A money mule, also known as a ‘smurfer’, is a person who transfers money obtained illegally through a financial institution. Money mules are often used by criminals to launder money. A money mule may not know that the money has been generated from illegal activity. Money mules are often tricked into participating in money laundering through ads promising easy money.

In this blog, we’re covering everything you need to know about money mules, how to detect money muling proactively, and how to prevent financial fraud.

Who are Money Mules?

Money mules are individuals unknowingly recruited by criminals to transfer stolen or illegal funds. They act as bank intermediaries, moving money through their personal bank accounts, often under false pretenses. This allows criminals to make money transfers, distance and protect themselves from the source of the funds and avoid detection.

Money mules are individuals unknowingly recruited by criminals to transfer stolen or illegal funds. They act as bank intermediaries, moving money through their personal bank accounts, often under false pretenses. This allows criminals to make money transfers, distance and protect themselves from the source of the funds and avoid detection.

Here’s a closer look:

- Unwitting individuals: These individuals are often deceived by promises of easy money or misled about the true nature of the transactions.

- Complicit individuals: Some knowingly participate in money mule schemes for personal gain despite the legal and ethical implications.

The Alarming Reality of Money Mules

According to a report by the Financial Trade Commission (FTC), people lost $10 billion to scams in 2023. The figure paints a grim picture; the human cost of money muling delves far deeper. Statistics reveal the vulnerability of specific victim demographics:

- Young adults and teens are prime targets: This age group, susceptible to “money mule” schemes, is targeted on online platforms by producers of child sexual abuse material, making them ideal victims (FBI).

- Over-40s are increasingly at risk: The over-40 demographic finds itself increasingly ensnared, with a concerning 29% surge in involvement (Lloyds Banking Group).

- Romance fraud on the Rise: In 2022, losses from romance fraud reported to federal and law enforcement agencies hit a staggering $1.3 billion – a costly affair indeed. (Commodity Futures Trade Commission).

Types Of Money Mule Accounts

There are four main types of money mule accounts: personal, business, corporate, and virtual. Each type has its advantages and disadvantages, so it is important to choose the right one for your needs.

- A personal account is the most common category of money mule accounts.

The first type is a personal account that is used to receive and send money. These types of accounts are often used by people who are looking to launder money or avoid taxes.

They are easy to set up and usually have low fees. However, they are not as flexible as other types of accounts and may not be suitable for large transactions.

- Business accounts are more flexible than personal accounts but often have higher fees. They are a good choice for businesses that need to send or receive large amounts of money.

These accounts are often used by companies that are looking to avoid taxes by claiming income as a business expense.

- A corporate account is the most flexible type of money mule account. They have the lowest fees and can be used for almost any type of transaction. However, they are only available to businesses and organizations.

These accounts are often used by individuals or companies as a strategy to resource and allocate funds in illegitimate ways that are out of the bounds of local governments.

- The fourth type of money mule account is a virtual account. These accounts are often used by people who are looking to launder money in a way that cannot be traced back to the owner.

Read more:

- What are the three money laundering stages?

- What is layering in money laundering?

- What is Smurfing and How You Can Prevent it Proactively

- What is Trade Based Money Laundering (TBML)?

Industries in the Crosshairs

While no industry is immune online from fraudsters, some bear the brunt of scams more frequently due to the nature of their transactions. Let’s break it down:

Financial institutions

- Banks, credit unions, and money transfer services handling vast sums become prime targets of money muling.

- Investment firms and FinTech entities dealing with high-net-worth individuals and intricate financial products expose themselves to the risk of becoming conduits for illicit activities.

Online businesses

- E-commerce platforms: Online stores facilitate numerous transactions, creating opportunities for criminals to disguise money laundering within legitimate purchases.

- Gaming platforms: In-game currencies and microtransactions can be used to move and launder illegal resources, often targeting young users.

- Online marketplaces: Platforms like eBay and Craigslist can be exploited for selling stolen goods with funds funneled through mule bank accounts.

Other vulnerable sectors

- Real estate: High-value transactions and complex inheritance processes can be manipulated to launder money through property purchases.

- Forex and cryptocurrency brokers: The allure of anonymity and speed in these markets makes them attractive to criminals looking to move and conceal illegal money swiftly.

- Carsharing and rental services: Stolen identities or mule accounts may finance vehicle or accommodation rentals, potentially fueling further illicit activities.

The serious consequences for organizations due to money mules go beyond just financial losses:

- Reputational damage: The mere association with money laundering corrodes customer trust and brand image, leading to dwindling business and potential regulatory sanctions.

- Operational disruptions: The investigation and suspicious activities reports consume time and resources, impacting business efficiency.

- Compliance costs: Implementing robust Anti-Money Laundering (AML) measures to prevent and detect money laundering involves significant financial investment.

Money Mule Red Flags

Be aware of these warning signs, both for individuals and businesses:

Red flags for individuals

- Job offers with unrealistic pay: Now, let’s talk about those tempting job offers that promise the moon and stars. Quick and easy money, especially online, often turns out to be a scam.

- Pressure to use personal accounts for business transactions: Legitimate companies won’t ask you to play Russian roulette with your personal accounts for business purposes. It’s a red flag waving frantically, telling you to step away.

- Requests to move money to unfamiliar accounts: Ever got a request to shuffle money into unfamiliar accounts? Hold your horses. Transferring money to mystery entities is like handing your wallet to a stranger in a dark alley. Don’t be that person.

- Secrecy and urgency surrounding the transactions: Criminals love a cloak-and-dagger approach. If a transaction reeks of secrecy and urgency, it’s time to raise those eyebrows. Scrutiny is your best friend in this game.

Red flags for businesses

- Customers with suspicious activity: Watch for unusual transactions, inconsistent information, or attempts to avoid verification processes.

- Employees pressured to bypass procedures: Watch out. Don’t let internal shortcuts mess with your AML and Know Your Customer (KYC) protocols.

- High-risk customers or transactions: Implement stricter controls for customers or transactions deemed high-risk based on your AML risk assessment.

Read more: What are the AML red flags?

Strategies for Financial Fortification Against Money Mules

As we venture into the strategies essential for thwarting the wily tactics of money mules, financial institutions emerge as the frontline bank defenders. Here’s the playbook:

Robust Customer Due Diligence (CDD) and KYC

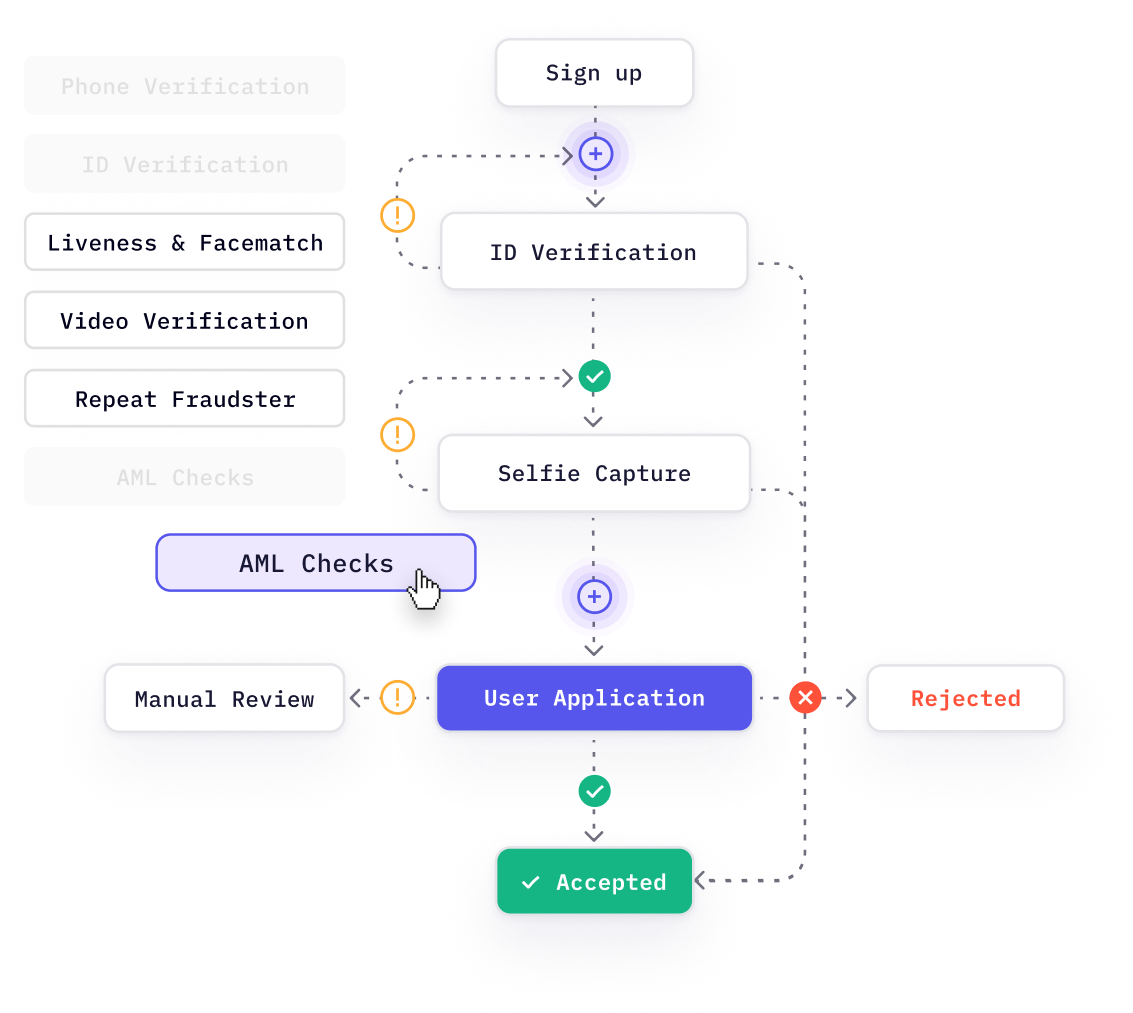

- Enhanced identity verification: Move beyond the basics. Embrace biometric authentication, wield document verification tools, and weave a tapestry of information from public databases to forge a robust understanding of customer identity and beneficial ownership.

- Risk-based approach: Tailor your CDD and KYC measures to the individual risk profiles in your midst. Heighten scrutiny for those in high-risk jurisdictions or exhibiting suspicious activity patterns.

- Continuous monitoring: The journey doesn’t end at onboarding. Regularly update customer information, stay attuned to shifts in risk profiles, and keep a keen eye on money muling activities throughout the customer lifecycle.

Read more:

- What is enhanced due diligence (EDD)?

- What is customer due diligence (CDD)?

- KYC and AML: Key Differences and Best Practices

- What is a customer identification program (CIP)?

Proactive Risk Assessment and Transaction Monitoring

- Comprehensive risk framework: Create a risk framework tailored to your institution and clientele. Delve into transaction patterns, geographical nuances, and customer demographics to identify and assess potential money mule risks.

- Advanced analytics: Equip yourself with the prowess of machine learning and artificial intelligence. Detect anomalies and suspicious patterns with real-time monitoring, staying one step ahead of the ever-evolving money mule tactics.

- Dynamic rule management: Adapt, evolve, and stay nimble. Continuously update monitoring rules based on shifting money mule tactics and emerging trends.

Read more:

- AML risk assessment process: a step-by-step process

- What is sanctions screening?

- What is pep screening?

- What is Adverse Media Screening: A Step-by-Step Process

Collaboration and Information Sharing

- Industry-wide partnerships: Forge alliances with fellow financial institutions, law enforcement agencies, and regulatory bodies. The collective exchange of information becomes a potent weapon against the rising tide of scams.

- Secure platforms: Leverage secure data-sharing platforms to facilitate seamless and secure information exchange. Efficient collaboration is the bedrock of effective counteraction.

- Industry initiatives: Join the ranks of industry-wide initiatives and task forces dedicated to the relentless pursuit of combating money laundering and financial crime.

Wrapping Up

There are legal bindings in place worldwide to prevent banks and individuals from criminal elements of money laundering. Advanced AML software, such as HyperVerge, is designed to take the pain out of the AML compliance process.

HyperVerge can help you with:

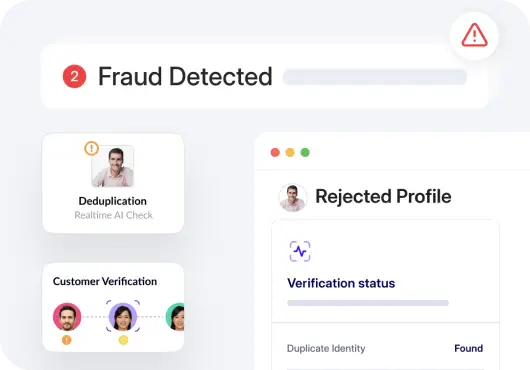

- Streamlined KYC and AML checks

- Real-time transaction monitoring

- Risk assessment, screening, and adverse media checks

Ready to learn more? Sign up to see how we can help with AML compliance.