Is Your Financial Data Analysis Process

Driving Up Underwriting Costs?

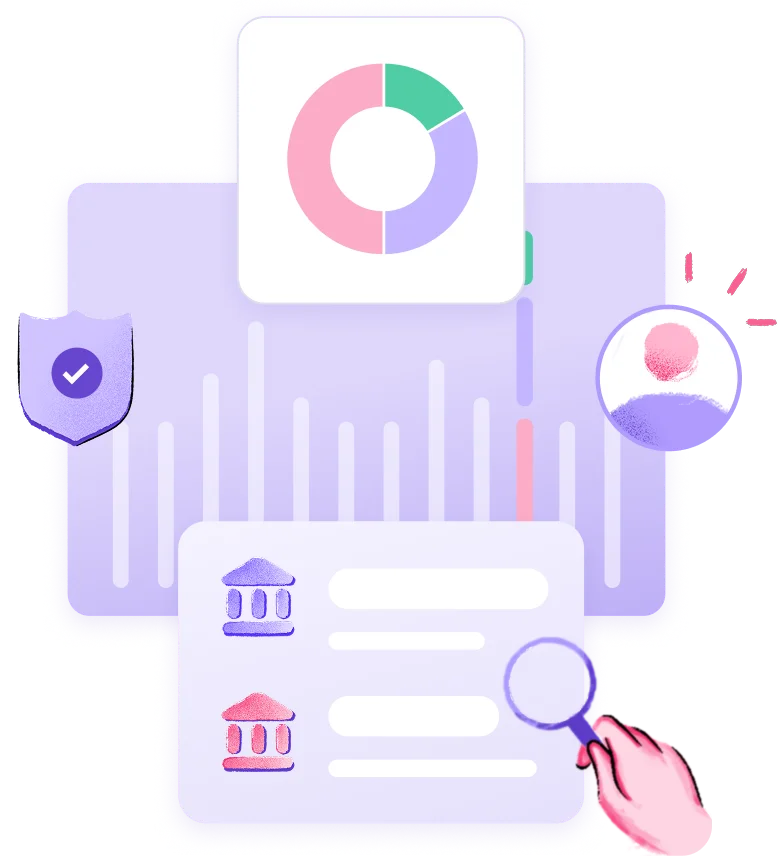

A comprehensive suite to verify the bank account details and match entered

name with account holder name.

Are You Making the Most of

Your Customers’ Financial Data?

Take this 1-minute quiz to find out if you're truly making the

most of your user’s financial data.

Use Cases

- Assess borrower repayment capacity with real-time financial insights.

- Prevent loan fraud by detecting tampered documents.

- Verify income details for F&O activation as per SEBI compliance.

- Accurately calculate life insurance premiums based on financial history.

See It in Action

We could talk about this all day, but the

best way to understand how it works is

to see it for yourself.

Why HyperVerge?

The Smarter Choice for Financial Data Intelligence

Fewer drop-offs

A seamless flow with instant responses increases the customer conversion rates

No more manual grunt work

Cut manual processing costs, boost efficiency, and detect fraud with precision

Works with any document format

Scanned PDFs, different bank templates—you name it, we process it all with high accuracy.

Fastest Go-Live

Integrate in just one day and go live without disruptions.

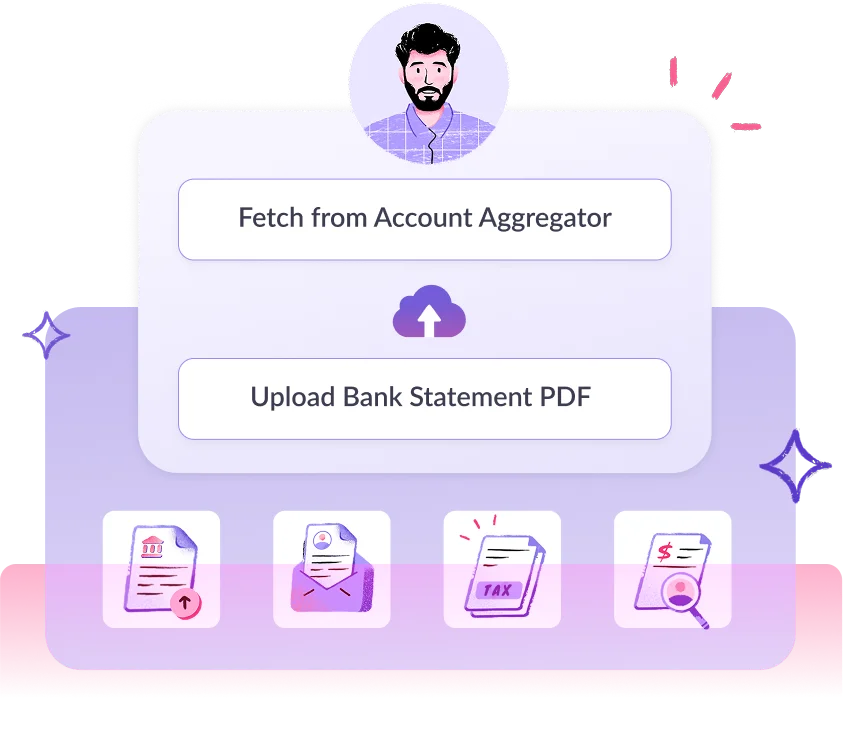

Offer multiple data fetch options

Support both AA-based and document uploads flows, so users can pick what’s easiest for them.

Still have doubts? Let’s Talk