In the past, document forgery involved simple photocopies or crude edits that rarely fooled trained staff. Today, it uses advanced digital manipulation, yet it easily slips past basic checks during onboarding, lending, and routine KYC activity across large institutions.

For BFSI teams, these shifts significantly increase risk, as forged identity records, income proofs, bank statements, and business registrations can trigger credit losses, fraud activity, AML issues, and public damage through a long chain of events. In fact, India’s banking sector reported huge losses because fraudsters used fraudulent records to steal ₹36,014 crore in FY 2024-25, a 194% jump from the previous year.

Because of these risks, global regulators now require institutions to provide clear proof of how they verify document authenticity as part of Customer Due Diligence (CDD), which means weak controls can trigger serious AML failures. This article explains how machine learning based image forgery detection in India supports banks that want stronger protection against forgers who use sophisticated digital tools to tamper with key records.

What Is Forgery Detection?

Document forgery refers to documents that have been altered, falsified, or created with the intent to mislead, deceive, or commit fraud. Forging documents can take many forms, including altered text, fake images, manipulated signatures, or fully digital creations designed to appear authentic. Criminals may also manipulate signatures to imitate approvals or authorizations, which creates serious legal and financial risks.

Beyond signatures, image manipulation allows people to alter photos or scanned documents to misrepresent information, while digital alteration modifies electronic files in ways that leave no obvious traces. Together, these techniques create a broad spectrum of threats, making it increasingly difficult for institutions to trust documents without robust verification systems.

India has become one of the fastest-growing markets for forgery detection because of rapid digital onboarding, widespread Aadhaar usage, and eKYC-driven financial inclusion. The attack surface has expanded dramatically with AI, as studies report digital document forgeries have surged by around 244% year-on-year, while deepfakes make up roughly 40% of biometric fraud attempts.

Rapid digitisation adds urgency because RBI-approved methods such as V-CIP, Aadhaar e-KYC, and DigiLocker e-documents scale onboarding but demand strong, audit-ready document verification. Adversaries now weaponise generative AI, driving a 700% year-on-year increase in deepfake-enabled fraud incidents, forcing institutions to treat digital forensics and image manipulation detection as a first-line defence to preserve portfolio quality, reduce losses, and protect brand trust.

📌Also read: Is Your Identity Verification Process Efficient

Types of Forgeries Seen in India

India faces an expanding spectrum of digital fraud that affects ordinary people and institutions alike, from fake IDs to AI‑generated scams. These crimes damage trust and drain money, and the biggest threats can be grouped as follows:

Document forgeries

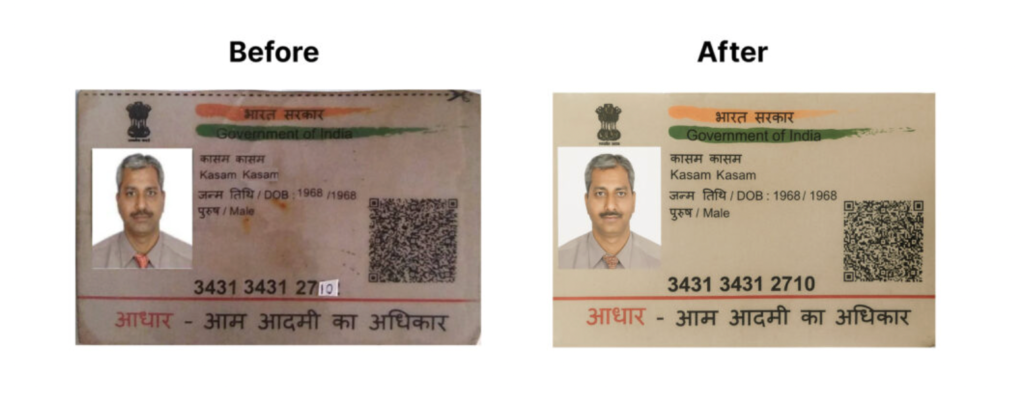

Left: Physical tampering used for fraud, where people manually alter documents even when key PII remains hidden.

Right: Digital manipulation made far easier through AI tools that create convincing forgeries, including systems like GPT.

In document forgeries, forgers create false PAN cards, fake Aadhaar documents, fabricated bank statements, and counterfeit salary slips or utility bills to deceive banks, lenders, and employers, siphoning off funds or securing undue credit.

For example, in Noida, a gang conspired with builders to fabricate property and financial documents, secure over ₹100 crore in housing loans, and launder money through shell firms using forged identities and records. Similarly, cases involving fake Aadhaar enrolment centres using forged credentials continue to surface across Maharashtra. These trends reflect the pervasive challenge of document forging in India.

Image forgeries

A fake Indian PAN card can pass OCR checks, yet still fail basic validation rules.

Image manipulation in India has shifted from low‑skill edits to highly realistic digital fabrications that fool casual viewers and harm reputations. Techniques like copy‑paste alterations and splicing appear in manipulated photos and online posts, while AI‑generated imagery makes it simple to create convincing yet false visual content.

To counter new threats, forensic experts are quickly adopting AI tools such as the LUC scientific dataset to help developers train models to detect tampered regions in images. This kind of manipulation damages trust in visuals that people once accepted as factual. Moreover, it encourages law enforcement and researchers to adopt copy-move forgery detection techniques in India and worldwide.

Scientific and research image manipulation

The scientific community confronts its own crisis with manipulated research figures.

For example, competitions such as the LUC Scientific Image Forgery Detection Kaggle challenge train algorithms to detect duplicated areas in biomedical visuals. This shows how research integrity efforts are intensifying in response to fraudulent data visualizations.

Audio & video forgeries

Deepfake voices and tampered CCTV footage are increasingly used to impersonate authorities, commit fraud, or misrepresent events. These attacks put banks, law enforcement, and private institutions at risk because altered audio or video can bypass traditional verification methods.

In fact, India saw a 280% increase in deepfake incidents in early 2024, especially before elections, as AI‑generated videos spread on social media, prompting authorities to consider changes to the law mandating clear labelling of synthetic content. In Bengaluru, a deepfake video of a national leader cost one woman over ₹33 lakh after she trusted a fraudulent investment pitch, highlighting the real‑world cost of manipulated media.

Identity & recruitment fraud forgeries

Fraudsters exploit trust in jobs and identity to cheat vulnerable populations, crafting fake offers and credentials that purport to be legitimate. For example, police recently arrested three men for defrauding job seekers with fake overseas employment offers, where victims paid large sums before realising the jobs never existed.

Traditional Forgery Detection Techniques

Before AI-driven tools became widespread, experts relied on the following traditional methods:

Manual forensics

Experts examine handwriting and compare stroke patterns to identify unnatural pressure shifts or inconsistent curves. They also analyze ink and paper characteristics to detect mismatched batches, altered layers, or incompatible aging patterns. Signature shapes are evaluated for irregular flow, abrupt stops, or unnatural repetition.

Metadata and EXIF-level checks

Metadata analysis reviews file attributes such as creation and modification timestamps, camera models, GPS tags, and editing software signatures. Inconsistencies—such as an image creation date that postdates an alleged event—may indicate tampering.

Compression artifact detection

This method examines inconsistencies in JPEG or PNG compression blocks. Forged images often display uneven compression patterns due to editing and re-saving. Traditional forensic suites, including open-source tools like Forensically and proprietary lab software, still use these techniques, though they struggle against advanced AI-generated forgeries.

Modern AI & Machine Learning Techniques for Forgery Detection

The biggest challenge today is that forgery keeps getting smarter. AI can now generate ultra-realistic fakes, Indian-specific labeled datasets are still limited, and adversarial attacks are designed specifically to fool detection models. On top of that, modern fraud often combines images, audio, and text into a single attack, making detection far more complex than it used to be.

Modern forgery detection uses deep learning to identify authenticity issues that traditional methods often miss. These models scale effectively, detect subtle manipulation patterns, and improve continuously through training.

CNN-based image forgery detection

Convolutional neural networks (CNNs) analyze fine-grained pixel inconsistencies common in manipulated images. Gabor filters support texture analysis, while Local Binary Patterns (LBP) map micro-texture variations. Models such as CAT-Net, IFAKE, and VerifyVision-Pro combine these approaches to identify subtle changes rarely visible during manual review.

Deepfake and GAN-based detection models

Detection systems counter generative adversarial networks (GANs) by training classifiers on both real and synthetic data. Adversarial and ensemble training improves resilience, enabling models to detect a broader range of manipulations.

Soft contrastive learning

This approach improves unsupervised detection by comparing image pairs and clustering authentic samples while isolating suspicious ones, increasing confidence in anomaly identification.

Firefly optimization with CNNs

Metaheuristic optimization techniques, such as firefly algorithms, tune CNN hyperparameters to improve detection accuracy while controlling computational costs.

CRC and chaos mapping

Cyclic Redundancy Check (CRC) methods combined with chaos mapping generate sensitive digital fingerprints that change drastically with minimal pixel alterations, enhancing tamper detection.

| Stay Ahead of Fraud! Download ‘Document Forgery Detection in 2025 and Beyond’ Now |

Forgery Detection for BFSI, Insurance & Government in India

To reduce malicious activities, organizations must implement strong preventive measures and effective fraud detection strategies. These steps lower the risk of unauthorized transactions and protect both the banking system and its customers.

KYC document tampering detection

In BFSI, KYC compliance is crucial to prevent money laundering and identity fraud. AI‑driven systems now detect PAN morphing, minor cosmetic edits on official certificates intended to bypass verification.

They also detect unusual salary figures or fictitious employment details on salary slips, as well as irregular formatting on bank statements. Recent reports indicate that attempted fraud templates increased by roughly 50% between 2023 and 2024, suggesting growing sophistication.

Fraud in loan applications

Sophisticated forgeries linked to real estate and loan scams have made headlines in 2025. Authorities uncovered a Rs 100 crore housing loan fraud involving fake property papers and shell companies used to siphon funds.

AI systems integrated with credit bureau and public registry checks find mismatches at scale, dramatically reducing fraudulent loan approvals.

Insurance claim fraud

Fraudulent insurance claims increasingly rely on doctored receipts, fake medical reports, and tampered accident evidence to obtain payouts illegally.

AI-based detection systems allow insurers to compare submitted claims with authentic records, reducing operational losses and protecting honest customers.

Recruitment fraud

Recruitment fraud remains a concern as companies onboard remote candidates during talent shortages.

AI models adapted from NLP technologies, such as Fraud‑BERT, analyze resume text, certificate authenticity, and employment histories to identify patterns indicative of manipulation.

End-to-End Forgery Detection Workflow

An effective forgery detection system traces every step from raw data collection to final human verification, to catch even the most sophisticated fraud attempts. Here’s how:

- Data ingestion – Collects scanned documents, digital images, audio, and video.

- Pre-processing – Cleans, standardizes, and formats data for analysis.

- Feature extraction – Identifies indicators such as pixel anomalies, handwriting traits, and metadata inconsistencies.

- AI/ML inference – Flags suspicious patterns through model analysis.

- Risk scoring and decisioning – Prioritizes high-risk items.

- Human-in-the-loop review – Combines investigator judgment with AI output to reduce false positives and improve accuracy.

Evaluating a Forgery Detection System: Key Metrics

Choosing the right forgery detection system requires evaluating multiple metrics that identify manipulated documents, images, and records.

Below are some of the most critical metrics to follow:

- Accuracy, recall, precision: Accuracy measures how often the system correctly identifies authentic and forged documents. Recall shows how many actual forgeries the system detects, while precision indicates how few legitimate documents are flagged incorrectly.

- False acceptance rate (FAR) & false rejection rate (FRR): False acceptance occurs when a forged document passes undetected, creating direct financial risk. False rejection flags legitimate documents, frustrating customers. Balancing FAR and FRR ensures strong security without harming user experience.

- Timeliness: Onboarding requires near real-time detection to prevent fraud, while batch analysis suits claims and audit workflows that still meet service-level agreements (SLAs).

- Robustness to adversarial manipulation: Systems must resist manipulation beyond simple forgery, AI‑generated alterations and recognizing adversarial tampering designed to fool detectors.

Key Datasets Used in Forgery Detection Research

Academic and industrial advances rely on carefully curated datasets that help train and benchmark forgery detection models across multiple domains. Here are some of them:

- The CASIA dataset provides a comprehensive collection of spliced and copy-move image manipulations, helping researchers test detection methods on fundamental forgery types.

- The LUC Scientific Image Forgery dataset from Kaggle focuses on manipulated scientific images, enabling researchers to identify altered figures and maintain data integrity in research workflows.

- DIS25k contains a diverse set of digitally altered images, enabling detection systems to train on multiple forgery styles and improve robustness to new manipulation techniques.

- DIRFIAF includes real-world forgeries across financial and identity documents, providing valuable examples for models designed to detect practical fraud in operational environments.

- The IMD dataset contains images of manipulated documents and multimedia, supporting the evaluation of detection algorithms across different image sources and resolutions.

- Passport verification datasets offer real-world examples of altered passports, helping BFSI and government systems strengthen KYC and identity verification processes against sophisticated tampering.

How HyperVerge Detects Forgery

HyperVerge provides an AI-driven identity verification platform that detects document tampering and fraud at onboarding. Its models analyze PAN, Aadhaar, and bank statements to identify generative artifacts, lighting inconsistencies, and pixel-level anomalies. Real-time fraud scoring, Video KYC verification, and structured outputs for compliance systems enable measurable reductions in fraud and regulatory risk.

| Did you know? The Wealth management platform IndMoney integrated HyperVerge’s Video KYC into its onboarding process in just 9 days, enabling the platform to grow nearly fourfold since then. |

Strengthening Fraud Defense with Advanced Verification

HyperVerge’s digital and video KYC solutions, including selfie verification, liveness checks, and advanced face matching, deliver high accuracy and prevent fake verifications. You can also create end-to-end customizable workflows with fallback options to minimize drop-offs during onboarding. With an average call duration of 70 seconds, HyperVerge ONE achieves conversion rates between 88% and 95%.

Schedule a demo and upgrade to our real-time verification and AI-driven detection solutions.

FAQs

What is forgery detection, and why is it important in India?

Forgery detection identifies altered, fake, or manipulated documents, images, and media to prevent fraud and identity theft. In India, forgeries fuel scams involving fake Aadhaar, PAN, loans, and identity theft, costing individuals and institutions financially and reputationally.

What types of document forgeries are most common in India?

Common forgeries in India include fake Aadhaar and PAN cards, altered bank statements and salary slips, forged property papers, and manipulated identity proofs used to obtain loans, benefits, or fraudulent registrations.

How do banks detect forged documents like PAN, Aadhaar, and salary slips?

Banks combine automated checks with backend database validations, OCR extraction, AI image analysis, and cross-referencing with official records to flag inconsistencies in IDs, income proofs, and bank statements during onboarding and loan processing.

What AI techniques are used to detect image manipulation?

AI forgery detection uses CNNs, transformer or attention models, autoencoders, and deep learning to identify pixel anomalies, compression inconsistencies, and semantic irregularities in tampered images.

What datasets are used to train forgery detection models?

Researchers and practitioners use datasets such as CASIA v2.0 for copy-move and splicing image forgeries, DFDC for deepfake videos, FaceForensics++ and other curated image/video forgery benchmarks for model training.

How accurate are CNN-based and contrastive learning models for detecting forgery?

CNN-based models often achieve high detection accuracy (over 90% on benchmark forgery datasets) by learning intricate features. In contrast, contrastive learning improves the separation between real and fake samples in feature space, leading to better generalisation.

Can AI detect deepfakes in loan onboarding videos?

Yes. AI systems analyse facial movements, inconsistencies in lighting and texture, and temporal patterns to distinguish real users from synthetic deepfake videos, adding liveness and biometric checks to protect digital onboarding.

What are copy–move and splicing forgeries in images?

Copy–move forgeries duplicate a region within the same image to hide or repeat content. At the same time, splicing combines elements from different photos into a single image.

How can BFSI institutions in India cost-effectively adopt forgery detection?

BFSI teams can leverage AI‑driven verification platforms such as HyperVerge ONE, integrate automated document checks into existing KYC flows, use shared fraud databases, and combine biometric liveness and risk scoring without heavy infrastructure overhead.

What is the future of forgery detection in a generative AI world?

Future detection will combine multimodal AI models, real-time on-device analysis, adaptive learning systems, and regulatory compliance tools to catch sophisticated synthetic fraud and maintain secure digital trust networks.