Digital fraud is a broad term encompassing various deceptive activities conducted online or via digital channels. Its primary aim is to defraud individuals or businesses, often leading to the loss of funds, sensitive data, or both. Digital fraud can manifest in numerous ways, including phishing attacks via emails, fraudulent websites and apps, fake social media profiles, fake accounts, and malware attacks.

The statistics highlight the urgency of this issue: According to the Federal Trade Commission, nearly $8.8 billion was reported lost to fraud in 2022, marking a significant rise from the previous year. Furthermore, the Identity Theft Research Center reported that the U.S. experienced the second-highest number of data compromises in a single year, affecting sensitive information of at least 422 million individuals.

How Digital Fraud Occurs?

Digital fraud typically exploits the vulnerabilities in digital systems and the human element in security. For instance, in bank account takeovers, attackers may use techniques like credential stuffing, where breached data is used to access other accounts, or brute force attacks, where multiple combinations are tried to crack passwords.

In cases of fraudulent payments, attackers often use stolen credit card information or manipulate online payment systems to initiate unauthorized transactions, especially targeting businesses handling numerous transactions.

Some common types of digital fraud and scams include:

- Account Takeover: This occurs when attackers gain unauthorized access to user accounts, leading to financial loss, identity theft, and unauthorized purchases. Methods like credential stuffing or brute force attacks are often employed.

- Brand Abuse: This involves using fake emails, websites, and messages to trick individuals into divulging personal information.

- Credit Card Fraud: Unauthorized transactions made using stolen credit card details, without the cardholder’s knowledge.

- Chargeback Fraud: Here, legitimate customers make purchases to issue a chargeback, essentially keeping both the money and the product.

- Cryptocurrency Fraud: Targeting cryptocurrency exchanges for theft, or creating fraudulent projects to siphon off investor funds.

- Ransomware Attacks: Involving malware that encrypts a victim’s files, with attackers demanding a ransom for access restoration. This primarily targets businesses reliant on data.

- Phishing attacks: Phishing attack is used to steal sensitive information from the user including login credentials, credit card numbers, bank account information, or any other data for the financial gain of the attacker. This can be made possible by making the user click the link of phishing sites, phishing emails, or any other mode to access the individuals’ data.

Digital Fraud Trends You Should Know

The transition to digital mediums has unfortunately been accompanied by a rise in digital fraud, with an 80% global increase in fraudulent activities since pre-pandemic times. This spike is significant, reflecting a proportional increase and a higher absolute number of fraud attempts due to the increased volume of digital transactions.

Key Trends

- Diverse Fraud Types: There’s been a worrying rise in ACH/Debit and synthetic identity fraud, with synthetic identity fraud increasing by 132% from 2019 to 2022.

- Targeted Industries: Fraudsters tend to target industries with high consumer engagement, like gaming and retail. The travel and leisure industry experienced a 117% surge in fraud attempts as travel resumed post-pandemic.

- Communication Channels: An alarming number of individuals report being approached by fraudsters via email, calls, and texts, signaling the pervasive nature of internet fraud attempts.

- Data Breaches: The U.S. has experienced an 83% rise in data breaches from 2020 to 2022, fueling the increase in identity engineering and synthetic identity fraud, which reached a record $4.6 billion in 2022.

Adapting to these trends with effective fraud prevention measures and robust is imperative for securing digital transactions and maintaining consumer confidence.

To understand the full scope of these fraud trends, insights into their prevention, and the role of sophisticated detection systems, explore the types of fraud detection techniques and systems further.

Choose a Powerful Online Fraud Prevention Service Provider

In the quest to combat digital fraud, selecting a robust online fraud prevention service provider is crucial.

Let’s delve into the most cutting-edge technologies that are being deployed to combat fraud. Technologies such as OCR, face recognition, and document verification play pivotal roles in enhancing security measures.

OCR (Optical Character Recognition)

OCR technology, particularly invoice OCR, is a game-changer in fraud prevention. OCR technology extracts text from images and documents, identifies security features in official documents, alerts for anomalies, and enables real-time verification.

Face Recognition

Face recognition technology is increasingly used to secure identity verification processes. It compares the facial features from an image with pre-enrolled data, making it exceedingly difficult for impostors to mimic or spoof identities, thereby safeguarding bank accounts against identity theft and unauthorized access.

Biometric Verification

Biometric verification uses unique biological traits, such as fingerprints or iris patterns, to confirm identities. It’s virtually impossible to replicate these biometric characteristics accurately, which significantly reduces fraud losses and the risk of fraudulent activity.

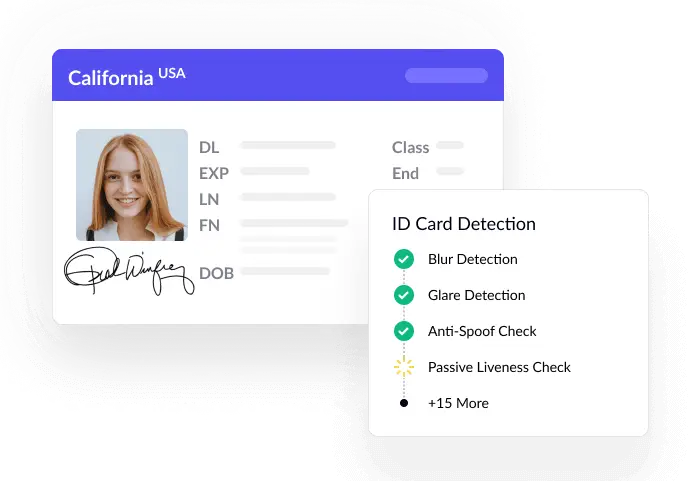

Document Verification

Document verification technology confirms the authenticity of documents in real-time by checking security features, cross-referencing data, and validating document integrity. This helps prevent identity theft and the use of forged documents in fraud attempts and phishing scams.

Check out our complete guide to identity verification and learn how it can strengthen your defense against digital fraud.

Real-world Case Study: Southeast Asia

Let’s look at Southeast Asia and the most common frauds that happen there.

- In ride hailing and delivery services:

- Phantom bookings and fake transactions have been made to acquire driver incentives, affecting the service organizations detrimentally.

- Identity fraud is on the rise where impersonation affects the safety of the one who avails the service and causes reputational damage to the delivery partner.

Twitter posts with the hashtag #UberAccountHacked: “I had a great ride in China this morning. Except, weird, I wasn’t in China this morning.”

Another: “I am in Bangkok now. But my account showed that I am riding in France.”

- In digital wallets and related services:

- The phishing of OTPs helps fraudsters access other user accounts and perform financial transactions leading that can cause heavy financial damage to an individual.

- The use of fake merchant accounts allows fraudsters to farm incentives.

- In insurance and loan-related services:

- Impersonating the victim and submitting false claims allows fraudsters to get insurance money that is not due to them.

- The use of fake details and authorization allows fraudsters to avail of a loan in another’s name when they have been banned or are ineligible.

The Damage and The Solution

These are three areas we picked, but with every arm of the industry going digital, the possibilities are endless. And the economic damage wrought on by them knows no parallel. Businesses in the retail, e-commerce and financial sectors of the Southeast Asian region recorded on average an amount of US$160,000 in losses due to fraudulent transactions every month.

There are at least 400 successful fraudulent transactions against them a month. Each fraudulent transaction further cost these businesses 3.5x the lost transaction value. These numbers are alarming, but more so for a company that is just starting out and which may not have rigorous security measures in place.

How do we battle these frauds? Is there a way to secure every individual’s personal information so that identity theft does not happen, and even if it does, that organizations are not affected by it?

Short answer: Yes. Through OCR of government IDs and face recognition, such frauds can be done away with.

Just about any OCR engine will not work

You need a highly accurate OCR engine. This will ensure smooth customer onboarding on your app, reduce turnaround times, and improve customer retention apart from fraud detection. The accuracy of an OCR engine is affected by several factors such as the quality of paper and ink used, smudges, artifacts present, and so on. When you opt for an OCR engine backed by AI/ML, its accuracy increases substantially, especially when the model is well-trained.

Not just any face recognition system will suffice

The same goes for a face recognition system as well. There are several generic solutions out there, many of them available online and free to use. However, their accuracy levels are very low. So while they may help for smaller groups of people or for social experiments, for the purpose of business, a more accurate AI-backed solution is required. Otherwise, there is a risk of racial bias. Let us consider the case of Microsoft’s face recognition software Face API. Labor Unions in the UK were of the opinion that the face recognition system on the app does not identify black drivers. Due to misidentification, several black drivers received notices from Uber and had their accounts deactivated.

Build vs. Buy: Pick the latter, here’s why!

So now that you know as a business to onboard customers reliably, you need face recognition and OCR working in tandem. Do you build the necessary technologies in-house or do you opt for the expertise of a third party? Even if you are able to understand your requirements, find good AI engineers, and set timelines, developing AI models in-house is a tough task. You also need to find sample data and keep updating the code against newer benchmarks, to combat evolving frauds and to support different types of documents. Can you imagine an entire product team for just building, designing, and maintaining just that? If building computer vision and capable image processing serves as a strategic differentiator to your core business as well, then it might make sense. Else it really does not.

When companies opt for a third-party identity verification solutions provider, companies can focus on their core business, and let an expert take care of the AI models and face recognition.Having an organization with the right expertise partnering will help drive more ROI as you scale.

Because all are not built the same way!

Now that you have decided to buy, how do you make sure that you are going in for the right service provider for your OCR and your face recognition feature? These are some of the things you can do:

For OCR:

- Go in for an on-demand OCR engine that will allow direct API requests and faster processing, much like HyperVerge’s Hyper Turing engine.

- Opt for an OCR service provider, that continuously benchmarks against industry standards and makes the latest version available to you.

For Face recognition:

- Opt for an AI-based identification services provider top-ranked in NIST, like HyperVerge.

- Look for additional features like passive liveness detection that helps fight static and dynamic attacks.

- Look for 1:n face dedupe detection.

For both:

- Compare performance with slightly skewed, blurry, or dark images.

- Check if integration with other third-party systems you use is possible, how easy it is, and if any kind of coding is required. HyperVerge has a co-code solution!

- Compare solutions from several service providers, or just opt for HyperVerge!

Parting Words

With identity theft, phishing email scams, and fraud attempts on the rise, employing advanced identity verification solutions is essential for protecting your business and customers. Embrace technologies like OCR, face recognition, and biometric verification to secure your digital transactions.

Ready to enhance your fraud prevention strategy? Explore our top-tier identity verification solutions and see the difference for yourself. Request a demo today and take a step forward in safeguarding your operations. Take the leap to prevent digital fraud with Hyperverge.