Identity verification automation is a rapidly evolving industry, driven by new technological advancements, sophisticated fraud methods, increasing cyber threats, and changing AML regulations.

As a result, businesses constantly face the challenge of finding reliable and cost-effective identity verification solutions.

According to a MarketsandMarkets report, the global identity verification market is projected to reach USD 21.8 billion by 2028, at a compound annual growth rate (CAGR) of 14.9% during the forecast period. This significant growth underscores the need for robust and adaptable identity verification solutions.

Given this landscape, it’s important for your businesses to find identity verification tools that meet their current needs, scale with their growth, and adapt to evolving challenges. While Shufti Pro is a popular choice for identity verification, it may not always be the ideal fit for every growing business or expanding customer base.

Whether you’re seeking better integration options, enhanced user experience, platform capabilities, or more competitive pricing, it is crucial to explore alternatives to create an effortless identity verification and customer onboarding process.

This blog delves into the top Shufti Pro alternatives to consider. We’ll examine them in detail. But first, let’s understand why you might want to consider a Shufti Pro alternative.

Why consider alternatives to Shufti Pro?

Check out some of the top reasons why you might have to consider migrating to a new tool from Shufti Pro.

| Changing business requirements: As your business scales, you need a solution that facilitates growing customer bases and expanding geographical operations. Better alignment with the budget: While Shufti Pro offers custom pricing, you may need to look for other options that offer affordable plans for the specific features you need. Access different sets of features: Shufti Pro offers comprehensive identity verification solutions, but you may need a more customized set of features such as low-code workflow builders & analytics reports for maximizing onboarding conversion rates. |

How we evaluated the top alternatives for Shufti Pro

We extensively researched the verification tools in the market, the top offerings that businesses look for, and the associated identity verification costs. From over 60 competitors, we narrowed the number of alternatives to 10 after analyzing their features, pricing, and credibility based on ratings in listing sites like G2 and Capterra.

These tools are:

- HyperVerge: Best for AI-powered identity verification and fraud prevention

- Sumsub: Best for user onboarding efficiency and fraud prevention for fintech companies

- Jumio: Best for real-time fraud detection

- Udentify: Best for low-code identity verification solutions

- iDenfy: Best for AML compliance and fraud prevention

- Socure: Best ID verification solution for finance companies

- Ondato: Best for real-time fraud monitoring

- Persona: Best for dynamic no-code workflows and global compliance

- ComplyCube: Best for AI-driven AML & KYC compliance

- Onfido: Best for comprehensive digital identity verification solutions

Listing of 10 Shufti Pro alternatives – At a glance

| Identity verification tools | Pricing | Standout feature |

| Custom | Deepfake detection & AI-powered biometric verification | |

| Starts at $149 per month | Transaction monitoring & AML screening | |

| Custom | Risk signals & fraud detection | |

| Starts at $99 per month | ID & biometric authentication | |

| Custom | Proxy detection & fraud scoring | |

| Custom | Global watchlist & fraud prevention | |

| Starts from $570 per month | KYB & customer data platform | |

| Custom | Flow builder & fraud detection | |

| Starts from $249 per month | Media checks & watchlist screening | |

| Custom | Tailored workflows & smart capture |

1. HyperVerge

HyperVerge ONE is an advanced platform for AI-powered digital identity verification and fraud prevention solutions that allows users to build a workflow for efficient customer onboarding. It provides services, such as ID document verification, biometric authentication, and liveness detection to ensure global KYC and AML regulations.

HyperVerge utilizes deep learning and deepfake detection technologies and supports a range of industries, including financial services, healthcare, and e-commerce. The company’s tools are designed to help businesses manage risk and streamline compliance processes.

Key features of HyperVerge

- AI-powered OCR document processing: Provides an efficient OCR tool that leverages AI to extract text and data with 95%+ accuracy from global ID structured and unstructured documents such as residence permits, passports, driving licenses, and social security cards.

- KYC checks: Supports multiple languages and regional requirements for thorough and global identity verification.

- AML compliance: Provides continuous real-time screening and monitoring, global sanctions and watchlist checks, and Politically Exposed Person (PEP) screening.

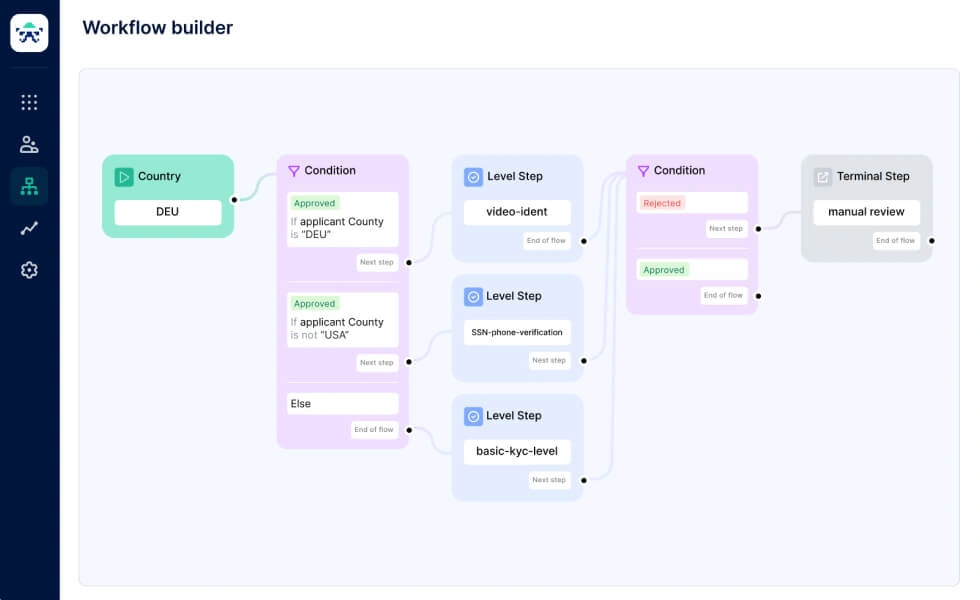

- Workflow builder: Offers a no-code workflow builder where users can create drag-and-drop personalized customer onboarding journeys.

- Biometric authentication: Provides a best-in-class face recognition technology with a single image passive liveness detection. This method improves security by detecting signs of genuine human presence, such as subtle reflections and depth cues, without requiring any user interaction.

HyperVerge pricing

HyperVerge offers the following pricing plans:

| Start plan (for startups) | Grow plan (for midsize companies) | Enterprise plan (For enterprise-level organizations) |

| This plan includes a free one-month trial and the benefit of seamless integration in less than four hours. | This plan includes all the features of the start plan. It allows businesses access to custom workflows and view and manage document processing. | This plan offers all the grow plan offerings, collaborative tools, a custom pricing structure, and dedicated support. |

What do HyperVerge users say?

2. Sumsub

Sumsub is an end-to-end identity verification provider that offers KYC, KYB, AML, and transaction monitoring solutions. The tool leverages AI technology to ensure a secure and swift customer onboarding process. It provides multi-language support, automated workflows, and global coverage for businesses looking to enhance their anti-fraud measures.

Sumsub also provides biometric verification, liveness detection, and integrations with the existing systems. Its adaptive technology continuously updates to meet evolving regulatory standards, making it a reliable solution for verifying identities. It primarily caters to the fintech, crypto, online gaming, transportation, and trading sectors.

Pricing of Sumsub

Sumsub’s pricing starts at $149 per month. It provides a compliance plan starting at $299 and custom pricing options for enterprises.

Key features of Sumsub

Document verification: Offers accurate identity document verification and supports a wide range of ID documents from over 200 countries.

AML screening: Conducts thorough checks against global watchlists to prevent money laundering.

Transaction monitoring: Helps users detect suspicious transactions and improve transaction and risk scoring.

Identity verification: Allows users to build unique workflows for secure identity verification and even add multiple verification steps for IDs that seem risky.

| Pros ✓ Customers feel that Sumsub fully adheres to all relevant regulatory requirements, ensuring that the verification processes comply with all applicable laws and regulations.✓ According to the user experiences, customer support is consistently responsive and helpful in addressing clients’ issues. Cons X A few users feel that Sumsub can improve the speed of document processing and analysis. Businesses also think Sumsub can add a few more built-in reports related to payment method verification success rates. |

Sumsub compared with Shufti Pro

Sumsub offers a wider range of AML features, like behavioral analytics and transaction monitoring, which Shufti Pro doesn’t offer.

3. Jumio

Jumio provides AI-powered identity verification and authentication solutions like facial recognition, liveness detection, and intelligent document processing. It facilitates identity verification checks and ensures authenticity by comparing ID documents from over 200 countries with real-time selfies.

Jumio offers solutions for various industries, like financial services, healthcare, online gaming, and travel. Its services include an advanced analytics dashboard, a self-service rules editor, and detailed transaction investigations, which allow businesses to tailor their fraud prevention strategies.

Pricing

Jumio offers custom pricing that fits different business needs.

Key features

Biometric authentication: Offers facial recognition and liveness detection solutions to match a user’s selfie with their ID, ensuring accuracy.

Fraud detection: Allows businesses to create customized fraud detection strategies with its advanced analytics and self-service rules editor.

Risk signals: Conducts geo IP checks, global identity document authentication, device checks, phone number checks, etc., to verify customers and add risk signals for them.

AML Screening: Provides AML screening by checking customers against global watchlists and sanctions.

| Pros✓User reviews conclude that Jumio provides a good library of documentation and implementation is significantly easier due to the same. ✓ Users also like the friendly and quick interface as it doesn’t take too long to upload images/videos to the cloud. Cons X Occasionally, customers feel that Jumio generates false positives or extracts two different results from the same ID document. X Some businesses report that the pricing becomes increasingly aggressive with each new feature they opt for. |

Jumio vs Shufti Pro

Jumio offers more extensive integrations than Shufti Pro, such as Microsoft 365 and OneSpan Identity Verification. However, Shufti Pro provides a free trial, while Jumio doesn’t.

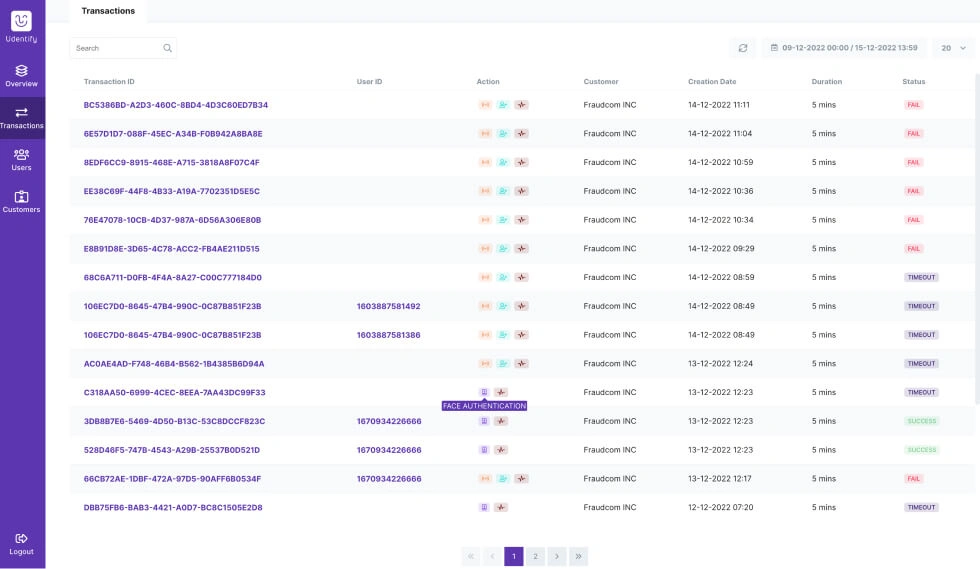

4. Udentify

Udentify is an identity verification tool by Fraud.com designed to securely verify customers’ identities and prevent different types of financial fraud in real-time. It provides a low-code solution that integrates into your existing systems, enabling a faster and more intuitive user experience.

Udentify offers biometric face matching, ID verification using OCR, and liveness detection, and supports documents from 237 countries and territories. It verifies identities using Near Field Communication (NFC) or OCR technology. This ensures KYC and AML compliance and facilitates evidence-based decision-making. Udentify offers its services for various industries like financial services, insurance, gaming & gambling, cryptocurrency, and government.

Pricing

Udentify provides a basic pricing plan that starts at $99 per month, a growth plan at $299 per month, and a plus plan at $799 per month. It also offers a custom plan for enterprises.

Key features

ID document verification: Udentify’s OCR technology auto-senses the identity document type, and analyzes barcodes, geometric patterns, etc.

Biometric verification: Provides a face-matching technology that matches the image of the presented face to their validated ID document.

Liveness detection: Conducts anti-spoofing and single-image analysis to prove the person is real.

| Pros✓ Based on user reviews on listing sites, Udentify offers real-time customer sentiment analysis during calls, allowing businesses to respond to customer needs promptly.✓ Users also like that Udentify’s similar image-processing technologies are efficient for age and gender estimation. Cons X A few customers feel that the pricing is expensive, especially for small and medium businesses that want to integrate facial recognition technology. X Some users are also experiencing difficulties with using its interface. |

Udentify vs Shufti Pro

Shufti Pro offers a free version of its identity verification tool which Udentify doesn’t.

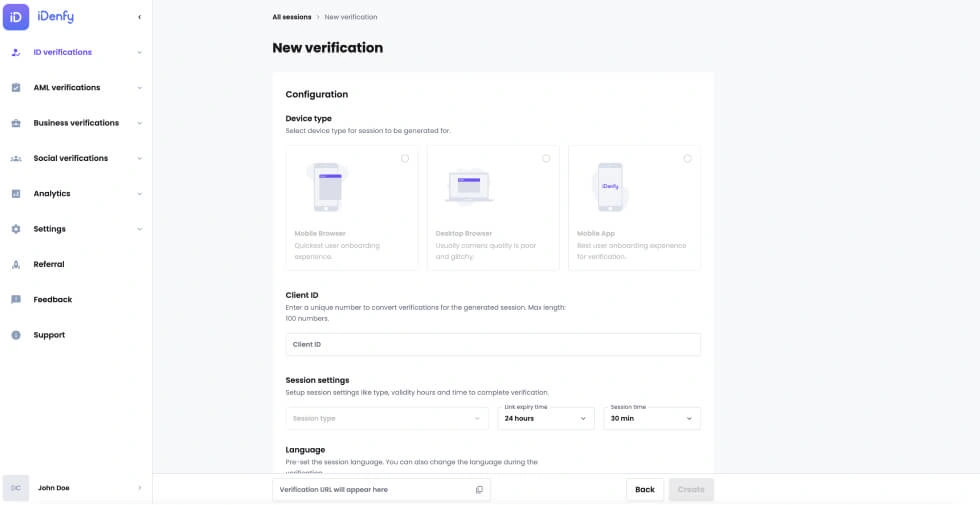

5.iDenfy

iDenfy is an identity verification solution provider that offers robust and secure verification services to help businesses comply with KYC and AML regulations. Its key offerings include document verification and biometric verifications. Identify leverages AI, fraud scoring, and NFC verification to help verify the customer identity verification process.

The platform is user-friendly, and it integrates seamlessly into the existing systems. It offers customized solutions for various industries like eCommerce, fintech, crypto, and online gambling.

Pricing of iDenfy

iDenfy offers custom pricing.

Key features of iDenfy

Fraud scoring: Allows you to assess the risk score of your customers and analyze fraud accident reports.

AML screening & monitoring: Helps you monitor your customers through sanctions screening, global watchlists, and politically exposed persons (PEP) screening.

Proxy detection: Facilitates you to receive real-time, anonymous IP detection to prevent fraud from proxy IP addresses.

Identity verification: Provides comprehensive identity services, including proof of address verification, phone verification, KYC checks, & NFC verification.

| Pros✓ iDenfy provides a well-documented API setup process for KYC integration into existing systems. ✓ iDenfy allows users to customize the mobile integration to be tailored to their own UX/UI. Cons X Some users occasionally experience inaccuracies and false positives, disrupting the document and identity verification process. X Businesses think the iDenfy’s pricing is high for lower volumes and smaller customer bases. |

iDenfy vs Shufti Pro

Shufti Pro provides key integrations such as KYC portal, RNDpoint, and Salesforce that iDenfy doesn’t provide.

6. Socure

Socure is an identity verification and fraud prevention company that utilizes AI and machine learning to deliver high-accuracy digital verification solutions. Socure’s fraud prevention platform provides real-time identity verification and risk assessment.

This helps businesses comply with KYC and AML regulations, reduce fraud, and improve customer onboarding processes. It aims to reduce the friction for legitimate users and gauge risk parameters for potential fraudsters. A wide range of industries, like financial services, healthcare, and e-commerce leverage Socure for verifying customer identities.

Pricing

Socure provides custom pricing.

Key features

Identity verification: Uses AI and machine learning to verify identities using biometric and behavioral data.

Fraud Prevention: Provides real-time risk assessment to detect and prevent fraud, reducing false positives.

Global watchlist: Enables users to screen and monitor their customers in real-time against sanctions, enforcement lists, and multiple identity verification databases.

| Pros✓ Users feel that Socure is very accurate in predicting risk scores. ✓ Reviews also mention that the platform is easy to use with a flexible learning curve. Cons X Some businesses think that Socure’s pricing is expensive for additional features other than ID checks. X Some users experience occasional cases of false positives and issues with iframe not recognizing IDs. |

Socure vs Shufti Pro

While both Socure and Shufti Pro offer real-time assessment, Socure heavily emphasizes machine learning and predictive analysis.

7. Ondato

Ondato provides a comprehensive digital identity verification service, enabling businesses to streamline customer onboarding, ensure KYC compliance, and prevent fraud. The platform includes document verification, biometric authentication, liveness detection, customer monitoring, and user-friendly integration.

Ondato provides customizable user journeys that businesses can tailor according to their requirements. It targets various industries, such as financial services, healthcare, retail and eCommerce, gaming, government, and the public sector.

Pricing

Ondato provides three types of pricing structures for KYC, KYB, and officer platform. The KYC plan starts at $0.99 per verification, with monthly fees varying for each plan. It also offers customized pricing for enterprises.

Key features

Transaction monitoring: Ensures a proactive risk management process involving tracking and analyzing a business’s financial transactions.

Business onboarding: Helps you create a comprehensive and efficient flow for business onboarding using KYB forms, ultimate beneficial ownership structure, and remote business information collection.

Analytics dashboard: Provides a customer data platform where users can generate internal reports and gather essential data.

| Pros✓ Businesses think that Ondato provides an intuitive platform with an easy-to-use interface. ✓ Users also enjoy superior customer support from Ondato. The team is professional and highly responsive. Cons X Some users experience a few inconsistencies in verification, and there is no clarity as to why a particular customer couldn’t complete the verification process. X Firms are also facing issues in integrating the platform with API. |

Ondato vs Shufti Pro

Shufti Pro provides a free trial and a free version of the tool, which isn’t available in Ondato.

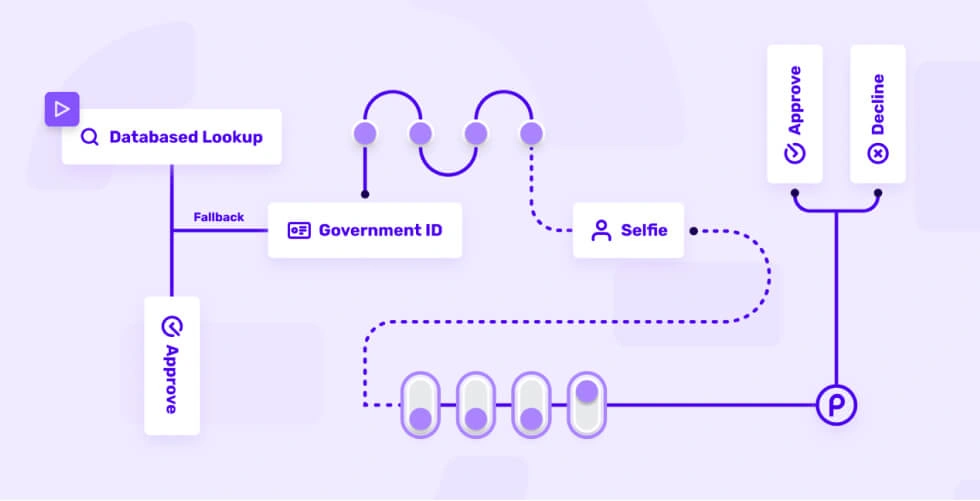

8. Persona

Persona is an identity verification and management platform designed to help businesses efficiently verify user identities. It offers a flexible and encompassing solution for identity verification that businesses can customize to meet industry-specific requirements.

Persona provides a no-code workflow builder that helps automate the customer onboarding process and comply with the KYC requirements. The platform offers a digital identity verification method encompassing ID document verification, biometric checks, and database lookups.

Pricing

Persona offers custom pricing.

Key features

Dynamic flow builder: Provides a no-code workflow builder where users can securely collect and verify sensitive identity information while building user journeys.

Fraud detection: Allows users to check risk signals using devices and IP addresses and check which users have already appeared in your customer base to catch fraud rings.

Case management: Facilitates users to see the right case information by building custom case templates for different user types, risk thresholds, and process requirements.

| Pros✓ Users feel that the setup is straightforward, especially for a non-technical user. ✓ Businesses like that the platform facilitate integrations that are quick and easy to implement. Cons X Customers experience a user drop-off in the registration flow due to OCR inaccuracy. X Persona users feel that the dashboard interface isn’t mobile-friendly. |

Persona vs Shufti Pro

Shufti Pro provides features catered towards AML, such as behavioral analysis and case management whereas Persona focuses on customer onboarding through workflows.

9.ComplyCube

ComplyCube is a leading identity verification and compliance solution provider that helps businesses securely onboard customers. It leverages AI to provide a suite of identity verification services, such as KYC compliance, document verification, and AML checks.

It supports a wide range of document types from over 220 countries and territories, ensuring high coverage and reliability. The platform is known for its user-friendly interface, robust API, and exceptional customer support and provides services for various industries like financial services, telecom, crypto, payments & fintech.

Pricing

ComplyCube’s pricing starts from $249 per month. It offers custom pricing for enterprises and mid-scale businesses.

Key features

Adverse media checks: Allows users to build risk profiles of their customers with adverse media screening services. It covers more than 50, 000 globally curated and trusted news sources.

Watchlist screening: Offers coverage of global AML watchlist sources to comply with stringent regulations.

Continuous monitoring: Uses AI and high-performance computing to screen millions of customers in real time every day.

Identity verification: Offers a range of identity verification solutions like biometric authorization, age estimation, and document verification.

| Pros✓ Banking firms like that the platform offers complete features and a one-stop AML/KYC solution under one platform. ✓ Businesses appreciate that ComplyCube regularly updates the AML regulatory requirements and helps companies comply with them. Cons X Some users prefer if ComplyCube’s local regulator backlist is not integrated into the global database. X Businesses experience challenges integrating ComplyCube with their existing systems, citing difficulties with API documentation and the need for technical support. |

ComplyCube vs Shufti Pro

ComplyCube only provides AI-powered solutions for KYC and AML, whereas, with Shufti Pro, you can opt for both AI-based verification and manual reviews.

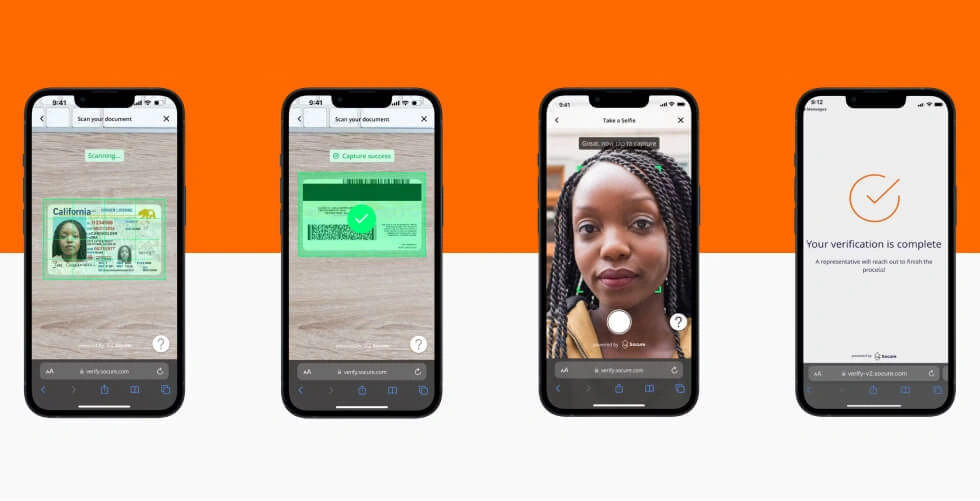

10. Onfido

Onfido provides an AI-driven identity verification service and authentication solution that helps businesses establish customer trust by ensuring a seamless digital onboarding process. Onfido’s services are trusted by over 1000 businesses worldwide and across various industries, such as financial services, healthcare, and retail.

Onfido’s platform leverages machine learning to verify identities using documents and biometrics, making the process fast and accurate. The company specializes in preventing fraud and meeting regulatory compliance requirements for KYC and AML.

Pricing

Onfido provides custom pricing.

Key features

Biometric verification: Provides AI-powered verification that protects your business from edited photos, submissions of screens, printed images, or masks.

Identity platform: Offers digital identity verification services such as document verification, biometric assessments, and AML compliance.

Smart capture SDK: Uses geolocation and network intelligence so that users get real-time feedback for blurry images and AML fraud detection.

| Pros✓ Onfido has low false positives and effectively detects false documents. ✓ Companies also appreciate its documentation for API Cons X Users feel that Onfido provides limited reporting options and needs to improve on that front. X The onboarding process is complex and lengthy for some subscribers. |

Onfido vs Shufti Pro

Onfido provides a wider range of integrations, such as Amazon Web Services (AWS), GlobaliD, Greenhouse, etc. However, it also has more enterprise-level clients than Shufti Pro, which primarily caters to SMEs.

Choose HyperVerge to automate the customer identity verification process

With multiple identity verification tools in the market, you need to opt for one that caters best to your business needs. Shufti Pro has multiple more AI-driven alternatives and offers an expansive feature toolkit.

HyperVerge ONE platform can be the personalized solution that perfectly suits your requirements. We provide a verification suite that covers document verification, biometric verification, liveness checks, personalized workflows for onboarding, etc.

HyperVerge is trusted by over 200 businesses and has verified over 900 million customer IDs with more than 96% accuracy. Contact us to learn more about how you can build workflows and create solid customer verification solutions using the HyperVerge ONE platform.

Frequently asked questions about Shufti Pro alternatives

1. How is HyperVerge better than Shufti Pro?

HyperVerge excels in offering customizable solutions with a strong emphasis on liveness detection and document verification. In comparison, Shufti Pro offers broad identity verification services, but HyperVerge’s focus on AI-driven accuracy and customization can provide more precise and tailored verification solutions for businesses.

2. Which are the primary Shufti Pro alternatives?

HyperVerge, Udentify, Sumsub, Ondato, Socure, and Jumio are some of the primary Shufti Pro alternatives available.

3. What factors should I consider when choosing a Shufti Pro alternative?

Some of the primary factors you need to consider before you choose a Shufti Pro alternative are pricing, features, AI, accuracy, and scalability.

4. Are there any cheaper alternatives to Shufti Pro?

Yes, many tools offer free versions and free trials for customer verification automation. However, check the list of features provided in the free and basic plans.