: Imprisonment up to 7 years, and may also be liable for fines

- Severity: It’s a non-bailable offence under Indian law

Read More: Top 10 Examples of Deepfake Across The Internet

Section 467 IPC – Forgery of Valuable Security / Will

Section 467 IPC deals with forgery of documents of immense legal and financial importance. This includes documents like:

- Valuable securities (bonds, stocks, promissory notes)

- Wills and testamentary documents

- Authority to adopt a son

- Documents authorizing the transfer of valuable security or the receipt of money, interest, or dividends

- Receipts or acquittances acknowledging payment of money or delivery of property

Punishment: Lifetime imprisonment, or imprisonment up to 10 years + fine

Section 467 has one of the harshest penalties under the IPC, reflecting the serious nature of the crime.

Section 468 IPC – Forgery for Cheating

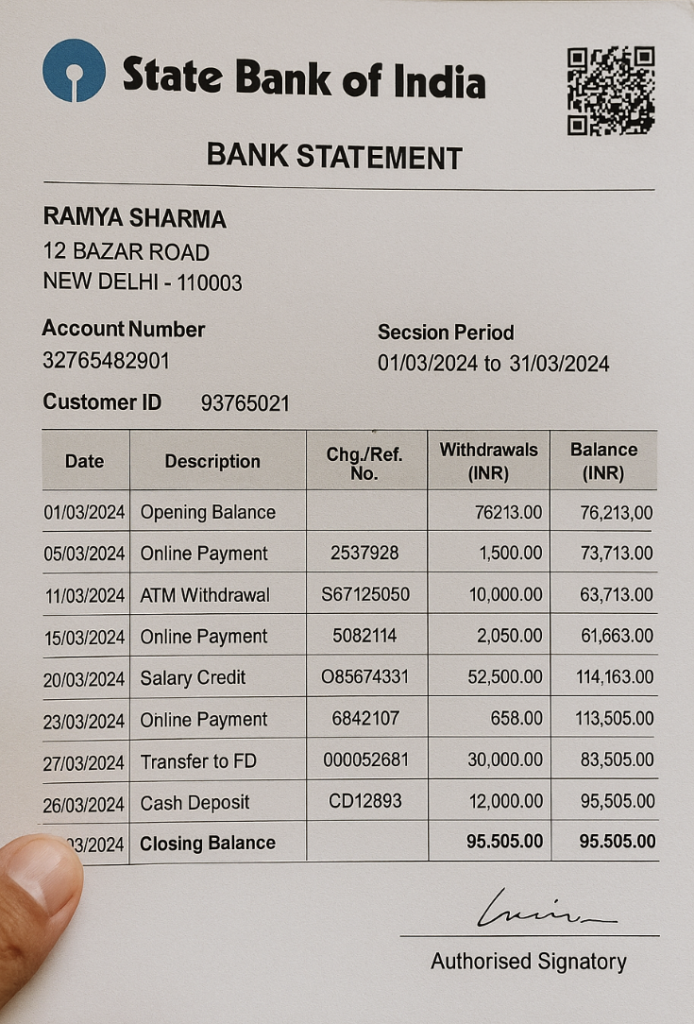

Bank statement tampered with false entries and balances

When a person uses a forged document or electronic record with the intent of cheating, they are punished with imprisonment of up to 7 years and a fine.

This includes fraud cases where identity documents are forged, counterfeit financial documents are used, and similar cases.

Section 469 IPC – Forgery for the purpose of harming reputation

A person who commits forgery with the intention that the forged document or electronic record will harm the reputation of any party (or knows it’s likely to be used for that purpose) is:

- Punished with an imprisonment of up to 3 years

- A fine

Section 471 IPC – Using a Forged Document as Genuine

Whoever fraudulently or dishonestly uses as genuine any document or electronic record which he knows (or at least has a reason to believe) is forged, gets the same punishment as someone who has forged such documents.

Depending on what forged document a person is using, they get the applicable punishment, i.e., using forged public records (up to 7 years), using forged wills or securities (up to 10 years)

Section 474 IPC – Having possession of a document described in section 466 or 467, knowing it to be forged and intending to use it as genuine

Section 474 IPC addresses the possession of forged documents (specifically documents described under Section 466 or 467) with the intent to use them fraudulently. Unlike other forgery sections that focus on creation or use, this section specifically targets possession with criminal intent.

- A person possessing forged documents under Section 466 is punishable with imprisonment of up to 7 years and a fine.

- Whereas, if they possess forged documents mentioned under Section 467, they can be punished with life imprisonment or imprisonment of up to 10 years and a fine.

Punishment Under Bharatiya Nyaya Sanhita (BNS), 2023

While the core principles of forgery remain unchanged in BNS, this new legal framework restructures and renumbers the provisions with clarity and clear language.

Section 336 BNS – Forgery

Section 336 of BNS defines Forgery and its punishment under 4 subsections.

- 336 (1): Any false document or electronic record created with the intent of causing damage, harm, or fraud is considered forgery under BNS Section 336 (1). It’s the exact same law as defined under IPC Section 464

- 336 (2): A person committing forgery as defined under 336 (1) shall be punished with imprisonment of up to 2 years, or a fine, or both

- 336 (3): A person committing forgery with the intent of cheating is punished with imprisonment of up to 7 years + fine

- 336 (4): A person using a forged document or an electronic record to harm the reputation of any party is punished with imprisonment of up to 3 years and a fine

Here’s a quick correspondence/ comparison table of the IPC to BNS:

| IPC section | Subject | BNS section | Summary of comparison |

| 463 | Forgery | 336 (1) | The section is included as a sub-section in BNS. No other change |

| 465 | Punishment for forgery | 336 (2) | The section is included as a sub-section in BNS sans heading. No other Change. |

| 468 | Forgery for cheating | 336 (3) | The section is included as a sub-section in BNS sans heading. No other Change. |

| 469 | Forgery for the purpose of harming reputation | 336 (4) | The section is included as a sub-section in BNS sans heading. No other Change. |

Section 337–338 – Forgery of Court Records & Valuable Security

Under Section 337, forgery of court and judicial records, government identity documents, public registers, official certificates and documents, legal authorities and powers, leads to imprisonment of up to 7 years + fine.

Under Section 338, forgery of valuable securities and financial instruments, personal and inheritance documents, and transactional authorities leads to lifetime imprisonment or an imprisonment of up to 10 years + fine

Here’s a quick correspondence/ comparison table of the IPC to BNS:

| IPC section | Subject | BNS section | Summary of comparison |

| 466 | Forgery of record of Court or ofpublic register, etc. | 337 | Added: Court or an identity document issued by the government, including a voter identity card or Aadhaar cardExcluded: Baptism |

| 467 | Forgery of valuable security and will | 338 | No change |

Section 339–340 – Possession and Use of Forged Documents

Under Section 339, when a person having possession of a document described in Section 337 or Section 338, intends to use it as genuine (knowing it’s forged), he is punishable the same way as he would under the given Section.

Under Section 340, whoever fraudulently or dishonestly uses as genuine any document or electronic record which he knows is forged shall be punished in the same manner as if he had forged such document.

Here’s a quick correspondence/ comparison table of the IPC to BNS:

| IPC section | Subject | BNS section | Summary of comparison |

| 474 | Having possession of a document described in section 466 or 467, knowing it to be forged and intending to use it as genuine. | 339 | No change |

| 470 | Forged document or electronic record | 340 (1) | The IPC section is included as a sub-section in the BNS. Added: “using it as genuine” is added in the heading. |

| 471 | Using as genuine a forged document or electronic record | 340 (2) | The IPC section is included as a sub-section in BNS sans heading. |

Read More: Not All That Looks Real Is Real: The New Face of Forgery in the Age of AI

Punishment for Digital and Electronic Document Forgery

The amendments by the IT Act (inserting Section 29A into the IPC) expanded the scope of traditional forgery laws to incorporate electronic elements.

The IT Act overrides IPC/BNS (general criminal law) in digital forgery cases. However, in cases where the IT Act misses any key element (e.g., “deception” or “inducement” in cheating), both laws apply simultaneously.

Here’s a quick table showing how different types of digital forgery are punished:

| Offense | IT Act + punishment | BNS offense + punishment |

| Fake PDFs | Section 65 Imprisonment up to 3 years + ₹2 lakh fine | BNS 335(c) + 336(2) Imprisonment from 2-7 years + fine |

| Edited bank statements | Section 66D Imprisonment up to 3 years + ₹1 lakh | Section 336 (3), Section 338 Imprisonment from 7-10 years + fine |

| Fabricated certificates | Section 66 (C) Imprisonment up to 3 years + ₹1 lakh | Section 336, Section 337 Imprisonment from 2-7 years + fine |

| Forged e-signatures | Section 66C, 66D, 73-74 Imprisonment up to 3 years + ₹1 lakh | Section 338 Imprisonment from 2-10 years + fine |

| Fake online records | Section 65 Imprisonment up to 3 years + ₹2 lakh | Section 337 Imprisonment up to 3 years |

Is Fake Document Forgery Cognizable & Bailable?

Before we check which forged documents are cognizable and bailable, here’s what these terms mean:

- Cognizable offence: Police can arrest without a warrant and start an investigation without requiring permission from a Magistrate

- Non-Cognizable offence: Police cannot arrest without a warrant and must obtain permission from a Magistrate to investigate

- Bailable vs non-bailable offence: The accused has the right to be released on bail, which can be granted at the police station itself

- Non-Bailable offence: Bail is not a matter of right and must be granted by a court after hearing the case

Here’s a complete classification table for different forgery offenses:

| Offence | Cognizable vs non-cognizable | Bailable vs non-bailable |

| 336 (3): Forgery for cheating | Cognizable | Non-bailable |

| 336 (4): Forgery to harm reputation | Cognizable | Bailable |

| 337: Forgery of court and public records | non-cognizable | non-bailable |

| 338: Forgery of valuable security/ will | Non-cognizable (except if it relates to the Central Govt, then Cognizable) | Non-bailable |

| 339: Possession of a forged document | Cognizable, non-cognizable if a forged document is a section 338 type) | Bailable |

| 340 (2): using forged documents as genuine | Cognizable | Non-bailable |

| Tampering with computer source documents | Cognizable | Bailable |

| Electronic identity theft | Cognizable | Bailable |

Important Supreme Court & High Court Judgments

As we mentioned earlier, intent is at the center of the Forgery definition. It’s important to prove the intent to deceive for it to be a punishable offence.

Here’s the Sheila vs Jawahar case that further clarifies the user vs maker line in forgery:

Case Details: Mrs. Doris Victor’s daughter alleged that her father, R. Jawaharaj, forged a Power of Attorney using an imposter and executed a mortgage deed. The trial court convicted him of forgery, but the High Court acquitted him. The Supreme Court upheld the acquittal.

Key Legal Principle: The Supreme Court held that you cannot be convicted of forgery unless you personally made, signed, or altered the false document. Simply benefiting from a forged document or causing someone else to create it is not forgery.

Why Intent Matters:

- Forgery requires intentional creation or alteration of a false document

- The prosecution must prove that the accused directly made the false document

- Being a beneficiary of fraud ≠ committing forgery

- The actual maker/creator is liable, not the person who benefits

Read More: 15 Most Common Examples of Embezzlement & Real-World Cases.

Forgery vs Cheating vs Fraud: What’s the Difference?

Forgery, cheating, and fraud overlap in Indian law but differ in intent and action. Here’s what each of these terms covers under different sections:

- Forgery (IPC 463/468): Creating fake documents or signatures to support a claim or cause harm; no actual loss needed if intent to cheat exists

- Cheating (IPC 420): Deception causing property delivery or financial loss; requires victim inducement

- Fraud: General deceit for gain; often charged via 420 or 468 when documents are involved, distinct from forgery’s document focus

Police often charge FIRs under both 420 and 468 (plus 471 for using forged documents), creating a “series” of offenses for stronger prosecution. This compounds penalties but requires evidence linking intent across acts.

Real-World Examples of Fake Documents

Seemingly perfect fake documents are being created every day that are bypassing legacy detection systems in seconds. As AI-powered technologies get more accessible, we are to see a rise in hyper-realistic fake documents.

These recent news are the proof:

- Fake Aadhaar / PAN: The government detected 489 forged PAN-Aadhaar GST registrations between April and October 2025, used to evade over Rs 3,000 crore in taxes

- Forged rental agreements: Catena Homes India Private Limited allegedly created dual rent agreements: fake modest rental deals shared with housing societies and employers for HRA claims, while real lease pacts hid massive deposits (₹17-20 lakh) to evade taxes

- Altered marksheets: Noida-based racket was caught recently for producing 66+ fake marksheets for students and overage job applications

- Fake bank guarantees: A company secured three immigration projects in Madhya Pradesh worth Rs. 974 crores from MPJNL, using eight fake bank guarantees valued at Rs. 183.21 crores

Evidently, the line between real and fake documents is blurring fast. You need an AI-first forgery detection system that is learning from the newest forgery methods and adapting just as fast.

HyperVerge’s next-gen forgery detection toolkit is the first step you need to take. Download HyperVerge’s forgery detection paper and see what next-generation tech-forward leaders are deploying.