After the digitalization of many financial institutions and businesses, the risk of money laundering and other financial crimes has risen. Anti-money Laundering (AML) regulations are also strengthened to counter such money laundering activities and financial crimes. Complying with such regulations can be difficult and time-consuming for financial institutions to ensure compliance.

AML software helps financial institutions and businesses detect, continuously monitor, and prevent suspicious transactions. Ensuring AML compliance is challenging and that’s why finding a trustworthy AML compliance software is one of the most important decisions you’ll make.

There are various AML software solutions available in the market, and this comprehensive article will help you find the best AML solution and software for your business.

What is AML Software?

AML software is a specialized tool within regulatory technology (RegTech) designed to help financial institutions and businesses detect, prevent, and continuously monitor their transactions and create reports to stay compliant with AML regulations.

These AML software solutions use artificial intelligence and advanced algorithms for data analysis to monitor transactions, detect suspicious activity patterns, and compliance officers when money laundering activities are identified.

Read more about money laundering:

- What are the three money laundering stages?

- What are the AML red flags?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

Top Features of AML Software

To choose the best AML software, you must keep these key features in mind:

Identity Verification

AML software offers robust identity verification features to authenticate customers’ identities, ensuring compliance with KYC (Know Your Customer) regulations. It verifies identity documents and biometric data to reduce high-risk customer identity fraud and verify the customers.

Read more:

- What is a customer identification program (CIP)?

- What is customer due diligence (CDD)?

Sanctions and PEP Screening

AML software seamlessly screens individuals and businesses against the AML database. These databases contain essential lists of sanctioned individuals, including PEP (Politically Exposed Persons), RCA (Relatives and Close Associates), and sanctions lists.

It identifies individuals, financial institutions, or businesses involved in illicit activities, helps to prevent suspicious transactions made with high-risk parties, against money laundering risks, against terrorist financing, anti-money and anti-money laundering laws, and complies with regulatory requirements.

Read more: What is pep screening?

Transaction Monitoring

AML software monitors financial transactions in global databases in real-time transaction monitoring over time, analyzing patterns and anomalies to detect any suspicious activity report or activities denoting money laundering or financial crime.

It alerts compliance teams to investigate potentially illicit transactions, reducing money laundering and financial crime risk and regulatory non-compliance by financial institutions.

Risk Assessment and Management

AML software assesses the risk management associated with customers and transactions based on various risk factors such as data sources such as transaction amount, geographical location, and customer history.

It assigns risk scores and categorizes customers accordingly. It helps organizations see risk classification, allocates resources effectively, and prioritizes high-risk customers and at-risk areas for enhanced due diligence and monitoring.

Read more: AML risk assessment process: a step by step process

Record-keeping and Reporting (SAR)

AML software facilitates comprehensive record-keeping and reporting functionalities, allowing organizations to maintain detailed audit trails of customer interactions, transactions, and compliance activities.

It streamlines the process of filing Suspicious Activity Reports (SARs) to regulatory authorities, ensuring timely and accurate reporting of suspicious activities and demonstrating compliance with regulatory obligations.

5 Best AML Software and Solutions

Let us explore the top 5 AML software and solutions that empower businesses to detect and prevent financial crimes.

1. HyperVerge

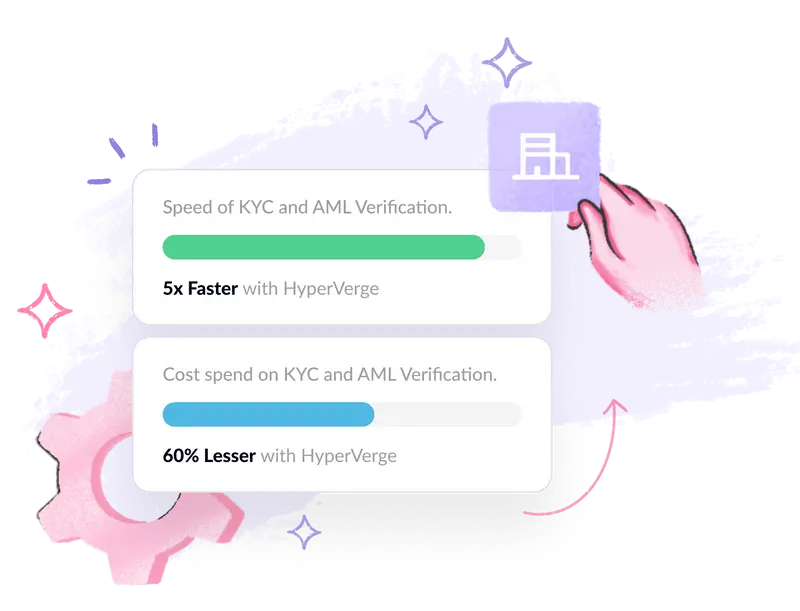

HyperVerge offers all-in-one KYC/AML solutions and leverages artificial intelligence and advanced machine learning technologies to assist organizations in reducing risks and complying with regulatory requirements.

With global coverage, technical support, and hassle-free integration, HyperVerge has become the trusted partner for many top-tier financial institutions and finance companies.

HyperVerge AML software for AML compliance

Best Features

- It employs both AI and rule-based methods for KYC (Know Your Customer), sanctions, PEP & RCA, adverse media, suspicious transaction alerts, and risk assessment.

- 24/7 real-time watchlist screening process, PEP & adverse media updates every 7 mins.

- Cut false positives with custom DOB and country-based filtering.

- Filter non-relevant profiles for accurate AML screening and get a comprehensive risk profile including date of birth, location, and media information.

Limitations

HyperVerge’s customers haven’t reported any significant limitations.

Pricing

HyperVerge offers a range of pricing options suitable for different types of users:

- Start Plan: Targeted at startups, includes a free trial in a sandbox environment, 1-month duration, integration in less than 4 hours, and basic verification management.

- Grow Plan: Designed for mid-size companies, it adds end-to-end ID verification, central database checks, AML checks, and custom workflow options.

- Enterprise Plan: For large organizations, offering collaborative solutions, custom pricing structures, dedicated support, and custom collaborative innovation.

If you’re interested in exploring more, sign up now.

2. ComplyAdvantage

ComplyAdvantage is the leader in financial crime intelligence, powered by complyData. They provide complete, financial crime compliance solutions. ComplyAdvantage software is used in high-risk sectors such as banking, insurance, gambling, and gaming.

Best Features

- Screening new and existing customers against various watchlists, sanctions checks, politically exposed persons (PEPs) lists, and other regulatory databases.

- Adverse media screening tools for screening individuals against news articles, regulatory announcements, and court records to identify reputational risks.

- Assign risk scores based on various risk factors.

- They offer includes name screening checks and API-based risk monitoring.

Limitations

- No real-time fraud screening platform.

- ComplyAdvantage’s monitoring system often generates false positives, resulting in unnecessary investigations and resource allocation.

Pricing

The pricing is volume-based and typically requires an annual commitment. There are various plans offered, priced competitively in the mid-range compared to rivals.

3. Sanction Scanner

Sanction Scanner, based in the UK and Turkey, offers a dedicated transaction screening solution for businesses navigating global sanctions. A primary focus of their system is to do fraud prevention and minimize false positives, aiming to streamline compliance processes.

It offers API integration options and a user-friendly dashboard, allowing businesses to customize the solution to their specific needs with ease.

Best Features

- Sanction Scanner offers access to a vast database of sanctions, PEPs, and adverse media lists from around the world.

- It provides real-time screening capabilities, enabling organizations to instantly identify any matches against sanction lists and take immediate action to mitigate risks.

- It generates comprehensive compliance reports, detailing screening results and actions taken, which can be useful for audit purposes and demonstrating compliance with regulatory requirements.

Limitation

- Organizations focusing on sanctions might require extra tools for compliance officers to create a complete anti-money laundering (AML) strategy.

- Some users mentioned that the reporting screen could be more user-friendly.

Pricing

While specific pricing details are available, contact sales for more details. Sanction Scanner generally offers more affordable rates compared to some older, more established providers. Subscriptions typically require an annual commitment.

4. Dow Jones

Dow Jones Risk & Compliance offers global solutions for managing third-party risks and regulatory compliance. We provide products and services to help companies assess risks faster and with greater confidence.

With actionable information and applications that are developed for compliance requirements and workflows related to money laundering regulations, counter-terrorism financing, sanctions, terrorist financing, anti-bribery and corruption, and international trade compliance.

Best Features

- Conduct due diligence for customers and connected parties as part of a robust Know Your Customer (KYC) program.

- End-to-end third-party onboarding and ongoing monitoring and screen for sanctioned counterparties, locations, and vessels.

- Real-time payment screening.

- One-off and ongoing automated batch screening against global sanctions lists.

Limitations

- Some users have reported false positives and missing information compared with similarly priced competitors.

Pricing

Pricing structures for AML solutions are available upon inquiry and often offer flexibility based on the organization or financial institution’s specific risk management and requirements. Typically, an annual commitment is expected.

5. Sumsub

SumSub is a global provider of a trusted identity verification solution that helps businesses comply with AML and KYC regulations. Its platform enables organizations to quickly and accurately verify the identities of individuals, entities, and financial institutions they work with.

Additionally, SumSub facilitates risk management processes, ensuring businesses can operate securely and in compliance with regulatory requirements.

Best Features

- SumSub excels in AML transaction monitoring software by providing a comprehensive view of customers’ risk profiles. Its platform also tracks the entire user journey

- SumSub’s methodologies enable real-time detection of signs of fraud, allowing businesses to pinpoint and address potential risks promptly and effectively.

- The platform includes checks for sanctions lists, Politically Exposed Persons (PEPs), and adverse media mentions.

- SumSub checks official documents from 220 countries.

Limitations

- Additional charges apply for phone number verification. Address verification is also available, but costs can accumulate, especially if you require comprehensive user profiling.

Pricing

- Basic ($1.35 per verification starting at $149/month).

- Compliance ($1.85 per verification starting at $299/month).

- Flex ($1 per verification with a prepayment of $5,000).

- There is also an Enterprise plan available with pricing offered upon request.

Choose the Best AML Software

Selecting the perfect, top AML software is not as challenging as it may seem. While there are numerous options available in the market, you can keep these key points in mind while choosing the best AML software work solution.

- Key Features: Make sure that the best AML software offers the functionalities you require, ranging from fundamental AML screening and checks to more advanced features such as customer screening such as PEP and sanctions screening, or capabilities for adverse media screening tools.

- Your Budget: Establish a budget and filter your choices accordingly. Some solutions may come with a higher price tag but offer a wider range of features, while others may be more budget-friendly and focus on providing core functionalities.

- Data Security and Compliance Regulations: Make sure to prioritize software that adheres to strict data security to ensure compliance standards and data and transaction monitoring, to ensure compliance with regulations. This ensures reliable data, transaction monitoring, and the protection of sensitive information, and guarantees regulatory compliance.

- Pros and Cons: Certain compliance tools may possess unique pros and cons that could greatly influence your operations. For instance, the software’s end-to-end case management transaction monitoring capability might be a dealbreaker for some, while others may require additional solutions due to a focus on sanctions.

- Team Support: Having a responsive support team is important. Check if they are available 24/7 and the channels they offer, whether it’s chat, phone, or email.

- Accuracy and Scalability: Find software that can spot and suspicious activity report your activities well while avoiding mistakes, making business verification transaction monitoring, and compliance easier, and saving time. Also, make sure it can grow with your business and fit with your current systems easily.

- User Interface: Make sure the tool has a user-friendly interface, so your team can learn it easily.

- Customer Feedback: Reading real customer reviews and ratings on software comparison platforms can offer genuine insights into customer information about the strengths of AI and machine learning in the software.

HyperVerge provides the Best AML solution that meets these requirements and beyond. Using advanced AI technology, HyperVerge helps companies detect and manage financial risks while staying compliant with AML regulations.

Ready to get the right AML software solution? Consider HyperVerge for a comprehensive solution that ticks all the boxes. To learn more about HyperVerge’s AML software solution, sign up for a demo today.