Today, document fraud has become a major concern in multiple sectors, such as healthcare, finance, and public administration. Identity theft through fraudulent government documents or benefits ranks as the most prevalent form, with a total of 395,948 reported incidents.

Criminals increasingly generate and use fake documents like pay stubs, utility bills, or insurance documents to commit fraud. This includes the illegal manipulation of genuine documents and the creation of fake documents for deception.

Authentic and accurate documents are critical for identity verification, employment, financial transactions, travel documents, and legal proceedings.

Combating this fraud requires a multi-faceted approach that combines vigilance, advanced technology, and stringent processes.

What is document fraud?

Document fraud, called identity fraud in financial and legal industries, refers to modifying, forging, or misusing official documents. Criminals usually target identification cards, passports, bank statements, academic certificates, legal contracts, or any other official document that can be used to misrepresent one’s identity or status. These fraudulent documents are used to carry out both document and identity fraud.

The FTC received 5.7 million total fraud reports in 2021, of which 1.4 million were identity theft cases. Among these, Government Documents or Benefits Fraud tops the list of identity theft types with a total of 395,948 reported cases.

Document fraud can take many forms, including:

- Forgery: This involves creating or altering a false document. For example, changing the name or identification number on a fake passport or birth certificate is quite a norm.

- Identity Theft: Changing a person’s identifying information for carrying out financial crimes, like using their Amex card details to make unauthorized purchases.

- Fake Documents: These include fabricated documents that do not relate to anyone’s real identity or are created without the necessary authorization, for example, a Permanent Resident Card.

A forged document refers to a genuine document that has been altered for a criminal purpose, such as changing photographs, personal details, pages, visas, and stamps.

Document fraud is a heinous offense that leads to legal penalties, including imprisonment and hefty fines. Finance, law enforcement, immigration, police, and government agencies are some sectors that have to be on the lookout for document fraud owing to criminal activities that can result, namely- illegal immigration, money laundering, or something grave like terrorism.

Therefore, document fraud is a genuine concern, and combating it has become imperative due to its significant impact.

Importance of identity theft and document fraud detection

Detection and prevention of document fraud is crucial for the security features for the following reasons:

- Protecting Financial Institutions: Banks, credit unions, and other financial institutions are the primary targets of document fraud. Criminals and fraudsters usually use false documents to open accounts, take secure loans, or conduct illegal transactions. Thus, financial institutions must protect themselves from financial losses by detecting fraudulent use of documents.

- Preventing Identity Theft: Document fraud often precedes identity fraud, making it crucial to detect and prevent fraudulent documents to protect individuals from financial harm and damage to their credit history.

- Ensuring Regulatory Compliance: Financial institutions, banks, insurance, and fintech corporations must proactively detect and prevent document fraud to comply with strict regulatory requirements and avoid penalties.

- Safeguarding National Security: Illegal immigration and terrorism are a huge challenge for many countries globally. Document fraud is a real worry in these scenarios as individuals or criminals can use bogus papers, travel documents, or identity documents, posing tremendous challenges and implications to national security.

- Maintaining Trust: Businesses must take document fraud seriously to maintain credibility and trust with their clients. Vulnerabilities to fraud can erode their reputation, resulting in massive business-related losses as well as customers. Enterprises and agencies should implement a combination of manual checks and computer-aided AI algorithms to detect anomalies, illegal activities, and patterns indicating potential fraud.

Read our complete guide on fraud detection and prevention.

Types of document fraud

Forged documents

Forged or fraudulent documents are those document types that have been modified or altered from their original form. These may involve changing photos or images, adding fraudulent information, or even creating new documents that seem to be legitimate. For example, criminals may forge a passport by changing the age to make the person appear older.

Invoice fraud

Invoice fraud is the act of drafting fake invoices and sending them to businesses, individuals, or organizations. These invoices look legitimate, and the receiver may unknowingly pay for goods or services that were never delivered.

Blank documents

Blank documents often involve official documents filled with falsified information or data. They are used to deceive customers and individuals or commit some fraudulent activity. For example, illegal immigrants use blank passports with fake information to travel illegally.

Camouflage documents

Camouflage documents involve using counterfeit documents designed to appear like genuine documents. Phishing scams or spam advertising use these documents to deceive individuals.

Counterfeit documents

Phony papers are illegitimate documents that appear as if they were genuine identity documents or authentic. There are various types of forged documents, such as identification cards, voter cards, birth certificates, and passports, which can be used for illegal activities, like identity theft.

Consequently, preventing document fraud is a challenge for businesses and individuals. Therefore, companies and individuals need to be conversant with these forms of document fraud and take necessary actions to protect themselves. It’s also crucial to verify the authenticity of permanent resident cards and thoroughly examine such documents for potential fraud, emphasizing the need to detect indicators of document fraud.

How to combat document fraud while onboarding new users?

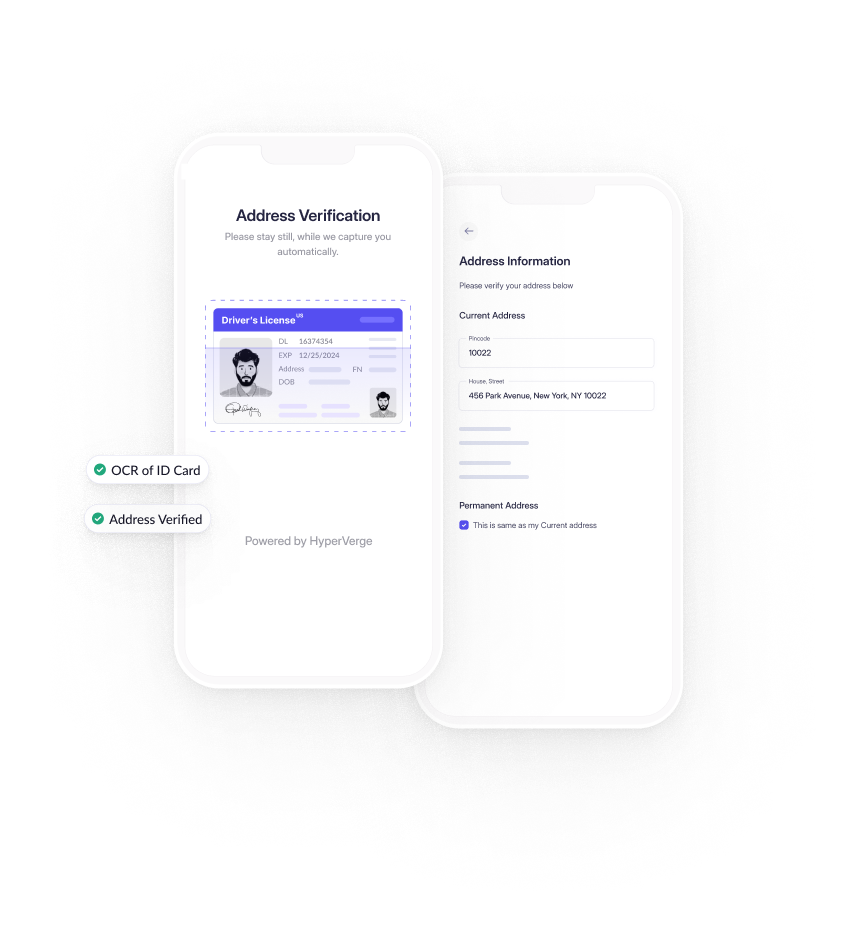

When onboarding new users, combating document fraud requires a multi-faceted approach that involves consistent vigilance, stringent protocols, security features, and computer vision technologies. The UK government provides guidance for regulated businesses in verifying official documents, emphasizing the importance of additional checks for PEPs and sanctions along with UK address verification. Following are some of the strategies that can be implemented on the genuine document front:

Identify and stay prepared for document fraud red flags

Corporations, banks, and other institutions can recognize red flags such as inconsistent information, low-quality or altered identity documents used, and suspicious user behavior patterns.

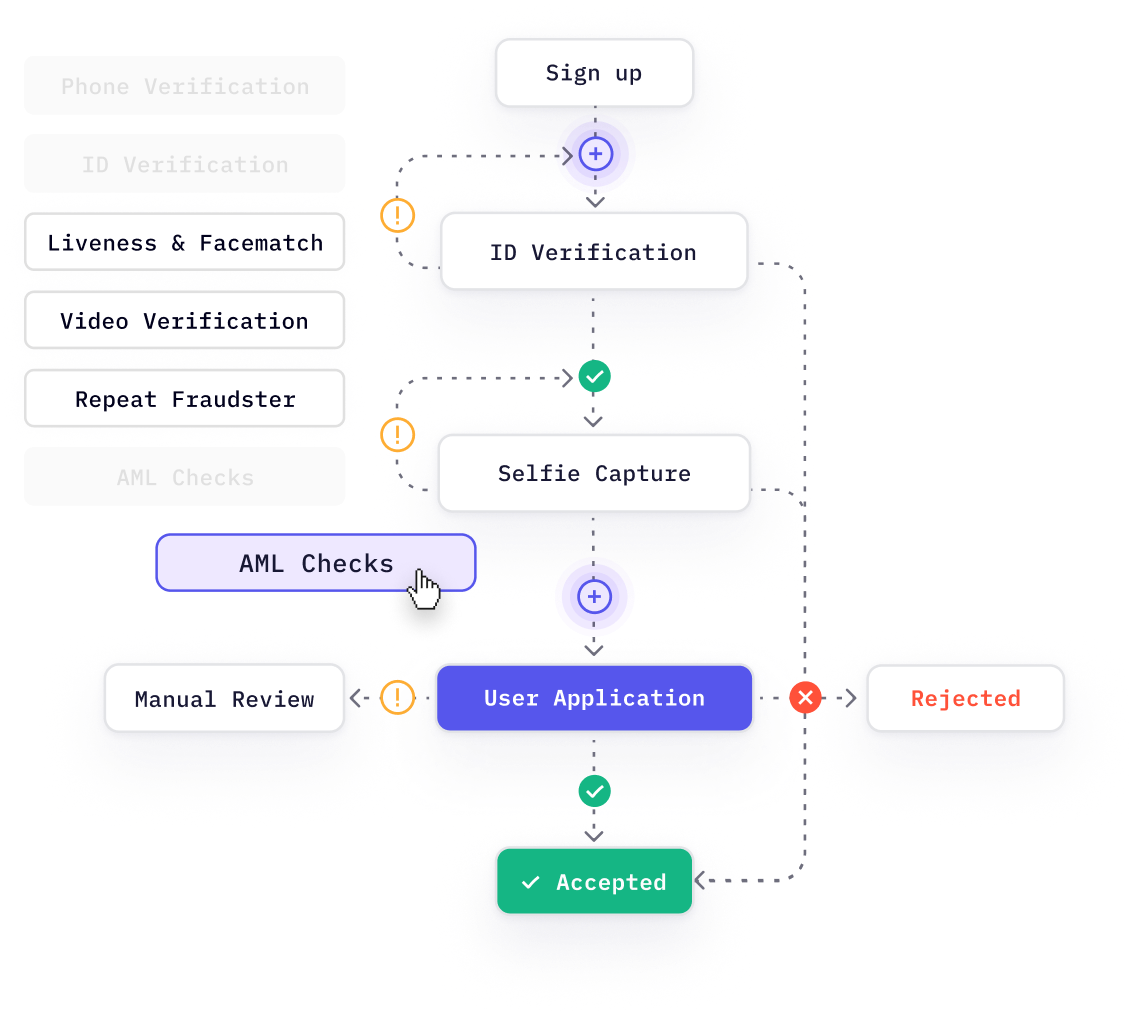

Implement an AI-powered document verification solution

AI-driven solutions can detect falsified documents effectively as they can go through and analyze large amounts of data, uncovering abnormalities connected with fraudulent activities. Moreover, AI/ML solutions can help verify the identity with automated processes that eliminate human errors.

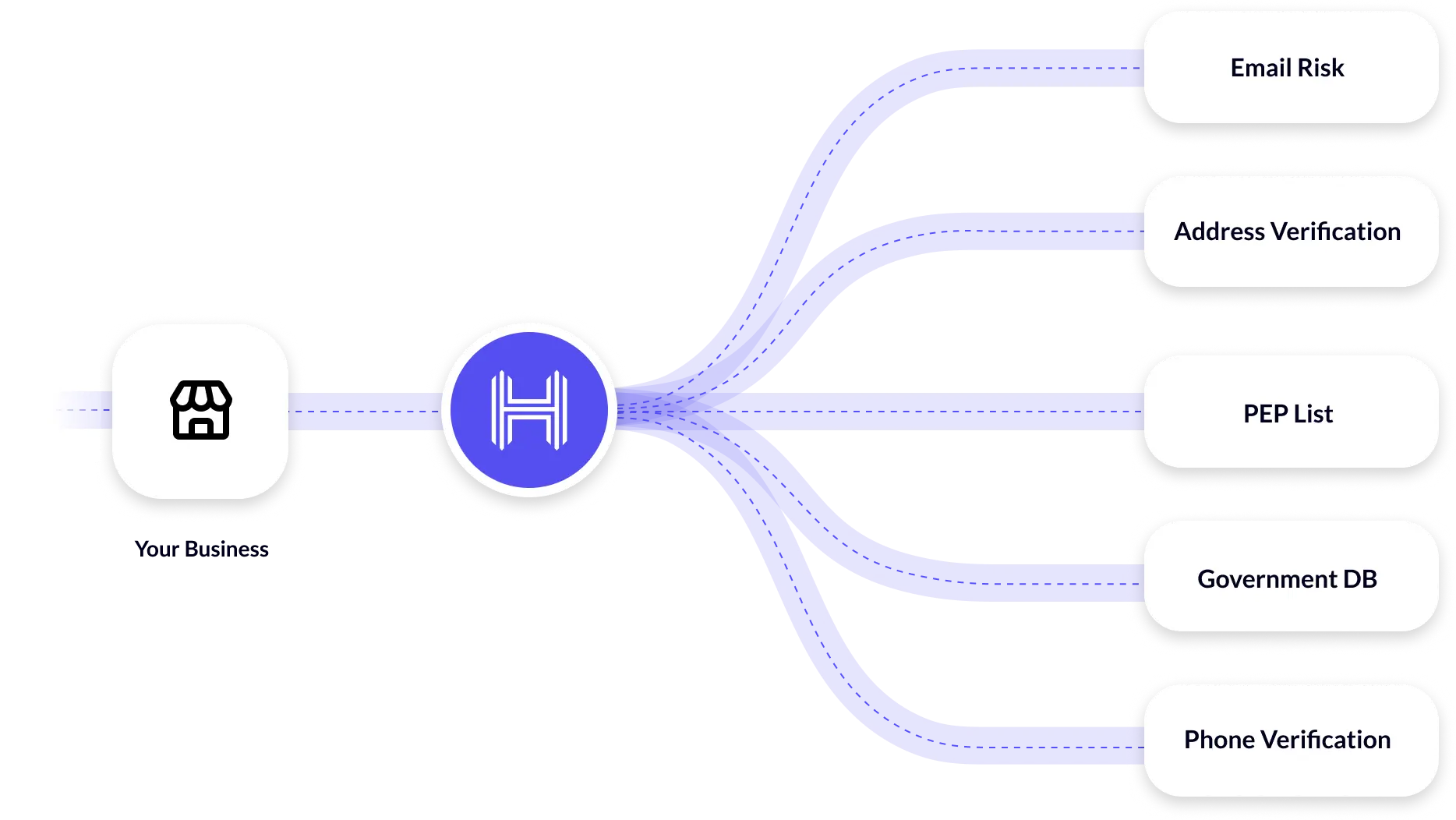

Deploy a multi-layer identity documents verification workflow

Companies and financial institutions can verify individuals’ identities and addresses by cross-referencing and verifying the provided information against various databases. This multi-tiered approach makes it challenging for criminals to commit acts of fraud.

Regularly conduct review audits

Frequent assessments should be conducted to identify vulnerabilities and streamline workflows. Regular checks for compliance with anti-fraud policies, accuracy checks, and regulatory adherence help mitigate risks of document fraud during the customer onboarding phase.

How robust document verification solutions can help businesses steer clear of document fraud

To prevent document fraud and counterfeiting, investing in robust document verification solutions is vital. Modern technologies, including Artificial Intelligence and Intelligent Document Processing, can assist businesses and financial institutions in the following ways:

- Streamlining document certification procedures improves efficiency and accuracy and reduces fraud risks.

- Increase the efficiency of the verification process while minimizing reliance on manual intervention and achieving cost optimization.

- Mitigate possible risks by proactively identifying and preventing suspicious activities.

- Reinforce compliance requirements with regulatory authorities and industry standards to foster trust and maintain ethical standards.

Ensuring the authenticity of travel documents is crucial in preventing document fraud, which can be achieved by implementing vigorous processes and cutting-edge technologies. By thoroughly examining official documents like passports, driver’s licenses, and other papers, businesses, and financial institutions can verify their legitimacy and detect any signs of falsification.

Our document verification solution ensures accuracy and efficiency while safeguarding against fraudulent documents. Sign up with HyperVerge to explore how we can help fortify your defenses against document fraud.