If you’ve ever sat with an underwriting team, you’ll notice something interesting:

Everyone is running. But the process is still slow.

Underwriters aren’t short on expertise. They’re short on time.

Between bank statements, income documents, customer declarations, and financial ratios, so much of their day goes into pulling information together instead of judging the information.

And this is exactly where things break. CAM creation has remained one of the slowest, most manual, and error-prone pieces of the entire loan lifecycle. That gap is now becoming too costly to ignore, pushing financial institutions to explore AI-led automation at scale.

This blog breaks down the current state of CAMs, where traditional workflows struggle, and what modern automation can unlock.

Who Uses CAMs and When?

Across banks, NBFCs, and fintech lenders, CAMs are core to the workflows of:

- Credit analysts and underwriters

- Senior management and loan committees

- Loan review and audit teams

- Regulatory examiners

- Digital lenders building automated workflows

- They are created during:

- New loan applications

- Credit limit enhancements

- Loan renewals

- Stress account evaluations

- Portfolio reviews

In short, every credit decision relies on the CAM.

Why CAMs Matter More Than Ever

As the lending ecosystem becomes more competitive and regulated, CAMs help institutions ensure:

Standardized risk assessment: No matter who prepares it, the CAM follows the same framework.

Regulatory compliance: Every number, note, and observation is documented and auditable.

Portfolio consistency: Ensuring identical risk logic across cases.

Transparency & traceability: Any stakeholder can understand why a decision was made.

When CAMs are slow or inconsistent, everything else gets affected: turnaround time, customer experience, portfolio quality, and even fraud detection.

The Gaps: Why Traditional CAM Workflows Are Failing Lenders

Despite their importance, traditional CAM creation is still largely manual and that’s where the problems begin.

1. Extremely Time-Intensive

Preparing a CAM can take:

- 1–2 hours for simple applications

- 50–60 pages of documentation for SME or commercial loans

This severely impacts turnaround time.

2. Massive Resource Drain

Credit teams spend 30–40% of their time writing memos instead of analyzing credit.

3. Highly Error-Prone

Manual data entry, spreadsheet juggling, and inconsistent analysis frameworks create opportunities for mistakes and bias.

4. Not Built for Scale

High-volume periods strain the system, causing approval delays and customer drop-offs.

5. Higher Fraud Vulnerability

Limited cross-validation across documents increases the risk of oversight.

6. Slows Down Decision-Making

Long preparation cycles reduce customer satisfaction and increase the chance of losing borrowers to faster competitors.

The Shift Toward Automation

Modern AI-powered CAM automation addresses these challenges head-on, removing the grunt work so underwriters can focus on judgment, not documentation.

Operational Efficiency

- 2x more efficient credit manager workflows

- Up to 5x faster CAM creation

- 30–40% reduction in manual work for first drafts

Enhanced Accuracy

- A noticeable drop in fraud exposure

- Cross-validation across multiple documents

- Metadata checks to spot tampering

Better Decision Quality

- Analysis across 80+ risk and strength signals: from income to behavioural to geo-based markers

- Real-time scoring aligned to internal policies

- Consistent evaluation through BRE-driven logic

Lower Costs

- 10x less reliance on external CPAs

- Reduced operational overhead

- Teams are free to focus on high-value cases

Scalability

- Support for rising loan volumes without increasing headcount

- Seamless integration with LOS and core systems

Automation transforms the CAM from a bottleneck into a growth enabler.

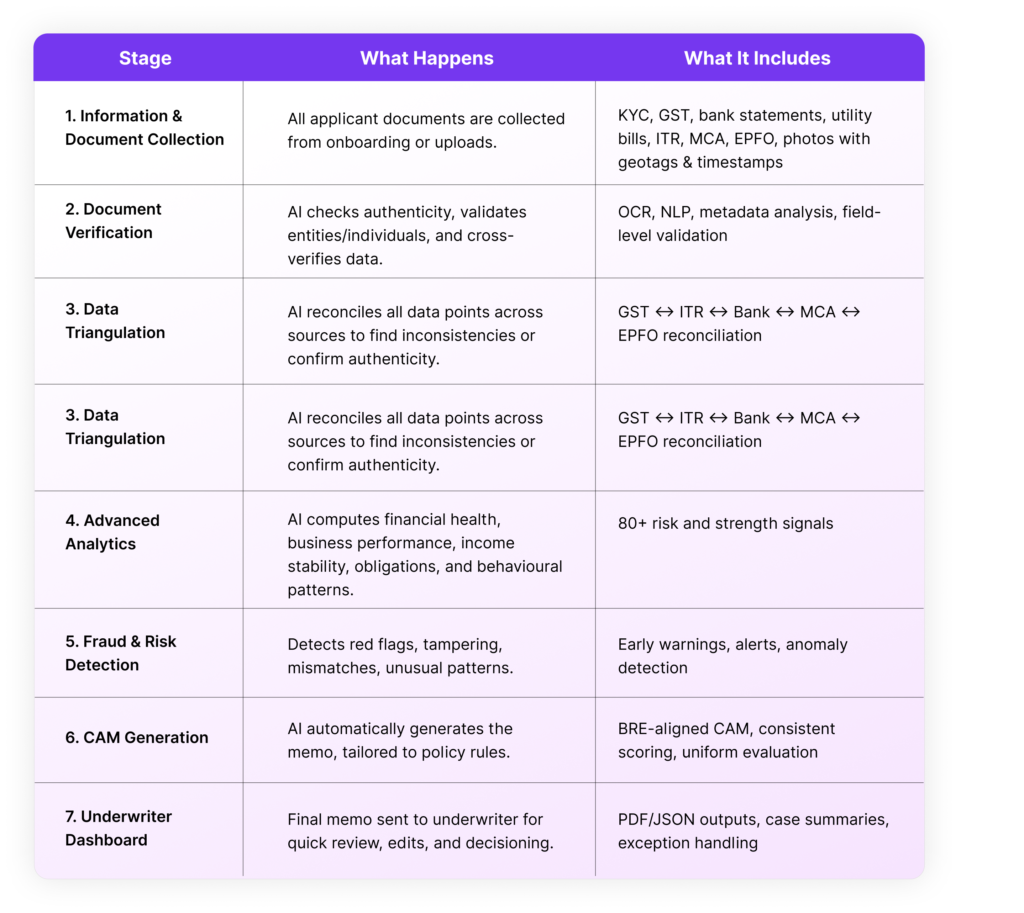

What an Automated CAM System Includes

A modern CAM automation engine typically covers the full workflow: from data collection to memo creation.

In simpler words:

Collect documents – KYC, GST, bank statements, ITR, MCA, EPFO, geotagged photos

Verify authenticity – OCR, NLP, metadata & field-level checks

Triangulate data – GST ↔ ITR ↔ Bank ↔ MCA ↔ EPFO

Run analytics – 80+ financial & behavioural insights

Detect fraud risks – anomalies, tampering, mismatches

Generate CAM – policy-aligned, structured, auto-scored

Underwriter review – summaries, PDFs/JSON, quick decisioning

This streamlines the entire lifecycle—from data ingestion → verification → risk computation → CAM creation, → underwriter review.

Key Considerations Before Using AI for Credit Memo Generation

AI-driven CAM generation promises efficiency, accuracy, and scale but getting it right requires careful planning. Before financial institutions adopt automated CAM systems, they must evaluate four foundational aspects: solution choice, data readiness, workflow alignment, and regulatory compliance. These pillars determine whether automation will enhance decision-making or introduce new complexities.

Below is an expanded view of each factor.

1. Solution Choice (Build vs Buy vs Customize)

Choosing the right approach determines long-term ROI and operational fit.

- Build: Offers full control but requires deep AI expertise, long timelines, and significant engineering investment. Suitable only for institutions with mature tech capabilities.

- Buy: Fastest go-live, predictable cost, and access to pre-trained models, advanced analytics, fraud checks, and templatised CAM outputs.

- Customize: Ideal for lenders with unique processes or policies, leveraging pre-built AI engines while tailoring workflows, rules, and CAM templates.

Your choice should depend on internal capability, urgency, and the complexity of credit policies.

2. Data Readiness & Quality

Automated CAM systems rely on clean, structured, and complete data to generate accurate assessments.

Key considerations include:

- Document Diversity: GST, ITR, KYC, bank statements, MCA, EPFO, utilities: AI must extract data accurately across all formats.

- Data Cleanliness: Incomplete or inconsistent data results in inaccurate signals or false alerts.

- Multi-Source Reconciliation: Automated CAMs depend on triangulating information across multiple documents to detect discrepancies, fraud, or behavioural anomalies.

- Image & Photo Metadata: Geo-coordinates and timestamps enrich the CAM with field-level validations.

Institutions must evaluate whether their current onboarding and document collection processes can feed high-quality data into the CAM engine.

3. Workflow Alignment

AI should complement, not disrupt, the existing underwriting workflows.

Key aspects:

- Integration with LOS/Core Banking: Automated CAMs must plug into the systems where underwriters already work.

- BRE Alignment: CAM outputs should follow the lender’s exact risk and policy rules without requiring additional manual interpretation.

- Underwriter Utility: The generated CAM must be delivered in formats (PDF/JSON) that underwriters can immediately act on.

- Exception Handling: When AI flags anomalies, the workflow must support quick human review and closure.

The goal is seamless adoption, not parallel processes.

4. Regulations & Compliance

Since CAMs are legal documents, automation must uphold regulatory expectations around:

- Data Integrity: Accurate extraction and faithful representation of applicant details.

- Auditability: Every field in the CAM should have an explainable data source and rationale.

- Fraud Controls: Systems should highlight inconsistencies (e.g., tampered metadata, mismatched ratios).

- Policy Adherence: Consistency in applying underwriting rules ensures compliant and defensible decisions.

Regulators expect transparent, traceable credit assessments; AI systems must enable higher compliance, not compromise it.

Where HyperVerge Fits In: CAM AI for the Future-Ready Lender

Everything you’ve read so far: clean data extraction, policy-aligned scoring, fraud checks, multi-source triangulation, and auto-generated CAMs is exactly what HyperVerge’s CAM AI is built to solve.

HyperVerge’s CAM AI offers:

- Unified extraction across GST, bank statements, ITR, MCA, EPFO, KYC

- Automatic cross-validation to detect inconsistencies and fraud

- BRE-aligned memo generation tailored to each lender

- 80+ risk and strength signals to support smarter decisions

- Ready-to-use CAMs generated in minutes, not hours

- Seamless integration with existing LOS and underwriting systems

The result?

Underwriters spend more time making decisions and less time preparing for them.

Conclusion

As lending becomes more competitive and regulatory expectations sharpen, institutions can no longer afford slow, inconsistent, manually created CAMs. AI-driven automation brings speed, accuracy, compliance, and scalability that traditional methods simply cannot match.

But successful automation requires thoughtful planning, evaluating the right solution, ensuring data readiness, aligning workflows, and upholding compliance.

When these pillars are strong, AI doesn’t just speed up CAM creation; it transforms underwriting itself.

Ready to see CAM automation in action? If you’re exploring AI-led CAM generation and want to understand how it fits into your workflows, risk frameworks, and policies:

👉 Sign up for a demo of HyperVerge CAM AI.

Experience how you can cut turnaround time, strengthen compliance, and scale credit operations effortlessly.

FAQ’s:

1. Can AI actually create a full credit memo from GST, bank statements, and ITR?

Yes. Modern CAM automation systems can ingest documents like GST returns, bank statements, ITR, MCA, EPFO, and KYC files, extract data accurately, reconcile inconsistencies, and generate a ready-to-use credit memo.

The AI doesn’t just compile information; it interprets it using financial ratios, risk signals, behavioural patterns, and policy rules to build a complete memo that mirrors what a human analyst would create.

2. How does AI detect fraud or inconsistencies in financial documents?

AI uses multi-source triangulation and behavioural analytics to surface red flags.

This includes:

- Cross-checking values across GST ↔ ITR ↔ Bank statements ↔ MCA ↔ EPFO

- Identifying unusual financial behaviour

- Spotting tampered documents or mismatched metadata

- Tracking sudden revenue spikes, cash flow gaps, or obligations hidden across sources

The system highlights these anomalies for quick underwriter action.

3. Is AI-generated CAM reliable enough for underwriting decisions?

Yes, mature CAM engines apply the lender’s exact BRE rules, scoring logic, and evaluation criteria. This ensures:

- Standardised assessments

- Consistent risk interpretation

- No subjective bias

- Full auditability

Underwriters still make the final call, but the AI eliminates grunt work and reduces the chance of manual errors.

4. How fast can AI generate a credit assessment memo compared to a human analyst?

A human typically takes 1–2 hours for simple profiles and much longer for SME/commercial cases.

AI-driven systems can produce a first draft within minutes because they automate:

- Document extraction

- Metrics calculation

- Data comparison

- Memo structuring

This enables smoother workflows, faster TAT, and higher throughput for credit teams.