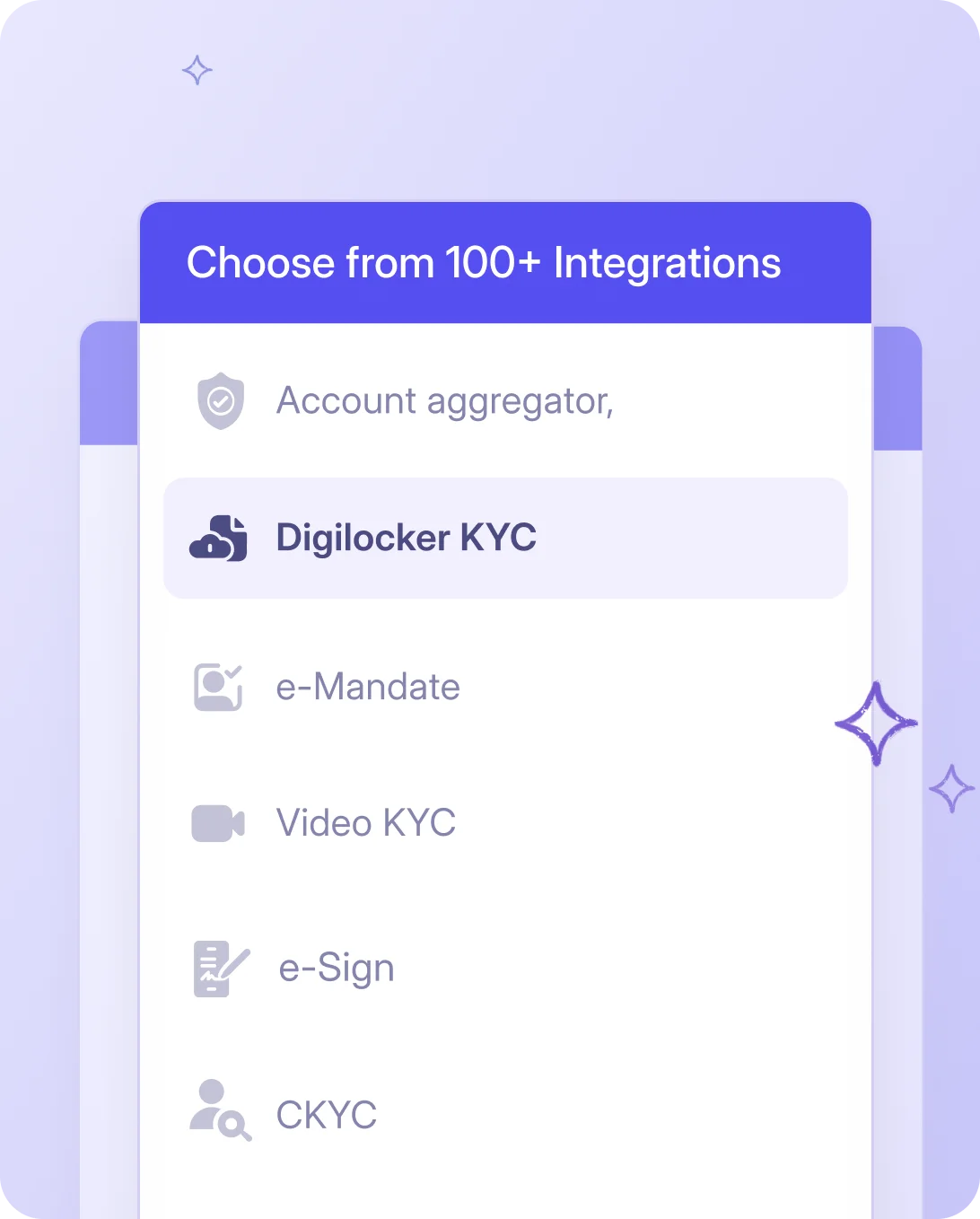

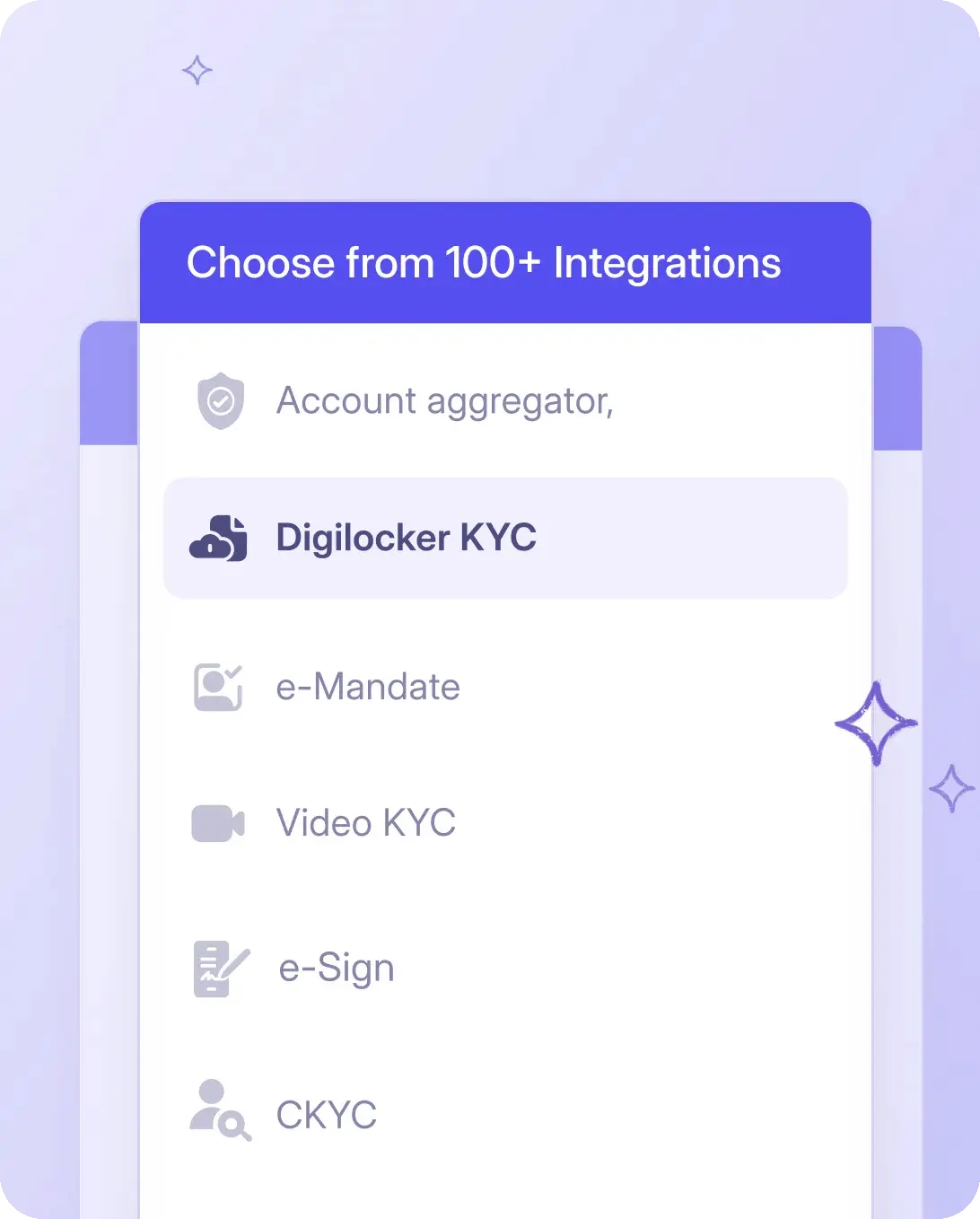

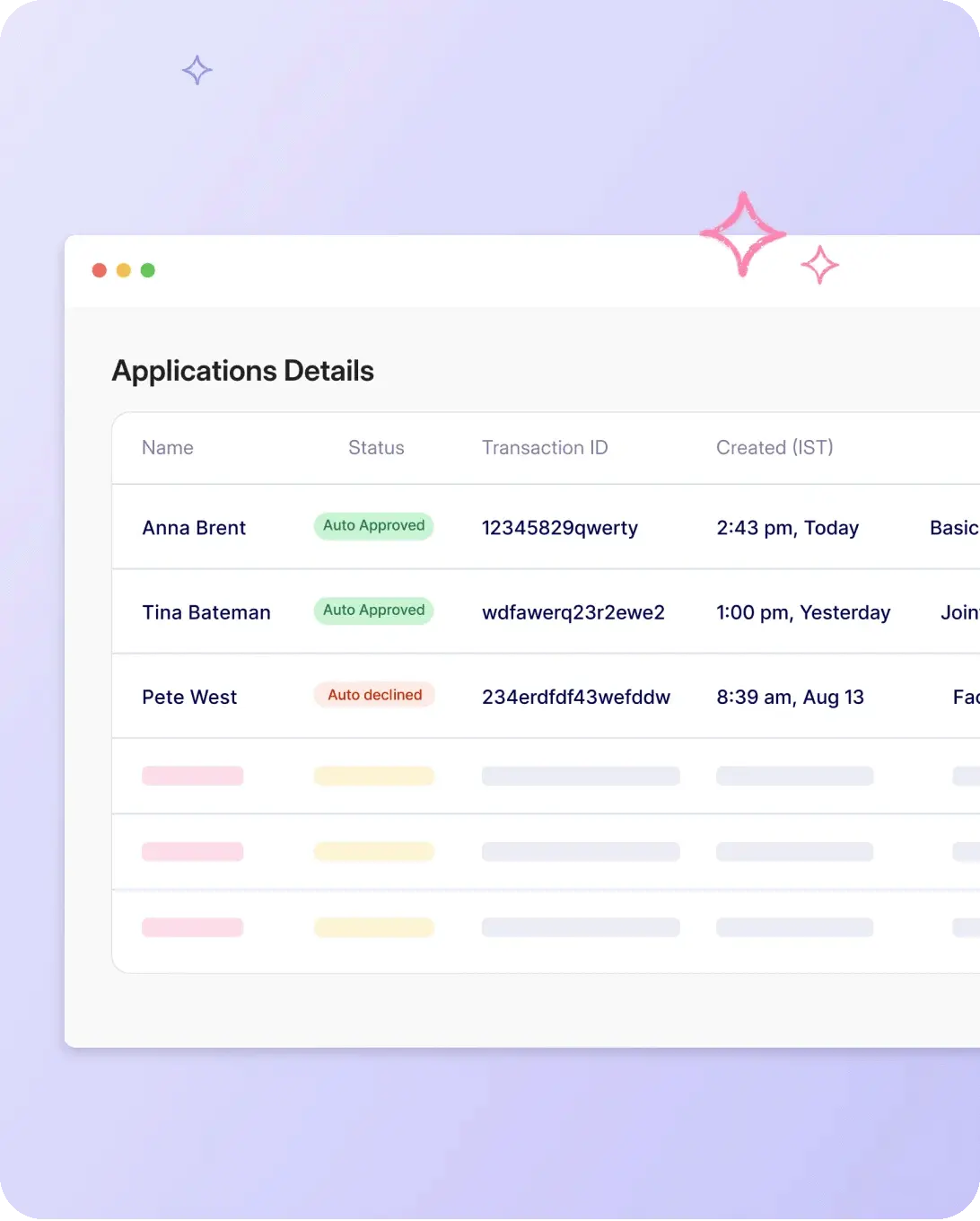

An identity verification platform utilizes a combination of advanced technologies and methods to verify the real identity of users. Some common features include:

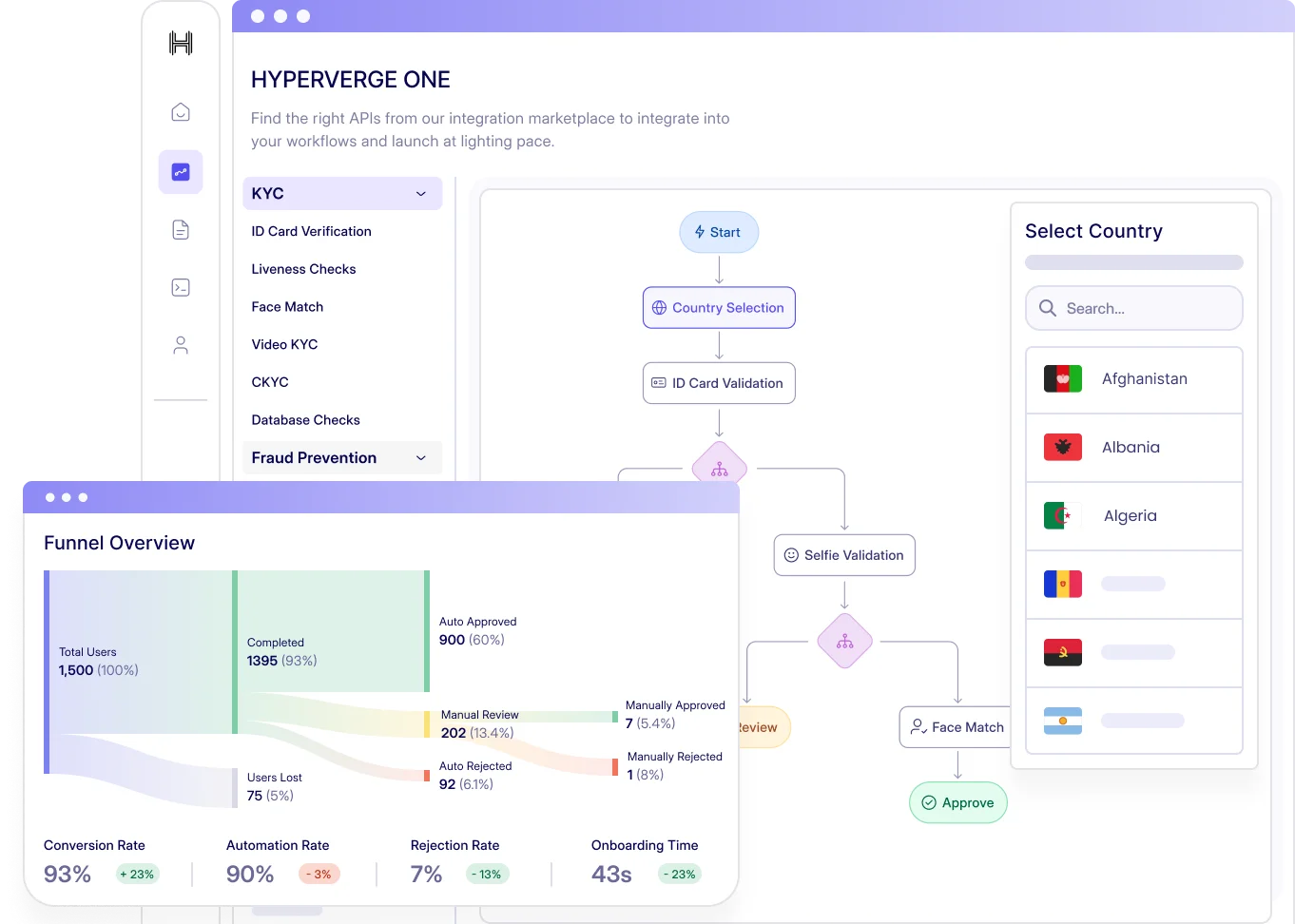

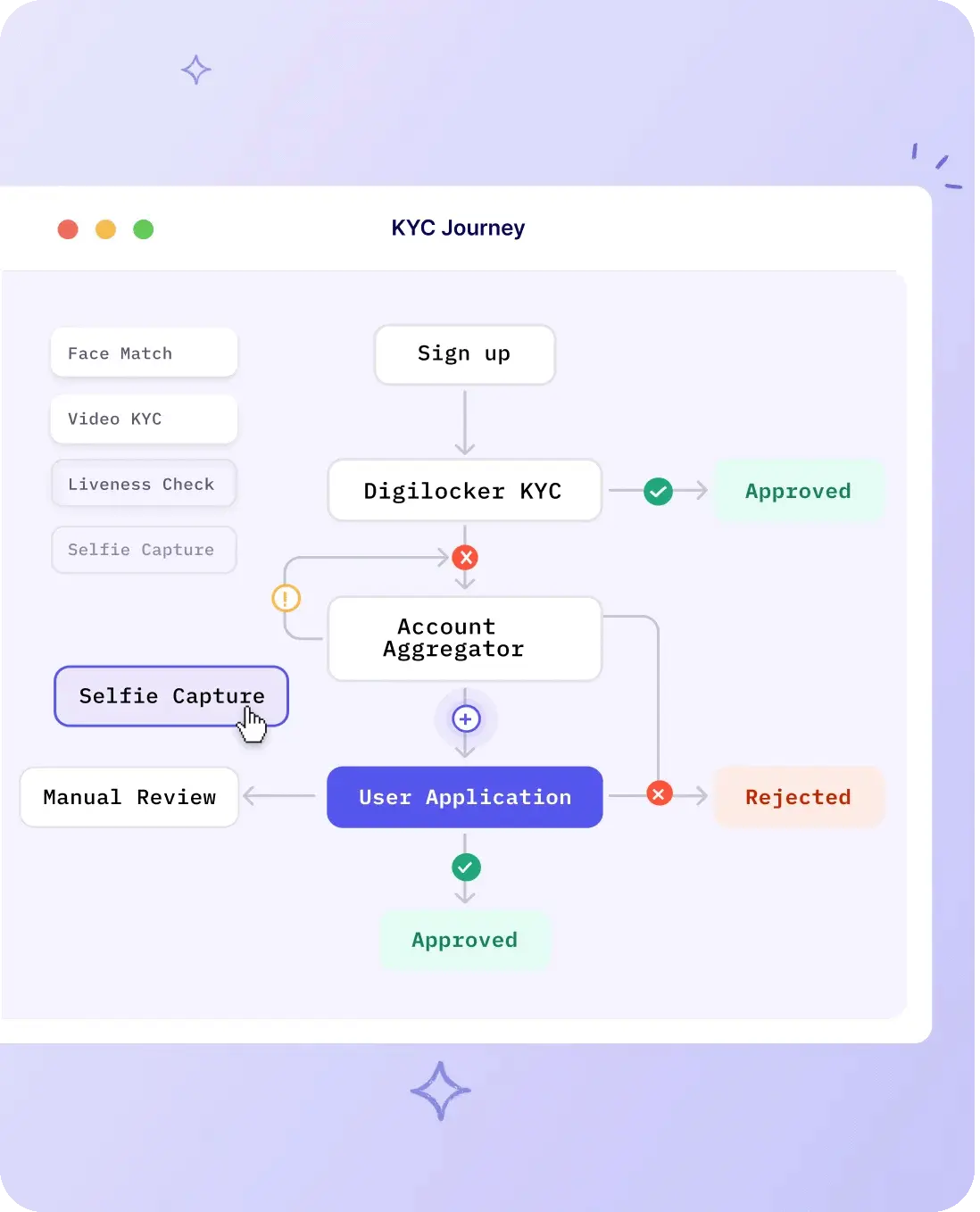

Document Verification: Users are required to submit official documents, such as government-issued IDs or passports, which are then analyzed for authenticity.

Biometric Authentication: Advanced platforms employ biometric data like fingerprints or facial recognition to ensure that the person presenting the identification is the legitimate owner.

Database Checks: Platforms may cross-reference user-provided information against various databases to validate details such as names, addresses, and other relevant data.

Machine Learning Algorithms: These platforms often use machine learning to detect patterns and anomalies in user behavior, helping stop fraud.

The combination of these features helps establish a robust and multi-layered approach to user verification, enhancing security and trust in online interactions. This can also be used for Know Your Business (KYB) or business verification.

February 7, 2024

February 7, 2024