Politically Exposed Persons (PEPs) are individuals who hold strong public positions or are closely connected with influential figures. PEP screening is important for KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance because PEPs pose a higher risk of being involved in financial crimes and illegal activities.

Financial institutions and businesses must identify new customers and screen their existing ones for PEPs. This blog will serve as the ultimate guide for understanding the PEP screening processes and choosing the best solution for your business.

What is PEP screening?

Politically Exposed Persons (PEPs) are seen as high-risk individuals because of their influential positions. This can make it easy to commit crimes like bribery, money laundering, terrorism financing, corruption, and other financial crimes.

Read more about money laundering:

- What are the three money laundering stages?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

PEP screening is an important component of Customer Due Diligence or CDD. It helps financial institutions and businesses identify PEPs and manage potential risks related to them to ensure regulatory compliance. In the United States, the Financial Crimes Enforcement Network (FinCEN) oversees the PEP screening requirements.

Ignoring PEP screenings can lead to serious consequences, including being placed on a sanctions list, reputational risk, political exposure, and facing fines from the Office of Foreign Assets Control (OFAC).

Who is considered to be a Politically Exposed Person?

PEPs are often in high public positions where they could misuse their power for various financial crimes. Here are examples of types of individuals who may be considered PEPs:

- Domestic PEPs: It is refer to individuals who hold prominent public positions within their own country such as Heads of state or government, senior politicians, senior government officials, judicial or military officials, senior executives of state-owned corporations, and important political party officials.

- Foreign PEPs: These are individuals who hold similar significant public positions but in foreign countries.

- International PEPs: These are individuals who hold influential positions in prominent public functions in international organizations or have global political influence, regardless of their nationality.

Other than that, PEPs can also include family members, relatives, or any close associates with public figures.

Why is PEP screening important?

PEPs are more likely to be involved in illegal activities and financial crimes. They possess a high risk of money laundering through bribery, corruption, and sometimes even terrorist financing.

According to the United Nations, $1 Trillion is paid in bribes, and $2.6 Trillion is stolen through corruption. These numbers are a serious concern, and financial institutions and organizations must prevent them.

Financial institutions and other organizations must conduct PEP screening to manage higher risks, prevent financial crime, and keep the financial system safe and stable. The PEP screening process will help identify potential risks and keep watch on PEPs.

PEP screening is a vital component of KYC/AML compliance. It helps identify risks concerning customers, determining whether they are on the PEPs list and might be involved in potential financial crimes. Not complying with AML laws can lead to penalties. To avoid penalties, financial institutions must stay compliant with the Financial Action Task Force (FATF) AML regulations.

How is PEP screening done?

Financial institutions such as banks and credit unions are the primary organizations that must conduct PEP screenings. Other than that, businesses and organizations that are required to follow AML and KYC regulations should screen for PEPs.

PEP screening involves several key stages to identify PEPs. Financial institutions must follow these stages. Organizations can effectively monitor potential candidates by implementing key measures such as developing a PEP

risk assessment framework, conducting enhanced due diligence (EDD), and monitoring PEPs for suspicious activities.

Here are the key stages typically involved:

1. Identify new customers

The PEP screening process involves identifying individuals who could be a PEP and assessing their potential risk. To identify PEPs among new customers, financial institutions or organizations need to collect sufficient data to screen customers against multiple data sources.

PEP screening is part of the customer onboarding process but could be done during the first interaction between the customer and the organization. The minimum data required for PEP screenings should include the customer’s full name, date of birth, gender, and any political exposure roles they may have held, including the years of service and appointment dates.

It’s important to know which country a politically exposed person was involved with and the current status or date the individual left the post. If a new customer is identified as a politically exposed person, the financial institution or institutions should quickly apply the necessary checks and measures.

Read more:

- What is a customer identification program (CIP)?

- Anti-Money Laundering Checks Explained: Everything You Need to Know

- What are AML red flags?

2. Risk assessment

After identifying PEP, the next step is to conduct due diligence procedures and an AML risk assessment and assign a level of risk to the individual. Several factors are considered when conducting risk assessment and PEP due diligence, including geography, type of business, and product.

According to FATK (Financial Action Task Force) guidelines, foreign PEPs are automatically classified as higher risk than domestic PEPs. Financial institutions must conduct customer due diligence when conducting risk assessments.

By considering various risk factors and using a screening solution, organizations can establish an appropriate level of monitoring for politically exposed persons (PEP) and maintain a robust compliance and internal risk assessment and risk management program.

3. Approval

Approval is an important stage of PEP screening. Before become customers, senior management should approve them. This step is crucial to identifying risks related to PEPs, who have PEP relationships, financial crime risk, and responsibilities within the entity’s AML control environment.

It also provides an opportunity for enhanced due diligence on any immediate family members and Close Associates with a PEP business relationship already. Senior management is responsible for making the final decision on whether or not to approve a PEP as a customer, based on the risk assessment and other factors.

The final decision must be well-documented and made by the organization’s policies and procedures.

Continuous monitoring and screening

Continuous monitoring and screening of current politically exposed persons (PEP) customers are necessary to detect any changes in their high-risk status. This is where customer onboarding and enhanced due diligence procedures will play a crucial role. This involves regularly checking their financial activities, verifying their sources of wealth and funds, and ongoing monitoring of their business transactions.

Ongoing monitoring involves regularly screening the PEP customer against updated PEP lists and other relevant watchlists to ensure they aren’t on any new lists. Whereas, Enhanced due diligence requires more in-depth research and analysis to understand the level of associated risk factors posed by the PEP customer.

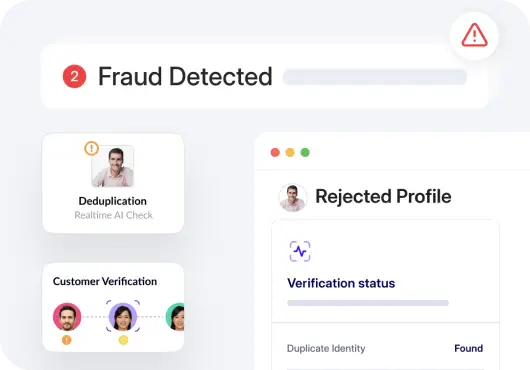

Financial institutions and businesses must identify false positives (Many people share identical names, which can be identified by the system as PEP incorrectly). This issue can be solved using intelligent screening solutions that use automated analysis and filter PEP data.

Best practices for PEP screening

PEP screening can lower risk and ensure compliance with AML and KYC regulations. To monitor potential risks related to PEP financial institutions and businesses must consider a risk-based approach with a few important factors such as using reliable sources to gather information, adopting a risk-based approach, keep clean records and CDD.

Here are some best practices to include during PEP screening:

Gather sufficient information from various sources

Gathering accurate information from independent and reliable sources such as public records, government and PEP databases, media reports, and specialized PEP lists provided by regulatory bodies is important.

Adopt a risk-based approach

Prioritizing PEP screening based on risk factors such as geographic location, business sector, and transactional behavior allows institutions to allocate resources effectively, identifying higher-risk individuals.

Continuous customer screening

Politically exposed person (PEP) may gain or lose their influential position. To monitor PEP status, regularly screening customers against updated PEP status in lists and regulatory databases. It will ensure compliance with regulatory requirements and take action if any changes occur.

Read more: What is transaction monitoring in AML?

Keep a comprehensive record

Maintaining detailed records of PEP screening activities, including screening results, risk assessments, and any follow-up actions taken, provides a clear audit trail for regulatory purposes. This demonstrates compliance with anti-money laundering (AML) and Know-your-customer (KYC) regulations helps monitor effectively.

Read more:

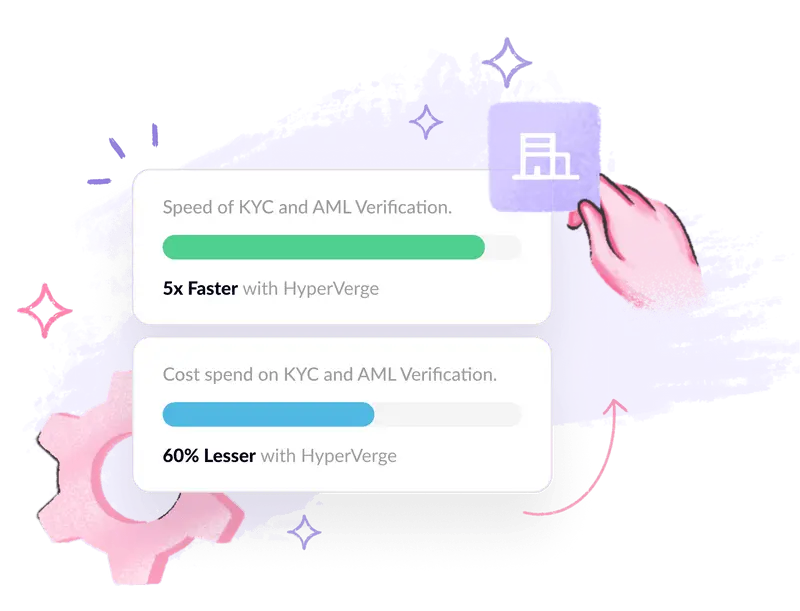

Automate the PEP screening process

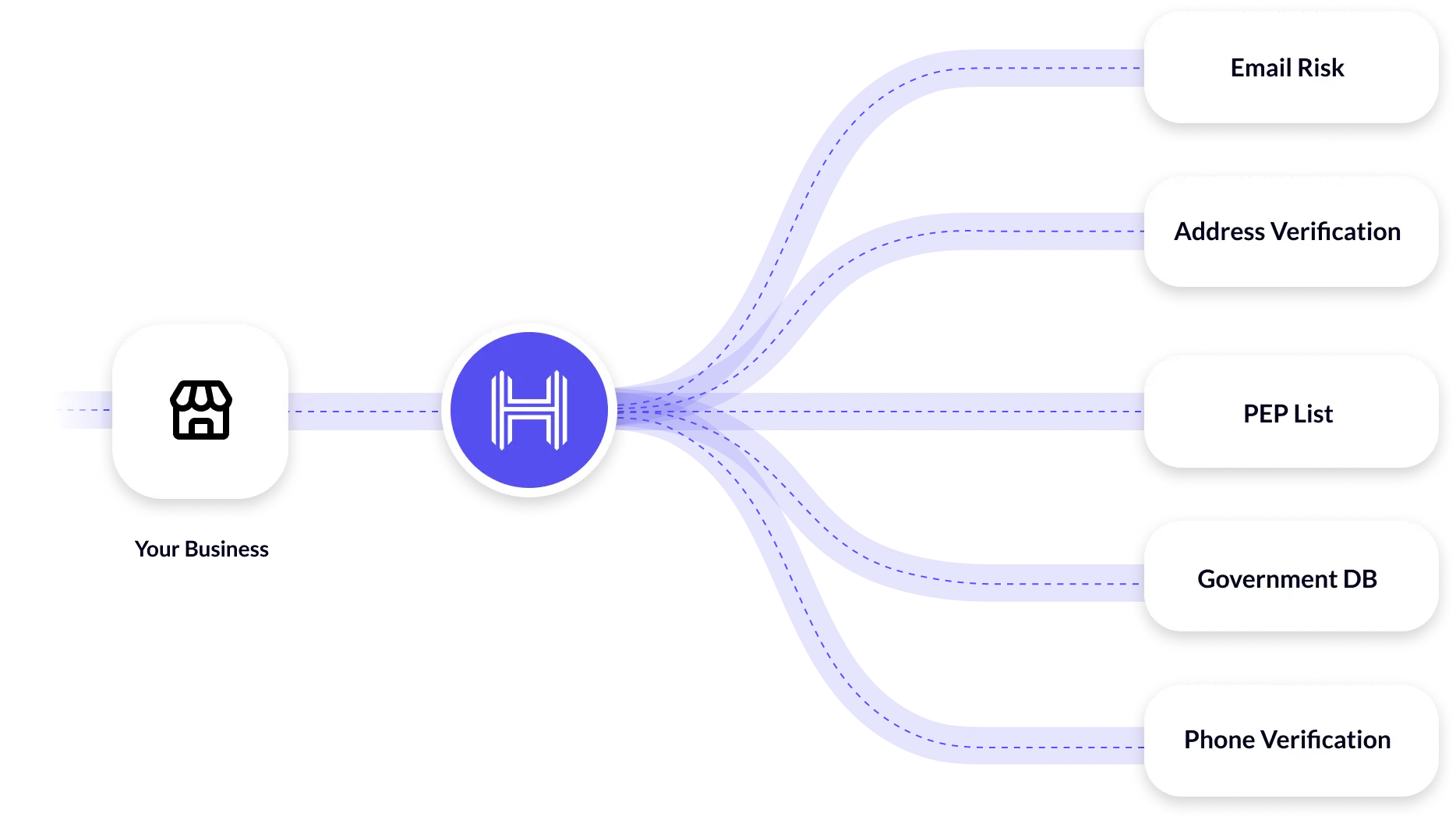

At HyperVerge, we offer solutions to streamline your Anti-Money Laundering (AML) compliance with our advanced AML Screening module. We provide daily updates on sanctions screening, adverse media screening and PEP lists, including those from organizations like UNSC, OFAC, Interpol, IRDAI, FIU, and UAPA.

HyperVerge’s AML solution is complete with risk assessment, enhanced regulatory compliance, and ongoing monitoring. Our AML software is designed to minimize false positives by offering custom filtering options based on date of birth and country.

Ready to start? Sign up here.