All you need to know about “fullz” and how to safeguard your business

Fullz is a slang term that means ‘full information’ or ‘full data’ or ‘full credential,’ which describes stolen data that can contain a person’s complete or partial identity proofs

This can include personal identity information like the social security number, or stolen credit card information that criminals and fraudsters acquire through illegal means.

Usually, a Fullz ID complete package contains a person’s full name, address, and personal details like DOB or Social Security number or personal identity number, passport number, email ID, or passwords in some cases.

This is why most businesses, organizations, institutions, or individuals – when dealing with finances – focus on having a by-default identity verification process for all new hires, alliances, investments, or when exploring new partnerships. These data breaches and identity theft are done in many ways, as discussed below.

How are fullz acquired?

Here’s how fullz are acquired:

Physical theft

This is done by stealing a person’s physical documents, which can be done in many ways, including house theft, stealing in public places or government transports, or theft in offices. The documents acquired through theft are mostly in their physical form or the hard copies that fraudsters misuse to make fraudulent purchases, dealings, or even sell Fullz to other criminals.

Phishing and spear phishing

This type of theft is done by influencing the targets to share confidential information like passwords, OTPs, or personal or official details. This is mostly done on phone calls where targets do not have much time to think or contemplate the situation, and they are influenced in a way that they think the company or person asking for details is legit and fall for their traps and become a victim of such fraud.

Account takeover

This is done by acquiring a person’s confidential information like email ID, bank account details, or beyond. These account takeovers can be done with an individual or an organization. Starting from address to email ID, confidential account access, or bank details, these takeovers have no limits. They can be severely damaging in terms of money, as well as the reputation of any person or business. Mostly, these thefts or takeovers are done digitally and target the weaker market segment that is not very tech-savvy or informed about such frauds.

Bought on the dark web

The dark web is unindexed web content used by hackers and criminals to target any system and infect devices with viruses, malware, trojans, or other malicious files. This type of activity helps fraudsters invade systems and access personal and confidential information like birth date, card security code, credit card number, email ID, or other types of proof that help them misuse the same. These dark webs are also used to trade Fullz and perform other illegal activities like crypto frauds or financial frauds.

How are fullz used?

Here’s how Fullz are used:

Loan fraud

Fraudsters use stolen information to apply for payday or other types of loans that victims are unaware of. They take the loans in their names and aim to deceive the lender in every possible way. Fraudsters target easily available options like online loan offers or credit facilities that do not require physical intervention. They facilitate online processes for such transactions so they are not tracked or assessed for potential risks.

This is when fraudsters use stolen medical or insurance cover information to claim medical services that the victim never applied for. This can be done by the policy buyer, insurance provider, healthcare staff, or any professional criminal.

This is when fraudsters use the personal information of any person to commit financial fraud, including but not limited to illegal transactions, opening fake bank accounts for illegal transactions, or taking a loan or credit card using fake identity proof.

Tax refund scam

This happens when fraudsters use calls, emails, or messages to influence victims by asking them to click a link or share a code stating that they are tax authorities and they can help them get income tax claims if the victims share their confidential information.

Bank drops

This is when fraudsters use Fullz or the stolen identity to open a bank drop account for illegal money transfers, the most common of which is money laundering. These accounts are used by fraudsters temporarily, and they ensure the discard of all related proofs so they are not tracked or caught in any way.

Account takeovers

Account takeovers, as the name suggests, are the hacking or taking over of account numbers or financial information of any person that is used for illegal financial transactions or criminal activity. These attacks can lead to the breach and exfiltration of different types of highly sensitive, confidential, or protected classes of data, such as personal email IDs, social security numbers, credit card numbers, and so on.

Buy now pay later schemes

Fraudsters mostly use a person’s credit card number to commit these frauds; they buy items on ‘buy now and pay later’ schemes and let the victim repay for it, which may also affect their credit score and the merchant’s revenue.

How to avoid fullz fraud?

Here’s how to avoid Fullz fraud:

Use a reliable fraud detection solution

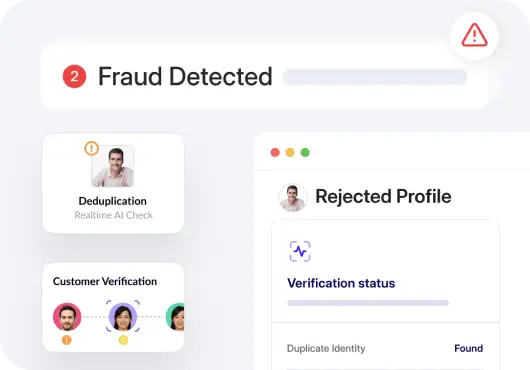

The best way to avoid any kind of financial or data fraud is to invest in fraud detection technology that helps you become more secure and stronger. Latest technology like machine learning, anomaly detection, and behavioral analytics are some of the reliable fraud detection solutions that help individuals and organizations assess potential risks and identify their customers in a better way.

Perform document verification

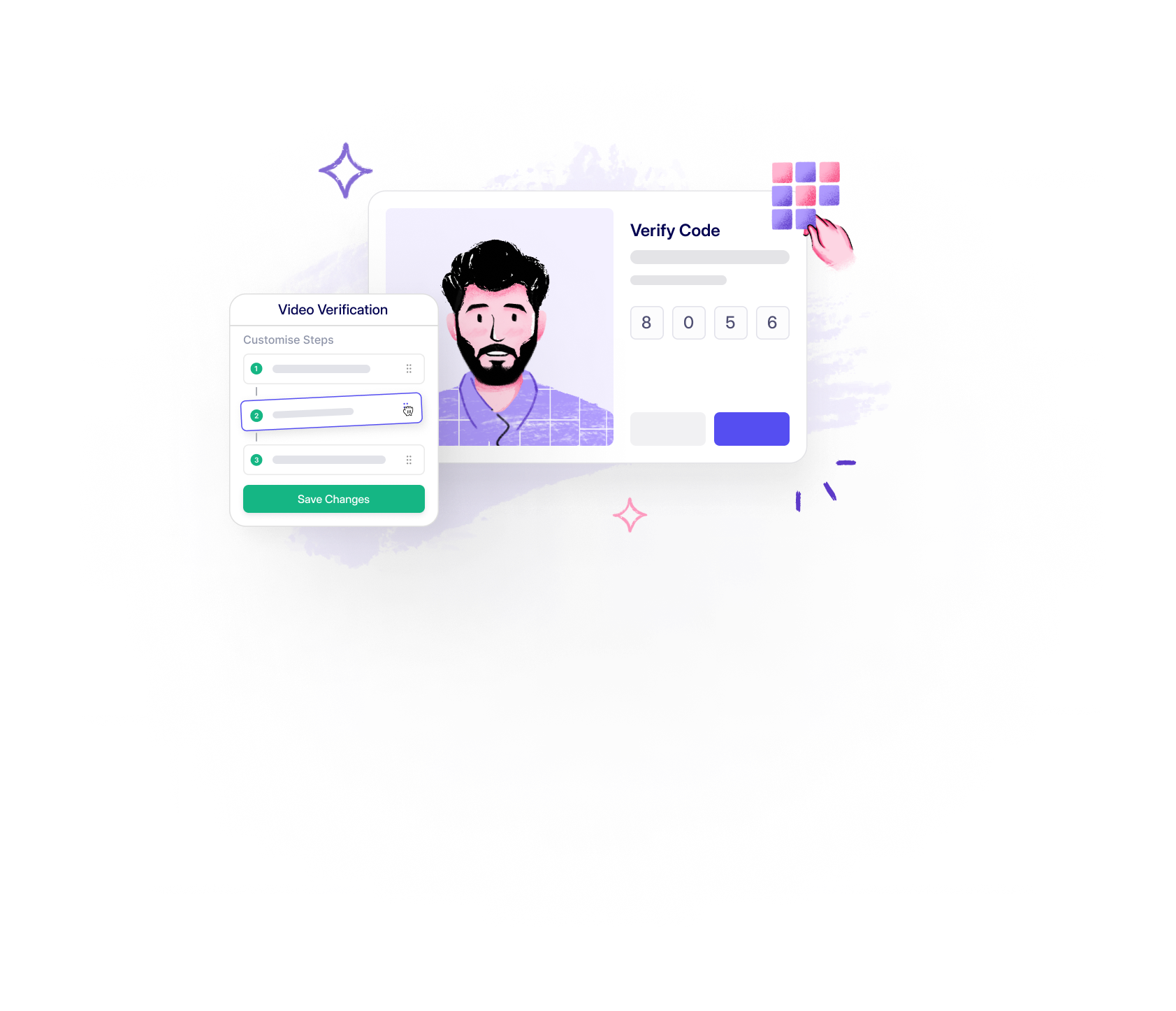

Document and person verification processes, such as digital and video KYC powered by AI-driven OCR, face match, liveness, and ID verification, help perform verification at a much faster pace and with greater reliability.

Read more about document verification.

Implement biometric verification

Biometric verification is one of the most widely used digital verification processes that feature single image-based liveness detection and comes with the best-in-class face recognition technology.

Regularly conduct review audits

Regular business and accounts audits help businesses identify potential risks and avoid fraudulent activities. There are special audit teams who take care of the sale and purchase account authenticate each transaction done in business and report in case of any suspicious activity to the concerned authorities.

Prevent fullz fraud with technology

Identity verification like KYC is one of the most effective and smartest ways of fraud detection and prevention. Whenever there is money involved, it’s important to have identity verification processes so that the authenticity of processes can be maintained and the business is not at risk of any fraudulent activities.

KYC is the process of virtual, physical, or digital identity verification that helps businesses know their customer better. It is done by authenticating their IDs like the social security number that is directly connected to their central governing authorities. It includes the five-step authentication process – customer identification, customer due diligence, risk assessment, ongoing monitoring, and reporting suspicious activities.

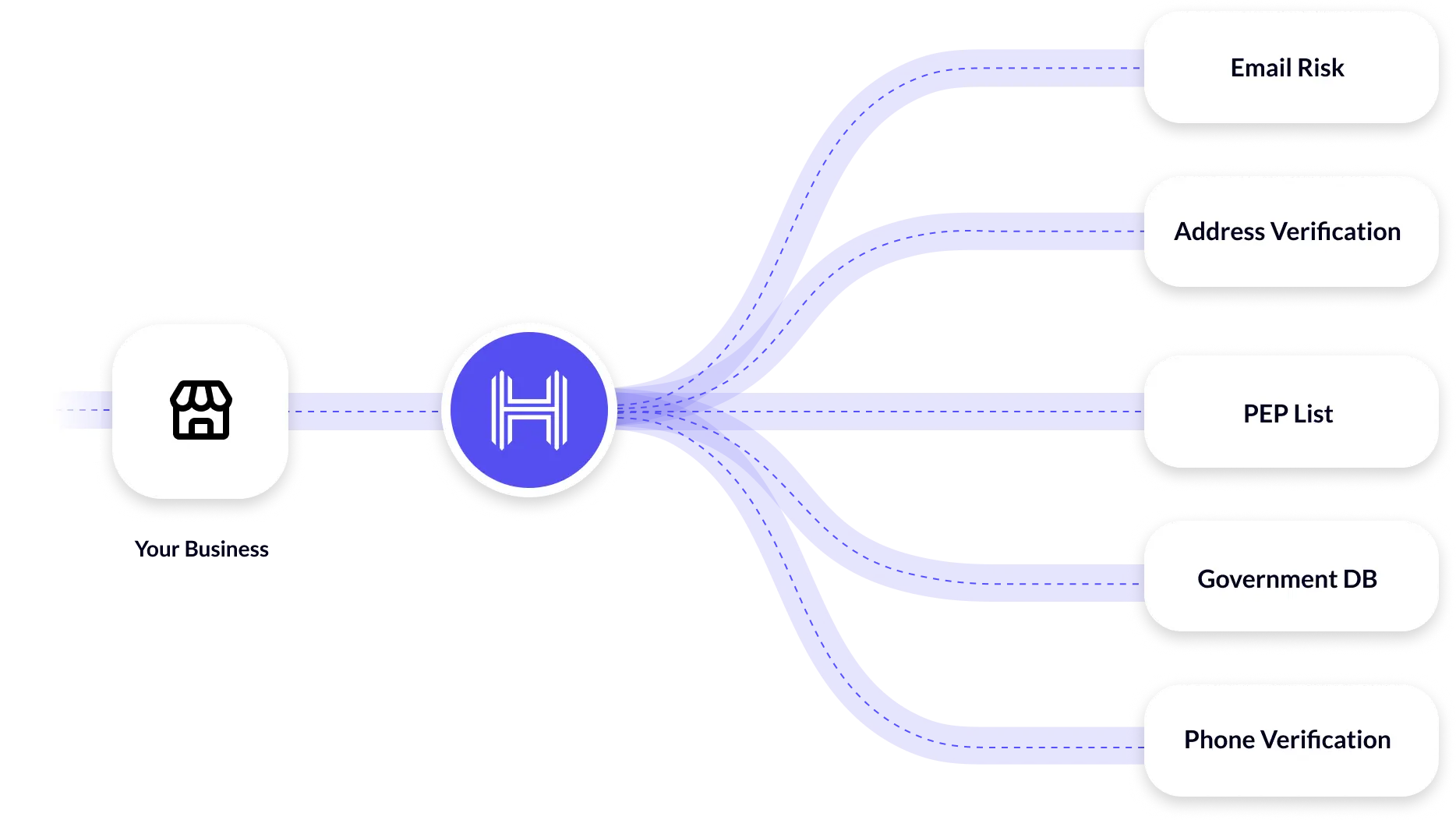

HyperVerge is a cloud-based identity verification solution that uses AI-driven OCR, face match, liveness, and document verification to ensure proper KYC and prevent identity fraud like fullz. Ready to get started? Sign Up now for a free trial.

Identity

Verification –

Onboard

users instantly across the globe with our high accuracy AI

models.

Identity

Verification –

Onboard

users instantly across the globe with our high accuracy AI

models. Video

KYC – Onboard

users remotely with very high confidence over video.

Video

KYC – Onboard

users remotely with very high confidence over video.

Central

KYC – Reduce

processing time and eliminate manual KYC data entry.

Central

KYC – Reduce

processing time and eliminate manual KYC data entry.

OCR

software –

Extract

data accurately from all global document formats.

OCR

software –

Extract

data accurately from all global document formats.

Anti-Money

Laundering –

Simplify

AML compliance and protect your business

Anti-Money

Laundering –

Simplify

AML compliance and protect your business