Have you ever heard your parents or grandparents talk about a massive financial fraud or money laundering case from their time? Or maybe you remember sitting in front of the TV with your family, watching as the news broke out about a fraud worth thousands of crores?

Fraud and scams have been around for centuries, but they’ve changed a lot over time. In the past, they might have been simple tricks, like a street hustler pulling a fast one or somebody trying to sell the Eiffel Tower. Fast forward to today, and we’re facing schemes that leverage technology and exploit trust. Think about notorious Ponzi schemes or the alarming rise of online scams—each era introduces fresh ways for people to get duped. And the impact? It’s huge.

As we increasingly rely on digital transactions and explore emerging markets, the need for fraud prevention measures is more dire than ever.

In this blog post, we revisit some of the biggest scams in history, particularly those that shook up the financial services, fintech, crypto, and gaming industries. By exploring these stories, we hope to highlight the importance of fraud prevention in safeguarding both businesses and individuals.

Historical context

Fraud and scams are not modern inventions; they’ve existed in some form for as long as people have desired wealth and power.

Coin forgery, one of the earliest recorded scams in Greece, medieval Europe, and America saw rulers and merchants shaving off precious metals from coins and replacing them with cheaper substitutes. In the 15th century, Perkin Warbeck’s attempt at identity theft stood out as a bold early scam. Claiming to be Richard, Duke of York, Warbeck convinced many in England and abroad to support his false bid for the throne!

Quick question for you: Do you think this was the first case of identity theft in history?

In the 1700s, the ‘South Sea Bubble’ lured British investors with promises of immense wealth, only to burst and cause widespread financial collapse.

Fun Fact: The great Isaac Newton was a victim of the ‘South Sea Bubble’ scam, losing several thousand pounds as a result.

As we moved into the 20th century, Charles Ponzi’s name became synonymous with financial fraud, as his pyramid scheme deceived thousands with false promises of high returns.

The digital age bred newer scams, including the notorious Enron scandal of the early 2000s, one of biggest scams in US history that wiped out billions in shareholder value. (We cover this in detail below). Also, if you have been following the news, you may have heard the names FTX, or Sam Bankman that defrauded the crypto community to the tune of $8 billion!

What we are trying to say is this–the tactics may have changed, but the essence of deception remains the same–exploiting trust for personal gain. Each era’s biggest scams reflect not only the ambitions of their perpetrators but also the vulnerabilities of their time.

Now, let’s explore the 5 biggest frauds and scams that took place in history and shook governments, communities, and economies alike.

Keep calm and let HyperVerge detect the fraud!

We’ll catch the cheats, so you can focus on the needs of your business. Schedule a DemoTop 5 notable scams in history

Let’s take a quick look at some of the biggest frauds and scams in history. This deep dive will help you understand how companies and businesses function when faced with fraud or when they are involved in it themselves.

1. Enron scandal

The Enron scandal, one of the most infamous corporate frauds in history, rocked the business world in 2001. Once a powerhouse in the energy trading sector, Enron’s value plummeted after it was revealed that the company had used fraudulent accounting practices, inflating revenues and profits.

At its peak, Enron boasted a market value of $68 billion! However, by late 2001, the company’s stock price had fallen from a high of $90.75 to less than $1 per share.

The key to Enron’s fraudulent success was its use of mark-to-market (MTM) accounting. Under this method, future contracts were booked as immediate profits, even if the revenue hadn’t materialized. This allowed Enron to project false profitability misleading investors.

Enron also hid debt and losses through complicated deals with special purpose entities (SPEs) like ‘Raptors,’ created by CFO Andrew Fastow. These entities helped mask the company’s financial troubles, giving a false impression of strength.

When the truth came out, Enron faced $23 billion in liabilities, leading to its bankruptcy filing in December 2001, and wiping out 4,000 jobs.

2. Bernie Madoff Ponzi scheme

Bernie Madoff’s Ponzi scheme is arguably regarded as the biggest scam in US history.

Madoff, a trusted Wall Street figure, lured thousands of investors by promising consistently high returns. Classic. However, instead of generating real profits, he used new investors’ money to pay off early investors. The scheme unraveled in 2008 when Madoff faced $7 billion in withdrawal requests he couldn’t fulfill, leading to his arrest.

The scam, which lasted nearly two decades, caused losses exceeding $50 billion. His once-legitimate business (Madoff Investment Securities LLC ) masked this fraud, devastating not just wealthy investors but also retirees and everyday people.

3. Volkswagen Emissions scandal

Volkswagen’s emissions scandal, often called the ‘diesel dupe,’ exposed a major deception in 2015. The company admitted to installing software in about 11 million diesel cars worldwide, designed to cheat emissions tests. In the U.S. alone, this affected around 500,000 vehicles, making it one of the largest scandals in automotive history.

This scam reached countries like Germany, the UK, and Italy, sparking global outrage and investigations. VW’s actions led to recalls of millions of cars and severely damaged its reputation. Not to mention, the financial hit was massive, with the company setting aside €6.7 billion to cover costs, while investors saw shares drop by nearly a third.

4. Theranos fraud

The Theranos scandal is one of Silicon Valley’s most eye-popping frauds.

Founded by Elizabeth Holmes, the company promised to revolutionize blood testing with a device capable of running hundreds of tests from just a drop of blood. Investors poured in over $700 million, boosting Theranos’ valuation to $9 billion at its peak.

However, it all unraveled when it was revealed that the technology didn’t work. Holmes, alongside company president Ramesh Balwani, was charged with criminal fraud in 2018 for misleading investors and doctors. Holmes was sentenced to 11 years in prison in 2022.

5. Mt. Gox hack (2014)

The Mt. Gox hack of 2014 was a monumental event in the cryptocurrency world. At its peak, Mt. Gox was handling about 70% of all Bitcoin transactions globally, making it the largest Bitcoin exchange at the time.

However, in February 2014, the exchange announced a shocking freeze on withdrawals due to ‘suspicious activity,’ revealing that a staggering 850,000 Bitcoins—worth more than $58 billion today, had vanished. For context, Bitcoin traded at $600 at the time of the scam and today is trading around +$60,000.

The total financial blow was catastrophic, leading to Mt. Gox’s bankruptcy filing. The incident also resulted in a massive loss of trust in the then-upcoming crypto market. Although some hopes were rekindled when 200,000 Bitcoins were later discovered, many investors faced significant financial setbacks.

In 2024, Mt. Gox began paying back to creditors (who waited 10 years) in Bitcoin and Bitcoin Cash. This sudden influx even caused Bitcoin to crash 6% on the indices!

The impact of scams on industries

We’ve read above in detail the different investment scams and financial crimes that plagued world history. But, have you ever thought about what implications these scams have on different industries and economies? Let’s find out.

Financial services

In the financial sector, trust is everything. Scams can shatter this trust, leading to a ripple effect that undermines confidence in institutions. When customers feel vulnerable, they hesitate to invest or engage, which can stifle growth. Compliance becomes a heavy burden as regulations tighten in response to fraud, forcing banks and financial institutions to invest heavily in security measures.

Fun Fact: Did you know the Sarbanes-Oxley (SOX) Act of 2002 was passed by the US government in response to the Enron Scandal?

Fintech and crypto

Cryptocurrencies are already a highly volatile asset class, and thanks to anonymity (which is an industry rule), they have also become prime targets for fraud–Ponzi schemes disguised as NFT projects and coin launches where founders vanish shortly after the launch.

Not to mention, digital crypto platforms and fintechs (because of their nature) are often easy targets for scams, from phishing attacks to fraudulent investments. In response to many billion-dollar scams that surfaced in the last 5 years (FTX and WazirX scams), governments around the world have tightened cryptocurrency regulations to protect consumers and restore trust.

This has been met with debates at both ends but most governments see these restrictions in the light of ‘prevention is better than cure.’

Gaming industry

Gamers often face scams that prey on their passion, whether through fake accounts, phishing attempts, or fraudulent in-game purchases.

The emotional investment in gaming makes individuals particularly vulnerable. In this context, safe transactions are essential to protect players and maintain a secure gaming community.

Future of scam prevention

With tech advancement, new opportunities for deception have arisen, from phishing emails to ransomware attacks. Fraudsters have learned to blend old-school tactics with extremely advanced tools, preying on human vulnerabilities that haven’t changed much since ancient times: greed, fear, and trust. It is thus imperative that businesses and individuals take proactive measures to safeguard against these threats.

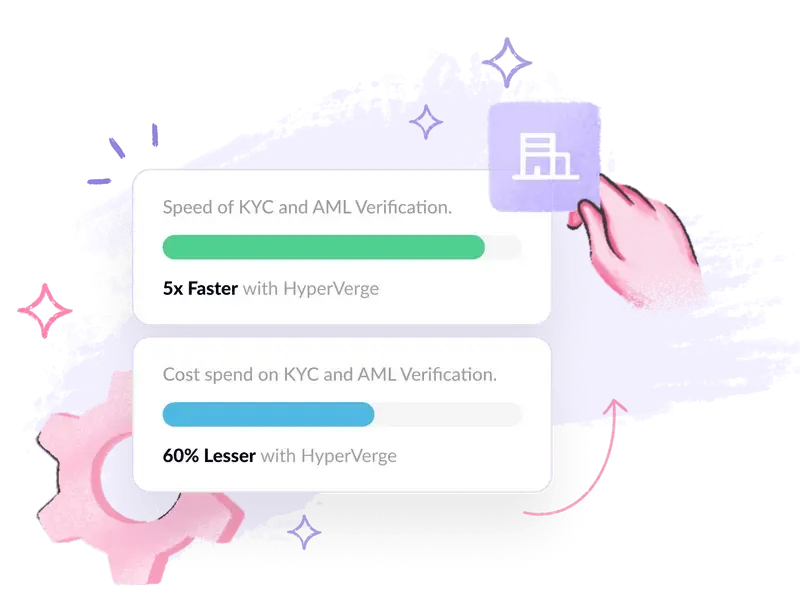

HyperVerge’s fraud prevention solutions are designed exactly for this purpose–to help your business stay one step ahead.

Utilizing advanced Anti-Money Laundering (AML) practices, AI-driven Optical Character Recognition (OCR) for instant document verification, and passive liveness detection, HyperVerge ensures a solid defense against potential scams. These tools not only enhance security but also streamline the onboarding process, allowing businesses to verify identities quickly and accurately.

To learn more about how HyperVerge can help you combat fraud, explore our comprehensive solutions here.

FAQs

1. What are the most common types of scams today?

Today, advanced tech scams, email phishing, and identity theft top the common scams list. For instance, today cybercriminals exploit our reliance on digital communication and online shopping, often tricking people into revealing sensitive information or making fraudulent purchases.

2. How can businesses protect themselves against scams?

To safeguard against fraud and scams, businesses can invest in comprehensive fraud prevention techniques. Solutions like HyperVerge offer advanced technology to detect and prevent fraudulent activities, enhancing security measures.

3. What role does technology play in preventing scams?

Technology, especially with the rise of AI has enabled businesses to identify spoofing attempts and detect identity theft more effectively. Additionally, advanced systems streamline KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, making transactions safer and more secure.