Challenges with Existing Solutions

- Identity Vulnerabilities: Businesses encounter increased risks in entity identity verification without dependable KYB solutions.

- Financial Setbacks: Absence of effective KYB tools may result in financial losses stemming from fraudulent entities.

- Diminished Customer Trust: Insufficient KYB measures undermine customer trust, raising concerns about transaction security.

- Regulatory Compliance Concerns: Inadequate entity verification solutions may lead to non-compliance with Indian regulatory requirements.

What We Offer

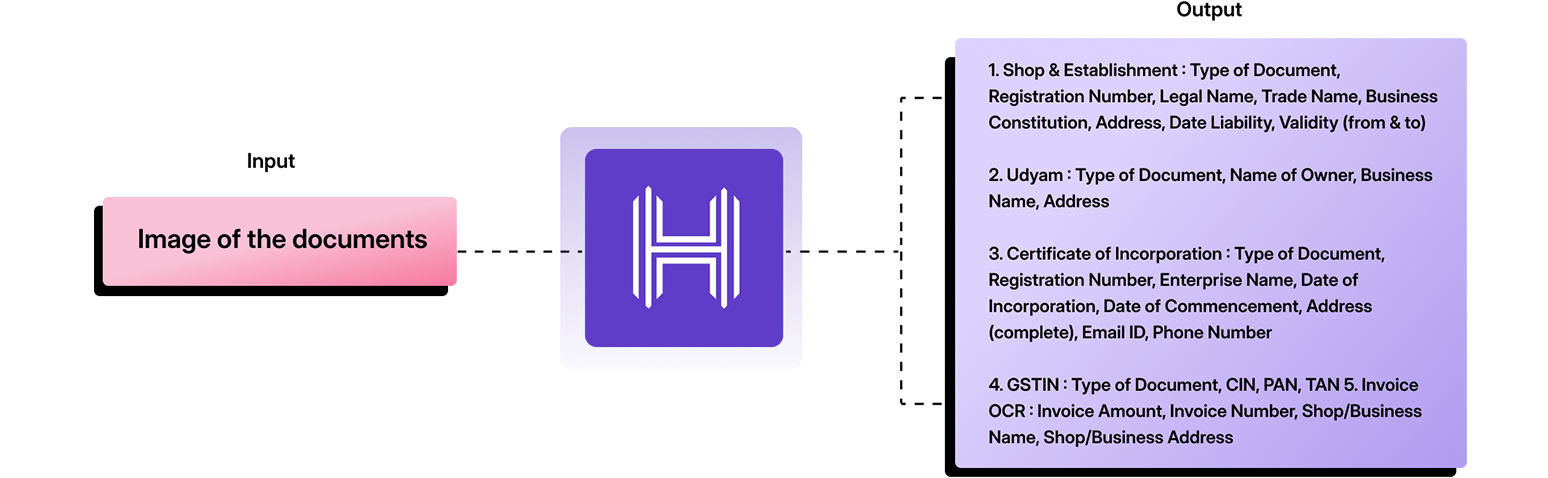

- Shop Front Detection: Simplifying Merchant Onboarding, our solution verifies Business/Shop Category, Name, and Address through a single shop front image.

- GSTN Verification: Our GST Authentication solution validates and provides details for 15-digit GST Identification Numbers (GSTIN) issued by the Goods and Service Tax Network in India.

- Company Data Through CIN/LLPIN: The Company and LLP Master Data solution authenticates and retrieves master data for CIN, LLPIN, FCRN, and FLLPIN issued by the Ministry of Corporate Affairs (MCA).

- Udham Aadhaar Verification: Our Udyam Aadhaar Verification solution validates and retrieves detailed information for an organization, including name, address, activity, contact details, and relevant registration data.

Input and Output

Integration Made Easy

Build End-to-end Journeys with HyperVerge ONE

Build end-to-end financial product onboarding journeys with ease

Configure user onboarding workflows and UI/UX without code.

Set automated fallback options to prevent user drop-offs during downtimes

Get analytics on conversion rates and optimize the friction points

Explore our Integrations Marketplace

Visit Page >Frequently

asked questions

What is the purpose of the KYB Documents OCR?

How does it contribute to KYB processes?

Can the solution adapt to various KYB document types?