Small business expenses are difficult to track. Either the paper slips and receipts can get lost, or the employees may not recall where the money went. The list goes on.

According to HubSpot, losing paper receipts is one of the biggest pain points for more than 53% of organizations. They find it challenging to manually track every dollar spent, which leads to expense mismanagement.

But thanks to receipt scanning automation, things are starting to look better for auditors and small business owners.

If you’re considering integrating a receipt-scanning app, you’re already halfway there to becoming a budget-conscious brand.

But the actual journey starts now.

You need to consider various tools, check compatibility with your business needs, and choose the receipt scanner app that helps you achieve your goals in expense management.

We’ve evaluated the top 10 receipt scanning tools based on various parameters, such as their features, benefits, pricing, and ratings.

Below is the list of tools for you to check out.

But first, let’s understand the basics.

What is a receipt scanner app?

A receipt scanner app is a technology that captures images of paper receipts with the intent of creating digital copies and making them machine-readable. This helps businesses file, manage, and control expenses regularly.

Most of the receipt scanner apps are integrated with other expense management and accounting software and allow you to categorize receipts based on their types of expenditure.

A lot of businesses still rely on manual expense management. For them, receipt scanner apps are a way to automate expense data entries and generate expense reports. These apps help businesses record expenses and meet their budget goals for in-house teams and clients.

Receipt scanner apps like HyperVerge leverage Optical Character Recognition (OCR) technology to determine the text of the receipts and convert the scanned copies into digital data.

How we evaluated top receipt scanner apps

We combined 10 tools based on extensive research of 25 receipt scanner apps. The process involved evaluating these tools based on ratings and reviews from notable review platforms like G2 and Capterra.

We also conducted first-hand research, checking these tools for their ease of use, features, integrations, support, cost, and scalability. We then narrowed the scope to the best receipt scanner apps in the market and came up with the following brands.

Overview: Top 10 receipt scanner app

| Tools | Stand-out Feature | Best for | Free-trial | Pricing |

| AI-powered OCR technology with an accuracy of 99% | Financial and bank institutions, small businesses, logistics | Yes | Custom | |

| All-round solution for expense management | Individuals & SMEs | Yes | $5/month, Custom | |

| Booking and auditing | Small businesses, accounting firms. | Yes | Free, $16/month pro plan | |

| Facilitates Gmail imports, and users can send receipts via emails | Entrepreneurs & small businesses | Yes | $18/month, $36/month, and $54/month | |

| Easy and quick expense reports | Enterprises | Yes | $99/year | |

| Supports multiple languages and currencies | Insurance agencies & banks. | Yes (up to 500 pages) | $500/month, $999/month Custom | |

| Integration with QuickBooks accounting tool | Users who are already using QuickBooks | No | Starts from $9/month until $60/month | |

| Fast, accurate, and secure document capture | Firms that have to comply with HIPAA, CCPA, and GDPR | Yes | $500/month, Custom | |

| Travel expense management | Enterprises | No | Custom |

Top 10 receipt scanning apps to track business expenses explained

1. HyperVerge

Source: HyperVerge

HyperVerge’s OCR technology is built to process unstructured documents such as receipts, bills, and invoices. It uses AI-powered OCR technology to scan and process slips with 95% accuracy.

The best part of using HyperVerge as a receipt scanner app is its AI model, which requires minimal training. This means that if you want to scan different forms of receipts, you can do it in a minimum time frame. HyperVerge’s OCR automation seamlessly fits into your workflows. HyperVerge holds credibility due to its notable clientele, such as L&T, LIC, and Acko, all of whom have leveraged HyperVerge’s OCR technology to ease their operations.

Key features

- Multilingual receipt processing: HyperVerge offers multilingual receipt processing with more than 150 language options. You can upload receipts in any language, and HyperVerge can process them accurately.

- Unstructured document processing: HyperVerge provides OCR software for unstructured documents like bills, receipts, and handwritten slips. You can also upload handwritten receipts and get them scanned.

- Integrations: It enables integrations to other expense management and accounting tools

- AI-powered OCR—HyperVerge boasts an accuracy rate of more than 95%, thanks to its advanced AI-powered OCR.

- Rapid adaptability: HyperVerge can immediately adapt any form of receipt or document type with a minimal number of samples in a very short time.

HyperVerge pricing

HyperVerge offers the following pricing plans:

| Start plan (for startups): This plan includes a free one-month trial and the benefit of seamless integration in less than four hours. | Grow plan (for midsize companies): This plan includes all the features of the start plan. It provides businesses with access to custom workflows and allows them to view and manage document processing. | Enterprise plan (For enterprise-level organizations): This plan offers all the grow plan offerings, collaborative tools, a custom pricing structure, and dedicated support. |

What people say about HyperVerge

-Vishakh B, Small-Business ★★★★★ (5/5)

-Vinay K., Co-Founder & CEO, Small-Business ★★★★★ (5/5)

-Deep B., Small-Business ★★★★★ (5/5)

Key takeaway

HyperVerge provides advanced AI-powered OCR automation combined with seamless integrations and advanced customer support. It offers high accuracy in scanning receipts regardless of their language or document type.

Customer video testimonial

HyperVerge uses AI-powered OCR technology for character recognition and deciphering text from physical copies to give them digital value. Check out how the OCR technology works and how it is an apt solution for scanning and reviewing receipts using the same methodology. Hop on to this link to know more.

| Need help with processing slips and receipts? Subscribe to our free trial and get started with HyperVerge now. Get a free demo |

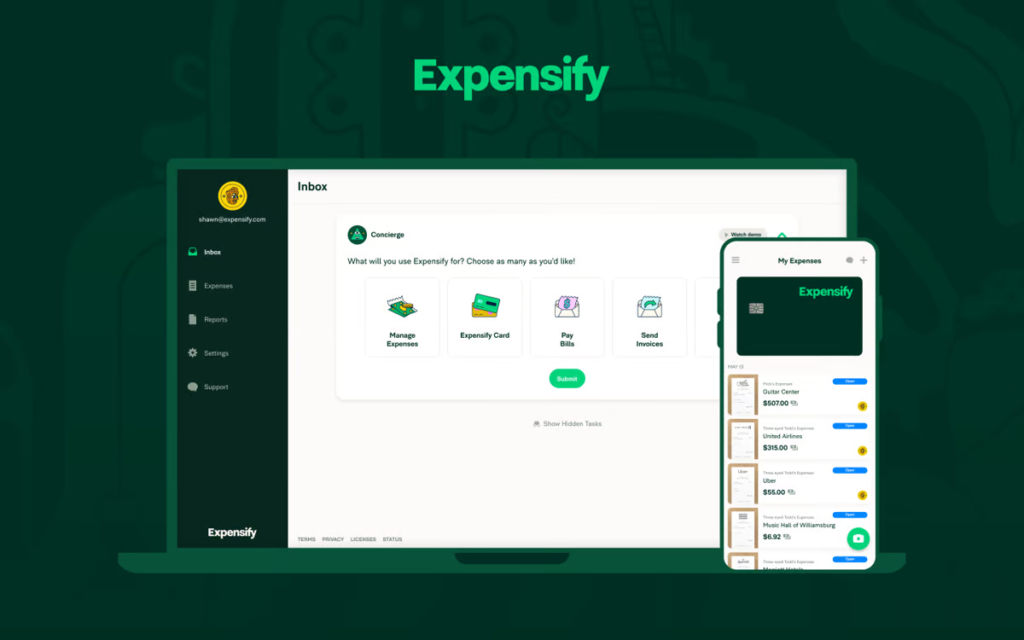

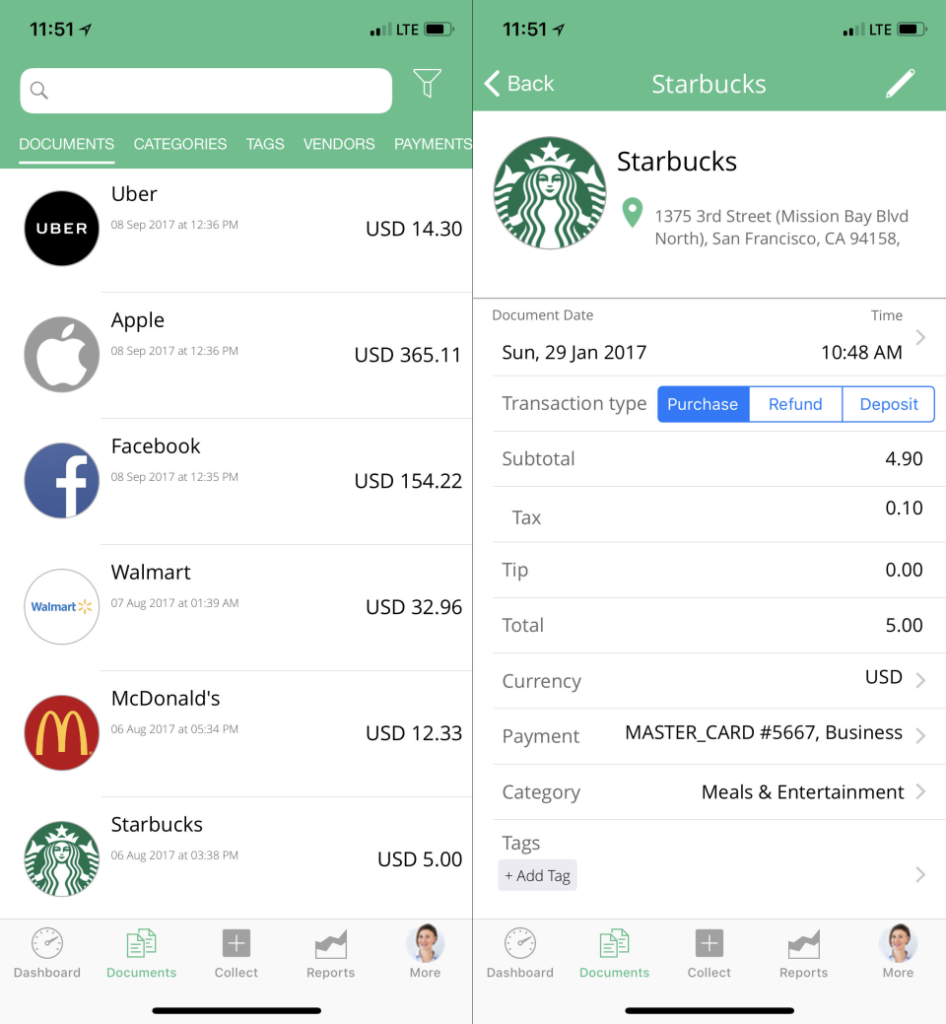

2. Expensify

About Expensify

Expensify provides an all-around solution for users to scan receipts and track expenses easily. It can categorize receipts and automate business expenses for approval and reimbursement. Expensify integrates with major accounting tools and saves time for multiple industries.

Pricing

Expensify offers a free plan for individuals where you can pay bills, send invoices, and reimburse expenses. Its paid plan starts from $5/month. It also offers a $9/month and custom pricing plan for corporates.

Key features of Expensify

- Expense management: Employees and admins can track, organize, submit, and reimburse expenses.

- Bank accounts integration: Option to integrate with the biggest banks to sync financial reporting and scan bank statements.

- Digital receipt management: Scan and add receipts organized to the app, enabling you to manage them based on their merchant, currency, date, and amount.

- Currency conversions: The app recognizes over 150 currencies that can be identified in scanned receipts.

Pros of Expensify

✓ Expensify is a great tool for managing small business expenses.

✓ Expensify provides ease of use where users can easily navigate, submit their expenses, and add them all in a single place.

✓ You can generate expense reports to manage your budgets better.

-Vanina T., Mid-Market ★★★★★ (5/5)

Cons of Expensify

✕ In some instances, users may have to input the details manually.

✕ Some users have reported inconsistencies in receipt uploads and image clarity.

✕ For users who are new to using such tools, the platform can seem overwhelming and non-intuitive.

-Tarun M., Enterprise ★★★★★ (5/5)

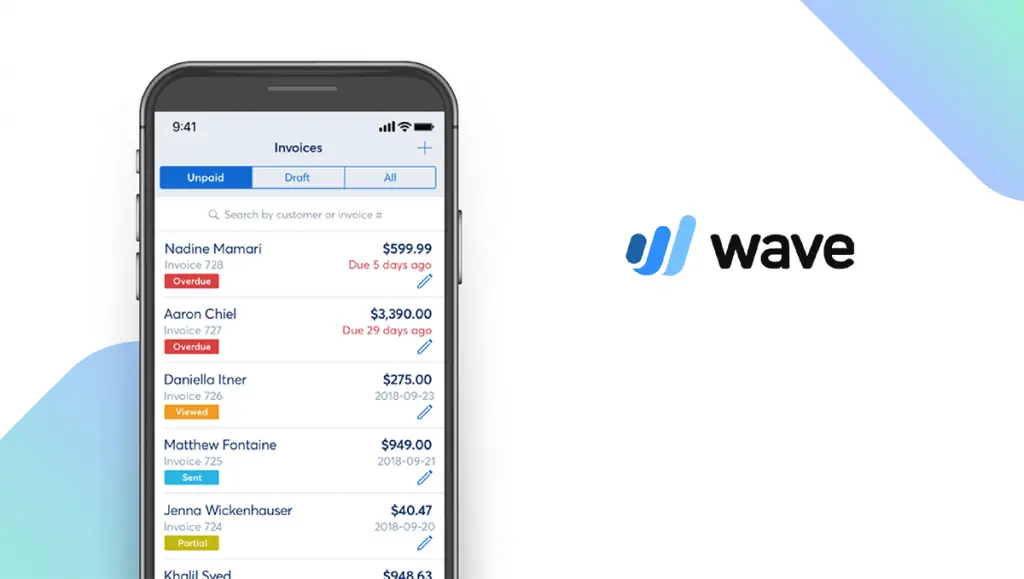

3. Wave

Wave is a small business accounting and money management software that you can use to automate rudimentary tasks such as bookkeeping and auditing.

With Wave, you can create professional invoices, generate financial reports, track payments, categorize bank transactions, and manage cash flows.

Pricing

Wave offers a free plan and a $16/month pro plan where users can access premium features.

Key features

- Invoices: With Wave, you can automate creating invoices, billing repeat customers, and bookkeeping.

- Payment processing: The app facilitates the automatic flow of accounting records so that you can keep track of them.

- Mobile receipts: It scans and recognizes receipts using OCR, allowing you to import data in seconds.

- Payroll: You can pay tax and contractual payments and automate journal entries.

Pros of Wave

✓ Wave is known for its ease of use. You can automatically create bills, send them, duplicate past bills, and set reminders.

✓ Can import bank statements and CSVs for reconciliation.

✓ Intuitive dashboard that shows the cash flows and profit and losses in the past 2 years.

-Na’Tima H., Small-Business ★★★★☆ (4/5)

Cons of Wave

✕ There’s room for improvement in customer support, especially for those who need live support.

✕ Some small businesses/ users may find it cost-intensive.

✕ Some businesses may experience errors in invoice processing.

-Kai “Kevin” C., Small-Business ★★☆☆☆ (2.5/5)

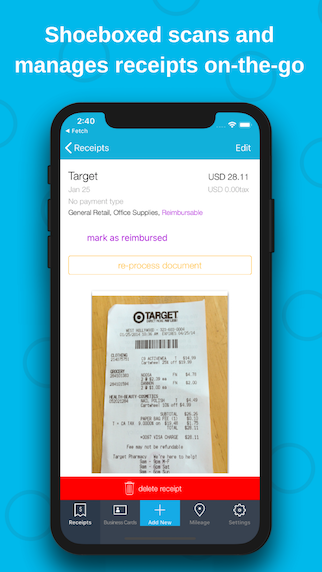

4. Shoeboxed

Shoeboxed is an app that provides document management services and tools for receipt scanning, organizing, and categorizing receipts, as well as other documents. Many small businesses and entrepreneurs use Shoeboxed to maximize tax deductions and provide digital value to paper receipts.

Shoeboxed is mostly used to streamline accounting and administrative tasks and reduce paperwork. Businesses can email the scanned copies of receipts and get their machine-readable copies by email itself.

Pricing

The pricing starts at $18/month for startups, followed by a professional plan at $36/month and a business plan at $54/month.

Key features

- Receipt scanning: Instantly capture receipts and upload images to get digital receipt copies. You can also send receipts via email.

- Expense reports: Users can create expense reports from the web and mobile devices.

- Client invoicing: You can integrate into AP systems to recognize revenue appropriately.

- Business tool integration: You can integrate Shoebox with various other tools, such as finance, payroll, CRM, and HRMS, to streamline expense management across operations.

Pros of Shoeboxed

✓ It is an app specifically for receipt scanning with an easy-to-use interface.

✓ You can create, copy & organize expense reports quickly

✓ You can email receipts with a drag-and-drop interface to get their digitized copies.

-Taylor F., Small-Business ★★★★★ (5/5)

Cons of Shoeboxed

✕ The tool is still improving its accuracy so you may encounter errors in receipt scanning and difficulty finding your invoice.

✕ Customer support can use revamping due to its current lackluster nature.

✕ For small businesses, the pricing can seem cost-intensive.

-Verified User ★★★☆☆ (3.5/5)

5. ABUKAI Expenses

ABUKAI expenses help businesses automate their expense management by creating and tracking expense reports. Users simply upload various file types through any device and add receipts to get editable copies.

Users can also send email receipts or upload them to the ABUKAI website and get cost categorization, dates of expenses, vendors, and other necessary information already filled in by you.

Pricing

There is a free plan, $99 per year (1 user). ABUKAI offers a custom corporate plan and $99/seat/year for up to 50 users.

Key features

- Expense reports: ABUKAI automates the process of generating expense reports from receipts. It reads out your receipts and turns them into valuable reports.

- Currency conversions: ABUKAI can also read different currencies in the receipts that the user uploads, making it easy to manage global travel expenses.

- Mileage tracking: ABUKAI allows users to track mileage from mobile devices using maps or GPS.

- Smart categorization: You can assign and segment accounts based on their credit card statements and past entries.

Pros of ABUKAI Expenses

✓ ABUKAI is an easy-to-use product where users simply need to upload their paper receipts and generate quality expense reports

✓ ABUKAI can automatically calculate exchange rates for various currencies based on their dates

-Paul N., Small-Business ★★★★★ (5/5)

Cons of ABUKAI Expenses

✕ Its base platform is intuitive, but users may find its additional features difficult to understand.

✕ The price can be hefty as there are no monthly payment options.

-David H., Small-Business ★★☆☆☆ (2/5)

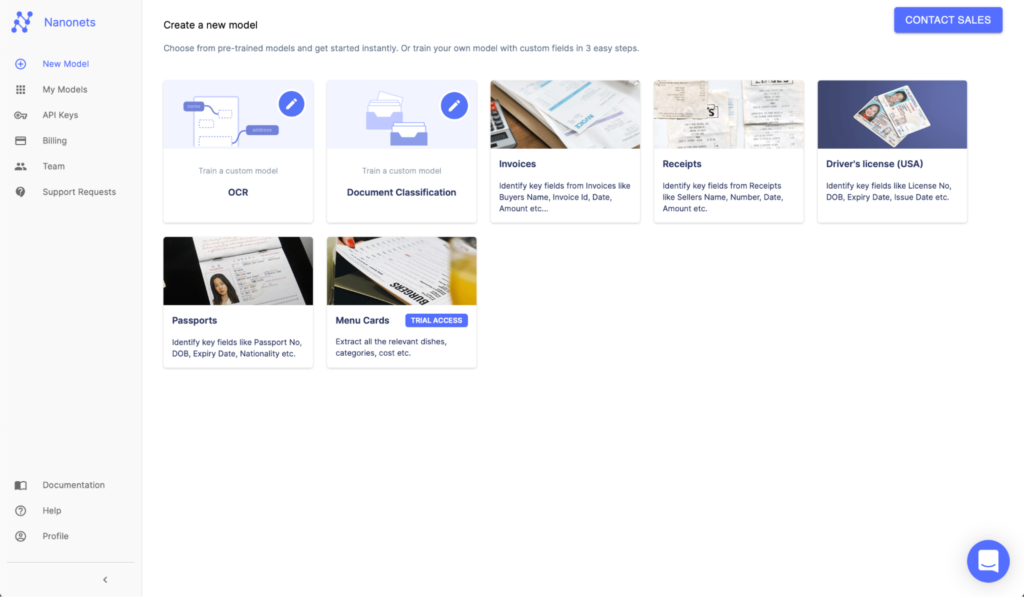

6. Nanonets Receipt OCR

Nanonets provides a receipt scanner app with advanced OCR software. It makes it easy for individuals and businesses to scan and digitize receipts. Users can scan their receipts and share them with the accounting and expense departments.

Nanonets provides end-to-end automation in receipt scanning across industries such as supply chain, accounting, and finance. It supports the scanning of multiple documents; structured or unstructured, and leverages AI to do so.

Pricing

Nanonets provides a pricing plan based on pages, which is free for 100 pages and charges $500 for 5000 pages. It also offers $999/month and a custom plan for enterprises.

Key features

- AI-based intelligent document processing: Nanonets uses AI-powered OCR to scan receipts, ensure their accuracy, and save them in secure storage.

- Expense reports: You can generate expense reports in a single click and share them with other related teams like accounting and finance.

- Multilingual receipt scanning: Nanonets provides receipt processing in a variety of languages.

- Integrations: It can integrate with other expense management software such as ERP, CRM, payment, and accounting tools.

Pros of Nanonets Receipt OCR

✓ Nanonets provides a UI that is very easy to navigate and a customizable solution with seamless API integration.

✓ Nanonets’ technology has a continuous learning model that ensures improvement.

-Rachit B., Mid-Market ★★★★★ (5/5)

Cons of Nanonets Receipt OCR

✕ The AI-model training at first can be a bit tedious to train and hard to visualize.

✕ The workflow management may experience hiccups as the tool needs more checkpoints to see if data extraction is optimal.

-Vanessa C., Mid-Market ★★★★☆ (4.5/5)

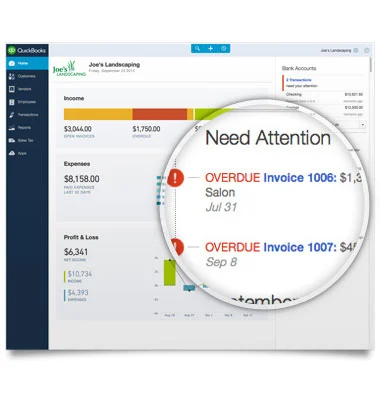

7. QuickBooks Online

QuickBooks Online is a small business cloud accounting solution that provides a receipt scanner app for users to manage their paper receipts and store them digitally. You can edit the scanned receipts, assign them to an account, and even match them to an existing transaction.

You can integrate your business management tool with other accounting tools to organize your books, send invoices, and track inventory.

Pricing

QuickBooks Online offers a start-up plan starting from $9/ month. It also offers essential features at $18/month, a plus plan with premium features at $27/month, and an enterprise plan with 25 users at $60/month.

Key features

- Receipts scanning: You can take images of the paper receipts and share them with the account team so that they can keep proper expenses.

- Data consolidation: Receipt scanning data is easily accessible under a single window. This helps you prepare a list of crucial expenditures.

- Produce valuable reports: QuickBooks Online can automatically generate financial statements, reports for tax purposes, cash flow statements, etc.

- Payment processing: It can manage and track numerous payments and accounts payable.

Pros of QuickBooks Online

✓ QuickBooks works best for users already using QuickBooks to automate their auditing and accounting transactions.

✓ QuickBooks is easy to use and user-friendly for users who are just beginning to automate their expense management and are already automating bookkeeping.

-Mark A. J., Small-Business ★★★★★ (5/5)

Cons of QuickBooks Online

✕ QuickBooks Online’s support turnaround time can use some improvement.

✕ Users report that the overall solution, along with the receipt scanning app, can be unresponsive.

-Annie K., Small-Business ★★☆☆☆ (2/5)

8. Veryfi

Veryfi is an invoice and receipt scanner app that uses AI-based OCR to extract data from scanned receipts. This app facilitates the scanning of unstructured receipts, invoices, and purchases and processes them into an editable format.

Veryfi helps businesses manage financial records, and expenses and even integrates with accounting software. The solution aims to eliminate manual data entry and avoid human error in adding budgetary information.

Pricing

Veryfi offers a free plan with minimal features. Its paid plan starts from $500/month and also provides a custom pricing plan for enterprises.

Key features

- Receipt scanning: Veryfi’s app allows you to capture receipts and bank forms from mobile devices and desktops.

- Data extraction: It can extract data from any unstructured document with decent accuracy.

- Integrations: It can integrate with your existing accounting tools and further automate your bookkeeping and expense management.

- Expense management and receipt app: It extracts all details from your receipts and enables you to control job costs and travel policies while meeting your tax obligations.

Pros of Veryfi

✓ The Veryfi receipt scanner app can quickly and accurately extract data from receipts, saving businesses significant time.

✓ This receipt scanner app is easy to use with minimal setup time. The system is also learning to improve the accuracy of data captured.

-Verified User, Mid-Market ★★★★☆ (4.5/5)

Cons of Veryfi

✕ Its OCR technology has room for improvement in accuracy.

✕ It is less flexible if you want to manage accounts of multiple organizations.

-Verified User, Small-Business ★★☆☆☆ (2.5/5)

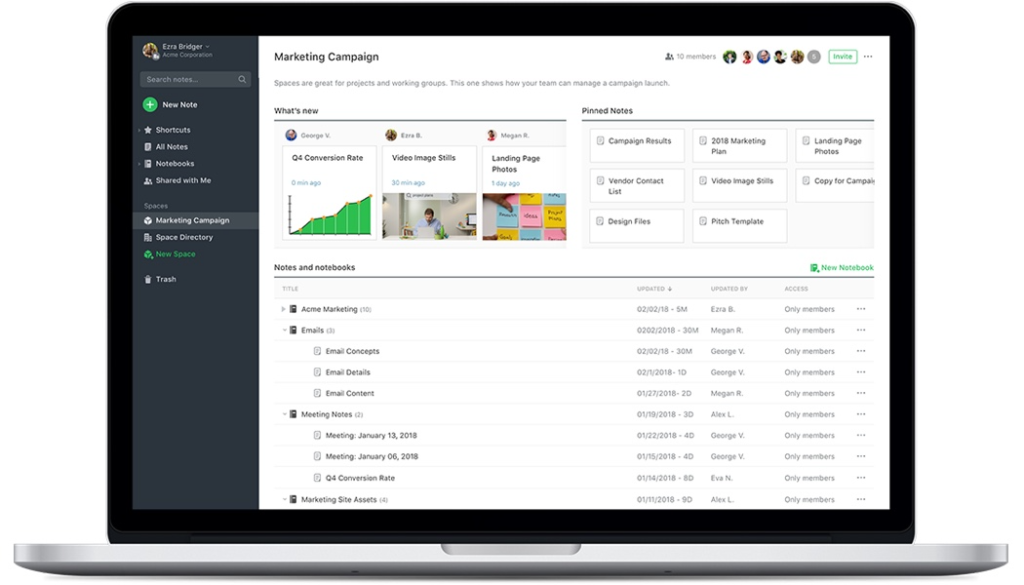

9. Evernote

Evernote is a task-management application that offers a receipt scanner feature. It automatically scans receipts for clear and easy reading and allows you to save and share scanned copies via email, text, or export to other apps.

You can use the receipt scanner to manage your expenses, add notes, and even extract information from other physical copies like business cards. With Evernote, you can scan multi-page documents and provide multiple users access to the receipt scanner from their devices.

Pricing

Evernote offers a free plan. However, to access its receipt scanner feature, you’d need to opt for a paid plan that starts from $10/month.

Key features

- Receipt scanning: Scans all your receipts, both printed and hand-written notes to manage expenses and add them to overall costs.

- Save & Search: You can save numerous receipts and manuals like boarding passes and receipts to access them later.

- Digitize business documents: Access digital copies of business cards to save phone numbers, names, and email addresses.

- Collaboration: Collaborate with teams to keep them in the loop for shared expenses and receipts.

Pros of Evernote

✓ The Evernote receipt scanning app provides a comprehensive task management solution. You can easily add receipt copies to your other critical business documents.

✓ You can save receipts and scanned business cards on your phone and even on Evernote.

-Sven H., Education Management ★★★★★ (5/5)

Cons of Evernote

✕ The OCR technology is still in its learning phase, which may pose problems in terms of accuracy.

✕ It has limited export and import options from Evernote.

-Aster C., Small-Business ★★★☆☆ (3/5)

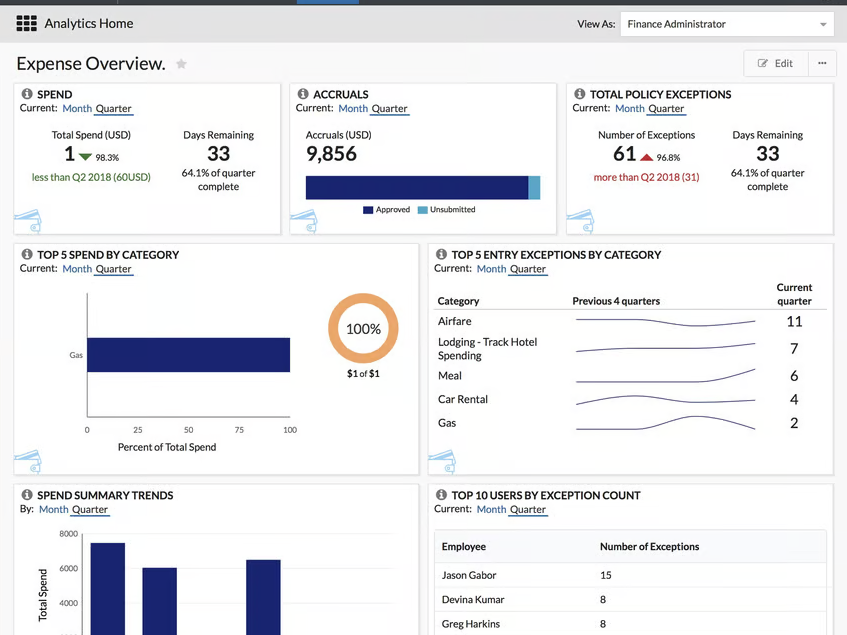

10. SAP Concur

SAP Concur is an expense management tool & a travel app solution for managing business travel expenses. It comes with an interactive dashboard that showcases spending statistics. This solution includes a receipt scanner feature for scanning invoices and receipts and generating expenditure reports.

Teams can effectively collaborate and manage budgets as they can track paper receipts from their smartphones and extract information effectively. Upper management can also gauge, track, and verify employee purchases. It offers integration with accounting software to utilize its potential fully.

Pricing

SAP Concur offers a fixed pricing plan at $9/month with limited features and a custom pricing plan for corporates.

Key features

- Invoice capture: You can send invoices by email or mail and you can get their digitized copies. SAP Concur captures vendor name, receipt number, and date using OCR technology.

- Integrate expense data: You can send your expenses and bills to SAP Copncur email. Managers can review this for reimbursement and even search and edit easily.

- Travel management: Your firm can gain complete visibility into real-time travel expenses while adhering to existing travel policies.

- Data insights: The dashboard displays up-to-date data to drive actionable insights. You can also personalize the reports to make them interactive.

Pros of SAP Concur

✓ SAP Concur is considered one of the best travel apps. It automates invoice processing and expense management, thereby easing the burden for enterprises that frequently travel for business.

✓ It has fully-built integrations with frequent flyer programs, travel agencies, and Lyft that further help enterprises consolidate their business travel expenses.

-CS Ankita A., Mid-Market ★★★★☆ (4/5)

Cons of SAP Concur

✕ Customer support can be more proactive.

✕ The learning curve of SAP Concur can be steep for a handful of features.

-Verified User in Airlines/Aviation, Mid-Market ★★★☆☆ (3/5)

6 Things to look for in a receipt scanner app

While there are various receipt scanner apps available in the market that help you scan your paper receipts, you can narrow them down to your business requirements and advanced features. Here’s a guide to choosing the best OCR software for receipt scanning.

- Highly accurate OCR technology

Look for a highly accurate technology. How do you do that? For starters, see if it implements AI in its OCR feature. This ensures that the technology can capture and analyze data from low-quality papers.

The approach is more advanced as it handles structured and semi-structured documents and receipts. HyperVerge’s AI-powered OCR technology provides an OCR accuracy rate of more than 95% and ensures accurate recognition and analysis of your receipts.

- Workflow automation

Check if the receipt scanner app provides an intuitive and easy-to-use interface for workflow automation. A no-code platform that is easy to navigate and clear options for uploading, receipt scanning, and categorizing receipts is a must if you want to use the tool for regular expense tracking.

If the tool is too technical and difficult for your team to use, learning and adapting it would be an additional burden.

- File types

Receipts are not your high-profile documents that are paper-bound and stored in secure cabinets. Receipts are small pieces of paper, often with poor clarity, printed in fading ink, and highly unstructured. Yet, they’re also the most important slips that keep your budget in check. Scanning and analyzing them is no cakewalk.

Check if your receipt scanner app is technologically capable of processing multiple types of receipts such as JPEG, handwritten receipts, and bills and what is the accuracy of scanned receipts.

- Integration capabilities

Receipt scanning tools need to integrate seamlessly with other tools like accounting or finance software. All businesses work within a tech ecosystem. The tool you choose must be adaptable to the existing software to facilitate real-time expense tracking, maintain up-to-date financial records, and streamline overall expenditure.

- Tracking feature

Tracking in a receipt scanner app helps you gauge what the primary expenditures were and summarizes your expenses to create reports. Once the app categorizes and classifies receipts, it generates reports that help you understand your spending habits and financial trends. Check if you can export files in various formats to save them as a part of your accounting document database.

- Storage capacity

Receipt scanner apps process sensitive financial information and cost details that are not meant for everyone to access. Ensure the app you choose encrypts data while in transit and has security measures to protect the invoice and receipt details. Some methods it uses are passwords and multi-factor authentication to ensure the data is always in the right hands.

Choose HyperVerge’s advanced OCR technology to scan all your receipts and expenses

HyperVerge provides superior OCR technology that can simplify receipt scanning and reduce manual data entries. It can process receipts in more than 150 languages and provide you with machine-readable copies in minutes. You can also scan and edit other important documents such as identity proofs, contracts, bank statements, and invoices.

HyperVerge also provides integrations that you can use to automate end-to-end expense management. Get a demo on leveraging HyperVerge’s OCR technology to automate receipt scanning and capture and go live.

Frequently asked questions about the receipt scanner app

1. How does a receipt scanner app help your business?

Receipt scanning apps extensively help with bookkeeping and expense management in firms. They benefit companies by reducing paperwork, improving expense tracking accuracy, improving budget management, and improving convenience and accessibility.

2. Is it safe to use a receipt scanner app?

Yes. Most receipt scanner apps use data security methods like encryption and password protection to protect data inside sensitive documents. Review the compliance measures (like GDPR) of the apps you choose before you move forward with signing up for the app.

3. Can I scan receipts using my phone?

Yes. Even without a receipt scanner app, you can use the Google Drive app on an Android phone to scan documents. You can save them or add more documents. On an iPhone, you can use the Notes app to do the same.

US

US

IN

IN