The international trade system involves the exchange of goods across nations, which requires multiple trade transactions with financial implications for both exporters and importers. Trade finance is vulnerable to trading-related financial crimes like trade-based money laundering (TBML).

TBML is a tactic used by criminals to hide the illicit origins of their funds by manipulating cross-border trade deals. This poses a serious threat to financial institutions involved in facilitating these transactions.

Understanding TBML is essential for combating this hidden threat. By unraveling its workings and impact on financial institutions, we can better protect against its harmful effects and uphold the integrity of international trade. Let’s delve deeper.

An Introduction to Trade-Based Money Laundering

Trade-based money laundering refers to trade-based illegal activities to legitimize funds from illicit origins generated through nefarious activities. TBML is used by criminals to launder the proceeds of crime through international trade systems.

In TBML, transactions involving trade finance are manipulated to launder illicit proceeds of crime to make them appear legitimate and evade sanctions.

How Does TBML Affect Financial Institutions?

TBML is a major concern for global financial systems because it poses several financial risks:

- Terrorism funding

- Compromising trade transparency

- Drug trafficking

- Human trafficking

- Arms smuggling

- Skewed data in the formal economy

- Undermining the integrity of financial institutions, and more!

Data reveals that in 2022, a whopping $68 billion worth of crypto was laundered. These figures indicate the magnitude of the problem and why it needs to be addressed.

Trade-based money laundering poses a significant threat to the international trade system. Hence, to ensure the integrity of cross-border trade transactions, governments, financial institutions, and other organizations must take proactive steps to detect and prevent TBML.

Techniques of Conducting TBML

Following are some common money laundering techniques used by criminals in the international trade system to legitimize excess funds:

Under Invoicing

Under invoicing is a TBML strategy often used to evade sanctions. Criminals generate invoices at a value lower than the actual price of the commodities. Undervaluation is often used to deceive customs departments to evade import duty.

Over Invoicing

This is a strategy wherein the invoice for a product is generated at a higher price than the product’s actual price. By over-invoicing products, the importer can launder money because the exporter receives a higher amount through the transaction.

Multiple Invoicing

Many a time, criminals raise multiple invoices for the same shipment. Hence, they receive substantial amounts through multiple third-party payments, thereby facilitating money laundering.

Fictitious Trades

Criminals may move funds internationally by creating fraudulent trade transactions where there is no real exchange of goods. They generate fictitious invoices and other trade-related documents to give an impression of a genuine trade deal.

Misrepresentation of Goods

Criminals may misrepresent the commodities being traded. For instance, illegal drugs may be disguised as pharmaceutical products, health supplements, etc. Hence, the illegal goods pass through legitimate trade channels, and the proceeds through such trade transactions get legitimized.

Altering the Quantity of Goods

In this method, criminals report incorrect quantities of goods being shipped. Reporting under shipment allows individuals to avoid paying import duties. Conversely, by reporting quantities greater than what they actually receive, they can generate illegitimate profits.

Phantom Shipping

In phantom shipping, the importer and exporter collaborate to create a fake transaction where no real shipment takes place. They generate invoices and other documentation to give an impression of a real transaction. Such trade transactions easily legalize illicit funds.

Non-documentary Transactions

In certain trading transactions, the regulators may have access to limited details of transactions. Hence, it is difficult for them to validate the trade transactions.

Red Flag Indicators of TBML

The Financial Action Task Force (FATF), an intergovernmental organization, has established standards to prevent trade-based money laundering techniques in international trade transactions. It has specified certain red flags or warning signs that indicate unusual transactions that international trade systems need to be alert to.

The following are some of the red flag indicators of trade-based money laundering:

- Inconsistencies between the invoices and the definition of commodities on the official documents. These include discrepancies in the quantity, quality, or value of goods, and inconsistencies in routes or timings of shipping, etc.

- Unusual trade patterns like infrequent trading routes, inconsistencies in product types, round-numbered transactions, etc.

- When shipments are routed through multiple countries or subsidiaries, it can indicate that the shipment is being used for trade-based money laundering.

- Suspicious payments made to shell companies or offshore accounts are definite red flags that regulatory bodies need to be alerted to.

- Shipment of certain types of goods, like luxury items, precious metals, gems, etc., are high-risk items for TBML. Therefore, they should be scrutinized thoroughly.

- Certain countries are identified as having a high risk for money laundering. Hence, it is crucial to monitor shipments entering or leaving such countries closely.

- Cash payments for shipments can indicate TBML because cash transactions are difficult to track and can evade Anti-Money Laundering checks.

- Payments made to third parties that are not relevant to the transaction are red flags because the third party is likely a facade for money laundering activities.

To learn more about AML policy, refer to this blog.

Strategies to Prevent TBML

Anti-money laundering software that leverages automation can help prevent TBML. It overcomes the limitations of traditional methods to detect anomalies, reduce false positives, and facilitate accurate reporting of suspicious transactions.

AML software powered by artificial intelligence (AI) detects and prevents TBML through these methods:

Enhanced Due Diligence

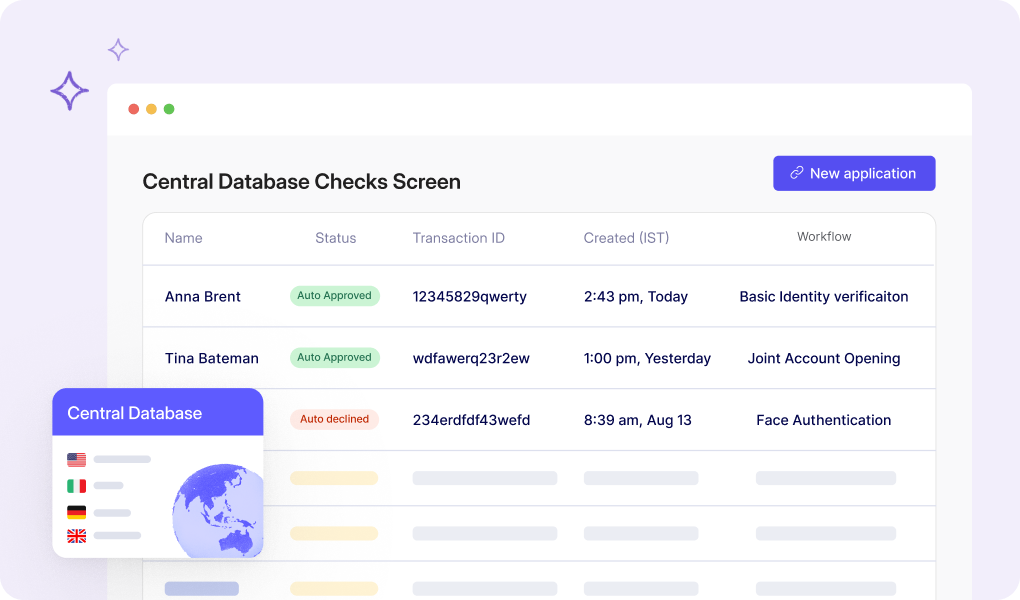

AI-based software performs enhanced due diligence on customers and suppliers, including screening against databases like sanction lists, global watchlists, etc., which helps identify TBML risks before they occur.

Read more:

- What is sanctions screening?

- What is pep screening?

- What is Adverse Media Screening: A Step-by-Step Process

- What is Customer Due Diligence?

Risk Scoring

AML software performs risk assessments to identify high-risk transactions. By utilizing this feature, businesses and financial institutions can divert their attention to such transactions and reduce the likelihood of TBML.

Read more:

Real-time Transaction Monitoring

The AI-based software monitors all transactions in real-time to identify those with a likelihood of TBML. It detects suspicious activities like those with high-risk countries, transactions involving suspected criminal organizations, etc.

Alert Generation

AML software raises alerts for spurious activities. This helps businesses take action promptly to prevent TBML.

In addition, a receipt tracker can help businesses track expenses and transaction details in real time, ensuring that they remain compliant with regulatory standards and prevent potential TBML activities.

Read more: What is Suspicious Activity Report?

Prevent TBML With Effective AML Solutions

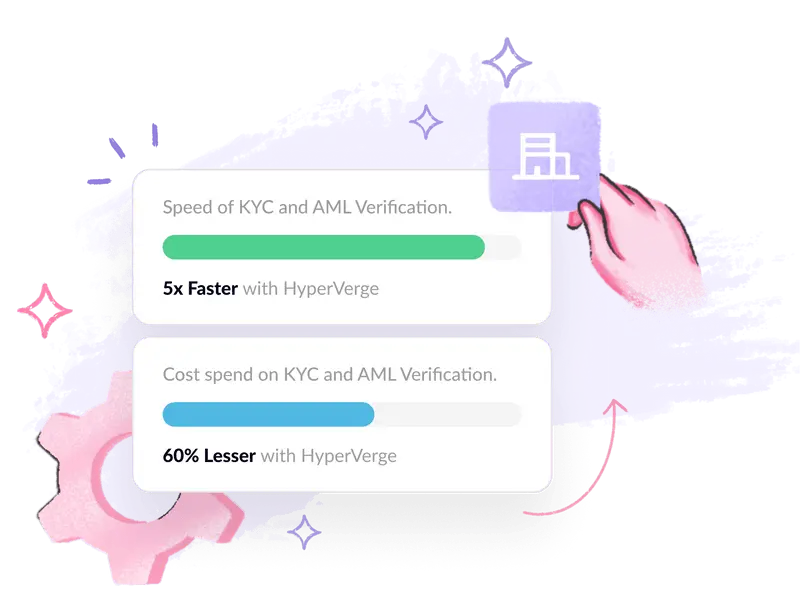

HyperVerge offers an AML software solution that helps detect and prevent trade-based money laundering. The software uses advanced algorithms and AI to analyze transactions and identify patterns that may indicate TBML. It can predict instances of TBML based on existing datasets to facilitate the prevention of TBML risks.

To sum up, through enhanced due diligence, risk scoring, real-time transaction monitoring, and alert generation, businesses and financial institutions can mitigate the risks posed by TBML. Moreover, leveraging advanced AML solutions like those provided by HyperVerge can further strengthen defenses against TBML. Sign up and try HyperVerge today.