Being a part of the finance team, you might find the following scenarios familiar.

- Fraudsters misuse financial systems and cause monetary losses.

- The lack of automated fraud checks results in slow processing times, which increases operational costs.

- Systems cannot often detect tampering in real-time.

- Failure to secure sensitive financial information leads to legal issues and regulatory sanctions.

To avoid any of these concerns, consider choosing fraud detection software. According to IMARC Group, the demand for fraud detection software is rising, with a Compound Annual Growth Rate (CAGR) of 13.23% from 2024 to 2032.

The challenging part here is to find the right software for fraud detection. Let’s help you by providing a curated list of top financial fraud detection software based on factors like reviews, pricing, features, and functionalities.

Let’s first learn what financial fraud detection software is and how it works.

What is financial fraud detection software?

Financial fraud detection software is a tool for identifying and mitigating fraudulent activities in economic transactions and operations. The tool uses machine learning techniques, advanced algorithms, and data analytics to identify suspicious patterns and anomalies.

Let’s learn how financial fraud detection software works.

- Collects data from various sources like transaction records, customer profiles, and external databases.

- It uses machine learning algorithms to establish baseline behaviors and find patterns in financial activities.

- Detects changes from the known patterns and raises a red flag for suspicious fraudulent transactions or activity.

- Monitors transactions in real-time to enable swift detection and response to suspicious behavior.

- Generates alerts or notifications when any kind of suspicious activity is detected.

Finding reliable financial fraud detection software in the market is not easy. To save time and effort researching various software, check out how we evaluated and shortlisted the top financial fraud detection software.

How we analyzed and selected the best financial fraud detection software

Our team followed a manual method to curate the top 10 financial fraud detection software. The manual method included a detailed analysis of 35+ fraud detection software. Our team compared all the software’s ratings & reviews from reliable platforms like G2 and Capterra.

We then sorted out the top financial fraud detection software based on detection capabilities, customer support, pricing models, system integration capabilities, available deployment options, and targeted industries. This detailed process ensures that our software list aligns well with your fraud detection requirements.

Overview of the top 10 financial fraud detection software

Here is an overview of the 10 best financial fraud detection software.

| Financial Fraud Detection Software | Deployment Options (Cloud, On-premise) | Best for | Targeted Industries |

| Cloud | • Startups • Small-scale businesses • Mid-sized companies • Enterprises | • Financial services • Education • Logistics and eCommerce • Remittance • Gaming • Crypto | |

| Cloud & On-premise | • Startups • Mid-sized companies | • Banking • Insurance • Online Lending • eCommerce • Payments • Crypto | |

| Cloud | • Startups • Mid-sized companies | • Retail • Apparel and fashion • Manufacturing | |

| Cloud | • Mid-sized companies • Enterprises | • eCommerce • Healthcare • eLearning • iGaming • Restaurants | |

| Cloud | • Mid-sized companies • Enterprises | • eCommerce • Digital goods • Fintech • iGaming • Travel & Transportation | |

| Cloud | • Mid-sized companies • Enterprises | • Financial services • eCommerce • Payments | |

| Cloud | • Startups • Mid-sized companies • Enterprises | • IT services • Financial services • Internet • Marketing & advertising • Retail • Wholesale | |

| Cloud | • Startups • Mid-sized companies | • Enterprises • Banking • Payments • Neobanks • Fintech | |

| Cloud | • Startups • Mid-sized companies | • Banks • Insurance • Payments • Corporates • Lending • WealthTech and investments | |

| Cloud | • Mid-sized companies • Enterprises | • Financial services • Insurance • Government • Healthcare • Non-profits |

Let’s cover each of the fraud detection software in detail.

A detailed list of the 10 best financial fraud detection software for online businesses

Here is a detailed explanation of each financial fraud detection software.

1. HyperVerge

About HyperVerge

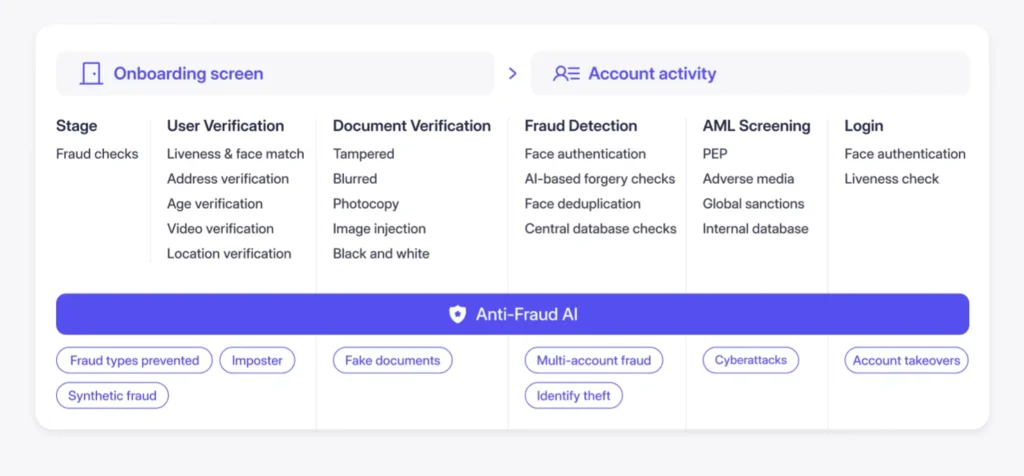

HyperVerge is a leading financial fraud detection software provider that offers advanced solutions to detect and prevent fraudulent activities. It uses advanced AI solutions like optical character recognition (OCR), facial recognition, anti-money laundering, and digital identity verification to optimize the entire customer onboarding journey.

Additionally, HyperVerge’s deepfake detection technology offers industry-leading accuracy. This solution utilizes features such as accurate image analysis, video processing, anomaly detection, facial recognition, and more to identify instances of manipulation and deepfake-generated fraud. It scrutinizes every minute detail in videos to distinguish real content from synthesized ones and has global certifications for facial recognition from NIST and iBeta.

This fraud detection software ensures document authenticity with techniques like signature/thumbprint detection associated with PAN cards and photo-on-photo verification while identifying physical and digital tampering.

Financial institutions can reduce processing times due to automated fraud checks and real-time detection capabilities. HyperVerge’s algorithms combat complex fraud types, including photo-on-photo fraud, ensuring a secure verification process.

Moreover, HyperVerge supports over 100 API integrations across various industries and offers dedicated customer support to ensure a smooth process. Within 4 hours, you can fully implement and operate HyperVerge and benefit from its advanced fraud detection capabilities.

Key features of HyperVerge

Here are the key features of HyperVerge.

- Signature detection: Identifies signatures and thumbprints on PAN cards to ensure document validity and avoid fraudulent submissions.

- Photo fraud detection: Detects photo-on-photo fraud attempts, protecting the verification process and identifying usual fraud types.

- Screen capture detection: Recognizes attempts to use screen captures. This keeps duplicate documents out of distribution and guarantees the integrity of the entire process.

- Automated checks: Automates fraud detection to decrease the need for manual reviews. This feature enhances efficiency, saves operation expenses, and reduces mistakes.

- AML Compliance: Simplifies anti-money laundering compliance by reviewing transactional data, spotting suspicious activity, and securing enterprises from financial fraud.

- Deepfake detection Detects deepfakes in photos and videos, helping to protect against identity theft and false information campaigns.

HyperVerge pricing

HyperVerge offers three pricing plans to serve all types of businesses. The Start plan is suitable for startups, the Grow plan is ideal for midsize companies, and the Enterprise plan is suitable for Enterprise-level organizations. Let’s examine each plan in detail.

| Start plan It offers a free trial and easy integrations in under 4 hours. It also includes tools to view and manage verifications for one month. | Grow plan The plan includes everything from the Start plan to the end-to-end ID verification suite, access to AML checks, central database checks, and customized business workflows. | Enterprise plan The Enterprise plan features all the Grow plan offerings, a custom price structure, and collaborative tools. |

What people say about HyperVerge

Client testimonial

HyperVerge provides fraud detection solutions to various clients, including Freo, a leading app-based credit line. The company faced a common challenge of fraudsters exploiting their services. To handle the situation, Freo reached out to HyperVerge for fraud prevention. With HyperVerge’s advanced fraud detection measures in place, Freo’s fraud rates dropped sharply, and their collection efficiency surged to an impressive 99%. Here is the feedback received by their chief risk officer.

2. SEON

About SEON

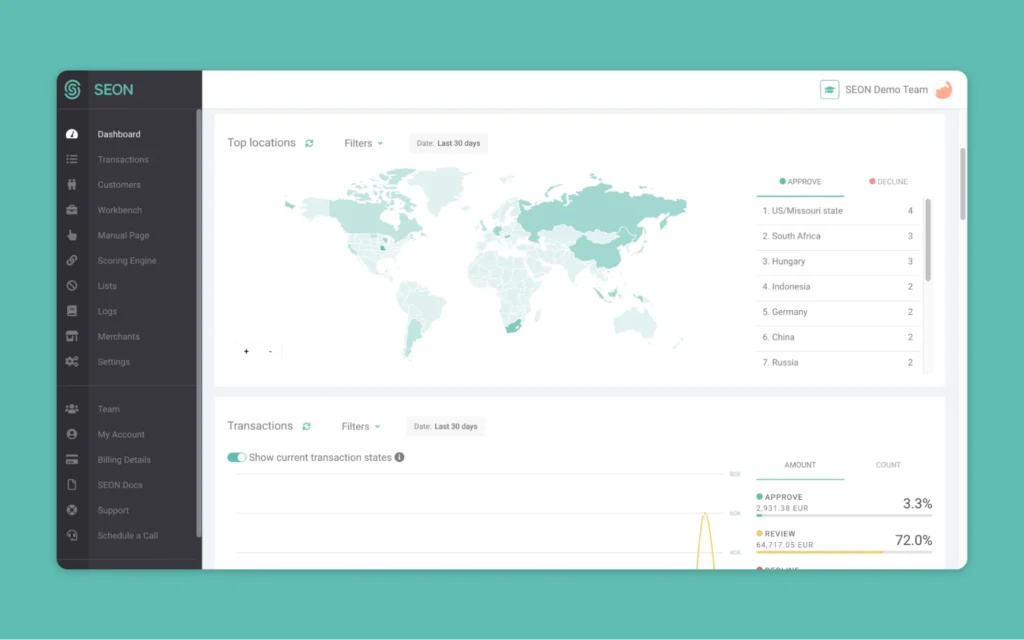

SEON is a well-known fraud detection software that uses AI-driven insights to prevent fraud and money laundering. This end-to-end solution covers fraud types, such as account takeover, bonus abuse, bot attacks, chargebacks, and money laundering. The software blocks fraudulent traffic and accounts using digital footprinting, device intelligence, and ID verification.

SEON provides real-time user activity monitoring to accelerate transaction verification and improve financial fraud detection. It consists of a codeless rule builder that helps deploy machine learning-suggested rules or create custom rules to reduce manual mistakes. This platform integrates AML screening, case management, and regulatory reporting to boost operational efficiency.

SEON Pricing

SEON offers multiple pricing plans starting from Free ($0) with 2 users, 10 custom rules, 500 manual checks/month, and 2 queries/sec to Professional (contact for pricing) with unlimited users, rules, API calls, queries, and technical account management.

Key features of SEON

- Digital lookup: This feature performs a background check using data points. It builds an extensive digital footprint to help identify fraud users.

- Risk scores & rules: Deploys several customizable rules to count risk scores and make better decisions. Users create, test, and refine custom rules to improve detection accuracy.

- AML & KYC integrations: Prevents financial crime with the integration of AML and completes Know Your Customer (KYC) checks.

- Device fingerprinting: This service offers SDKs for iOS, Android, and web apps to identify browsers and devices. It collects various data points to flag emulators or VPNs.

Pros of SEON

- Excels at detecting fraudulent activities using various data points and machine learning models.

- Offers real-time monitoring and alert systems to react quickly to fraud activity.

- Integrates easily with various platforms like Shopify in just a few clicks.

3. Signifyd

About Signifyd

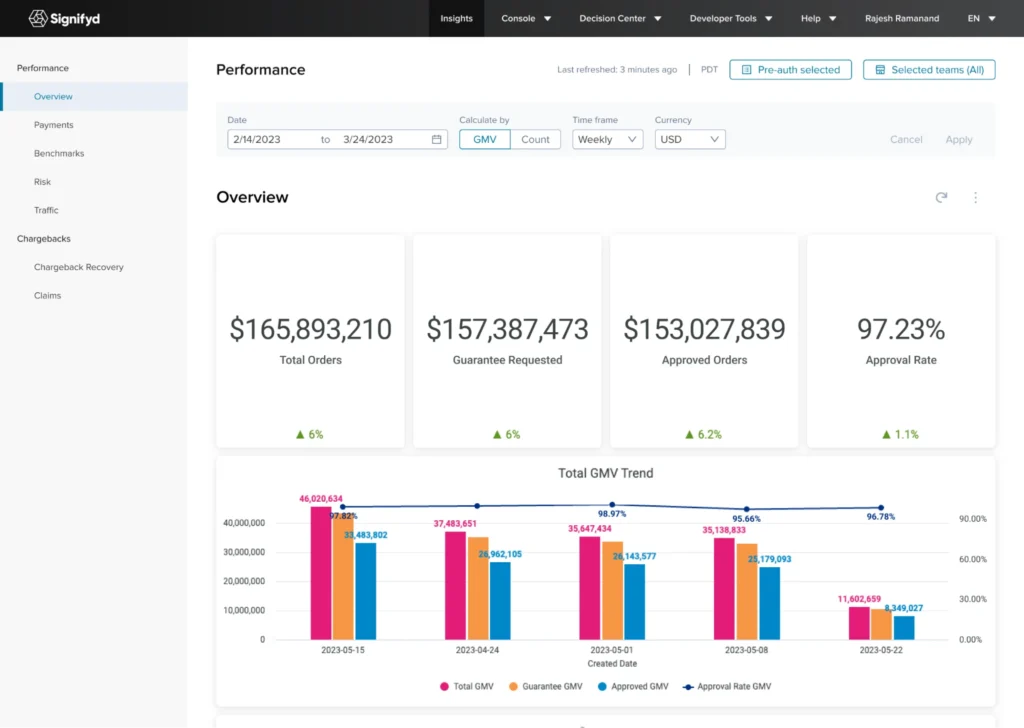

Signifyd is reliable fraud protection software that helps eliminate fraud losses and prioritizes customer experience. Using AI-driven analysis and Commerce Network, the software cross-checks suspicious activities with known fraud Signifyd patterns. This approach allows for blocking fraud attempts before they affect the business.

Signifyd supports custom storefronts through direct API integration and offers easy integrations with eCommerce platforms like Magento, Shopify, and BigCommerce. The software removes manual review requirements by automating order processing and fulfillment. It provides real-time reject and accept decisions based on identity intelligence, which guarantees financial assurance for accepted orders and reimburses fraudulent chargebacks.

Signifyd Pricing

Contact Signifyd to get pricing.

Key features of Signifyd

- Risk analysis: Offers precise insights into order decisions and fraud patterns via Agent Console and Power Search.

- Performance metrics reporting: Monitors and analyzes approval rates, chargeback rates, and decision times and tracks performance with diverse segments.

- Real-time order decisions: Performs accurate accept or reject decisions through identity and intent intelligence.

- Platform integration: Frictionless integration with Magento, Shopify, and BigCommerce to ensure a smooth shopping experience without interruptions.

Pros of Signifyd

- Easy to integrate with several eCommerce platforms like Magento and Shopify.

- Offers responsive customer support using platforms like Slack to streamline communication and scheduling.

- Cuts down on chargebacks and fraudulent orders to secure businesses from financial losses.

Cons of Signifyd

- Users say the system sometimes approves the transactions, which results in facing chargebacks.

- Users have even complained that sometimes Signifyd takes too much time to reflect on the improvements in the software.

4. Kount

About Kount

Kount is one of the best fraud prevention software that uses advanced machine learning algorithms to detect and prevent fraudulent activities. The software’s approach to trust and safety makes it a reliable option for fraud detection. Kount’s customizable business policies allow fraud prevention strategies customized to specific requirements to ensure robust protection.

Kount stands out as a holistic solution for several fraud challenges. The appealing dashboard provides customizable reporting to empower businesses with actionable data. The software offers automation to streamline processes and minimize human error. Kount specializes in simplifying fraud prevention complexities with machine learning capabilities and data analysis.

Kount Pricing

Kount pricing starts at $0.07 per transaction for the basic plan and goes up to custom pricing for customized solutions.

Key features of Kount

- Fraud detection: Identifies and mitigates fraudulent activities, such as account takeovers and fake account creation, in real time to protect business operations.

- Chargeback management: Managing fraudulent transaction disputes helps prevent chargebacks and recover all the lost revenues.

- Authorization optimization: Boosts transaction approval rates while minimizing false positives to ensure smooth transactions.

- Account takeover prevention: Protects customer accounts from unauthorized access and reduces friction in the authentication process.

Pros of Kount

- The integration of Kount with in-house tools and APIs is smooth and error-free.

- Offers advanced rules and reporting functionalities for real-time improvements and insights.

- Kount’s alerts system catches chargebacks before processing, offering a timeframe to address issues.

Cons of Kount

- Most non-developers say Kount could be a more user-friendly tool for non-developers and non-analysts in their daily work.

- Users have reported that the dashboard interface needs to be updated. Users are unable to delete rule sets.

5. Sift

About Sift

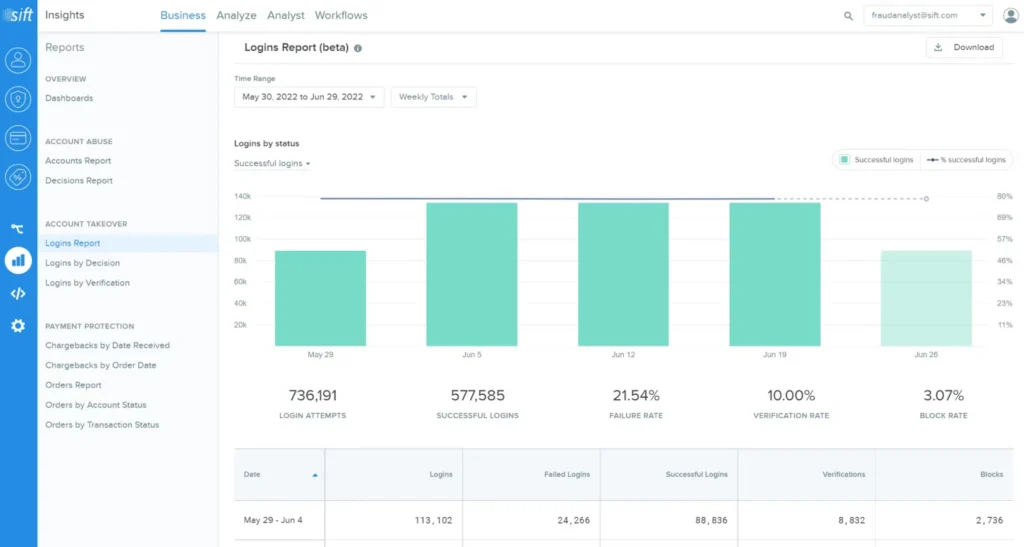

Sift is AI-powered fraud detection software that eliminates digital pain points and enhances security. The software excels at offering user-centric insights through its data consortium, which covers the global spectrum of markets and merchants. Such an approach leads financial institutions to make better decisions and eliminates fraud.

Several global brands trust Sift for its fraud detection capabilities. Forrester recognizes the software as a leader in digital fraud management. It provides AI-driven detection and analysis that helps businesses outpace competitors by transforming risks into revenue. Sift is the best option for companies looking to protect their user accounts and payment systems.

Sift pricing

Sift pricing starts at $1.75 per user per month for the Starter plan and goes up to $2.75 per month for the Pro plan, with custom pricing for the Enterprise plan.

Key features of Sift

- AI-powered fraud detection: AI technology delivers precise fraud detection and prevention, reducing the need for manual intervention.

- User analysis: Provides insights into user behaviors and patterns to pinpoint and avoid fraud risks at the user level.

- Chargeable management: Reduces the financial impact of fraudulent transactions by identifying and addressing chargeback-related fraud.

- Automated risk management: Automates the entire fraud risk management process by using AI to monitor and evaluate transactions consistently.

Pros of Sift

- Users say the software saves money and resources by automatically checking for fraud.

- Provides data that are clear, easy to search, and simple to read.

- The software is beneficial for catching bots and simplifying our fraud prevention process.

Cons of Sift

- Some users say Sift needs to identify users retrying payments using a verified email and billing address.

- The scoring system needs to be more transparent. Also, adjusting scores and making exceptions for rules is challenging.

6. Ekata

About Ekata

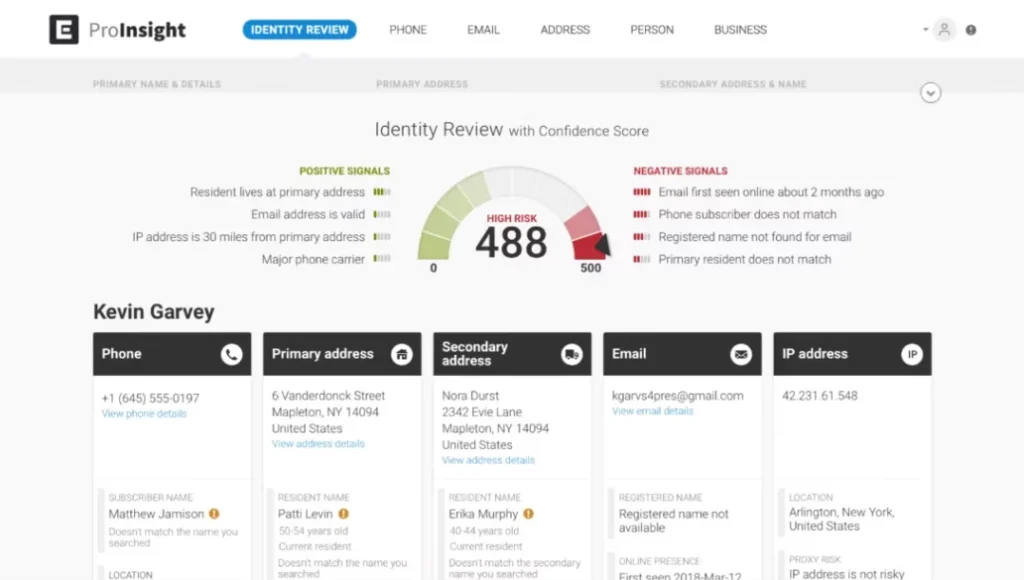

Ekata is a trusted fraud detection solution that helps businesses assess and mitigate identity risks. The software offers features that address multiple use cases, such as preventing fake accounts, performing manual fraud reviews, and authenticating payments. These offerings make Ekata a reliable tool for different sectors, from eCommerce to financial services.

Mastercard Identity complements Ekata’s solutions by providing machine learning-powered identity verification and fraud prevention. This technology improves the digital payments ecosystem by allowing businesses to identify legitimate customers. Integrating data science and machine learning helps the software provide fraud prevention solutions.

Ekata pricing

Contact Ekata for current pricing.

Key features of Ekata

- Transaction risk: Detects and flags potentially fraudulent transactions in realtime to prevent payment fraud.

- Account opening: Verifies the identity of new customers to prevent the creation of fraudulent accounts.

- Address risk: Evaluates and verifies global addresses to detect and mitigate risks associated with fraudulent addresses.

- Phone intelligence: Assess the risk of phone numbers by analyzing phone metadata to prevent phone-based fraud.

Pros of Ekata

- Offers risk assessment by providing details on how risky an email or phone number is.

- Ekata’s ability to identify user identities across different countries makes it an exceptional software.

- Provides an appealing and easy-to-navigate interface.

Cons of Ekata

- Users have reported that locating matches becomes more accessible when they are unfamiliar with the Ekata tool.

- Users have reported instances where the data including address verification, phone number validation, email checks, and identity verification details are not up to date.

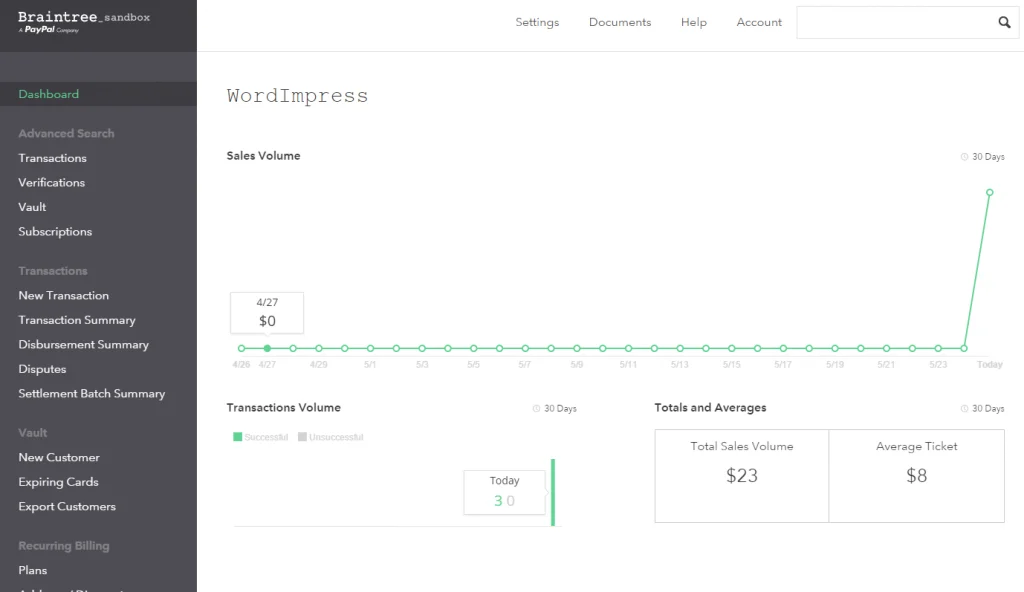

7. Braintree

About Braintree

Braintree is a leading fraud detection software provider, offering many tools and features to avoid fraud and secure payment data. Using advanced technologies like big data analytics and machine learning, the software provides exceptional fraud detection solutions. Braintree ensures that payment data remains safe and complies with PCI DSS standards.

With fraud detection, the software allows secure sharing of payment data with reliable partners. Braintree also offers access to in-house and partner experts, offering guidance on best practices and managing chargeback levels. The software addresses the great value customers place on safe transactions with a focus on security.

Braintree pricing

Contact Braintree for current pricing.

Key features of Braintree

- Address verification system (AVS): This system validates the customer’s address against the address on file with the card issuer to prevent fraud.

- Fraud dashboard: Offers a comprehensive dashboard displaying key fraud metrics and performance indicators.

- Automated decisions: Automatically makes transaction decisions based on pre-set criteria and reduces manual interventions.

- Risk analysis: Allows for detailed analysis and investigations into potential fraudulent activities.

Pros of Braintree

- Braintree offers a user-friendly payment terminal with a straightforward UI.

- Braintree efficiently manages transactions, making tracking accounts and managing subscriptions easy.

- It supports multiple payment methods and offers easy-to-follow documentation.

Cons of Braintree

- Users have reported that the initial setup and risk configuration are complex with Braintree.

- Some users say managing recurring billing becomes slower, particularly for businesses with high subscription volumes.

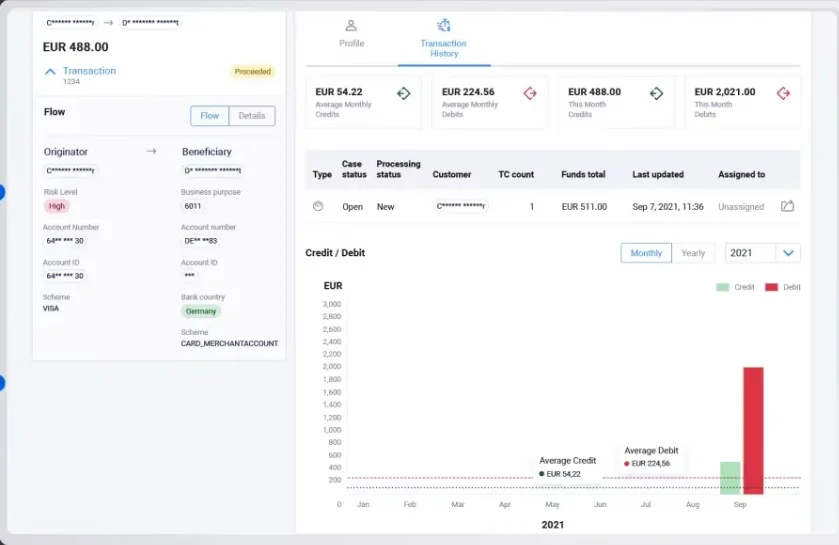

8. Hawk

About Hawk

Hawk is AI-powered software that provides fraud detection and financial crime prevention for banks and payment companies. It uses AML transaction monitoring, payment screening, and perpetual Know Your Customer (pKYC) to stand out as a reliable option for risk coverage. The software focuses on genuine threats and helps minimize false positives.

Also, Hawk provides flexibility and scalability to suit the requirements of different sectors. The software easily integrates with existing systems without interrupting current operations. Its no-code rule setup and detailed audit trails enhance regulatory compliance and internal accountability, making Hawk a trusted solution for detecting fraudulent patterns and improving financial security.

Hawk pricing

Contact Hawk for current pricing.

Key features of Hawk

- Automated payment screening: Uses matching technology to screen payments, identifying and preventing suspicious transactions.

- Transaction fraud detection: Detect fraudulent patterns with various channels and payment methods by monitoring fraud and AML transaction behavior (FRAML).

- Reporting: Generate reports for internal analysis and regulatory submissions to ensure detailed documentation.

- Integration: Integrate easily with existing systems to streamline operations and enhance data flow.

Pros of Hawk

- Features a modern API architecture and no-code rule setup for ease of use.

- The software uses advanced AI to boost risk detection by 3-5 times and reduce false positives by 70%.

- Allows customization and integration of multiple AML solutions under one contract.

Cons of Hawk

- Implementation and operational costs are higher for small businesses.

- Integrating with existing systems requires initial effort.

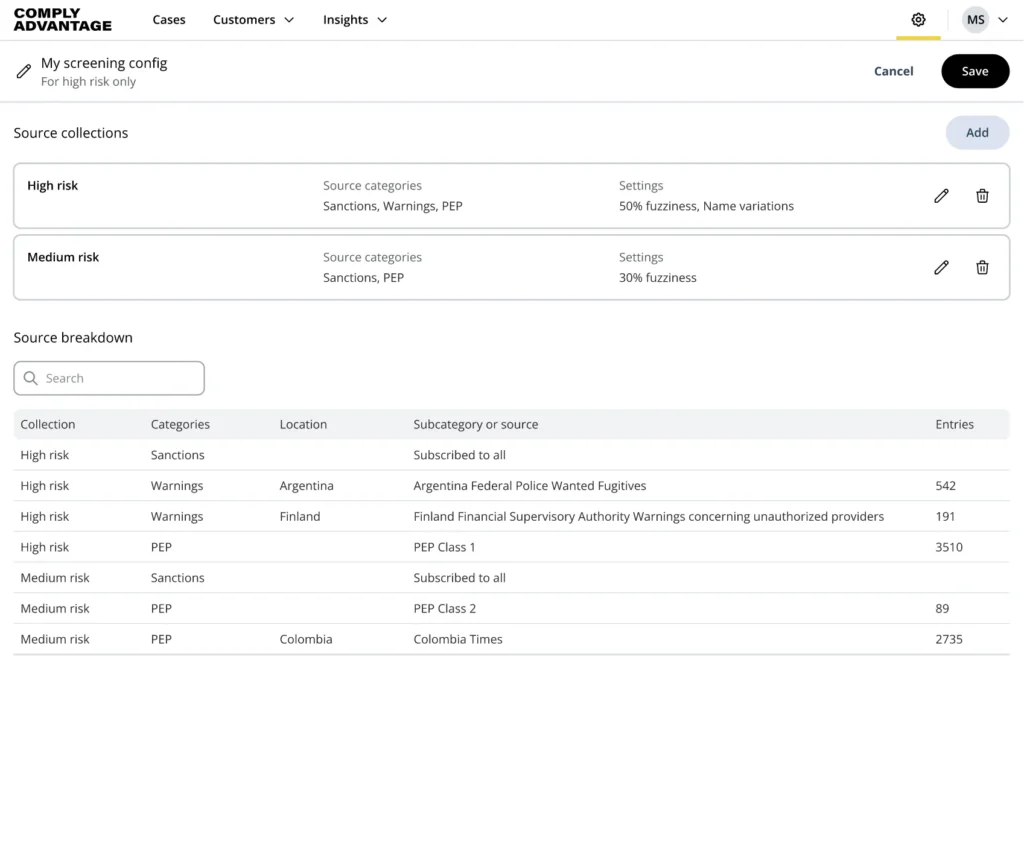

9. ComplyAdvantage

About ComplyAdvantage

ComplyAdvantage is a top-notch AI-powered fraud detection tool for identifying and mitigating payment fraud scenarios. The software integrates machine learning models and a rules library to cover diverse fraud scenarios, such as account takeover, authorized push payments, and identity fraud. It uses identity clustering and graph network detection technologies to enable the tracking of illicit fund flows.

The software’s AI-driven approach improves fraud detection accuracy and boosts operational efficiency. ComplyAdvantage offers the flexibility to create custom rules customized to different business needs. With its no-code rule builder, ComplyAdvantage simplifies the rule creation process. The platform also sports real-time data integration and specializes in providing enterprise support.

ComplyAdvantage pricing

Contact ComplyAdvantage for current pricing.

Key features of ComplyAdvantage

- Advanced machine learning detections: Machine learning models are used to capture unknown fraud risks that traditional rules may not detect.

- Anomaly detection: Identifies unusual behavior patterns within peer groups and individuals, helping to uncover hidden fraudulent activities.

- Intelligent alerts: Prioritize alert risk factors to streamline team efforts, increase operational efficiency, and focus resources on the most critical fraud threats.

- Fraud scenario coverage: Address over 50 payment-agnostic fraud scenarios, including account takeover, synthetic identity fraud, and authorized push payment fraud.

Pros of ComplyAdvantage

- Provides a user-friendly and customizable platform for transaction monitoring and customer screening.

- Easily integrates watchlist screening with KYC providers to facilitate effective screening.

- Maintains consistently prompt and helpful customer support to ensure quick resolution of issues.

Cons of ComplyAdvantage

- Some of the users say that the software’s user interface is outdated.

- Requires broader feature sets and integration with other compliance and operational risk solutions.

10. ThreatMetrix

About ThreatMetrix

ThreatMetrix is a fraud detection solution that uses a combination of digital identity and behavioral intelligence to prevent fraud. This AI-powered risk decision engine integrates real-time data networks, providing insights into fraud patterns and helping businesses make a precise customer risk assessment. This software excels at detecting and preventing fraud from opening accounts to making payments.

The software benefits from a community of fraud experts who fine-tune strategies for better detection. It also analyzes various risk factors to differentiate legitimate and suspicious activities. ThreatMetrix’s easy-to-use, no-code environment allows businesses to deploy custom models.

ThreatMetrix pricing

Contact ThreatMetrix for current pricing.

Key features of ThreatMetrix

- New account fraud protection: Analyzing digital identity patterns protects against new account fraud and bot attacks while ensuring the approval of genuine applications.

- Risk decision engine: Integrates existing data and processes into a flexible, scalable risk decision engine that automates responses to online transactions.

- Account takeover detection: Detects and prevents account takeover attempts, social engineering, and unauthorized accounts.

- Payment fraud protection: This method uses digital identity and behavioral intelligence to protect payments from threats like account takeover, scams, and money laundering.

Pros of ThreatMetrix

- ThreatMetrix easily integrates with the existing processes with the minimal requirements of data science knowledge.

- Delivers exceptional digital identity solutions and behavioral intelligence.

- Excels at offering a scalable risk decision engine that suits various business needs and growth goals.

Cons of ThreatMetrix

- Users experienced that the Initial setup and integration with several systems is complex for businesses with minimal resources.

- Requires constant updates and maintenance to stay effective against new fraud tactics as per the users.

What features should you look for in financial fraud detection software?

Here are the features to look for in financial fraud detection software.

- Machine learning and AI: Machine learning and AI use advanced algorithms to learn from data, identify patterns and anomalies that indicate potential fraud, and adapt to new fraud techniques over time.

- User behavior analytics (UBA): Analyzes user behavior to establish patterns and quickly identify deviations that indicate fraudulent activity.

- Transaction analysis: Performs in-depth examination of transactions to detect irregularities and patterns associated with fraud.

- Automated risk decisions: Automates the assessment and decision-making process for flagged transactions using predefined rules and criteria to reduce the need for manual review.

- Chargeback recovery: Provides tools to manage and recover funds lost due to fraudulent chargebacks, such as mechanisms to dispute and resolve chargeback claims.

- API integration: Supports integration with existing financial systems and databases through APIs. This integration enables data exchange and extends the functionality of the fraud detection system.

- Deepfake detection: Identifies and mitigates risks associated with synthetic media like deepfake videos or audio. This feature helps perpetrate fraud by impersonating individuals in authentication processes or communications.

Need a powerful tool

to prevent fraud? Schedule a DemoA step-by-step process to choose the right financial fraud detection software

Here is the step-by-step process to select the right fraud detection software for your business.

Step 1. Identify your specific needs and objectives

The first step is to understand your business operations, potential risk areas, and the types of fraud you aim to prevent or detect. Here are the specific needs and objectives to identify before opting for fraud detection software.

- Verify that the software conforms with all applicable industry standards like GDPR and PCI DSS.

- Examine the software’s capacity to support the expansion of your company and handle rising transaction volumes.

- Check if the software works well with the existing accounting, ERP, and CRM applications.

- Examine the software’s ability to modify rules and parameters to suit your business demands.

- Look for strong reporting and analytics capabilities to acquire insight into fraud patterns and trends.

Outlining specific needs and objectives helps you narrow your options and focus on solutions aligning with your priorities.

Step 2. Research and shortlist top fraud detection software

Now, research reliable platforms like G2 and Capterra, where you get reviews and ratings of the top software. Here are the factors to consider when shortlisting and choosing a software provider.

- Look for software that uses powerful machine learning algorithms to improve fraud detection accuracy.

- Prioritize tools with advanced behavioral analytics to detect anomalies based on user activity patterns.

- Select software with cross-channel transaction monitoring capabilities like online, mobile, and in-store.

- Examine the software’s multi-factor authentication, tokenization, and encryption features for preventing fraud.

- When assessing the software provider’s customer service quality, consider training, help with implementation, and continuing technical support.

Businesses that fail to consider these factors choose software that can lead to potential financial losses and reputational damage.

Step 3. Request free trials or demos to evaluate the software

Before making the final decision, request free trials or demos of the software. Consider the following questions to assess the software’s suitability.

- Is the interface intuitive and easy for your team to navigate?

- Does the software generate a manageable number of relevant alerts, avoiding overwhelming false positives?

- Does the software provide clear and actionable insights to help you investigate and resolve suspicious activity?

Conducting trials and demos helps you evaluate the software’s performance, usability, and suitability for your unique requirements.

Step 4. Make a decision and choose the software that best suits your needs

When you are finished with all the evaluations, make the final decision. Negotiate the price and customize the contract to fit your requirements. Also, ensure the software vendor provides a smooth deployment process, adequate training, and consistent support to address technical issues.

Following this step-by-step process makes selecting the right fraud detection software easier.

Pick the right fraud detection software for your business

Having a list of top fraud detection software helps save time and invest wisely in protecting the business. The purpose of providing this detailed list is to help you choose financial software that optimizes financial security.

But what if you could simplify your search? Choose HyperVerge and save your valuable time. The software offers exceptional fraud detection solutions, including document analysis, signature/thumbprint checks, photo verification, tampering monitoring, and screen capture detection.

Through automation, the software optimizes the verification process and reduces manual efforts. Protect your business with HyperVerge; sign up for a customized demo here.

Frequently asked questions

1. How do you detect financial fraud?

Opting a fraud detection software is an effective way to detect financial fraud. This type of software uses advanced algorithms, machine learning, and data analysis to monitor transactions and identify suspicious activities. Such an approach helps businesses to prevent fraudulent activities before causing damage.

2. Which tool is used to identify fraud in banks?

Banks use several tools to identify fraud, such as transaction monitoring systems, behavioral analytics software, and machine learning algorithms. These tools help banks detect unusual patterns and anomalies in their financial transactions, enabling them to respond to potential frauds efficiently.

One of the leading fraud detection solutions banks use is HyperVerge. The software offers advanced AI-driven features such as document verification, facial recognition, and real-time transaction monitoring.

3. What are the benefits of a financial fraud detection software?

Here are the benefits of a financial fraud detection software.

- Prevents unauthorized transactions and fraudulent activity.

- Reduces repetitive tasks by automating fraud detection processes.

- Detects and mitigates fraud early, avoiding significant financial loss.

- Ensures compliance with regulatory requirements like GDPR and PCI DSS.

- Provides accurate data analysis and reporting to understand fraud tendencies.

- Integrates easily with current systems to simplify operations and improve workflow.

4. What types of fraud can financial fraud detection software detect?

Here are the types of fraud that financial fraud detection software detects.

- Identity theft

- Payment fraud

- Account takeover fraud

- Transaction fraud

- Document forgery

- Insider fraud

5. Can financial fraud detection software integrate with existing systems?

Yes, financial fraud detection software easily integrates with your existing systems. Whether using accounting software like QuickBooks, ERP systems like SAP, or CRM applications like Salesforce, it smoothly integrates with each system. This integration ensures no interruptions in the workflow and provides real-time monitoring.

6. How does financial fraud detection software handle identity theft?

Financial fraud detection software easily handles identity theft using advanced features like multi-factor authentication, biometric verification, and AI-driven anomaly detection. With such features, businesses can easily verify the identity of the users accurately, detect suspicious activities, and prevent unauthorized access to sensitive data.